July 15th - 19th: Weekly economic updates

Key market insights

Macroeconomic Statistics

INFLATION

- Core Consumer Price Index (CPI) (YoY) (June): 3.3%, pre: 3.4%;

- Consumer Price Index (CPI) (YoY) (June): 3.0%, pre: 3.3%.

THE FED'S INFLATION TARGET

- Basic personal consumption expenditures price index (YoY) (May): 2.6% (pre: 2.8%)

- Personal consumption expenditures price index (YoY) (May): 2.6%, (pre: 2.7%).

INFLATION EXPECTATIONS

- 12-month expected inflation (June): 2.9%, pre: 3.0%;

- 3-year expected inflation (June): 2.9%, pre: 2.8%;

- 5-year expected inflation (June) 2.9%, pre: 3.0%.

GDP (QoQ) (Q1)(third valuation): 1.4% (second: 1.3%); GDP deflator (QoQ) (Q1): 3.1% (pre: 1.7%).

Business Activity Index (PMI) (above the 50% mark - economic expansion, below - slowdown):

- Services sector (June): 55.3 (pre: 51.8);

- In the manufacturing sector (S&P Global Composite)(June): 54.8 (prev: 54.5).

LABOR MARKET

- Unemployment rate (Apr): 4.1% (pre: 4.0%);

- Change in the number of people employed in the private non-agricultural sector (Apr): 136K, (prev: 193K);

- Average Hourly Earnings (June, YoY): 3.9% (prev: 4.1%);

- Total initial applications to unemployment benefits: 222K (prev: 238K).

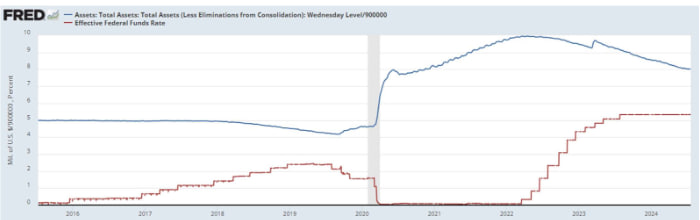

MONETARY POLICY

The federal funds effective rate (EFFR) is 5.50% (highlighted in red). The balance sheet decreased by $13.27 billion last week compared to a $3 billion increase the previous week.

From the peak ($9.015 trillion), the balance has decreased by 20% (-$1.81 trillion).

RHETORIC OF FEDERAL RESERVE REPRESENTATIVES

Jerome Powell stated (following the CPI release):

- Economic data for the second quarter gives the committee more confidence that inflation will continue to slow, potentially paving the way for rate cuts in the short term.

- He does not intend to provide a specific signal on the timing of rate cuts.

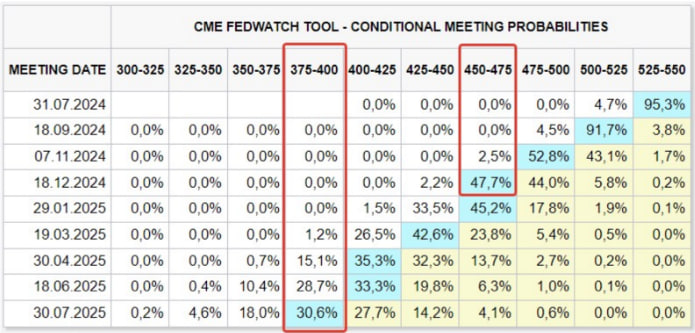

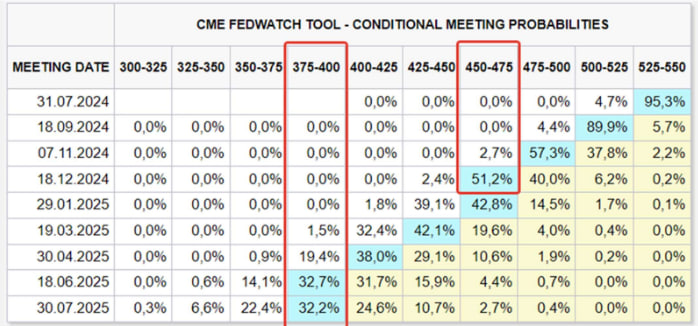

MARKET FORECAST RATE (FEDWATCH)

Today:

A week ago:

Market expectations for the rate over the past week remain unchanged:

- For December of this year: 4.50% - 4.75% (three cuts)

- Long-term expectations (for the next year): 3.75% - 4.00% (six cuts)

The market expects the first rate cut in September with a probability of 92%.

MARKET

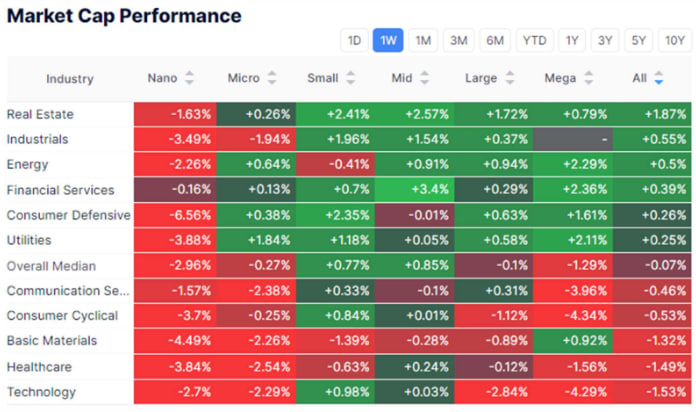

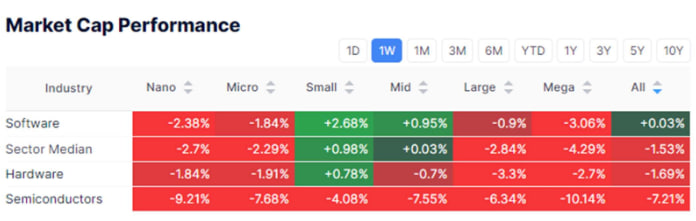

MARKET CAP PERFORMANCE

Technology sector:

Sector dynamics were mixed last week. On average, the stock market decreased by 0.07%. The technology sector was the outsider after the U.S. government announced export restrictions in the semiconductor industry, particularly considering the possibility of the strictest trade restrictions against ASML if it continues to provide China with access to advanced semiconductor technologies.

Additionally, Trump questioned whether the U.S. should provide defense assistance to Taiwan, indicating a new wave of global trade wars if Trump wins the election. FAANG stocks ended the week down by 7%.

SP500

The S&P 500 index hit another high at the beginning of the week but closed the week down by 2.9%. Further correction of the index is possible if the decline in market leaders continues. This week's focus will be on the earnings reports of GOOGL and TSLA.

CrowdStrike

A failure in updating the Falcon Sensor platform caused disruptions across various industries worldwide, including airlines, banks, and hospitals.

The company's shares fell 25% from their peak to the 200-day moving average. Further declines are possible as some clients may be lost, but it's important to note that CrowdStrike is a leading player in the cloud cybersecurity sector and will not exit the market.

TREASURY BONDS

Long-term U.S. Treasury bonds closed the week almost unchanged.

The debt market's dynamics will be determined by the FOMC meeting on July 31. This week marks the start of the Fed's "silent period" before the meeting. The likelihood of a surprise rate cut at the July meeting is low, according to swap markets and Powell's rhetoric. However, Goldman Sachs sees grounds for a rate cut at this meeting.

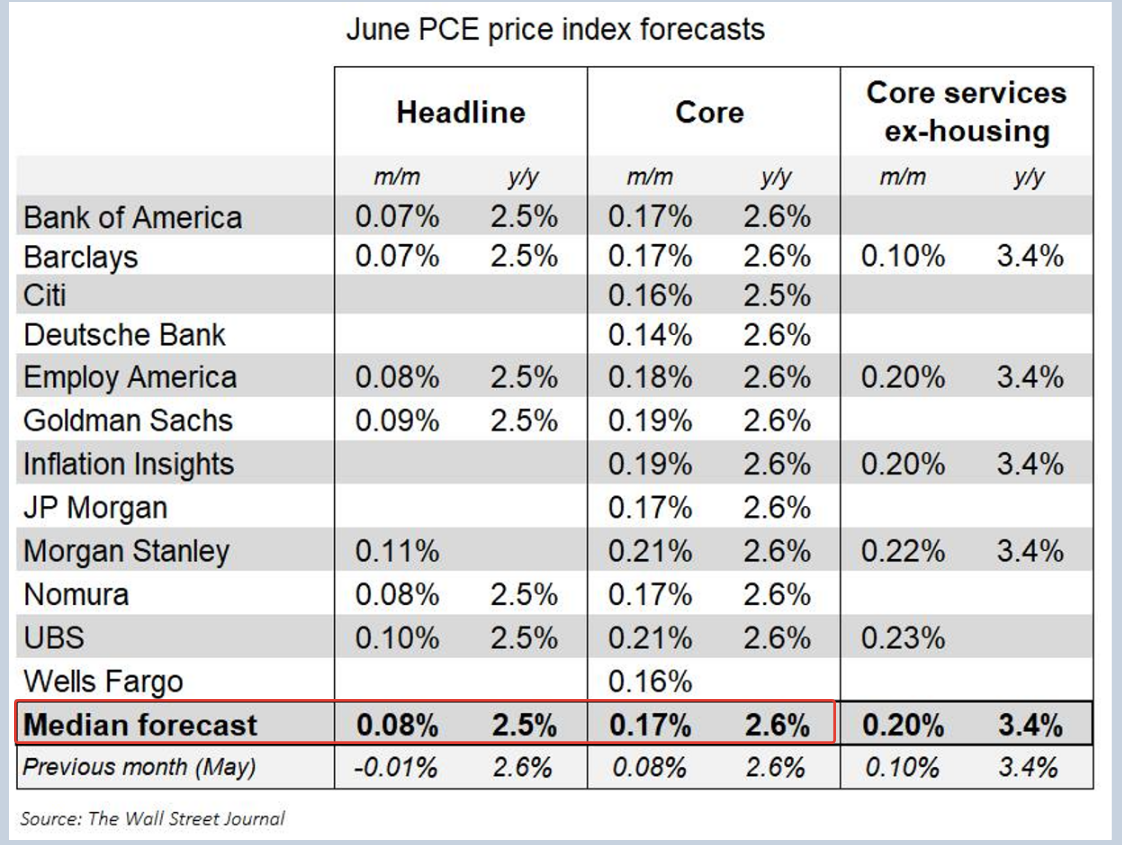

Support for the bond market this week could come from the PCE index data release.

PCE is the main inflation target of the regulator. The median forecast from leading banks suggests a 0.1% decrease in both components of the index.

If the data matches the forecast, it will boost positive market expectations regarding the rate, and the bond market will continue to grow.

OIL

According to OPEC's monthly report, the forecast for oil demand growth for 2024 and 2025 remains at 2.25 and 1.85 million barrels per day, respectively.

The International Energy Agency (IEA) lowered its forecast for oil consumption growth for this year by 1 million barrels per day.

Technically, oil futures are currently in a local correction, but it's worth noting that hydrocarbon companies may receive support if Trump takes office, as he prefers traditional energy.

IPO MARKET

Swedish fintech giant Klarna is the undisputed global leader in the "buy-now, pay-later" (BNPL) sector. The metrics of its nearest competitors are significantly lower.

As the "buy-now, pay-later" service is highly sensitive to rates (as it is a form of lending), the expected start of the rate-cutting cycle will positively impact the industry and could raise company valuations in this sector.

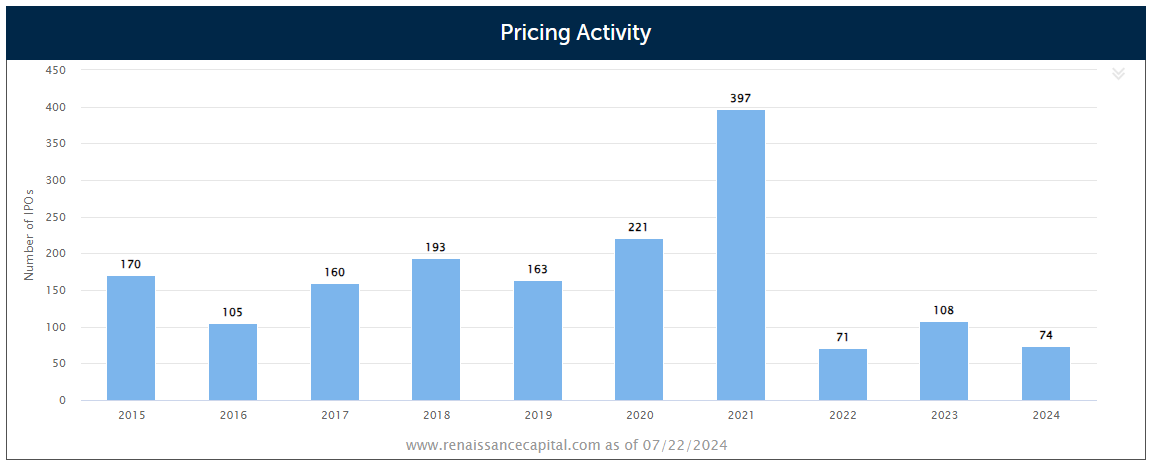

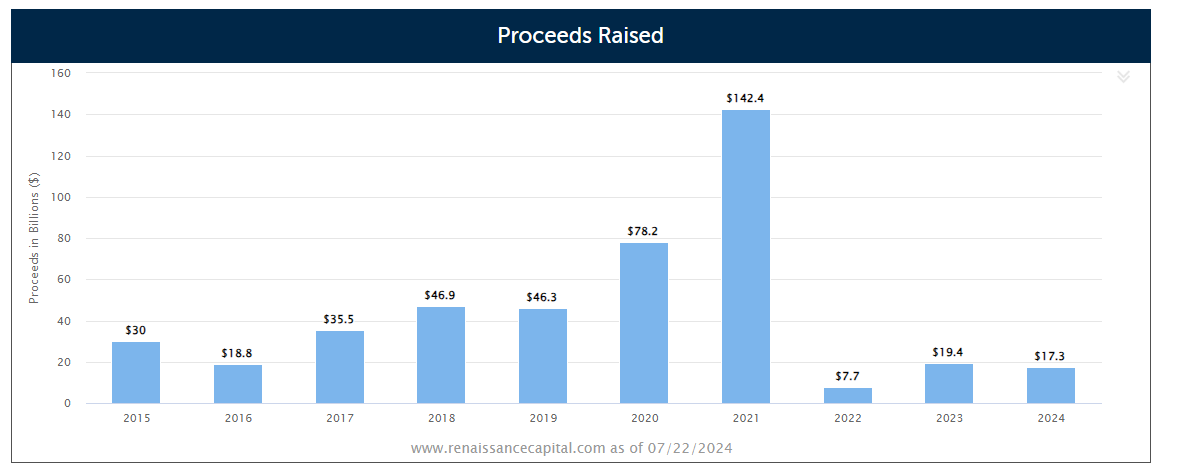

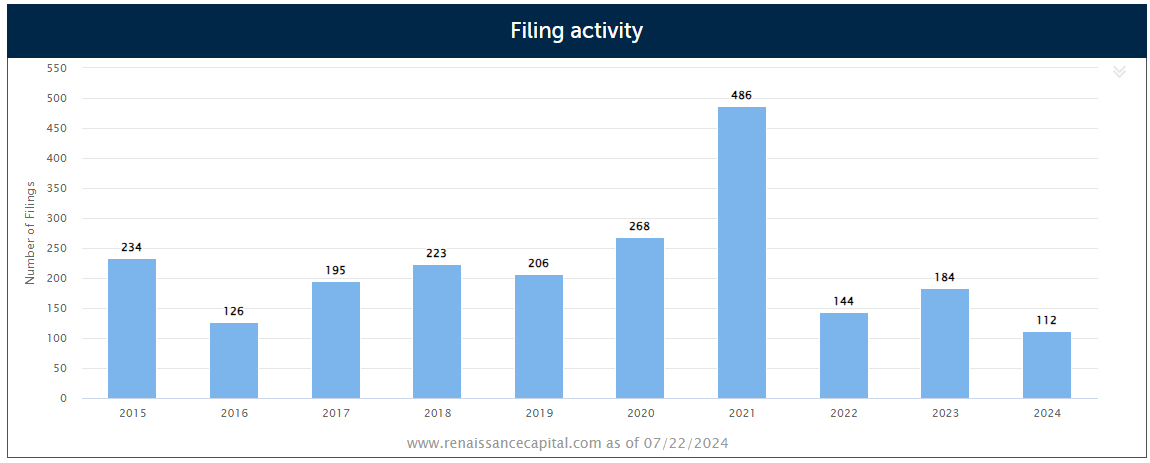

According to Yahoo! Finance, Klarna is in talks with several leading investment banks about a possible IPO in New York, which could take place in the first half of next year. According to renaissancecapital, the IPO market continues to recover.

This year, 74 IPOs have been assessed, 29.8% more than on the same date last year:

The total amount of funds raised was $17.3 billion, 75.9% more than on the same date last year.

112 applications for initial public offerings (IPOs) were submitted, 16.7% more than on the same date last year:

The recovery of the IPO market is also indicated by the entry of major players into the public market. This week, the world's largest cold storage operator, Lineage is entering the market. Lineage (LINE), plans to raise up to $4 billion. This is a high bar, and the IPO could become the largest in 2024. Read more

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша