January 13, 2025 — January 17: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

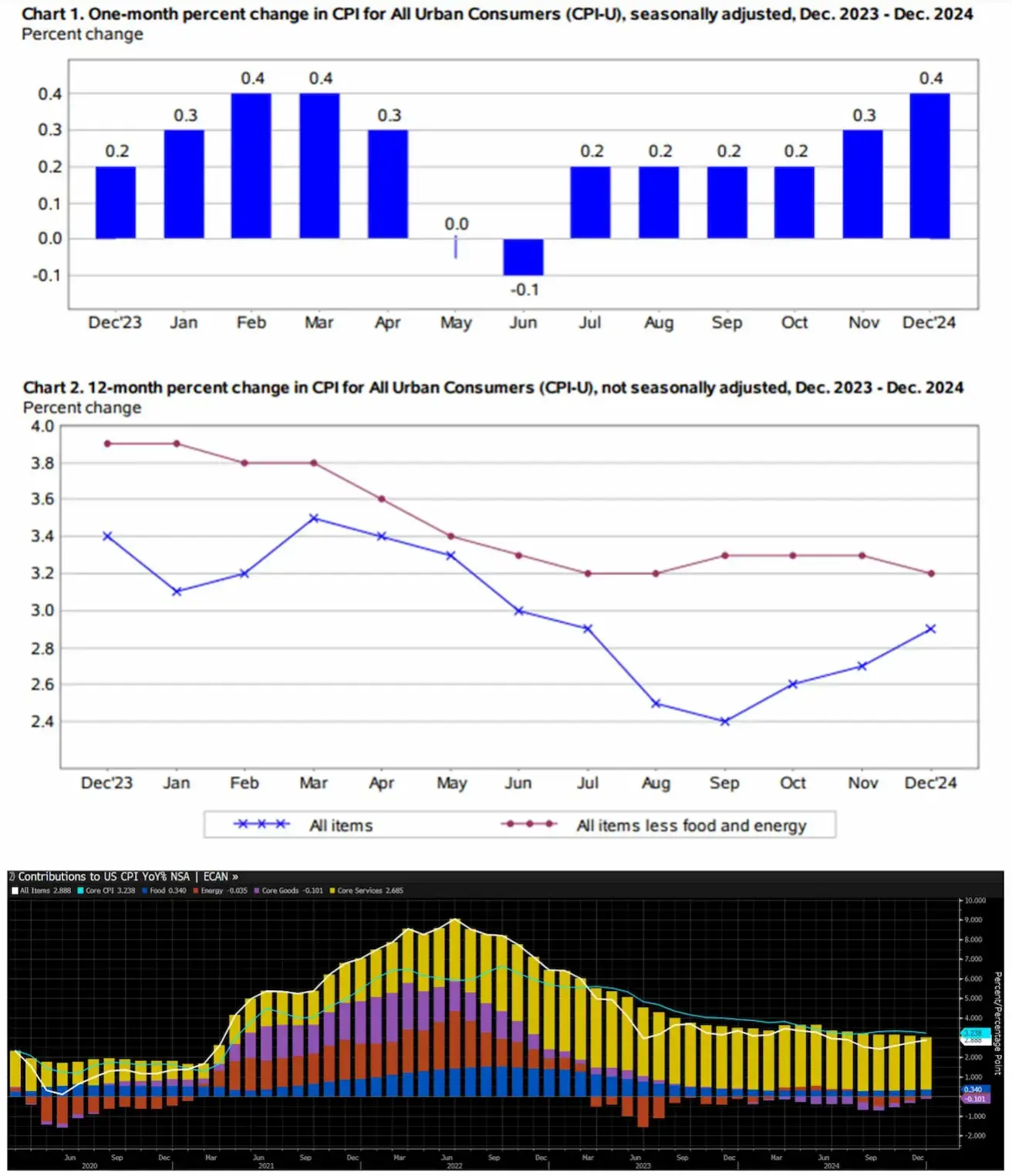

- Core Consumer Price Index (CPI) (m/m) (December): 0.2% (prev: 0.3%);

- Consumer Price Index (CPI) (m/m) (December): 0.4% (prev: 0.3%);

- Core Consumer Price Index (CPI) (y/y) (December): 3.2% (prev: 3.3%);

- Consumer Price Index (CPI) (y/y) (December): 2.9% (prev: 2.7%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (December): 3.3%, prev: 2.8%;

- 5-year expected inflation (December): 3.3%, prev: 3.0%.

BUSINESS ACTIVITY INDEX (PMI)

- Services Sector (December): 56.5 (prev: 56.1);

- Manufacturing Sector (December): 49.3 (prev: 48.4);

- S&P Global Composite (December): 55.4 (prev: 54.9).

GDP (BEA) (q/q) (3Q), third estimate:

- 3.1% (prev: 3.0%).

LABOR MARKET

- Unemployment Rate (December): 4.1% (prev: 4.2%);

- Nonfarm Payrolls Change (December): 256K (prev: 212K);

- Private Nonfarm Payrolls Change (December): 223K (prev: 182K, revised);

- Average Hourly Earnings (December, y/y): 3.9% (prev: 4.0%).

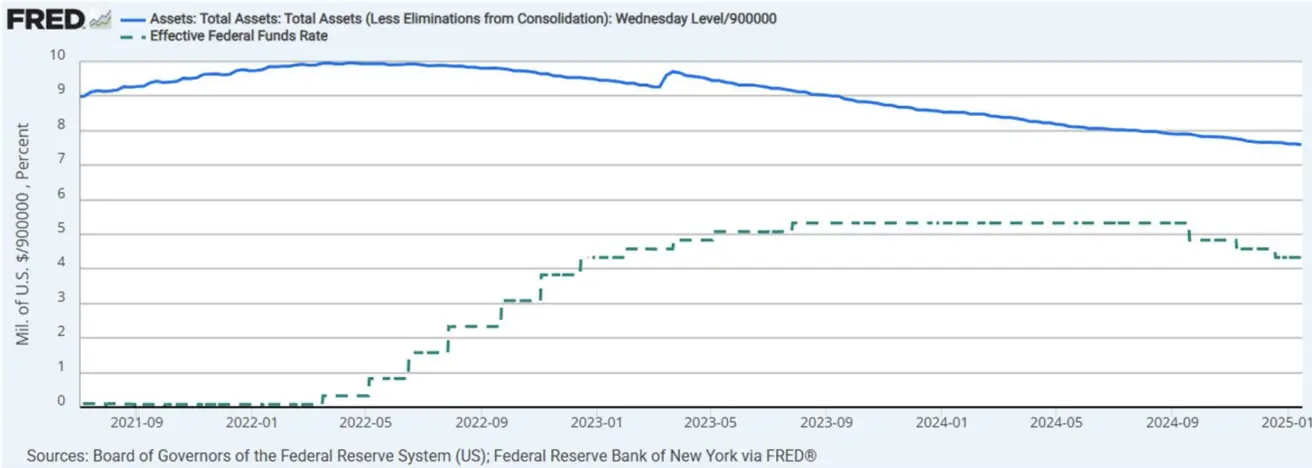

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- The Fed’s balance sheet (in blue) remains almost unchanged: $6.834 trillion (vs. $6.852 trillion the previous week).

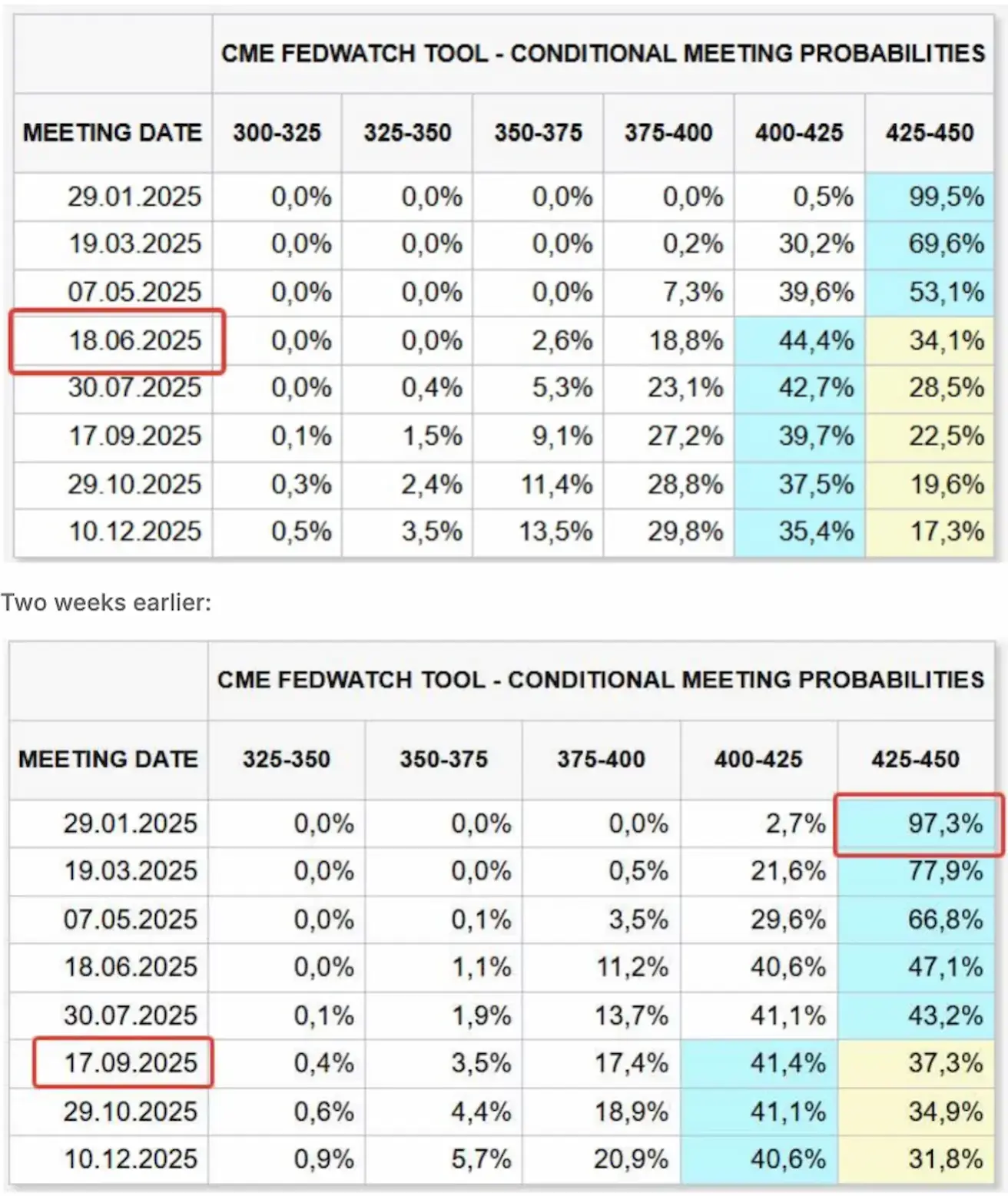

MARKET FORECAST FOR RATE

Today:

Commentary:

Last week, the latest U.S. consumer inflation data was released, which was positively received by the market. The Consumer Price Index rose by 0.4% month over month (seasonally adjusted) after a 0.3% increase in November. Over 12 months, the all-items index rose by 2.9%.

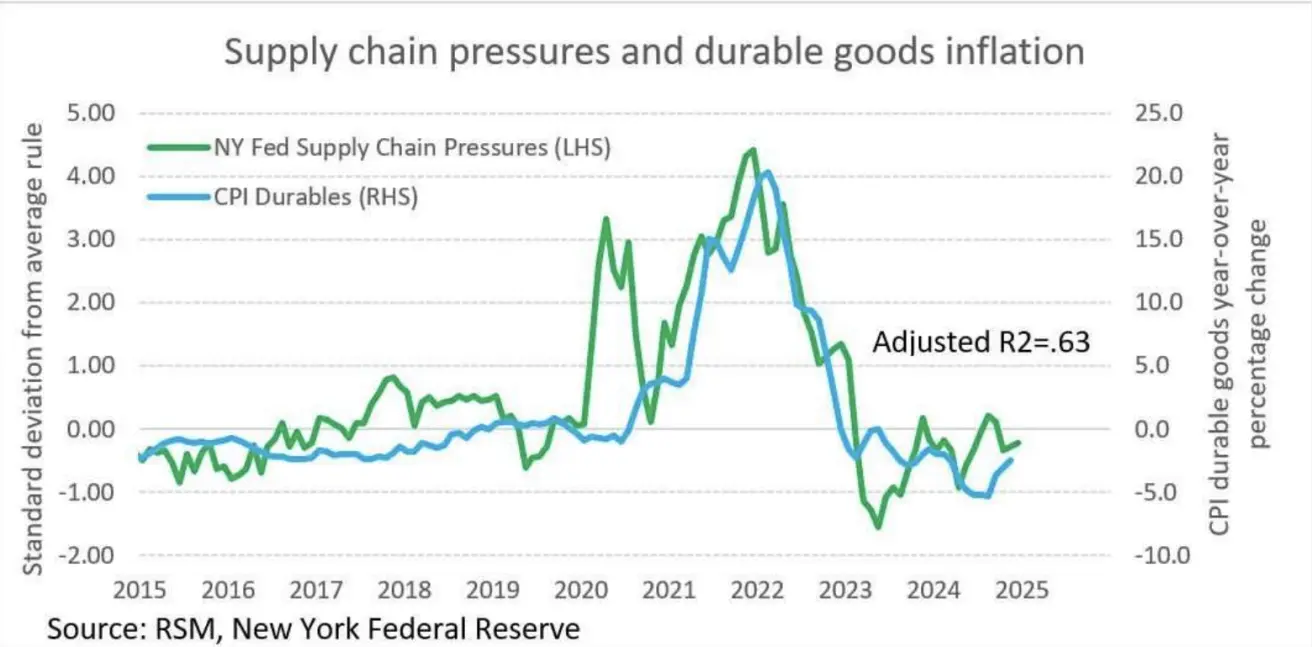

Core inflation in the U.S., excluding items such as food and energy, declined to 3.2%, below the market expectation of 3.3%. This drop in core inflation generated optimism. Prices for services excluding energy slowed to 4.4% from 4.6% in the previous month, driven by a softer rise in housing costs (4.6% vs. 4.7% in November), the cost of transportation services accelerated (7.3% vs. 7.1%). Compared to the previous month, core consumer prices rose by 0.2%, slowing from November’s 0.3% increase. President Trump’s policies remain in focus. The Federal Reserve Bank of New York’s supply chain index, which strongly correlates with durable goods inflation.

Since service inflation is declining very slowly and there are possible risks of goods inflation, the Fed is clearly not in a hurry to ease monetary policy. The most likely outcome is a pause in rate cuts.

“Beige Book”: Key Takeaways

- In its latest Beige Book study released on Wednesday, the Federal Reserve commented that economic activity increased “slightly to moderately” across the U.S. at the end of November and December, supported by strong holiday sales.

- Economic activity rose slightly or moderately in the twelve Federal Reserve Districts in late November and December.

- Consumer spending grew moderately, and strong holiday sales exceeded expectations.

- Manufacturing decreased slightly overall, as some manufacturers built up inventories in anticipation of higher tariffs.

- Commercial real estate sales rose slightly.

- Surveys indicated increased optimism regarding 2025, though there are persistent concerns about the impact of immigration and tariff policies on the economy.

- Employment grew slightly, with six Districts reporting gains and six reporting no change.

FedWatch indicates nearly a 100% probability that the rate will remain unchanged in January and a single 0.25% cut this year, with expectations shifting from September to June.

MARKET

MARKET CAP PERFORMANCE

Stock market:

Last week, 10 out of 11 market sectors ended in the green. Utilities, Energy, and Industrials led the gains. The median growth was 2.68%.

The rally was supported by strong earnings reports from major banks. Their results beat expectations for both earnings and revenue, along with upward revisions to net interest income forecasts.

SP500

+3.70% (weekly close at 5995.53)

NASDAQ100

+4.13% (weekly close at 21443)

BOND MARKET

Yields declined. Additional support came from the statements of Federal Reserve Governor Christopher Waller, who suggested the possibility of rate cuts if inflation trends remain favorable.

Treasury Bonds (ETF TLT): +1.94% (weekly close at $87.19).

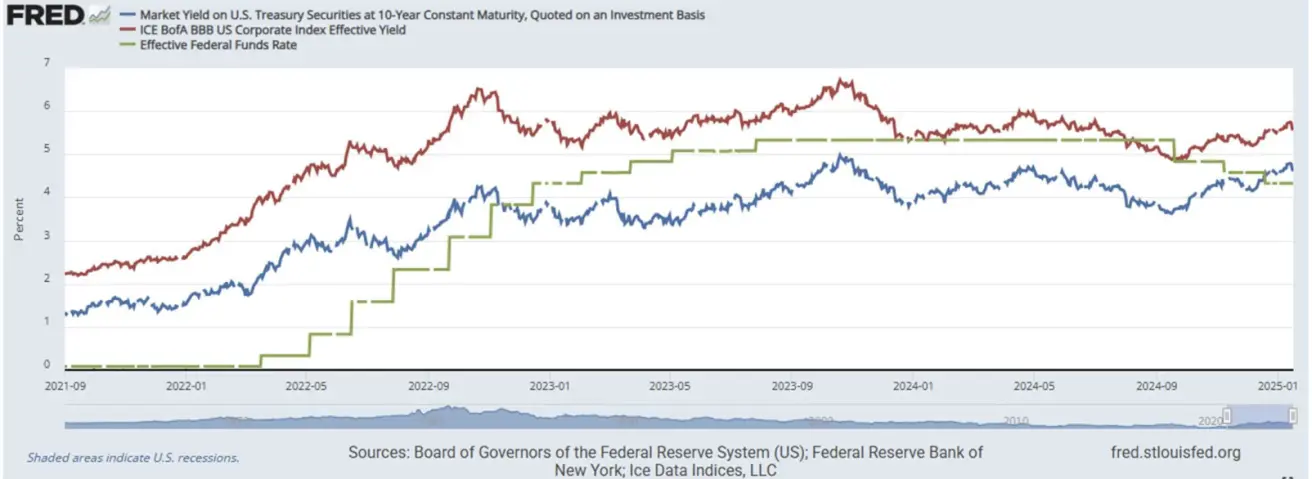

YIELS AND SPREADS

Yields and Spreads (2025/01/09 vs. 2024/01/02):

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4.622% (previously 4.759%);

- ICE BofA BBB US Corporate Index Effective Yield: 5.56% (previously 5.55%).

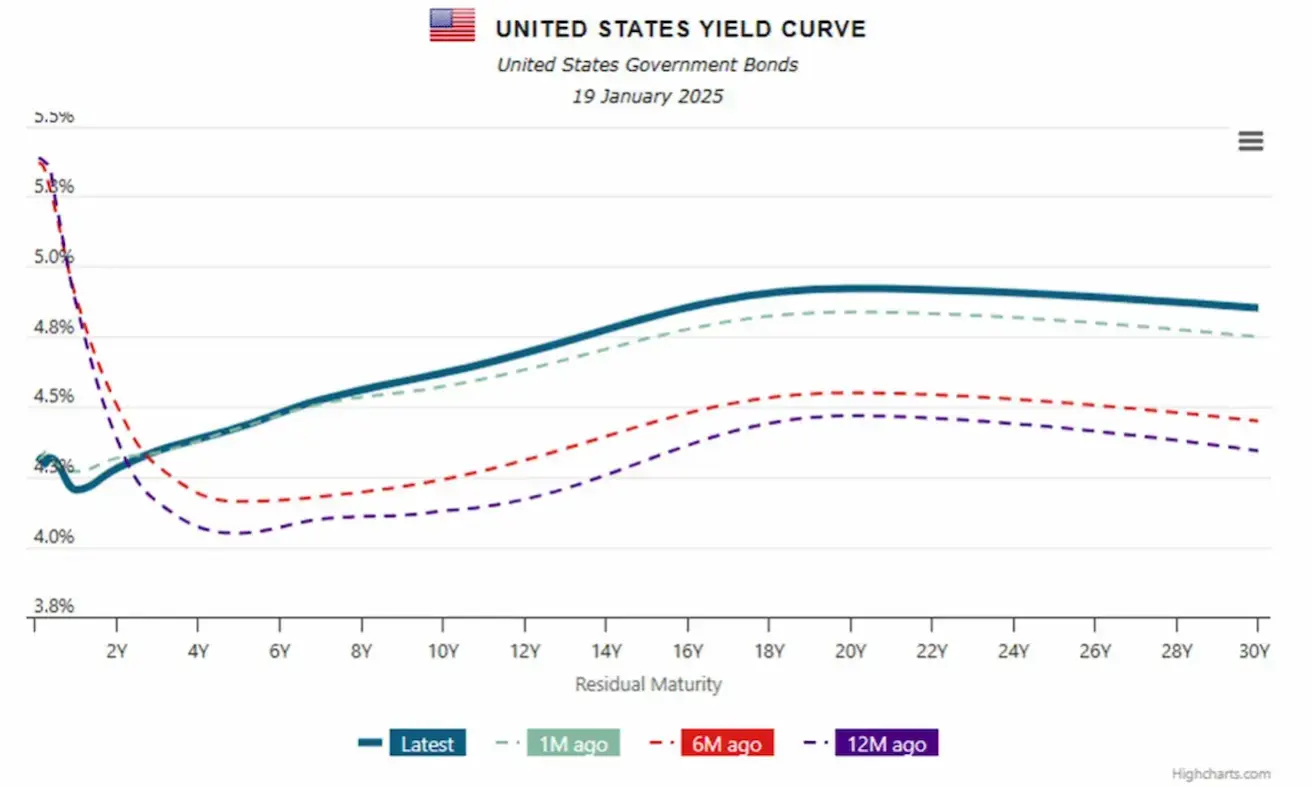

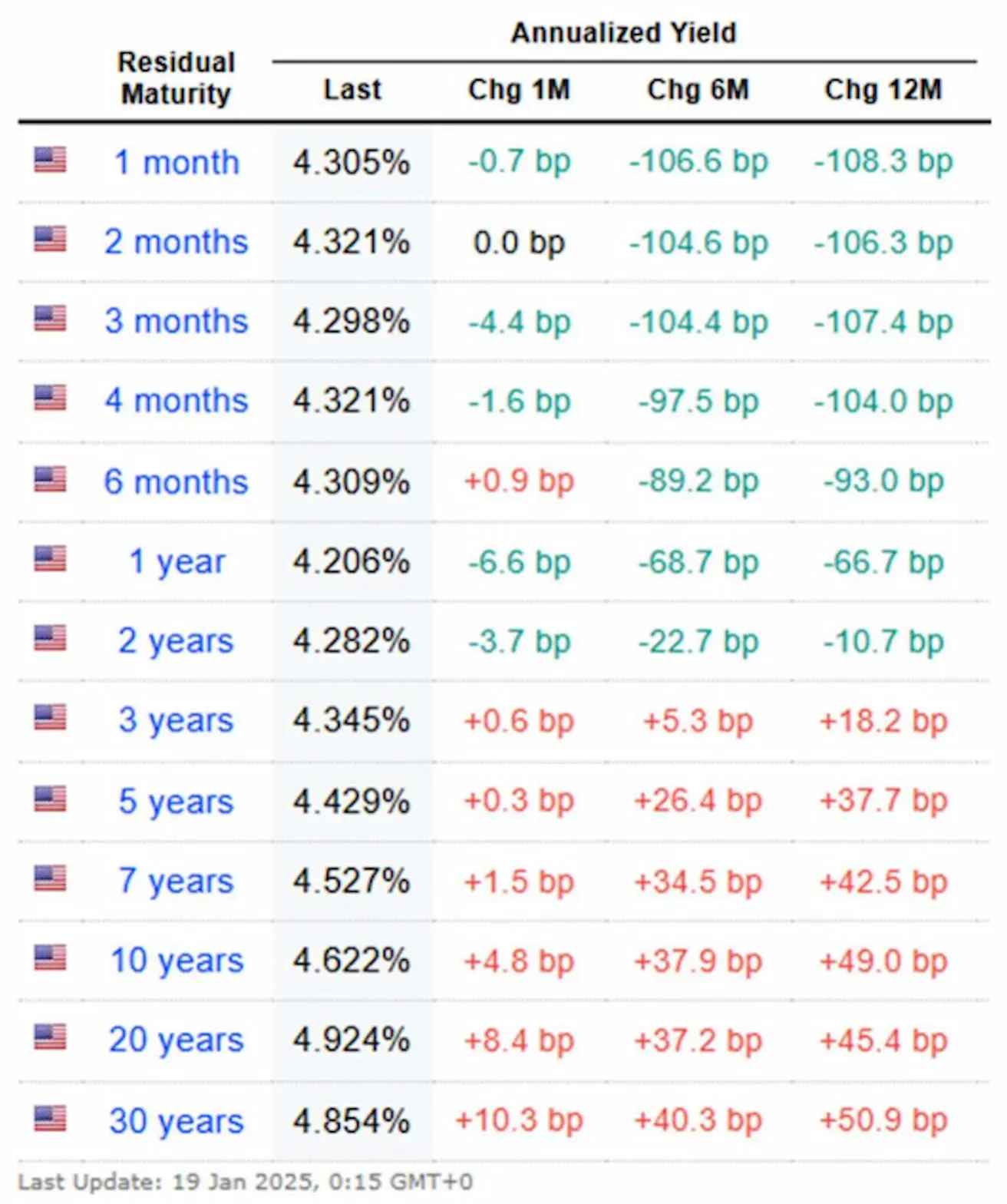

The U.S. Treasury yield curve (indicating yields on bonds with different maturities and serving as a key indicator of economic conditions and market expectations) shows an average money market yield of around 4.3%, while long-term bonds yield 4.6–4.9%.

GOLD FUTURES

Trading near a local resistance level. Last week’s increase: +0.87%, weekly close at $2,740.70 per troy ounce. The rise is driven by ongoing political and trade uncertainty.

DOLLAR FUTURES

-0.23%, weekly close at $109.255. The dollar index continues to move steadily upward on strong economic data.

OIL FUTURES

+1.12%, weekly close at $77.37/barrel.

IEA Report

Global oil supply is forecast to rise by 1.8 mb/d in 2025 to 104.7 mb/d, compared with a 660 kb/d increase in 2024. Non-OPEC+ production is expected to grow by 1.5 mb/d in 2024 and 2025, reaching 53.1 mb/d and 54.6 mb/d, respectively.

Annual demand is now estimated at 940 kb/d for 2024 and is expected to accelerate to 1.05 mb/d in 2025 as economic prospects slightly improve.

EIA (U.S. Energy Information Administration):

Global Oil Prices. We anticipate reduced upward pressure on oil prices for most of the next two years as we expect global oil production to outpace global oil demand. We forecast the average Brent oil price to be $74 per barrel (b) in 2025, 8% lower than in 2024, followed by an additional 11% decline to $66/b in 2026.

Global Oil Production. The unwinding of OPEC+ production cuts and strong growth in oil output outside OPEC+ lead to an increase in global oil production in our forecast. We expect global liquid fuels production to rise by 1.8 million b/d in 2025 and by 1.5 million b/d in 2026. Although we forecast OPEC+ to increase output, we expect the group to produce less crude oil than its latest production target to avoid a significant buildup in inventories.

Global Oil Consumption. Growth in global oil consumption in our forecast remains below the pre-pandemic trend. We expect worldwide consumption of liquid fuels to increase by 1.3 million b/d in 2025 and by 1.1 million b/d in 2026, primarily driven by consumption growth in non-OECD countries. Most of our expected growth is in Asia, where India is currently the leading source of global oil demand growth in our forecast.

OPEC

The forecast for global oil demand growth in 2025 remains unchanged at 1.4 mb/d. OECD countries are projected to grow by about 0.1 mb/d, while non-OECD countries are expected to grow by about 1.3 mb/d. This steady demand growth is set to continue in 2026, with global oil demand forecast to rise by 1.4 mb/d year over year. OECD countries are projected to grow by about 0.1 mb/d y/y, and non-OECD demand is expected to grow by about 1.3 mb/d.

Non-DoC liquids supply (i.e., from countries not part of the Declaration of Cooperation) is forecast to grow by 1.1 mb/d y/y in 2025, unchanged from last month’s estimate. The main drivers of this growth are expected to be the U.S., Brazil, Canada, and Norway. Non-DoC liquids supply in 2026 is also forecast to grow by 1.1 mb/d, primarily from the U.S., Brazil, and Canada. Meanwhile, natural gas and unconventional liquids from DoC-participating countries are forecast to rise by about 90 tb/d y/y in 2025 to an average of 8.4 mb/d, followed by an increase of about 0.1 mb/d y/y in 2026 to an average of 8.5 mb/d.

Crude oil production by DoC countries declined by 14 tb/d in December, m/m, averaging about 40.65 mb/d, according to available secondary sources.

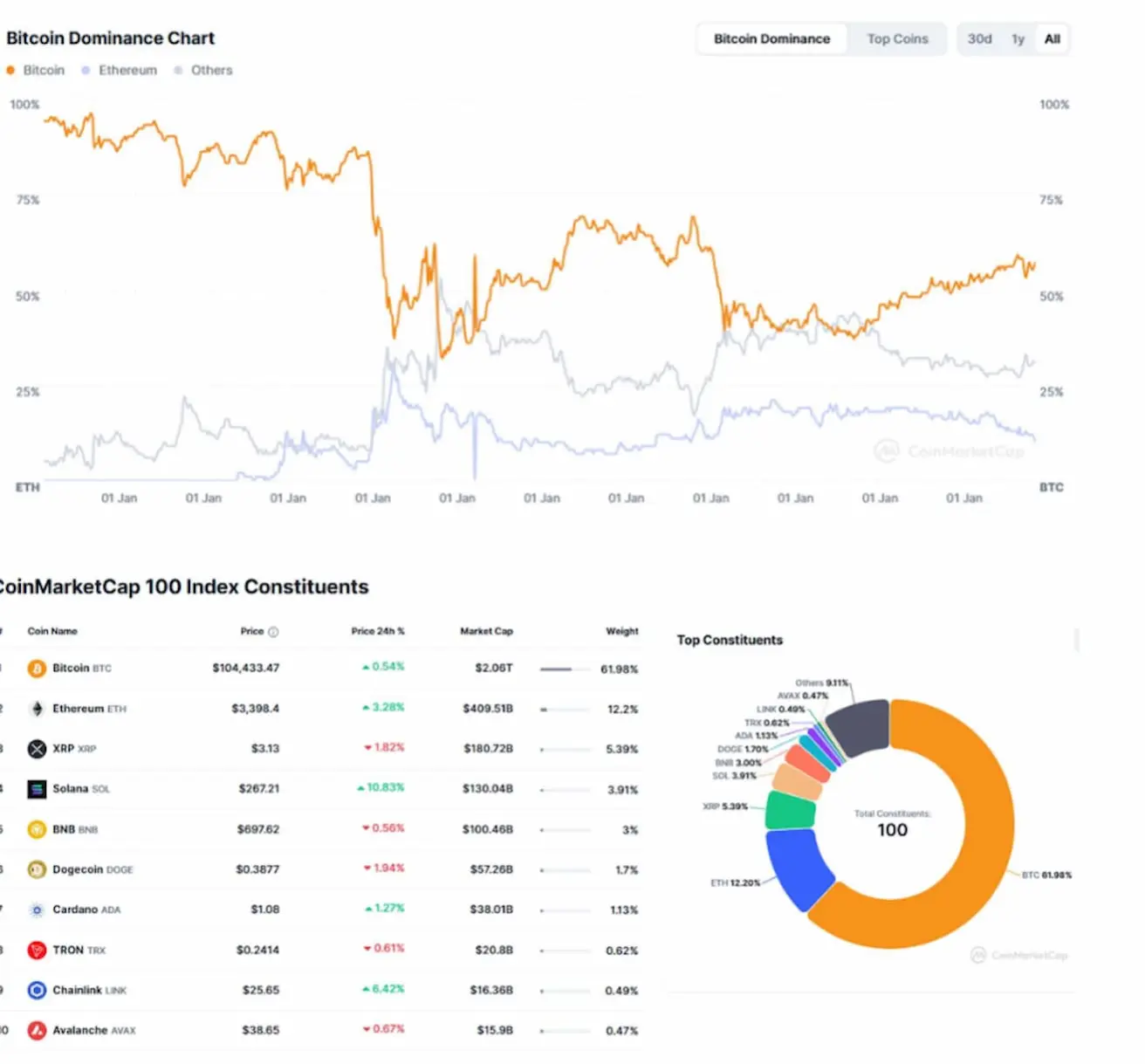

BTC

Approaching its all-time high, having once again broken above 100K. Weekly growth amounted to +11.20% (weekly close at $105,100).

ETH

+7.50%, weekly close at $3,497.

The cryptocurrency market is buoyed by several optimistic narratives, resulting in continued growth. In particular, Donald Trump announced that his upcoming presidency plans to introduce more crypto-friendly SEC regulations and reduce legal restrictions after his inauguration next week. In Wyoming, a bill has been introduced for a strategic Bitcoin reserve. A positive development for Solana (the 4th largest token by market cap): ProShares has filed for an ETF.

CRYPTO MARKET CAPITALIZATION

$3.65 trillion ($3.21 trillion a week earlier) (coinmarketcap.com):

- Bitcoin’s market capitalization: 57.4% (was 57.2%)

- Ethereum’s market capitalization: 10.6% (was 11.8%)

- Others: 31.9%

Қазақша

Қазақша