July 29 - August 2: Weekly economic update

Key market insights

Macroeconomic Statistics

Inflation:

- Core Consumer Price Index (CPI) (YoY) (June): 3.3% (previous: 3.4%)

- Consumer Price Index (CPI) (YoY) (June): 3.0% (previous: 3.3%)

Federal Reserve Inflation Target:

- Core Personal Consumption Expenditures (PCE) Price Index (YoY) (June): 2.63% (previous: 2.62%)

- Personal Consumption Expenditures (PCE) Price Index (YoY) (May): 2.51% (previous: 2.6%)

Inflation Expectations:

- 12-month expected inflation (June): 2.9% (previous: 3.0%)

- 3-year expected inflation (June): 2.9% (previous: 2.8%)

- 5-year expected inflation (June): 2.9% (previous: 3.0%)

GDP (QoQ) (2Q) (preliminary estimate): 2.8% (previous: 1.4%), GDP deflator (QoQ) (1Q): 2.3% (previous: 3.1%)

Business Activity Index (PMI) (above 50 - economic expansion, below - slowdown):

- Services Sector (June): 56.0 (previous: 55.3)

- Manufacturing Sector (June): 49.5 (previous: 55.6)

- S&P Global Composite (June): 55.0 (previous: 54.8)

Labor Market

- Unemployment Rate (July): 4.3% (previous: 4.1%)

- Change in Non-Farm Private Sector Employment (June): 97K (previous: 136K)

- Average Hourly Earnings (July, YoY): 3.6% (previous: 3.8%)

- Initial Jobless Claims: 249K (previous: 235K)

Monetary Policy

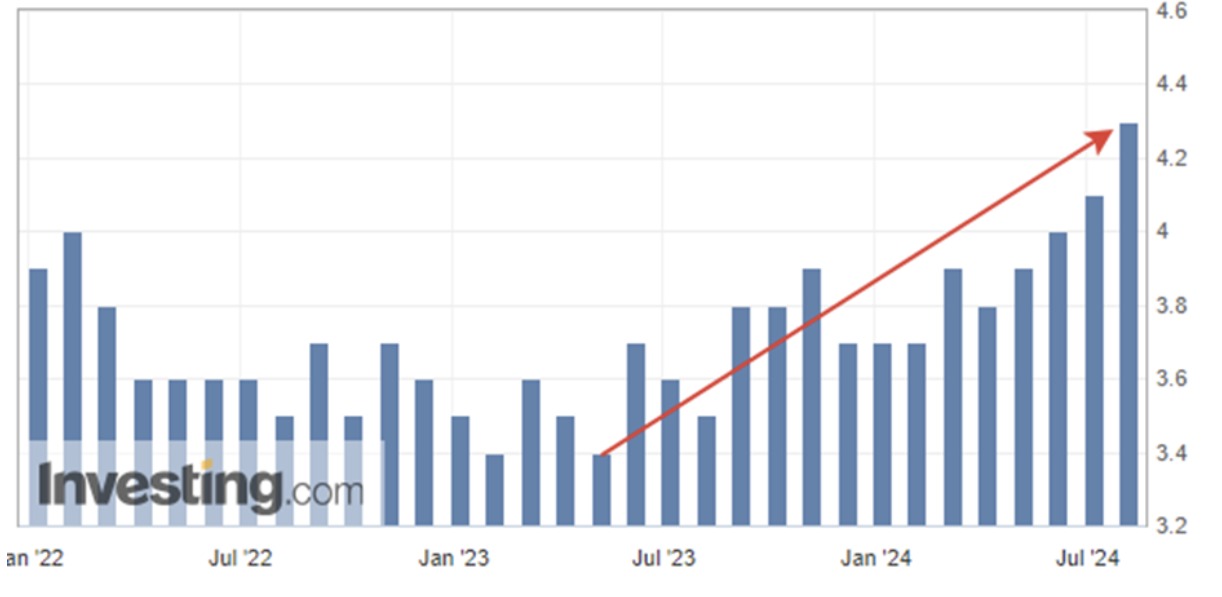

- Federal Funds Rate (EFFR): 5.50%

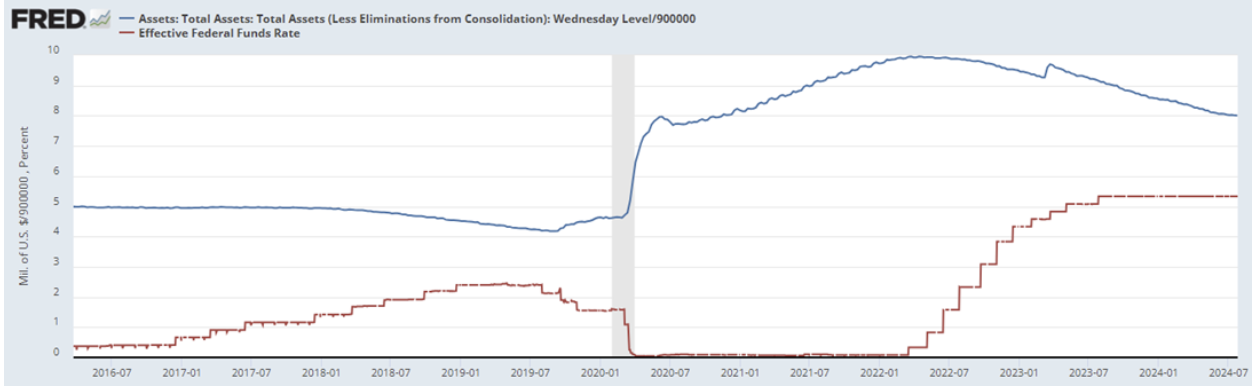

- Federal Reserve balance sheet continues to decline at a slower pace: $7.178 trillion

Market Forecast for Rate (FedWatch):

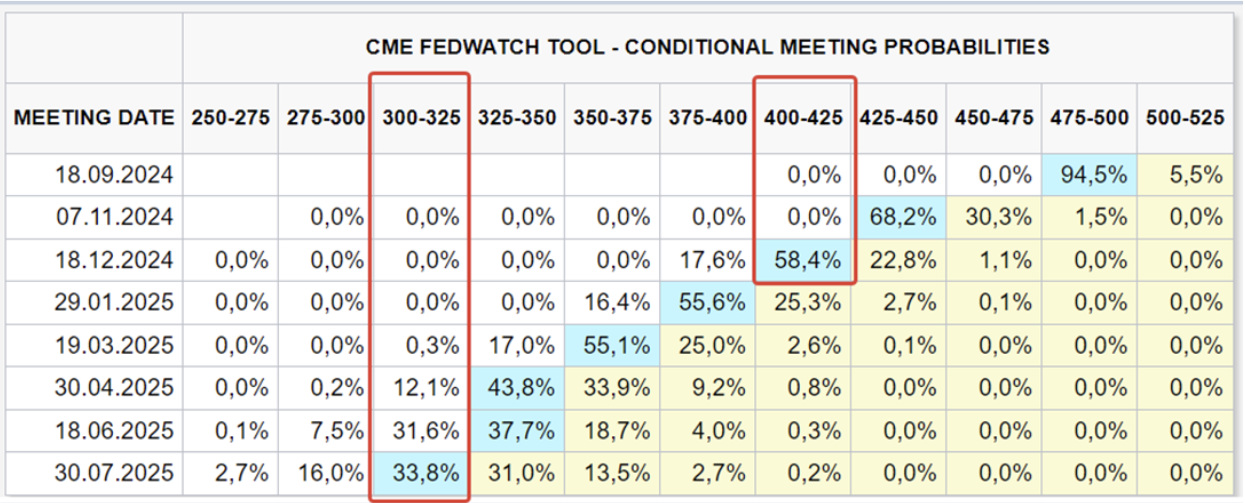

Today:

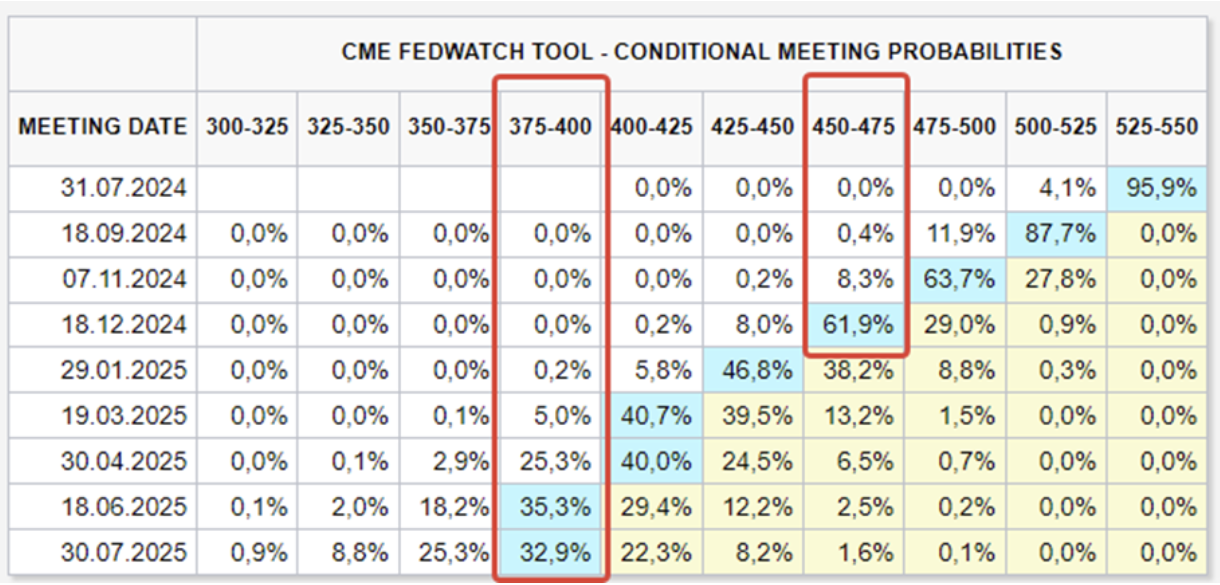

A week earlier:

Commentary

On Wednesday, July 31, the Federal Reserve held a meeting. The rate was maintained in the range of 5.25-5.50%. The actions of the Federal Reserve are aimed at achieving a balance between inflation and the labor market.

The tightening of monetary policy began in March 2022, and since the May meeting, the rhetoric of the Federal Reserve Chairman has shifted from inflation to the labor market.

A key aspect of this meeting was the discussion of the beginning of easing monetary policy, considering several scenarios of rate cuts this year - from one to several cuts.

At the press conference, Powell expressed concerns about the shift of risks towards a stronger economic slowdown compared to inflation risks, pointing to stagnation in production. The Federal Reserve's concerns were supported by Friday's labor market data showing an increase in unemployment.

There is a time lag between the Federal Reserve's actions and the real economy, which has widened in this cycle due to monetary impulses. The two-year restrictive monetary policy is increasingly affecting the economy.

The increased risk of economic cooling mentioned by Powell has heightened market expectations for faster rate cuts.

FedWatch for December this year indicates three cuts to 4.00% - 4.25% (by 1%), but there will be only three meetings this year, and the market is pricing in a 0.5% rate cut at the November meeting.

Long-term expectations for the year ahead suggest seven cuts to 3.00 - 3.25% (2.25%).

Market

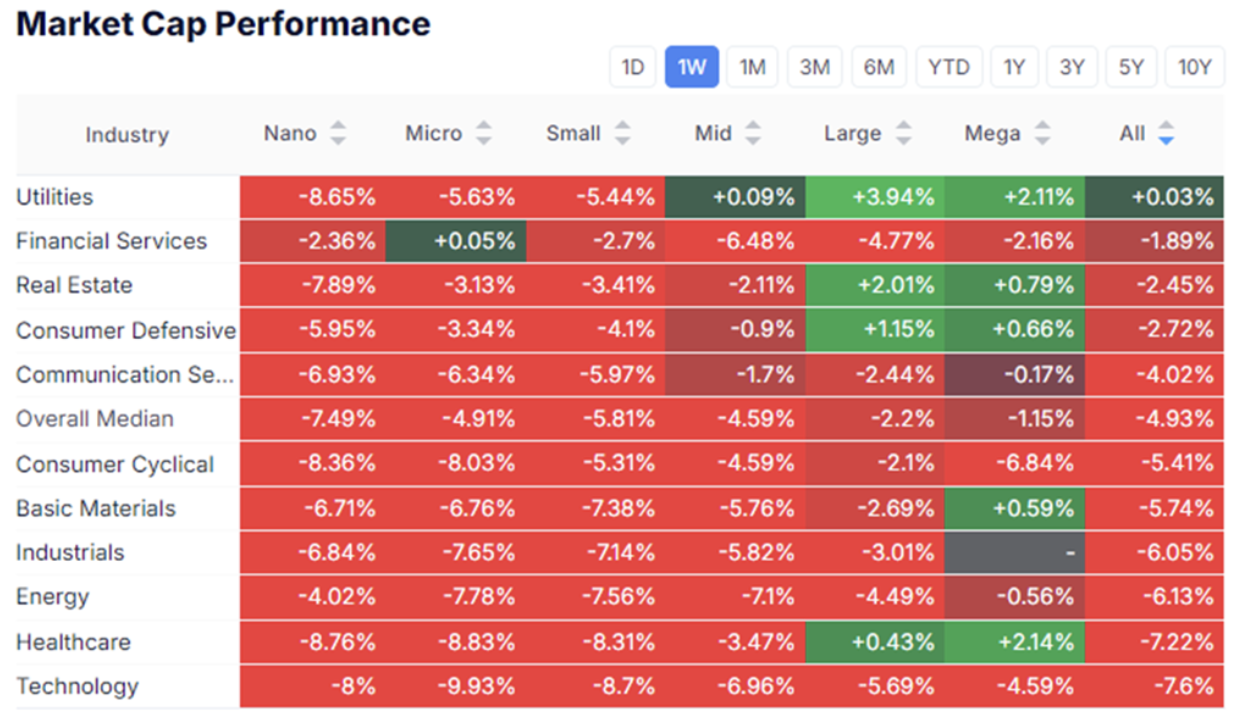

Market Cap Performance

The stock market:

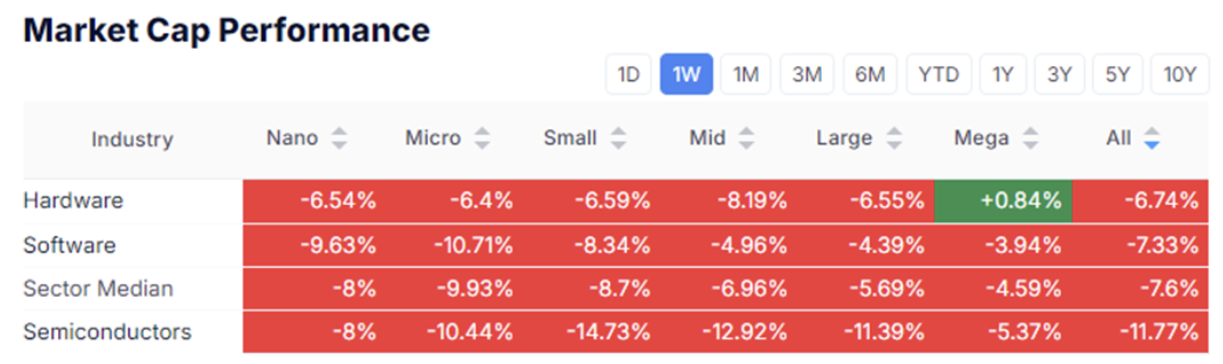

Technology Sector:

By the median stock market declined by 1.15%. The main sell-offs were in the technology sector and the cyclical consumer sector (non-essential goods), with results: -4.59% and -6.84% respectively.

There is a capital flow into protective sectors: particularly Utilities, Consumer Staples, and Healthcare.

In the technology sector, the semiconductor subsector showed a larger decline of 5.4% (NVDA -15%, MSFT -10%, INTC -36%, AAPL -9%, AMZN -12%, etc.).

As a result, the Federal Reserve meeting and corrections in technology locomotives pulled the indices down.

Standard&Poor's 500:

- From historical peak: -8%

- Weekly: -4.5%

NASDAQ 100:

- From historical peak: -11%

- Weekly: -3.75%

VIX:

The VIX jumped by 150% from 16 to 41. At the moment, of course there are some negative sentiments in the markets, and as seen across sectors, there is a shift from risk to defensive sectors.

The above factors, on the contrary, supported the Treasury bond market, which serves as a safe haven in conditions of risk aversion and the beginning of monetary policy easing.

Long-term Treasury Futures: broke an important resistance level, rising by more than 5.5% over the week.

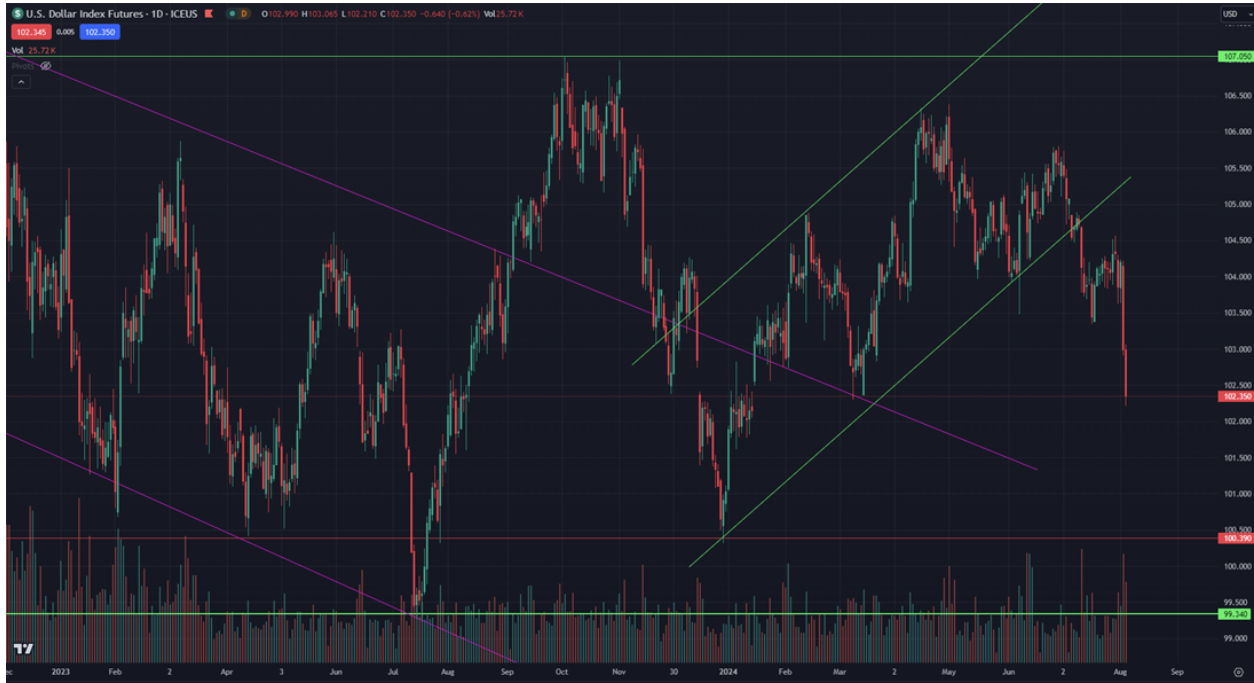

Dollar: -1.66%, the main trigger - expectation of a rate cut.

Gold:

The safe-asset metal has not yet reflected a strong flight from geopolitical risks and recession risks. The price consolidates above the 4-month horizontal channel. Long-term growth triggers remain.

Summary:

The spike in the VIX index, the sharp decline in stock indices with a capital flow into defensive assets, and increased demand for US government debt reflect some investor negativity, likely short-term.

The market dynamics were influenced by a combination of macroeconomic and geopolitical factors. We believe the correction is likely to continue, but high volatility will subside as:

-

It is still early to talk about a recession in the US (the Federal Reserve has only noted risks). The current real GDP growth estimate (GDPNow model from the Atlanta Fed) as of August 1, 2024: 2.5%, which is slightly lower than the official BEA release for the second quarter and does not reflect a sharp economic slowdown.

-

Given the previous growth led by technology giants, a correction in stock indices was quite reasonable.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша