February 3 - 7, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

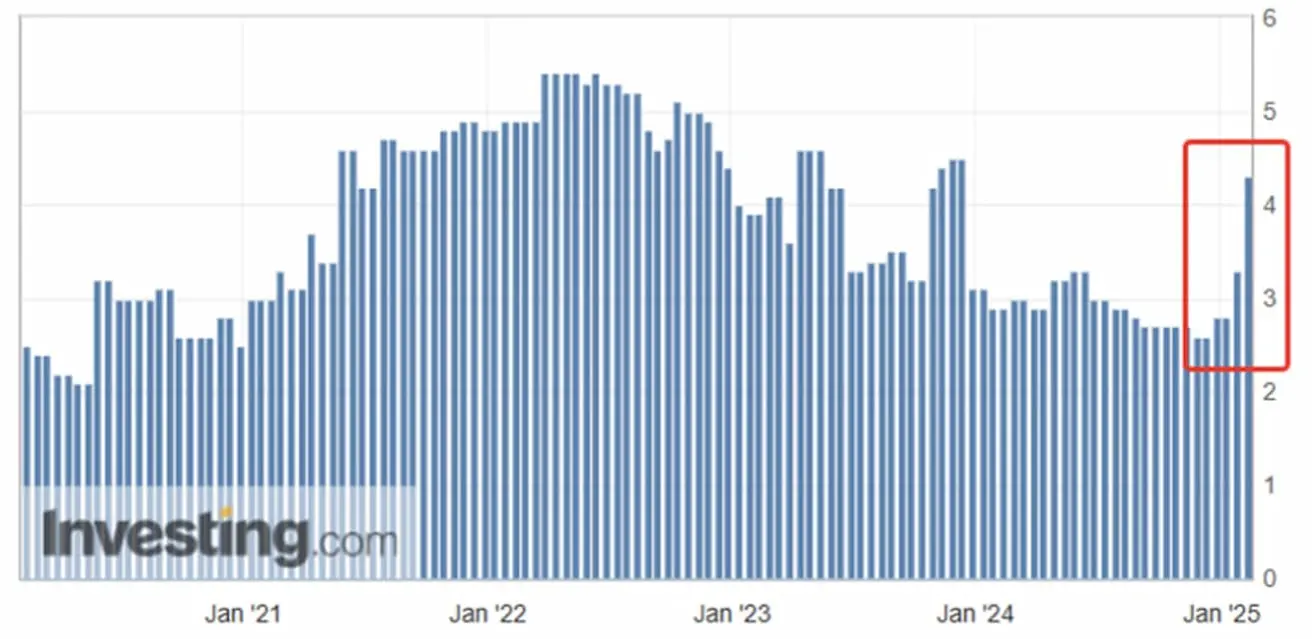

INFLATION

- Core Consumer Price Index (CPI) (m/m) (December): 0.2% (prev: 0.3%);

- Consumer Price Index (CPI) (m/m) (December): 0.4% (prev: 0.3%);

- Core Consumer Price Index (CPI) (y/y) (December): 3.2% (prev: 3.3%);

- Consumer Price Index (CPI) (y/y) (December): 2.9% (prev: 2.7%).

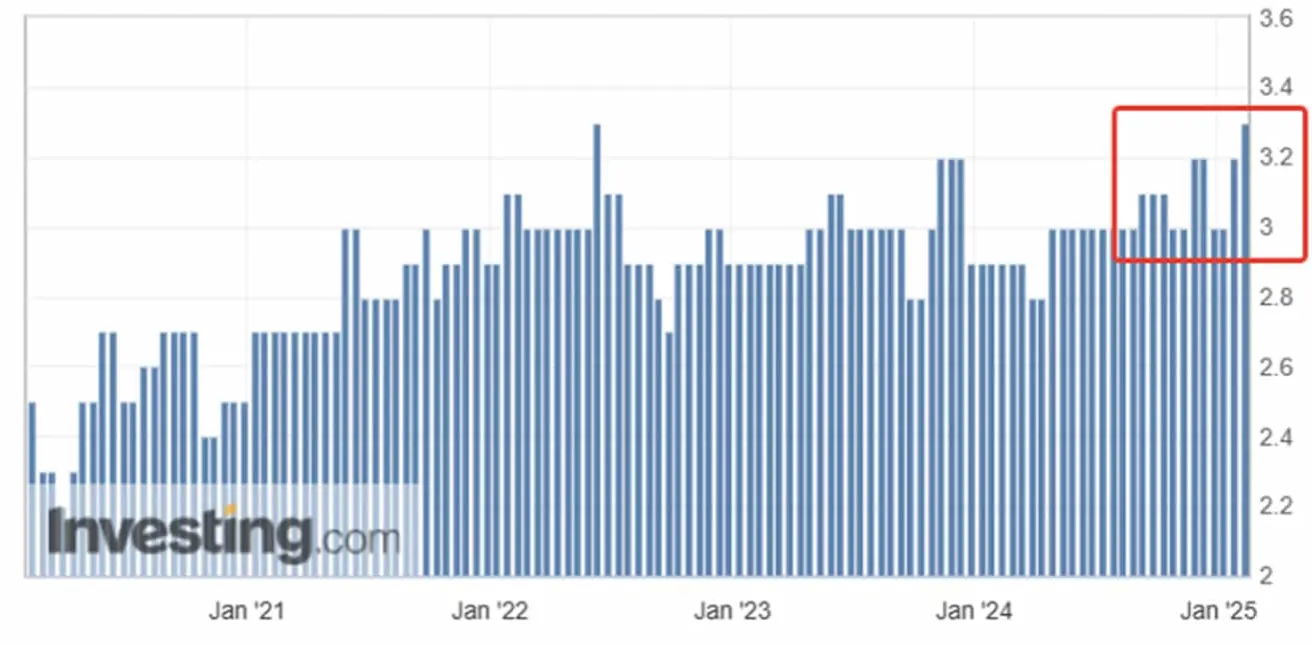

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (January): 4.3%, prev: 3.3%;

- 5-year expected inflation (January): 3.3%, prev: 3.2%.

BUSINESS ACTIVITY INDEX (PMI)

- Services Sector (December): 52.8 (prev: 56.8);

- Manufacturing Sector (December): 50.1 (prev: 49.3);

- S&P Global Composite (December): 52.4 (prev: 55.4).

GDP (BEA – U.S. Bureau of Economic Analysis) (q/q) (Q) (Preliminary Estimate):

- 2.3% (prev: 3.1%)

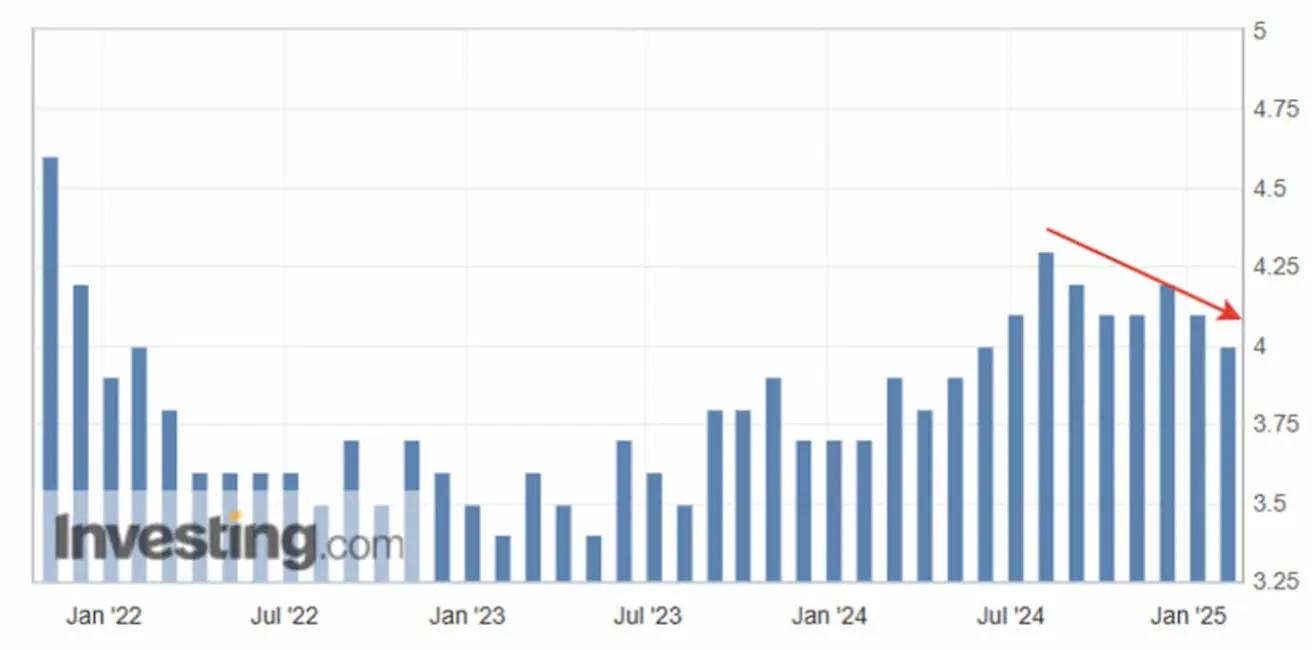

LABOR MARKET

- Unemployment Rate (January): 4.0% (prev: 4.1%);

- Nonfarm Payrolls Change (January): 143K (prev: 307K);

- Private Nonfarm Payrolls Change (January): 223K (prev: 111K, 273K revised);

- Average Hourly Earnings (January, y/y): 4.1% (prev: 4.1%).

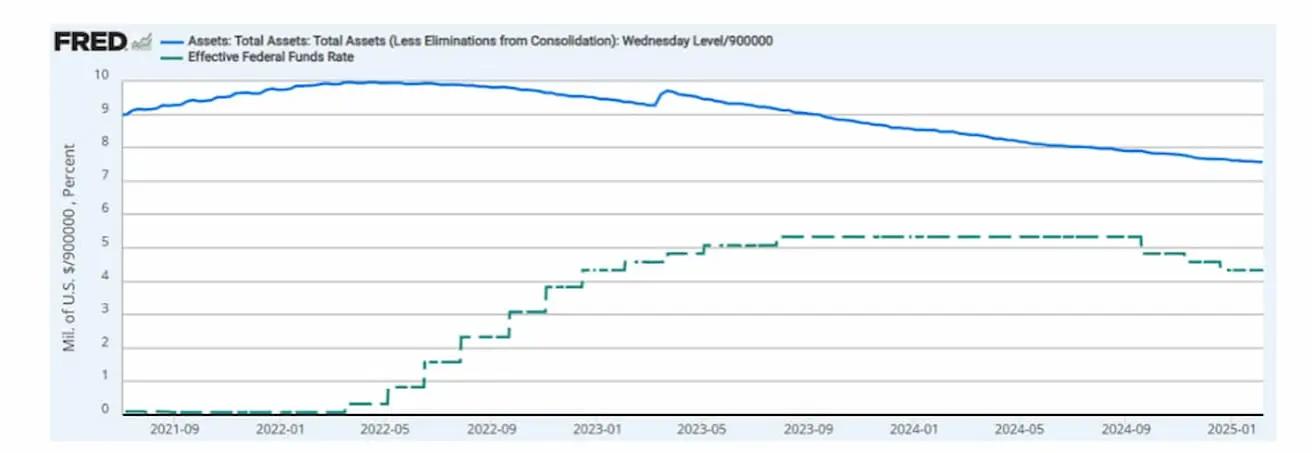

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- Fed Balance Sheet (blue): $6.810 trillion (vs previous week: $6.818 trillion)

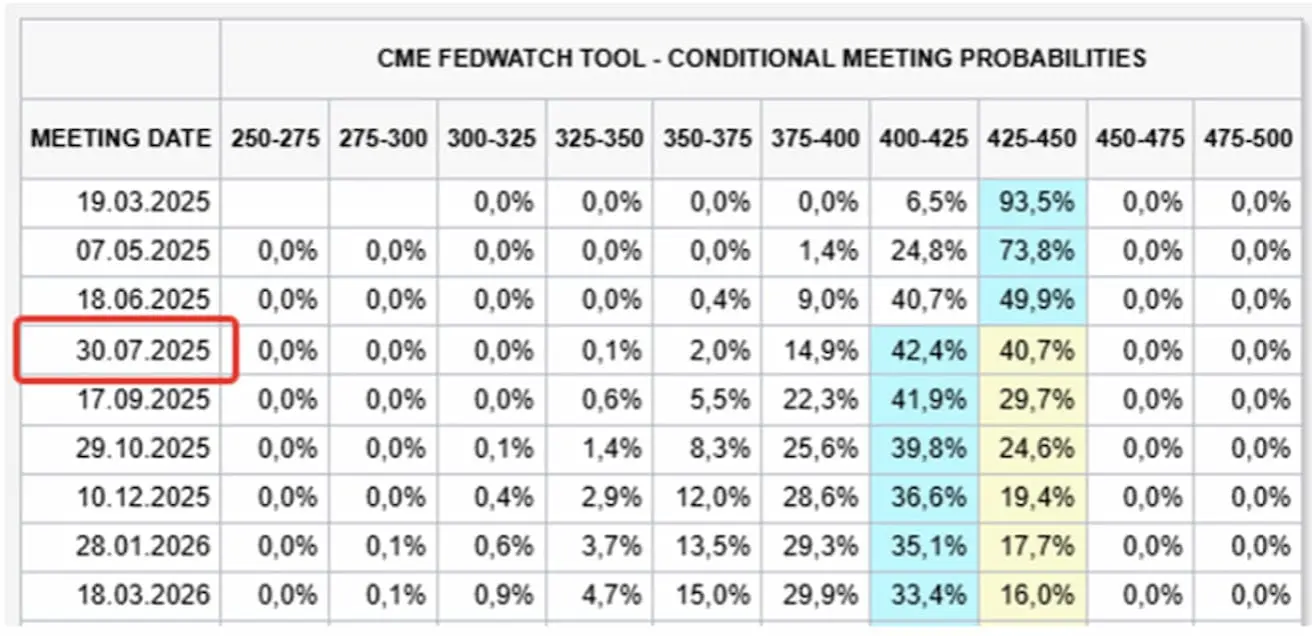

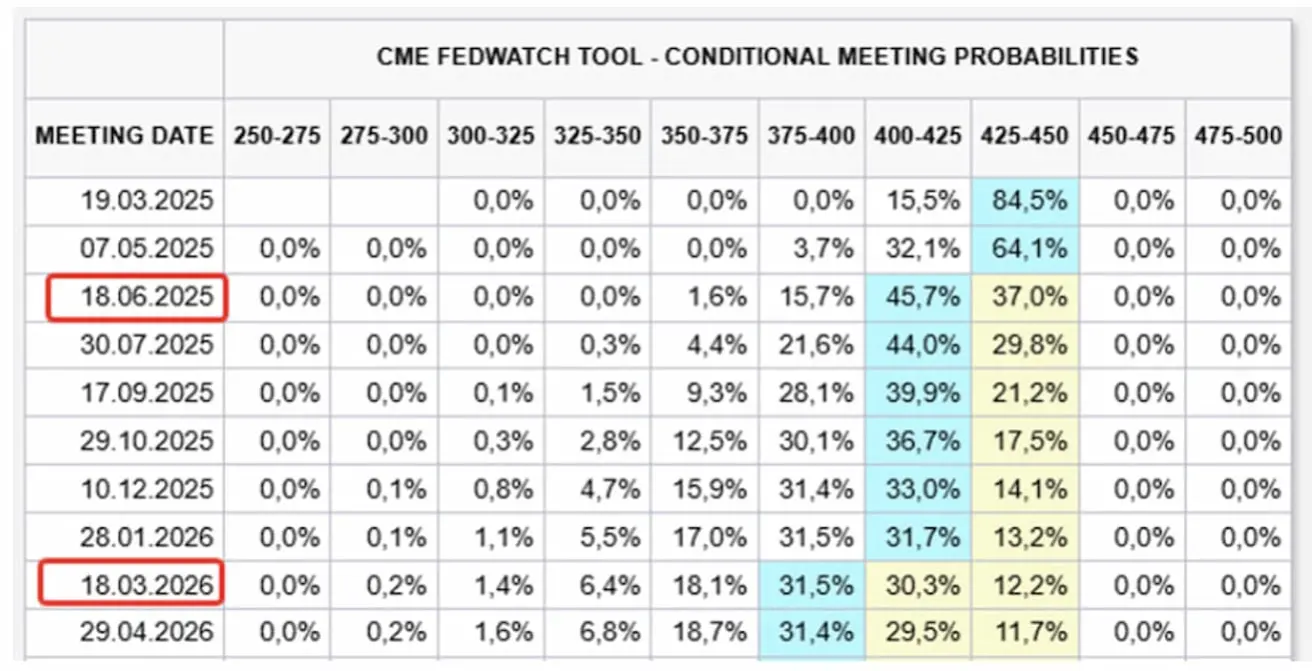

MARKET FORECAST FOR RATE

Today:

A week earlier:

Commentary:

The latest release of inflation expectations from the University of Michigan showed a sharp increase in expectations both for the 12-month period (+1% to 4.3%) and for the 5-year period (+0.1% to 3.3%).

Total non-farm payroll employment increased by 143,000 in January. Job growth was recorded in healthcare, retail trade, and social assistance. Employment declined in the mining, quarrying, and oil & gas industries.

The unemployment rate continued to decline, reaching 4.0% compared to 4.1% a month earlier (forecast: 4.1%). This indicator has been decreasing since August 2024.

Inflation expectations and labor market data support maintaining the current interest rate.

Overall, FedWatch shows no significant changes:

- Short-term expectations: The first rate cut of 0.25% is expected in July this year.

- 12-month forecast: No changes expected; the anticipated rate remains at 4.00-4.25%.

The Trump administration postponed tariff implementation for Canada and Mexico by 30 days. In response, Canadian Prime Minister Trudeau and Mexican President Sheinbaum announced an agreement to strengthen border security in response to Trump’s demand to combat immigration and drug smuggling.

Tariffs against China remain in place, and China has begun retaliatory measures.

MARKET

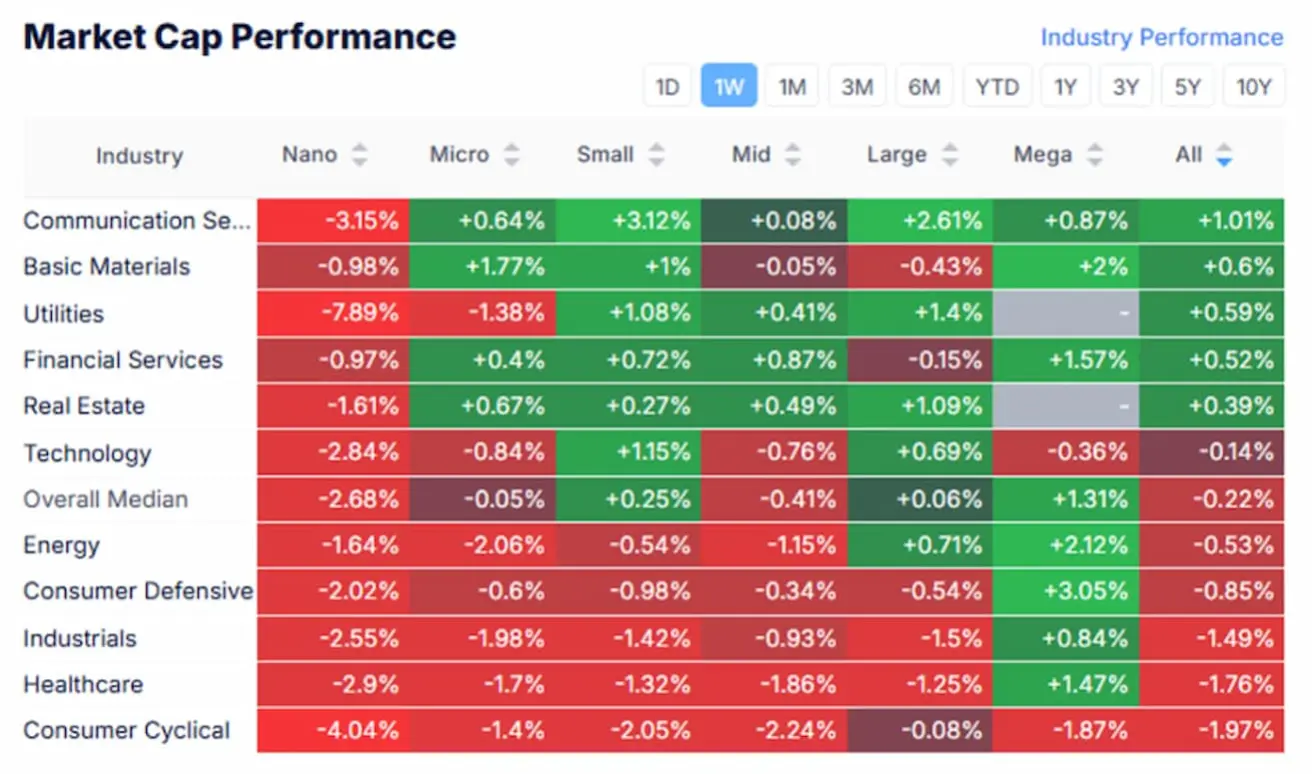

MARKET CAP PERFORMANCE

Sector performance last week was mixed. Growth was seen in communication services, basic materials, and utilities. Declines were recorded in consumer cyclical, healthcare, and manufacturing sectors. The median decline was -0.22%.

YTD (Year-to-Date – period from the beginning of the year to the current date).

The leaders in growth since the beginning of the year are basic materials, financials, and utilities. Defensive sectors remain the underperformers.

SP500

S&P 500: Tested the 6100 resistance level for the third time, with a sharp pullback on Friday. Weekly performance: -0.24% (weekly close: 6025.98). YTD growth: +2.08%.

NASDAQ100

Nasdaq 100: Weekly performance: +0.06% (weekly close: 21491.31). YTD growth: +1.76%.

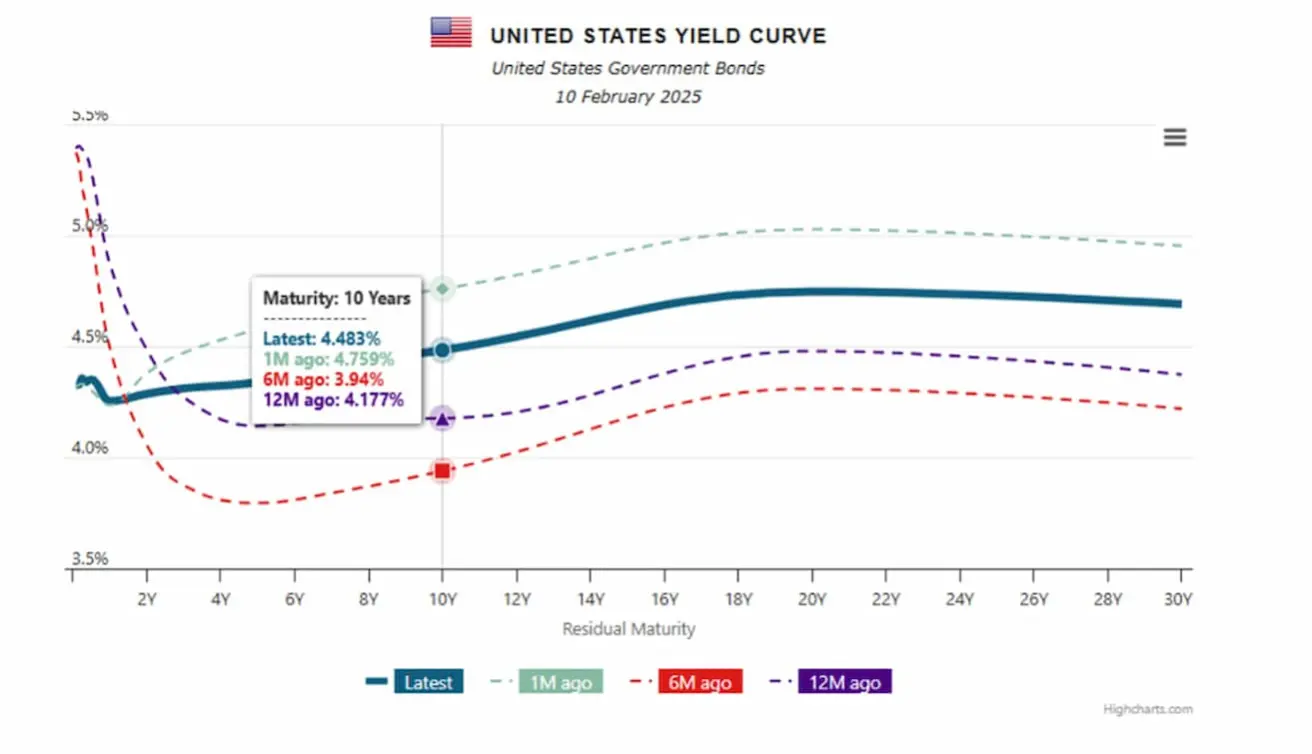

BOND MARKET

Bond Market – Yields Declined Over the Week. Treasury Bonds 20+ (ETF TLT): +1.72% (weekly close: $89.27). YTD: +1.67%.

YIELS AND SPREADS

Yields and Spreads (2025/01/23 vs 2024/01/17):

- 10-Year U.S. Treasury Yield: 4.48% (prev: 4.54%)

- ICE BofA BBB US Corporate Index Effective Yield: 5.44% (prev: 5.47%)

The yield spread between 10-year and 2-year U.S. Treasury bonds stands at 19.6 vs. 34.0 basis points (the difference in yield between long-term and short-term debt). The U.S. Treasury yield curve illustrates the yields of bonds with different maturities. It serves as a key indicator of economic conditions and market expectations:

Yield Curve for U.S. Treasuries:

- Short-term (up to 1 year): 4.32 - 4.25%

- Mid-term (3-7 years): 4.31 – 4.41%

- Long-term (10+ years): 4.48-4.69%

GOLD FUTURES

Gold Futures (GC):

- Gold continues to hit historical highs.

- Weekly performance: +3.18% (weekly close: $2,921.1 per oz.)

- YTD growth: +10.62%

Goldman Sachs expects a technical pullback in gold prices if tariff uncertainties subside. However, continued central bank purchases and a gradual increase in ETF holdings after Fed rate cuts will support gold’s long-term outlook, with a target of $3,000 per ounce by mid-2026.

DOLLAR FUTURES

Dollar Index Futures (DX):

- Weekly performance: -0.17% (weekly close: 108.165)

- YTD: -0.15%:

OIL FUTURES

Oil prices are falling after the U.S. reached agreements with Canada and Mexico to postpone the introduction of tariffs.

- OPEC+: The organization stated that it does not intend to change its plan for the gradual increase in oil production starting in April. The group is expected to ease current cuts by approximately 180,000 barrels per day, fully restoring production by September 2026.

- Weekly change: -3.18%, closing at $71.46 per barrel.

- Year-to-date change: -0.54%.

CRYPTOCURRENCY MARKET

BTC

- Weekly performance: -6.09% (weekly close: $96,285)

- YTD growth: +1.07%

ETH

Ethereum Futures:

- Weekly performance: -22.53% (weekly close: $2,592)

- YTD decline: -23.40%

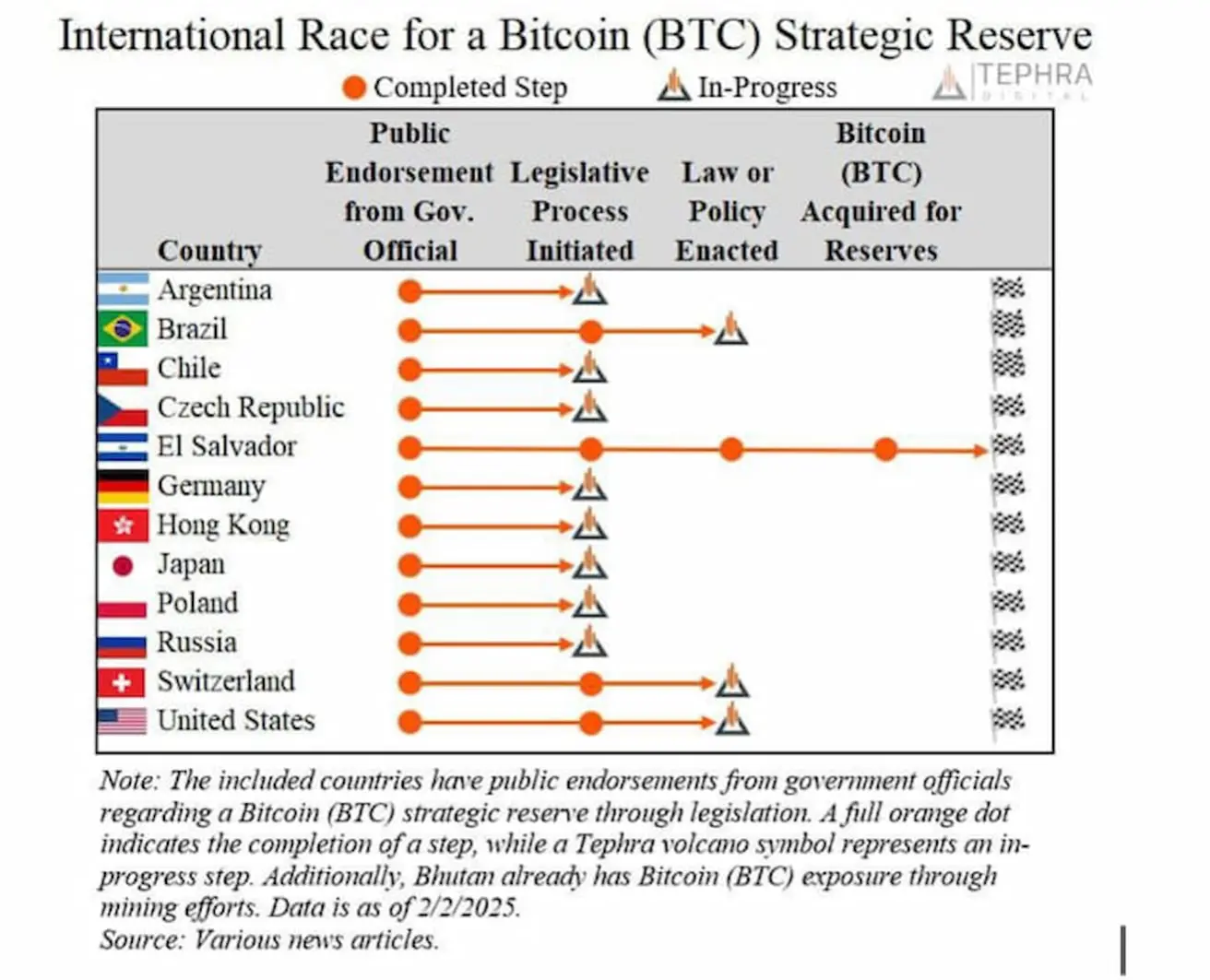

Adoption of BTC as a Strategic Reserve by Country:

So far, only the government of El Salvador has acquired BTC as a strategic reserve. However, 12 countries have already initiated the legislative process on this issue, and three—Brazil, Switzerland, and the U.S.—are in the voting stage.

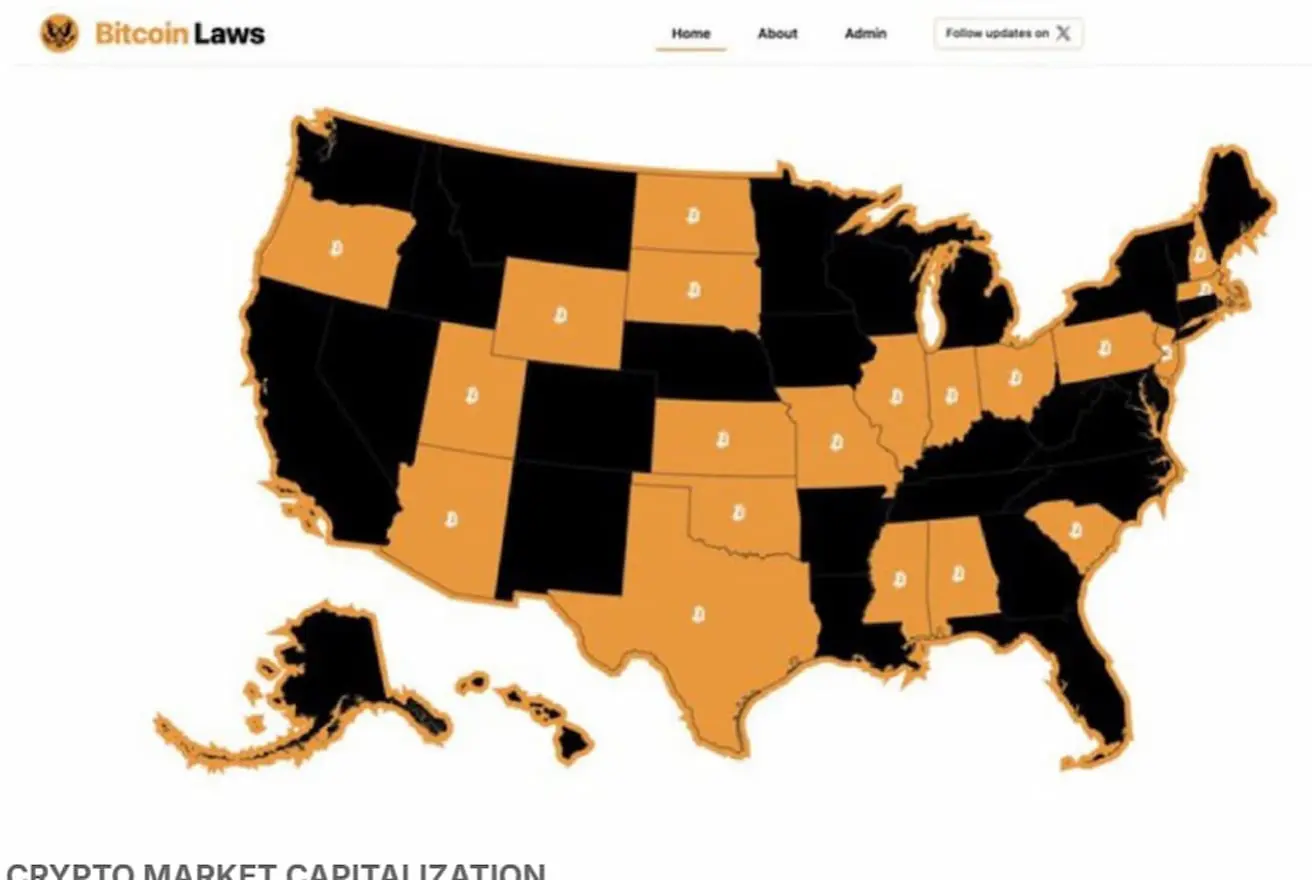

The number of U.S. states considering laws supporting BTC has increased to 19.

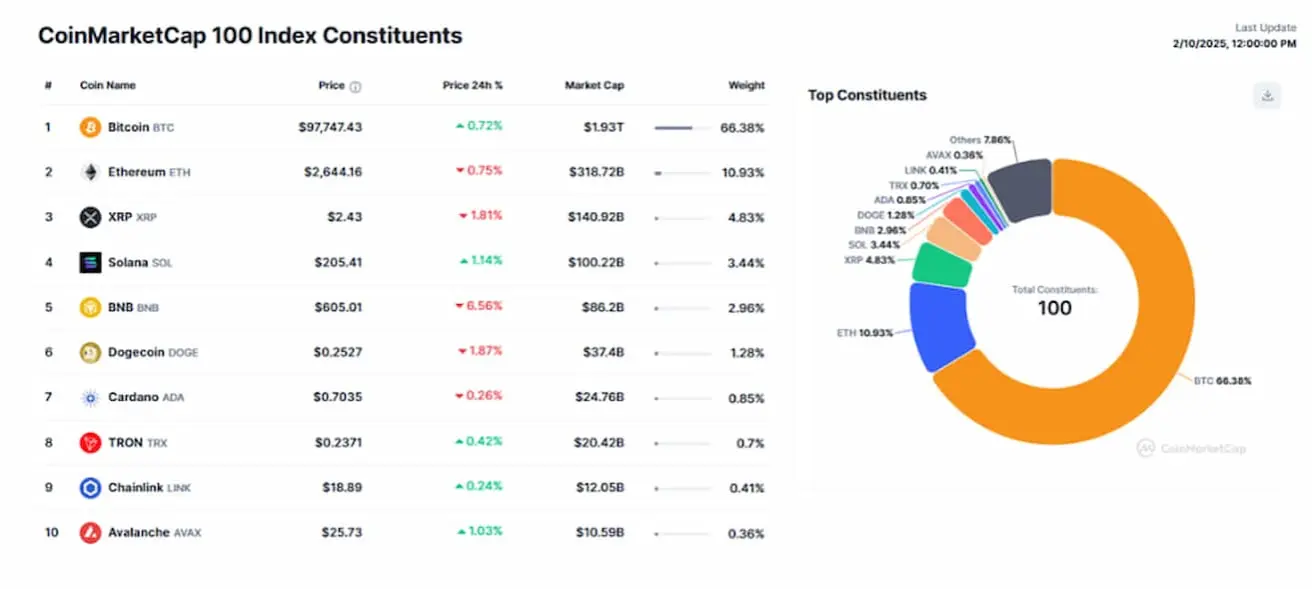

CRYPTO MARKET CAPITALIZATION

- Crypto Market Capitalization: $3.19 trillion ($3.09 trillion a week earlier) (coinmarketcap.com)

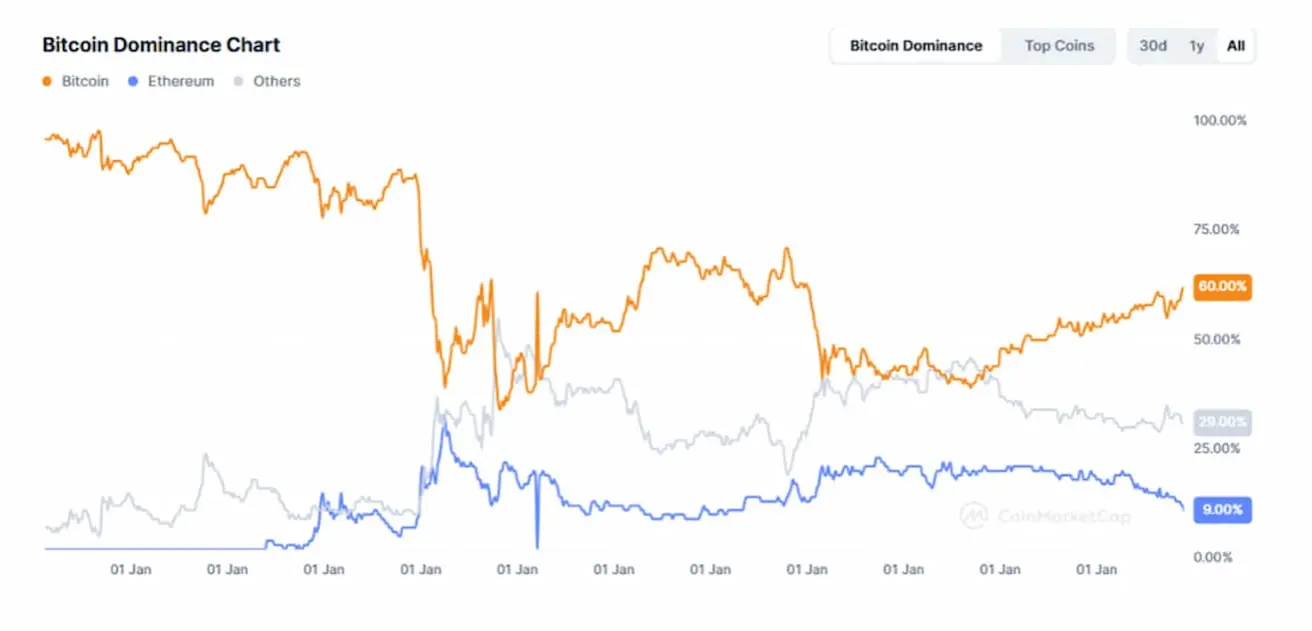

- Market Share: Bitcoin – 60.7% (61.1%), Ethereum – 9.0% (10.0%), Others – 29.3%.

Қазақша

Қазақша