January 27 - 31, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (December): 0.2% (prev: 0.3%);

- Consumer Price Index (CPI) (m/m) (December): 0.4% (prev: 0.3%);

- Core Consumer Price Index (CPI) (y/y) (December): 3.2% (prev: 3.3%);

- Consumer Price Index (CPI) (y/y) (December): 2.9% (prev: 2.7%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (December): 3.3%, prev: 2.8%;

- 5-year expected inflation (December): 3.3%, prev: 3.0%.

BUSINESS ACTIVITY INDEX (PMI)

- Services Sector (December): 52.8 (prev: 56.8);

- Manufacturing Sector (December): 50.1 (prev: 49.3);

- S&P Global Composite (December): 52.4 (prev: 55.4).

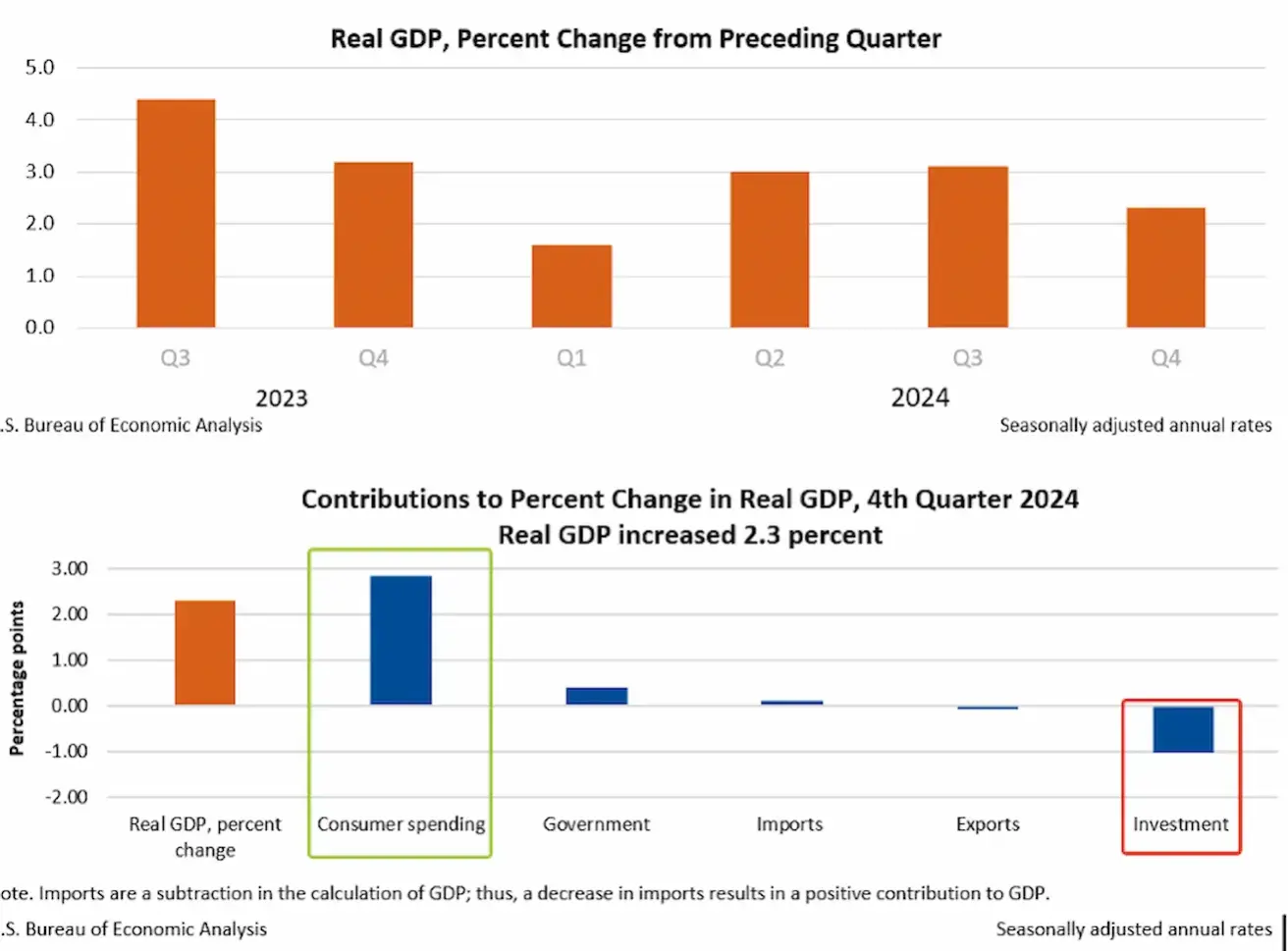

GDP (BEA – U.S. Bureau of Economic Analysis) (q/q) (Q) (Preliminary Estimate):

- 2.3% (prev: 3.1%)

LABOR MARKET

- Unemployment Rate (December): 4.1% (prev: 4.2%);

- Nonfarm Payrolls Change (December): 256K (prev: 212K);

- Private Nonfarm Payrolls Change (December): 223K (prev: 182K, revised);

- Average Hourly Earnings (December, y/y): 3.9% (prev: 4.0%).

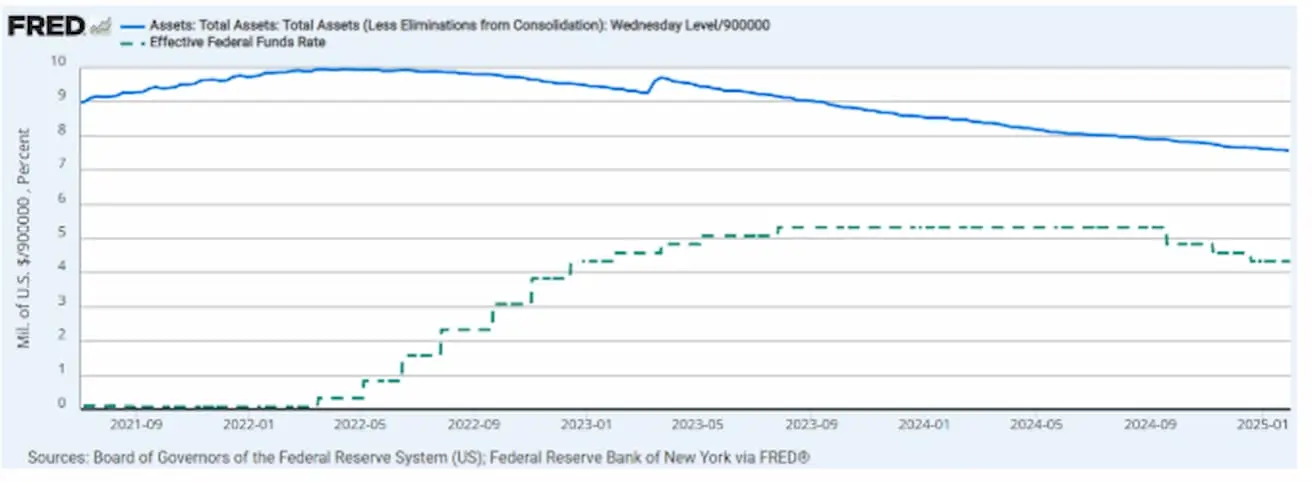

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- The Fed’s balance sheet (in blue) remains almost unchanged: $6.818 trillion (vs. $6.831 trillion the previous week).

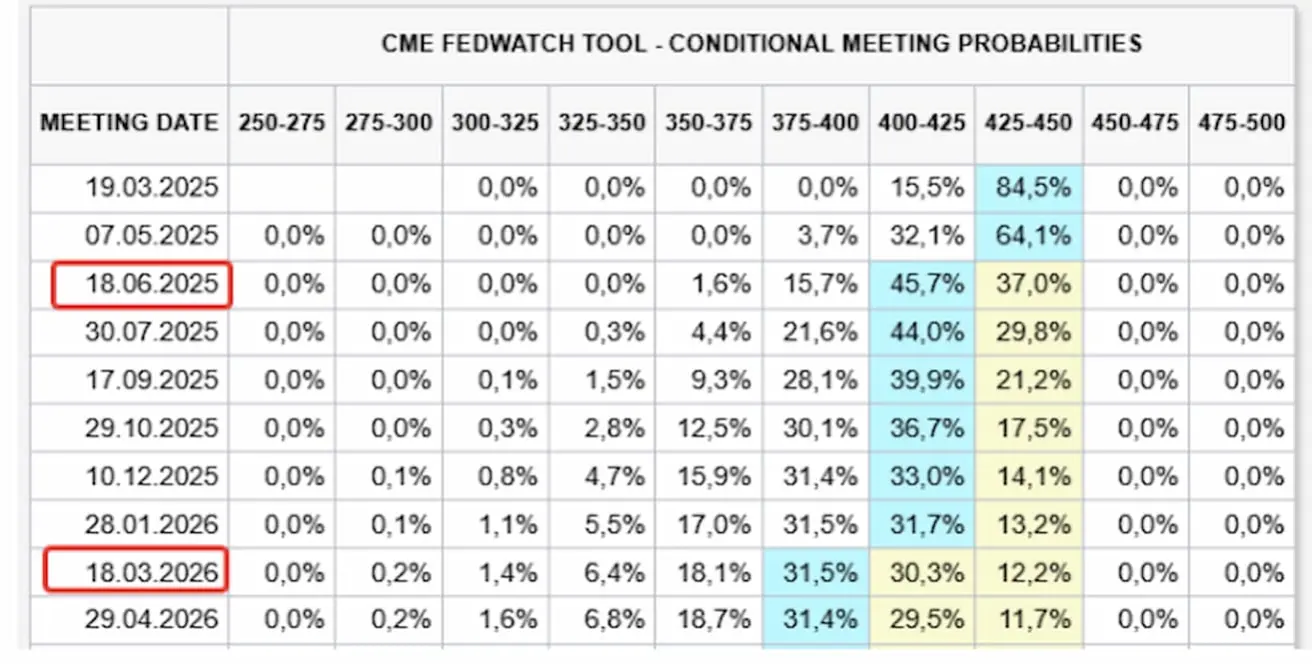

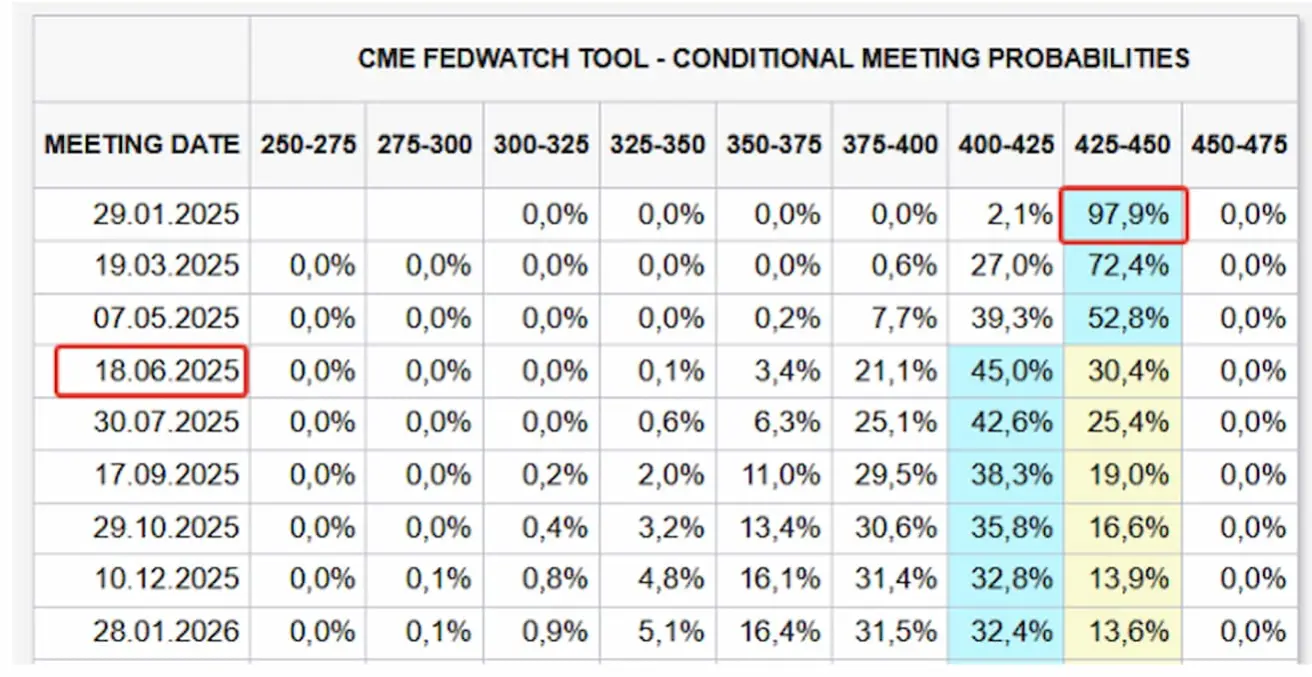

MARKET FORECAST FOR RATE

Today:

A week earlier:

Commentary:

According to the preliminary estimate published by the U.S. Bureau of Economic Analysis, real Gross Domestic Product (GDP) in the fourth quarter of 2024 increased at an annualized rate of 2.3%. The figure declined from 3.1% in the third quarter.

The growth of real GDP in the fourth quarter primarily reflected the dominant contribution of consumer spending and, to a lesser extent, government spending. The increase in consumer spending was driven by growth in both services and goods. In the services sector, healthcare made the largest contribution to growth. In the goods sector, the main contributors were recreational goods and vehicles, as well as motor vehicles and parts.

There is a significant decline in investments. The reduction in real sector investments is currently driven by two key factors: high capital costs and macroeconomic instability. This decline in investments, in turn, is not directed toward future economic expansion.

Last week, the FOMC meeting was held, where the interest rate was expectedly maintained within the 4.25%-4.50% range, and markets showed virtually no reaction to this decision.

The main message from Powell at the press conference: The committee does not need to rush to adjust monetary policy, as the economy remains strong, and the current interest rate level remains restrictive, allowing time to wait for further evidence of inflation decline. The committee is also in a wait-and-see mode to observe what policy measures will be taken by the new administration.

FedWatch:

-

Short-term expectations remain unchanged – the first rate cut of 0.25% is expected in June this year, with the second cut projected for March next year.

-

Key points from the FOMC press release:

-

Economic activity continues to grow at a steady pace.

-

The unemployment rate has remained at a low level in recent months.

-

Labor market conditions remain stable.

-

Inflation remains somewhat elevated.

-

The committee decided to keep the target federal funds rate range at 4.25%-4.50%.

-

The committee will continue reducing its holdings of Treasury and other securities.

MARKET

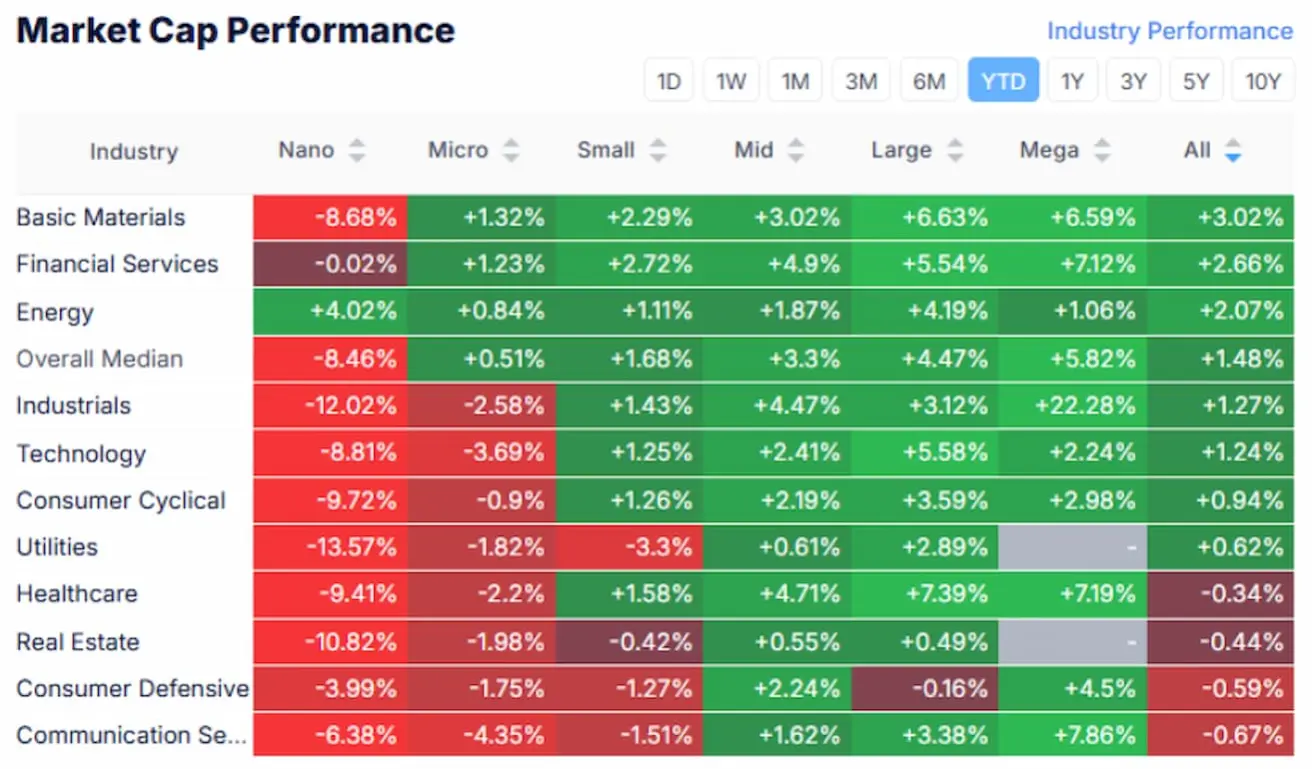

MARKET CAP PERFORMANCE

The energy sector showed the worst performance last week (-4.15%). The median decline was -0.56%, while utilities, financials, and real estate sectors showed positive performance.

YTD (Year-to-Date – period from the beginning of the year to the current date).

The leading growth sectors since the beginning of the year remain basic materials, financials, and energy (as shown in the lower table). Defensive sectors continue to underperform.

SP500

After dropping at the opening last week due to concerns about Deepseek, the S&P 500 recovered throughout the week. However, on Friday, after closing the gap, the index shifted downward, forming a resistance level at 6100.

- Weekly performance: -1.00% (closed at 6040.52)

- 2025 performance: +2.33%

NASDAQ100

Nasdaq 100 Index:

- Weekly performance: -1.36% (closed at 21,478.05)

- 2025 performance: +1.70%

Today, U.S. stock futures are down 2% in pre-market trading after President Donald Trump announced new tariffs on key trading partners over the weekend.

The U.S. imposed:

- 25% tariffs on goods from Canada and Mexico

- 10% tax on Chinese imports

In response:

- Canada announced reciprocal tariffs

- Mexico stated it may introduce its own restrictions

- China expressed its intention to file a complaint with the WTO

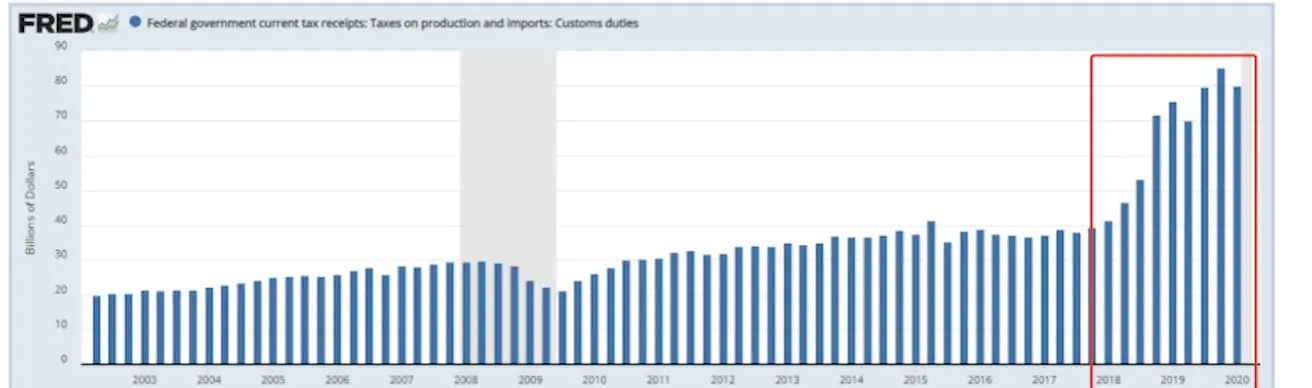

Chart of federal government tax revenues. Taxes on production and imports, customs duties:

Trade tariffs were accompanied by a sharp increase in government revenues during Trump's first term. However, today's market reaction suggests greater concerns over inflation risks and the monetary policy response.

BOND MARKET

Bond Market – Yields Declined Over the Week.

- U.S. Treasury Bonds 20+ (ETF TLT): +0.62% (weekly close at 87.76)

- 2025 performance: -0.05%

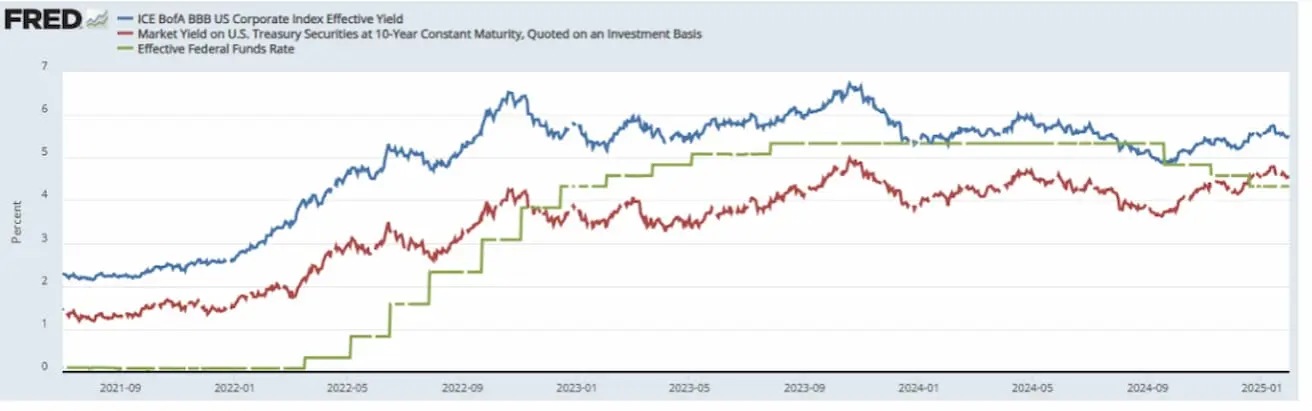

YIELS AND SPREADS

Yields and Spreads 2025/01/23 vs 2024/01/17:

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4,54% (4,61)%;

- ICE BofA BBB US Corporate Index Effective Yield: 5,47% (5,57%):

The yield spread between 10-year and 2-year U.S. Treasury bonds is 34.0 basis points (the difference in yield between long-term and short-term debt).

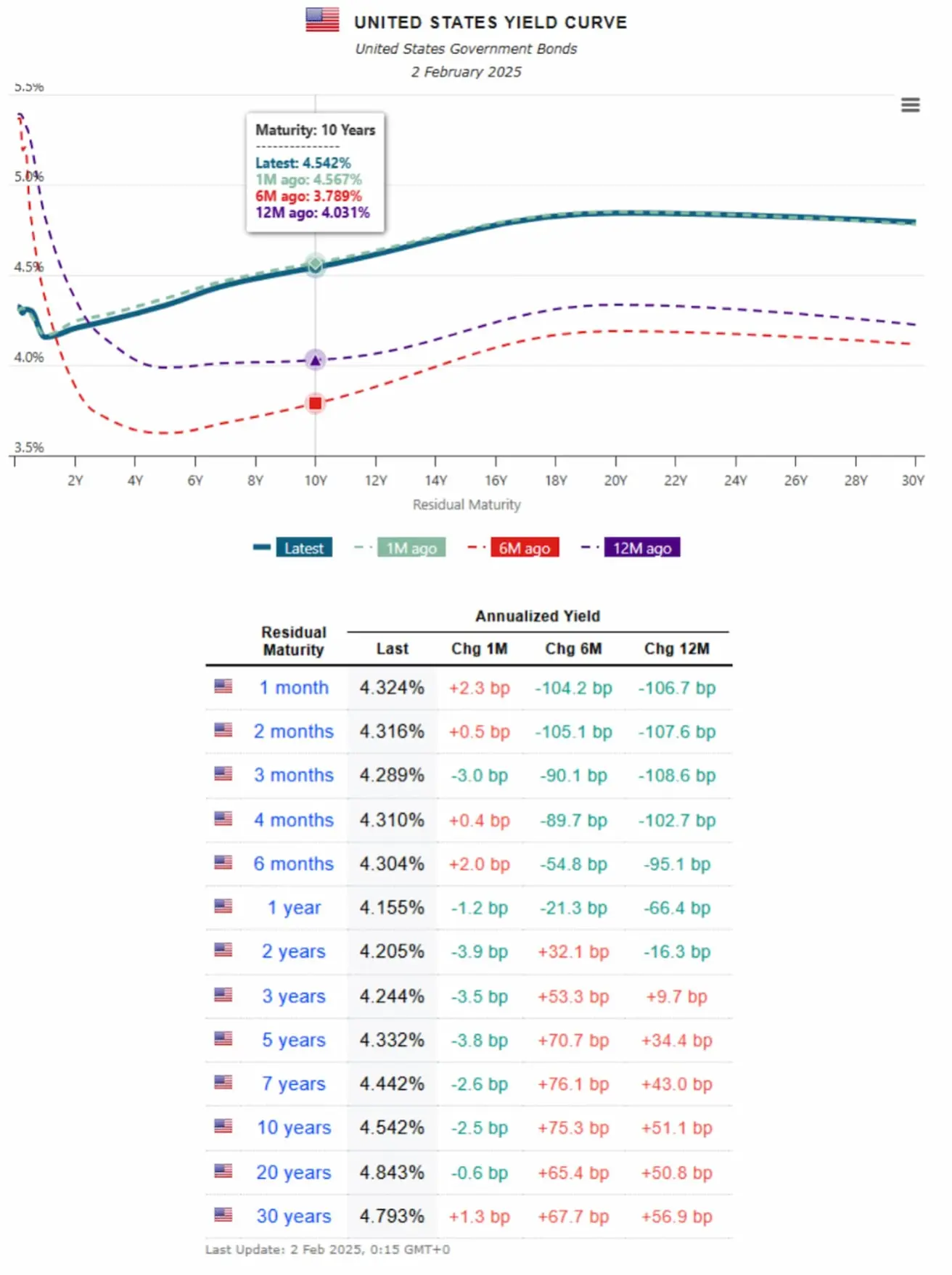

The U.S. Treasury yield curve shows the yields of bonds with different maturities. It is a key indicator of economic conditions and market expectations:

- Money Market Yield (maturity up to 1 year): 4.32% - 4.15%

- Mid-Term Yield (3-7 years): 4.24% – 4.44%

- Long-Term Yield (10+ years): 4.54% - 4.79%

GOLD FUTURES

Gold Futures (GC):

- Reached an all-time high of $2,863 per troy ounce last week.

- Weekly performance: +1.95% (closed at $2,831.5)

- 2025 performance: +7.21%

DOLLAR FUTURES

Dollar Index Futures (DX):

Historical trend: During macroeconomic uncertainties, demand for the dollar increases, supported by high interest rates.

- Weekly performance: +1.02% (closed at 108.35)

- 2025 performance: +0.02%

OIL FUTURES

Oil Futures (CL):

- Weekly performance: -1.06% (closed at $73.81 per barrel)

- 2025 performance: +2.73%

CRYPTOCURRENCY MARKET

BTC

Bitcoin Futures:

- Weekly performance: -2.80% (closed at $102,530)

- 2025 performance: +7.62%

ETH

Ethereum Futures:

- Weekly performance: +0.34% (closed at $3,346.00)

- 2025 performance: -1.12%

Last week, Bitcoin tested its upper resistance level but failed to break through. Ethereum, in general, remained in a neutral trend.

Today, due to the same news:

- Bitcoin futures are down 6%;

- Ethereum futures have already dropped 23%.

- Additional News from Last Week – Key Points: The U.S. Senate confirmed Scott Bessent as Treasury Secretary. He supports the long-term crypto economy in the U.S.

Texas introduced a bill to establish a Bitcoin strategic reserve of up to $500 million per year.

Indiana proposed legislation allowing the state to invest pension funds in BTC-ETFs.

Senator Cynthia Lummis, newly appointed Chair of the Senate Banking Subcommittee on Digital Assets, advocates for Bitcoin, urging people to save Bitcoin for retirement and the future.

ECB President Christine Lagarde, on the other hand, stated: “Bitcoin will not be included in the EU reserves.”

Meanwhile, the Czech National Bank approved an initiative to assess investments in alternative asset classes, including Bitcoin.

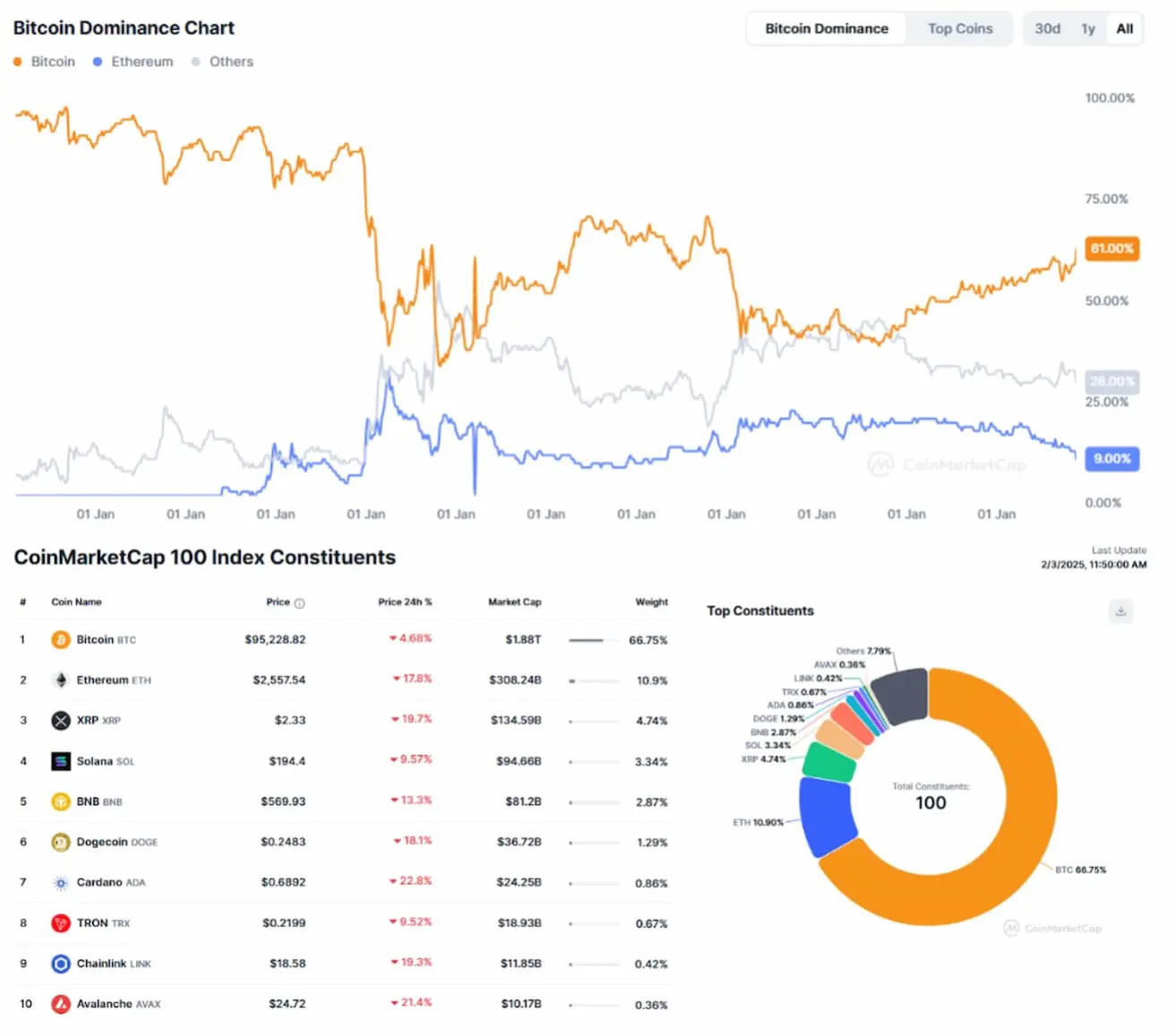

CRYPTO MARKET CAPITALIZATION

- Total market cap: $3.09 trillion (previous: $3.36 trillion)

- Bitcoin dominance: 61.1% (previous: 58.2%)

- Ethereum dominance: 10.0% (previous: 11.0%)

- Other assets: 29.0%

Compared to last Monday, the crypto market lost over $300 billion in capitalization. Capital redistribution favors Bitcoin, now holding over 61% market dominance.

Қазақша

Қазақша