August 4–8, 2025: Weekly economic update

Key market updates

Macroeconomic Statistics

Inflation (CPI):

- Core Consumer Price Index (m/m) (June): 0.2% (prev: 0.1%)

- Consumer Price Index (m/m) (June): 0.3% (prev: 0.1%)

- Core Consumer Price Index (y/y) (June): 2.9% (prev: 2.8%)

- Consumer Price Index (y/y) (June): 2.7% (prev: 2.4%)

Inflation Expectations (University of Michigan):

- 12-month expected inflation (May): 4.5% (prev: 5.0%)

- 5-year expected inflation (April): 3.4% (prev: 4.0%)

GDP (U.S. Bureau of Economic Analysis, BEA) – 2Q25 annualized, preliminary estimate: 3.0% (1Q2024: –0.5%). Atlanta Fed GDPNow (Q2): 2.5% (vs 2.4%)

*GDPNow is a real-time forecasting model providing an unofficial GDP estimate ahead of BEA publication, using a similar methodology.

Business Activity Index (PMI) (>50 = expansion; <50 = slowdown):

- Services sector (July): 55.7 (prev: 52.9)

- Manufacturing sector (July): 49.8 (prev: 52.0, revised)

- S&P Global Composite (July): 55.1 (prev: 52.9)

Labor Market:

- Unemployment rate (June): 4.2% (prev: 4.1%)

- Change in nonfarm payrolls (June): +73K (prev: +144K, revised)

- Change in private nonfarm payrolls (June): +83K (prev: +137K)

- Average hourly earnings (June, y/y): 3.9% (prev: 3.8%)

- JOLTS job openings (May): 7.769M (vs 7.395M)

Monetary Policy

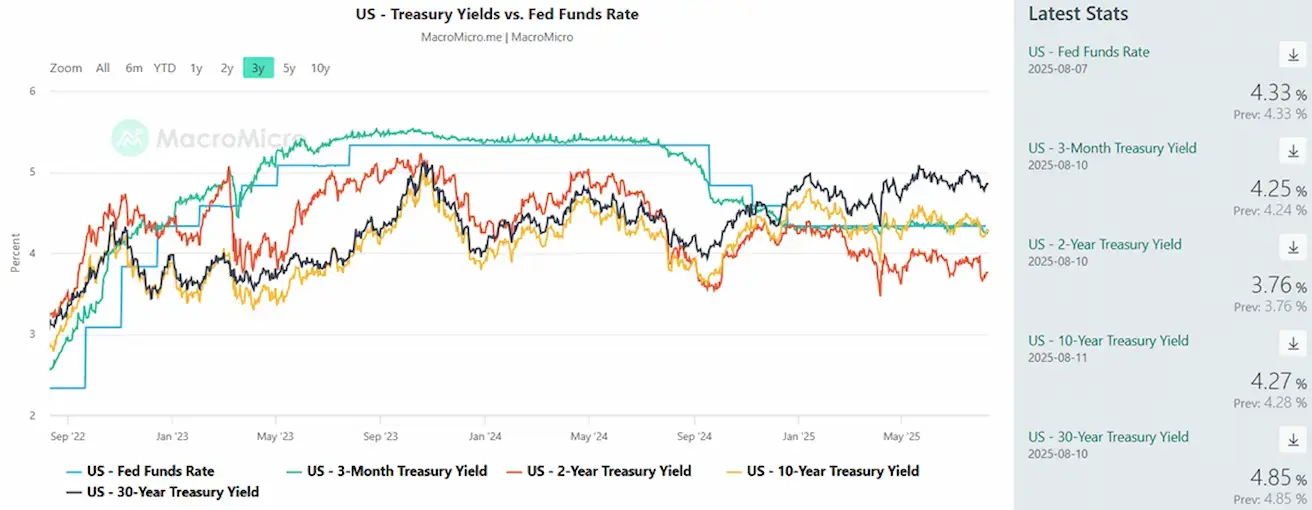

- Federal Funds Rate (EFFR): 4.25%–4.50% (unchanged)

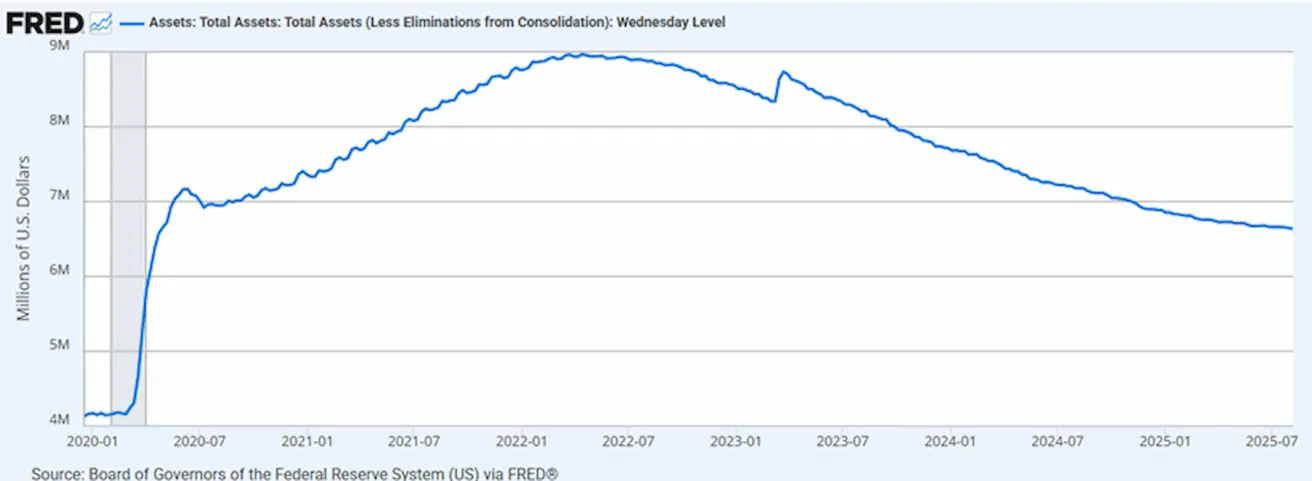

- Fed balance sheet: $6.40T (vs $6.42T last week)

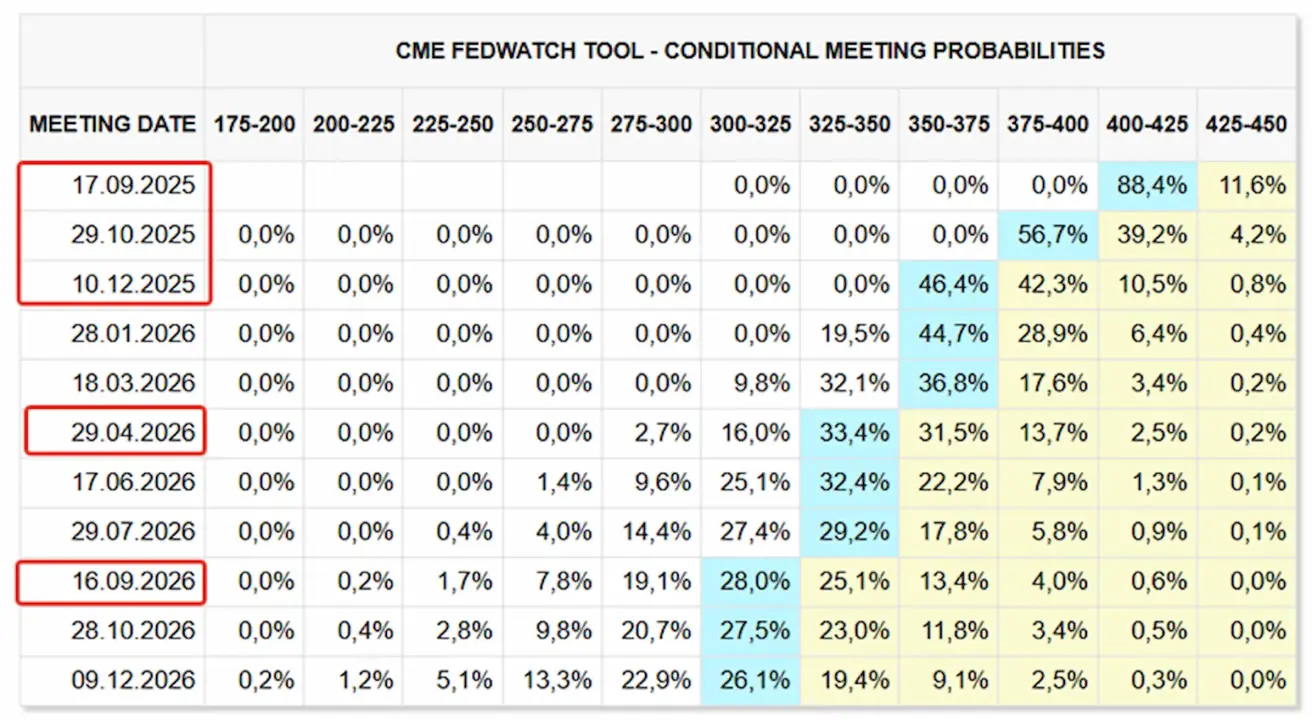

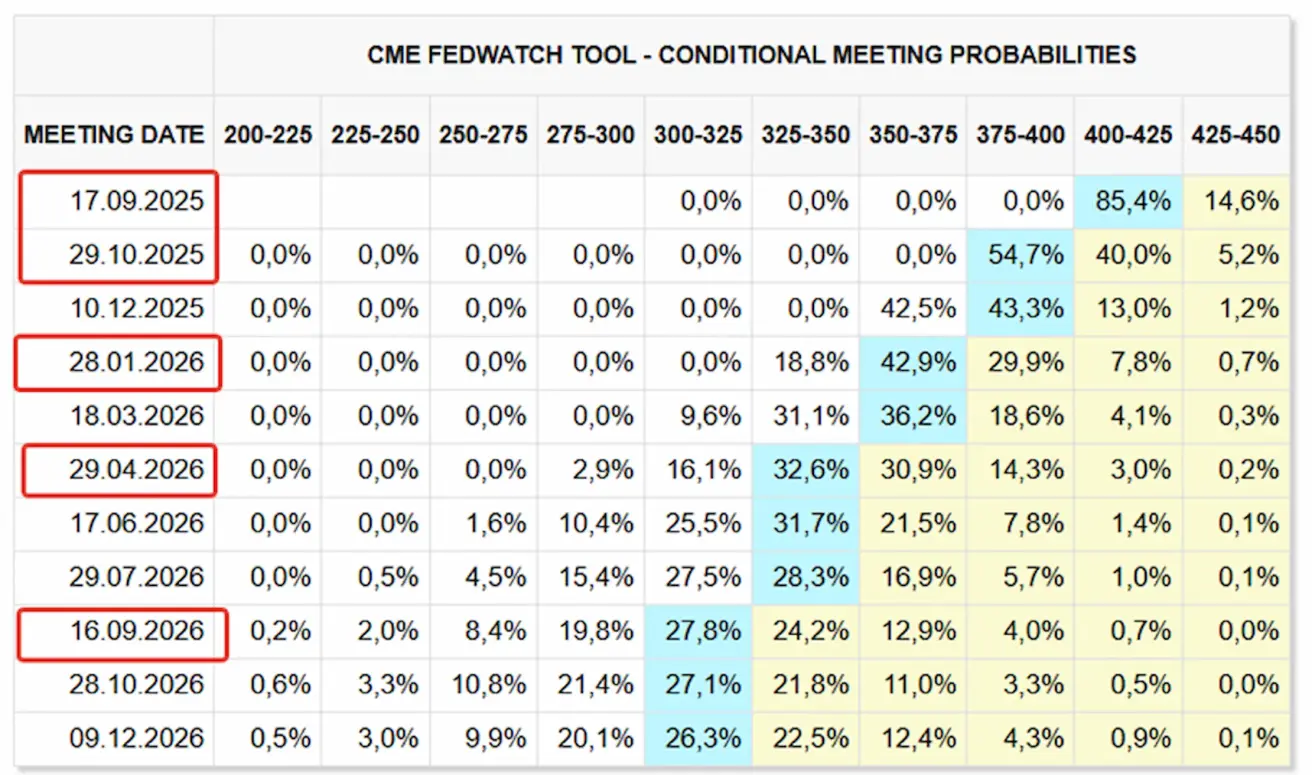

Market Rate Forecast (FedWatch):

Today:

Last week:

Commentary

Risk-on sentiment dominated equity markets, driven by strong corporate earnings and expectations of resumed rate cuts.

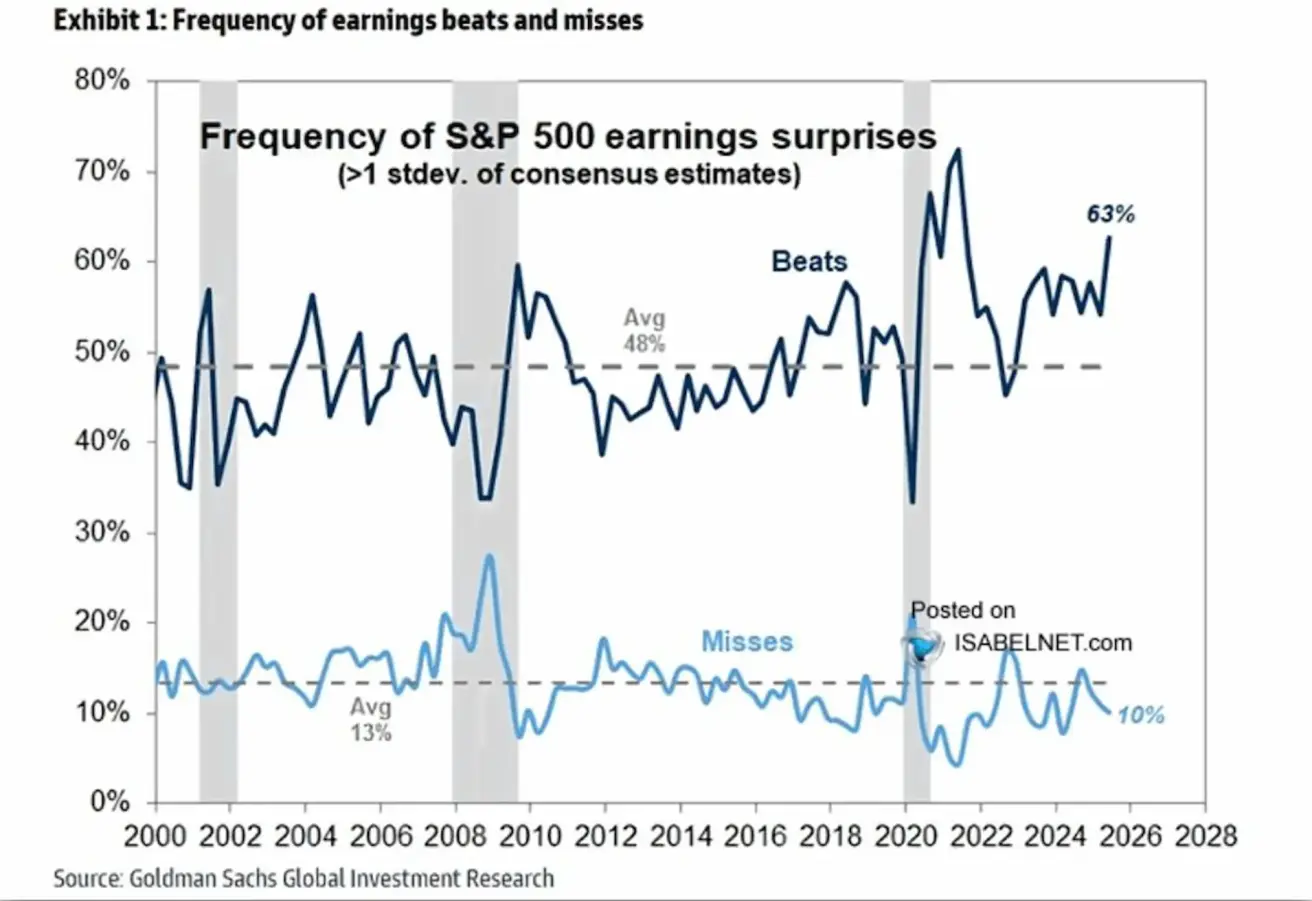

In Q2, 63% of S&P 500 companies beat analyst estimates, with only 10% missing forecasts – the highest beat rate in 25 years (excluding stimulus-driven 2021).

As for monetary policy expectations, Fedwatch shows three consecutive rate cuts this year with an 88% probability of the first cut in September. Next 12 months: five cuts of 0.25% each to a range of 3.00-3.25%.

The standoff between Trump and Fed Chairman Powell is gaining momentum. At the last Fed meeting, Powell's rhetoric hardened with the quote: "it may take more time to make the right decision." The leading candidates for the post of Fed Chairman are in favor of an earlier start to rate cuts.

In addition, Trump will appoint the head of his Council of Economic Advisers Stephen Miran to fill the term of Fed Board member Adriana Kugler.

Today, the markets are focused on the US consumer inflation data for July, which will be released tomorrow. The data for June shows that the core CPI has started to rise after 3 months of stabilization. The monthly volatile CPI rose 0.3%, above the average of 0.2%.

The July and August data will reflect the beginning of the impact of tariffs on consumer and producer prices. Accordingly, a sharp increase in CPI indicators will lead to further tightening of the Fed's rhetoric and will increase volatility in the markets. Moderate values will be perceived positively by the market.

Tariff Wars

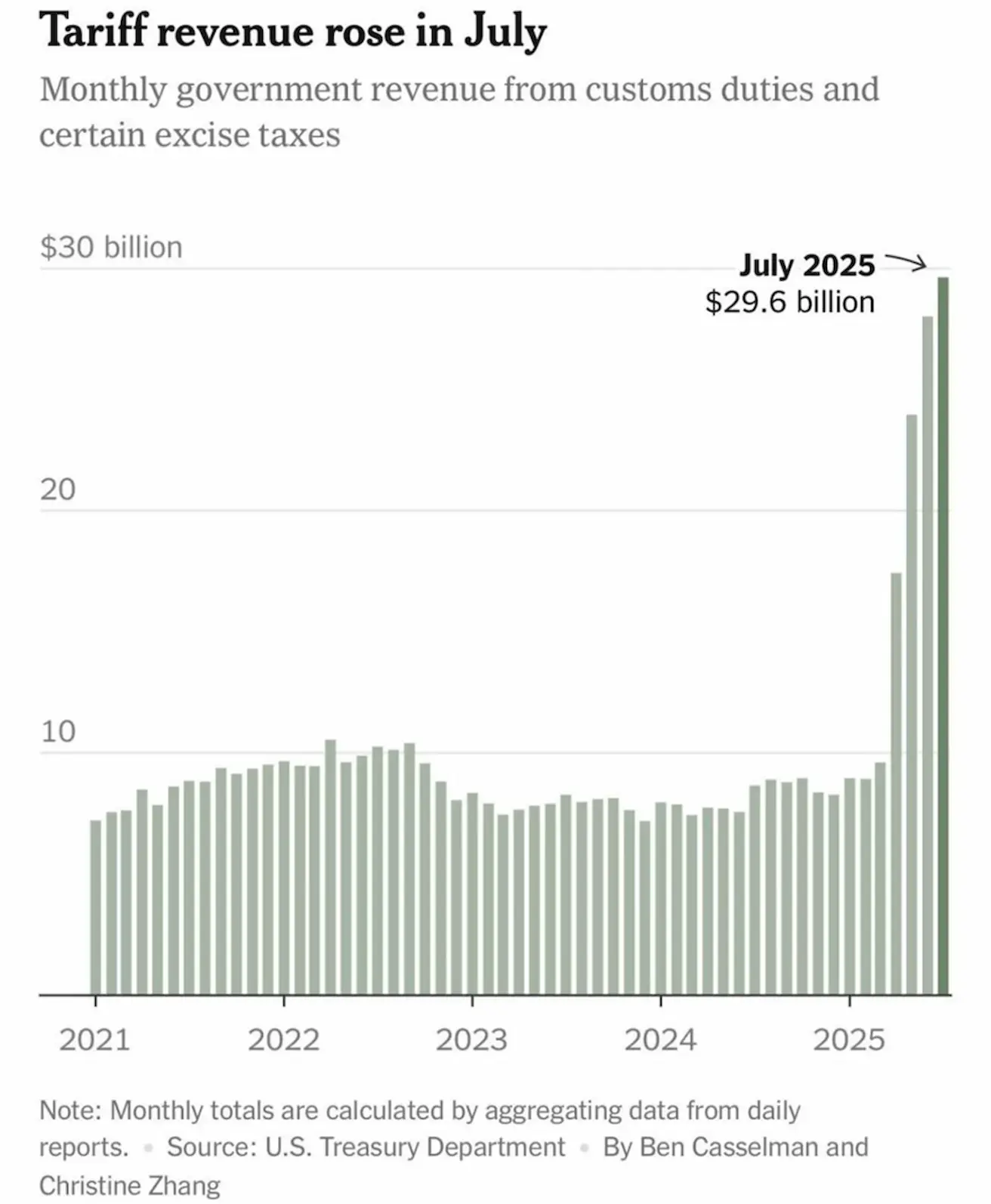

July U.S. tariff revenue: $29.6B – record high. Annualized pace: ~$360B (still insufficient to offset budget deficit).

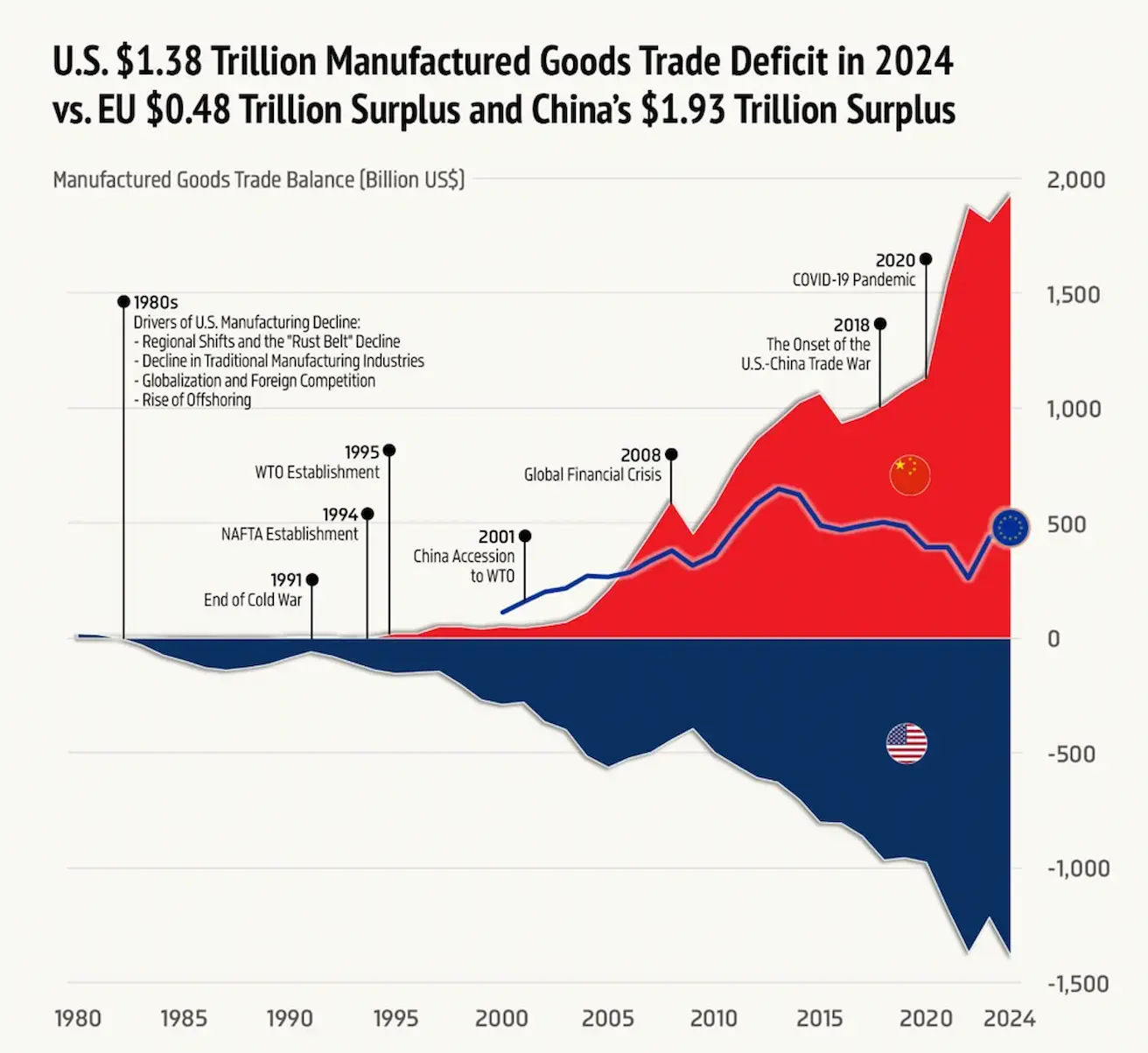

2024 trade balance: US deficit $1.38T vs EU surplus $0.48T and China surplus $1.93T.

Trump signed an executive order imposing additional 25% tariffs on Indian goods, citing India’s continued imports of Russian oil.

Equity Market

YTD sector leaders: Utilities, basic materials, financials

YTD laggards: Technology (–10.29%), healthcare (–15.6%)

S&P 500

+2.43% (6,389.44) | YTD: +8.24%

Nasdaq 100

+3.73% (23,611.27) | YTD: +11.80%

Euro Stoxx 600

+2.65% (549.1) | YTD: +8.60%

CSI Index

+1.23% (4,104.96) | YTD: +4.43%

Hang Seng TECH

+1.17% (5,460.3) | YTD: +23.07%

Bond Market

- Slight weekly rise in yields

- U.S. Treasuries 20+ (ETF TLT): –0.60% weekly (87.29), –0.58% YTD

Yields and spreads 06/30/2025 vs 07/07/2024

- 10-year yield: 4.27% (vs 4.22%)

- BBB corporate yield: 5.14% (vs 5.13%)

- 10Y–2Y spread: 51 bps (vs 49 bps)

- 10Y–3M spread: 2 bps (vs –4 bps)

Commodities & Crypto

Gold Futures: +1.24% weekly ($3,458.2/oz), YTD +30.94% (intraday >$3,500)

Dollar Index

–0.39% weekly (98.09), YTD –9.45%

Oil Futures

–5.81% weekly ($63.35/bbl), YTD –11.83% (pressure from OPEC+ output expectations)

Bitcoin Futures

+2.77% weekly ($117,425), YTD +23.25%; pre-market +4% (> $122K)

Ethereum Futures

+15.50% weekly ($4,080.5), YTD +20.58%; pre-market +5.5% (~$4,300)

- Crypto Market Capitalization $4.06T (prev: $3.72T)

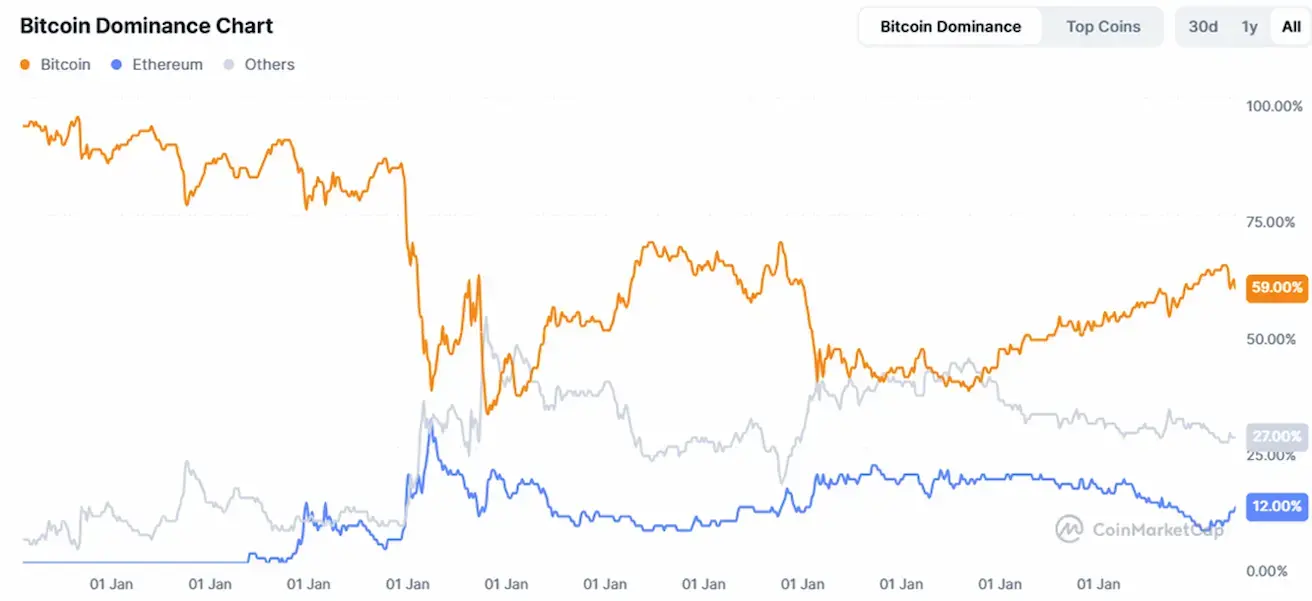

- Bitcoin dominance: 59.9% (prev: 61.1%)

- Ethereum: 12.8% (prev: 11.9%)

- Other cryptocurrencies: 27.3% (prev: 27.2%)

Қазақша

Қазақша