FOMC Meeting Summary

Fed Cuts Rates and Restarts QE Amid Cooling Labor Market

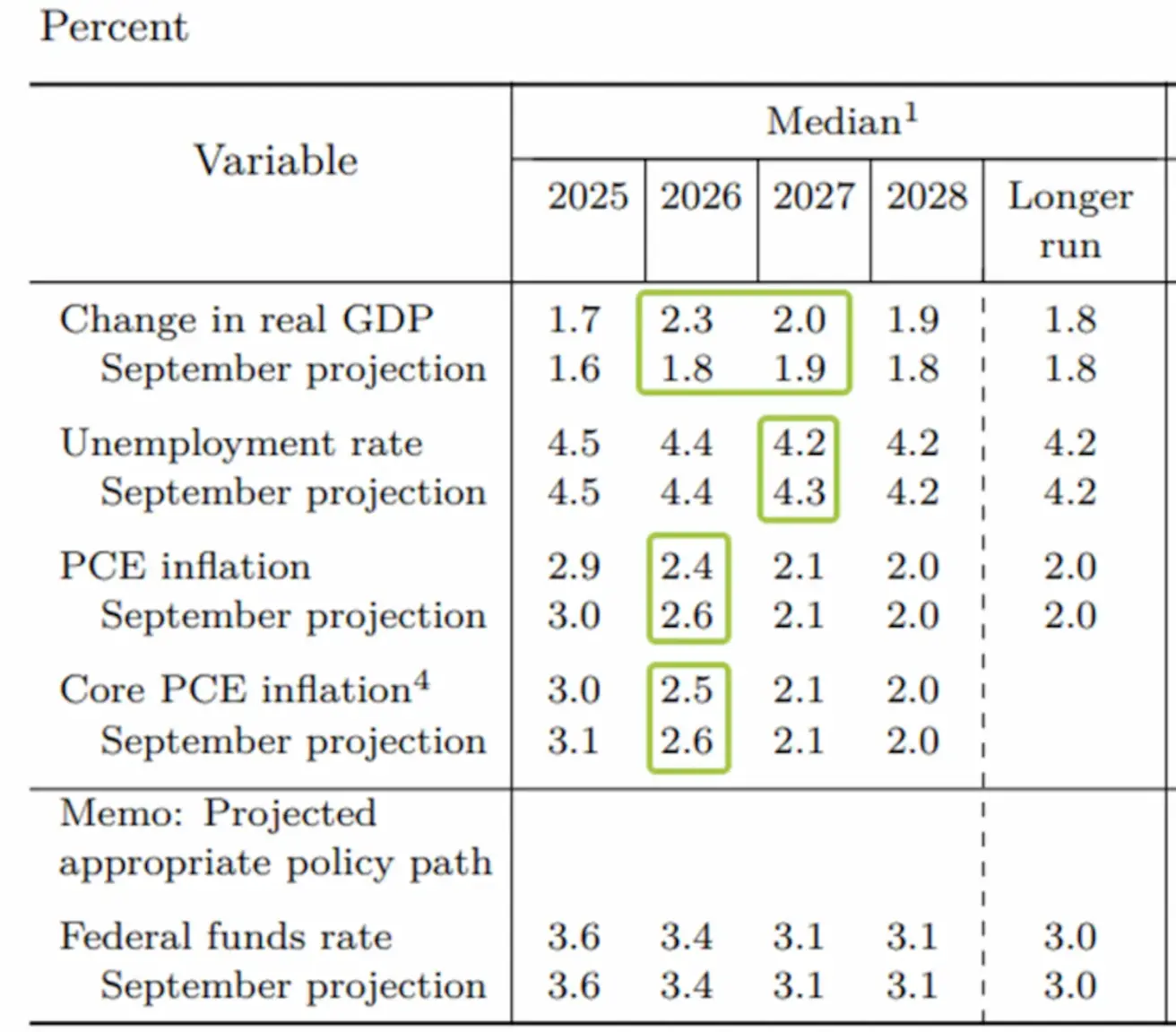

The last FOMC meeting of the year was held, at which the rate was (expected) reduced by 0.25% to a range of 3.50-3.75% with the resumption of the quantitative easing (QE) program. The Committee once again improved its macroeconomic forecasts for all items for 2026-27, while the forecast for EFFR (key rate) was left unchanged.

Powell at the October speech: the balance of risks between inflation and the labor market as a whole is balanced and the committee will probably pause in cutting rates. Yesterday's rate cut, according to Powell, was due to the cooling of the labor market. But, at the same time, he noted that all members of the committee agree that inflation is too high (!). It is noteworthy that the decision was made in the absence of corresponding full macroeconomic data for October and November.

Powell: The current rate level is in the neutral range. The Fed's rate forecast for 2026 suggests only one cut, but the swaps market (Fedwatch) continues to outpace the regulator and expects two cuts. The Fed introduces a QE (new liquidity) program with asset repurchases for $40 billion / month.

POWELL: asset purchases can remain high for several months to ease the pressure on the money market. Further reduction in the volume of purchases is expected. Also Powell: the increase in the GDP growth forecast partly reflects the sustainability of consumer demand and increased labor productivity. The baseline forecast for next year suggests an acceleration in GDP growth.

Summarizing the speech, we can say that the consistent rate cut is over and the regulator is likely to pause. But further decisions may be influenced by the rotation of Fed board members amid pressure from the Trump administration and missed macroeconomic data.

Market reaction was broadly neutral:

- S&P 500 futures: +0.11%

- VIX: –4.24% (16.11)

- Gold futures: +0.56%

- Dollar Index futures: –0.43%

- TLT ETF (20+ year Treasuries): –0.04%

- Bitcoin futures: –2.25%

Қазақша

Қазақша