July 7 - 11, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Core Consumer Price Index (CPI) (y/y) (May): 2.8% (previous: 2.8%)

- Consumer Price Index (CPI) (y/y) (May): 2.4% (previous: 2.3%)

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (May): 5.0% (prev: 6.6%)

- 5-year expected inflation (April): 4.0% (prev: 4.2%)

GDP (U.S. Bureau of Economic Analysis, BEA) – Q1 2025

*Annualized (third estimate): -0.5% (second estimate: -0.2%; Q4 2024: 2.4%) Federal Reserve Bank of Atlanta's GDPNow estimate for Q2: 2.6% (vs. 2.9%)

Business Activity Index (PMI):

(Above 50 indicates expansion; below 50 indicates contraction)

- Services sector (June): 52.9 (previous: 53.1)

- Manufacturing sector (June): 52.9 (previous: 52,0, revised)

- S&P Global Composite (June): 52.9 (previous: 52.8)

LABOR MARKET:

- Unemployment rate (June): 4.1% (previous: 4.2%)

- Nonfarm payroll employment change (June): 147K (previous: 144K revised)

- Change in US private nonfarm payrolls (June): 74K (prev: 137K)

- Average hourly earnings (June, y/y): 3.7% (previous: 3.8%)

- JOLTS job openings (May): 7.769M (vs. 7.395M)

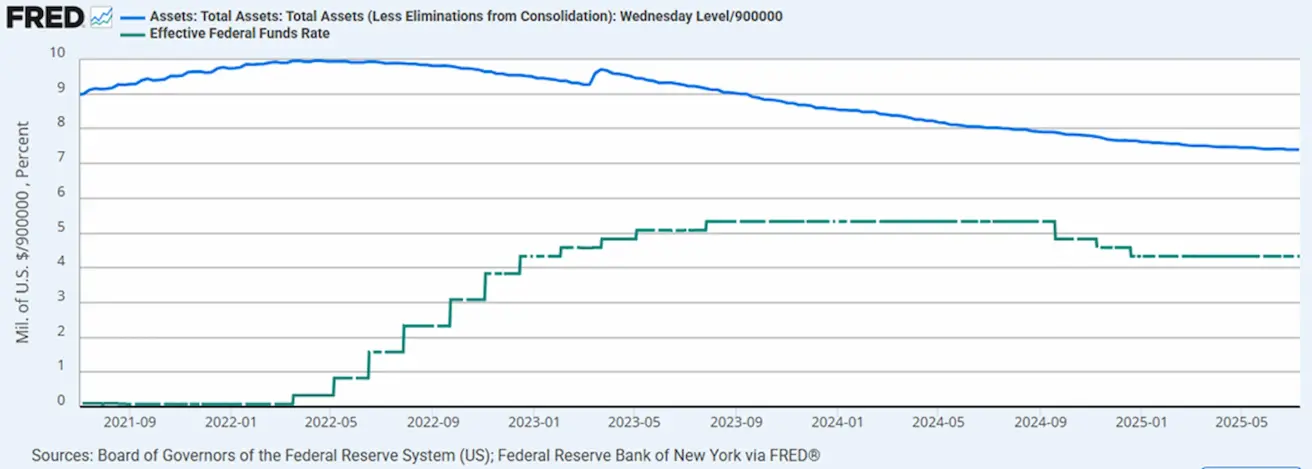

MONETARY POLICY

- Federal Funds Effective Rate (EFFR): 4.25% - 4.50% (unchanged)

- Federal Reserve balance sheet increased: $6.662T (vs. previous week: $6.659T)

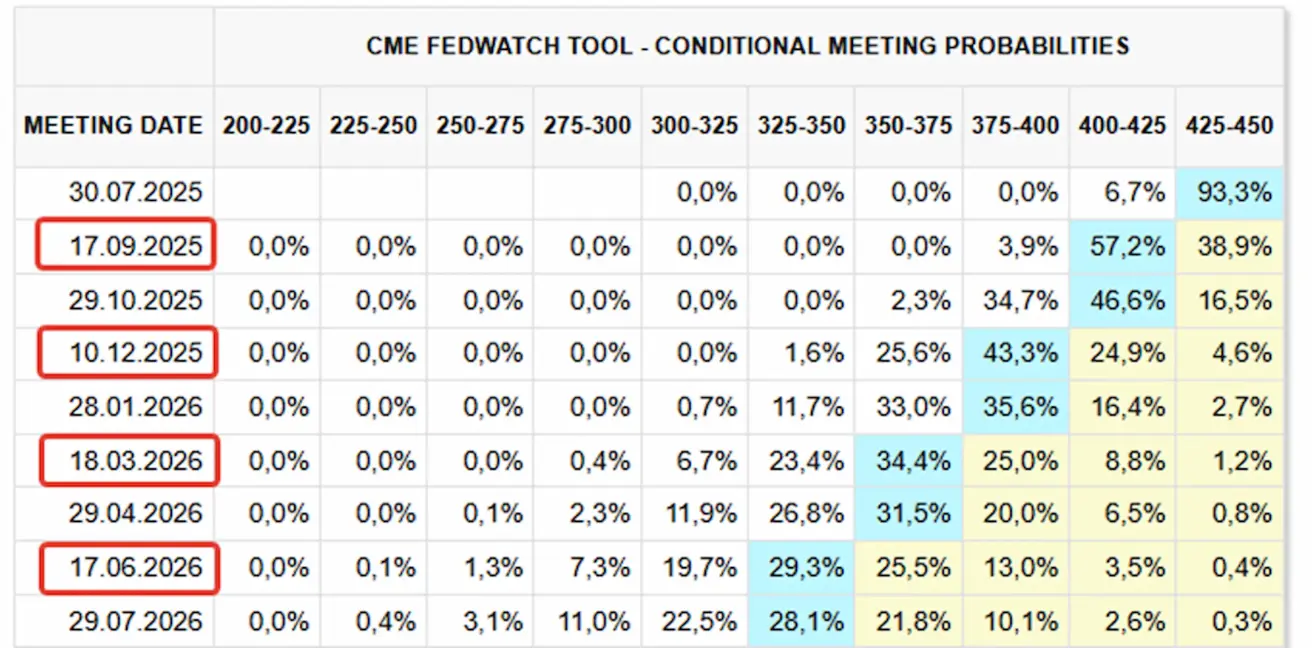

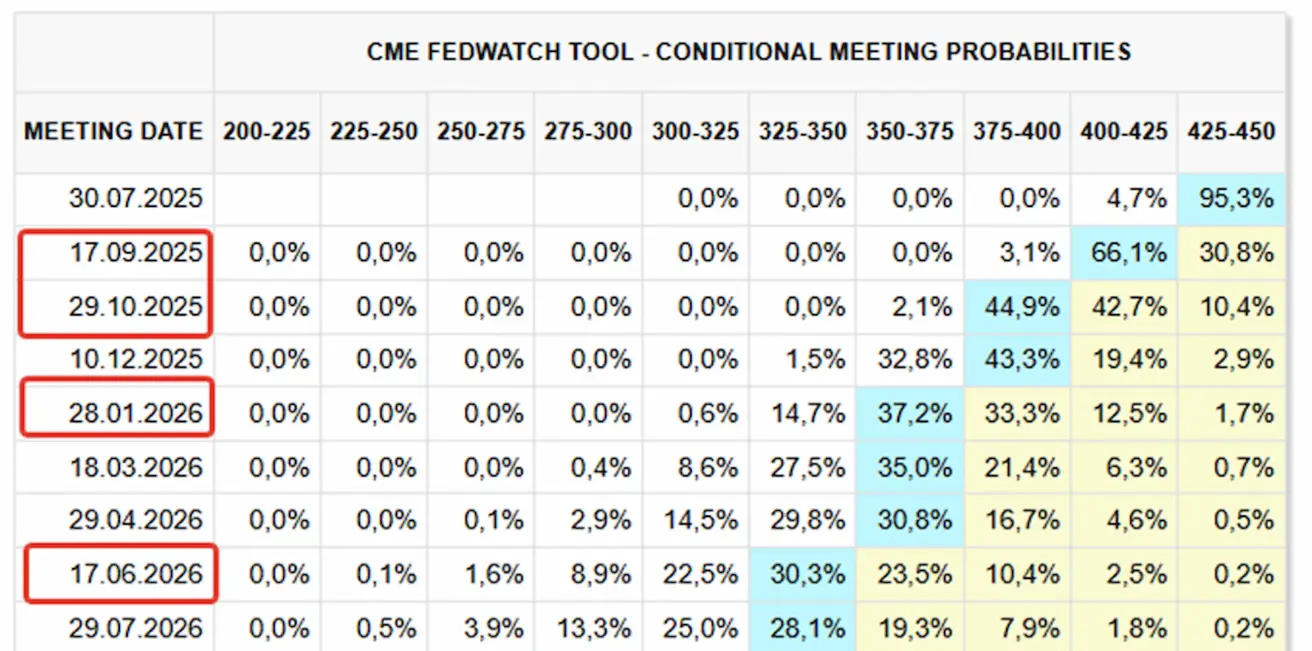

MARKET FORECAST FOR RATE

Today:

А week earlier:

Commentary

FOMC Minutes:

- Rate cut expectations: The majority of FOMC participants consider a rate cut in 2025 both likely and appropriate.

- Tariff impact on inflation: Inflationary pressure from tariffs is seen as temporary or moderate.

- Inflation expectations: Medium- and long-term inflation expectations remain well-anchored.

- Economic risks: A potential weakening of the economy and labor market may warrant policy easing.

- Readiness to cut rates: Some participants expressed willingness to consider a rate cut at the next meeting, contingent on expected economic developments.

Market Expectations via FedWatch:

- Next meeting (July 30): No change expected — 93% probability of no rate cut.

- Next 12 months: The market anticipates 4 rate cuts of 25 bps each, bringing the target range to 3.25–3.50%. The first cut is expected in September, with a 57% probability.

- By year-end: Only 2 cuts remain priced in.

Trade Wars:

- Tariffs to take effect on August 1, with no changes expected to the announced schedule.

- Trump announced a 50% tariff on copper, triggering a record surge in metal futures.

- Pharmaceutical warning: If pharma companies fail to relocate production to the US within 18 months, import tariffs of up to 200% on medications may be imposed.

- New tariffs from August 1: Trump announced 30% duties on the EU and Mexico, and 25% on Canada and South Korea, stating: “If retaliatory measures are taken, tariffs will be increased by the same amount in response.”

MARKET

Equity Market

Sector performance was mixed over the past week, with no significant sell-offs, despite escalating tariff rhetoric. The market remains cautious, anticipating potential tariff relief. However, if the proposed measures are implemented as announced, a broad risk-off move may follow.

- Median decline: –0.36%

- Top performers: Basic materials, healthcare, and energy sectors

- Lagging sector: Technology, down 2.13%, posting the weakest performance Despite overall tech weakness, NVIDIA hit another all-time high, becoming the first company in history to surpass a $4 trillion market capitalization.

Year-to-date (YTD) performance stands at –0.36%. The utilities, basic materials, and financial sectors continue to lead the market in 2025.

US stock indices remained range-bound near their highs last week. The Q2 earnings season begins on July 15, and the broader market consensus is optimistic.

SP500

Weekly: -0.31% (weekly close: 6259,74), 2025 YTD: +6.04%

NASDAQ100

Weekly: -0.38% (weekly close: 22780.60), YTD: +7.86%

Euro Stoxx 600:

The index posted solid gains in the first half of the week, but Friday’s pullback erased much of the advance, resulting in a weekly performance of +1.65% (closing at 548). Year-to-date performance: +8.39%

CSI Index

+1.24% (weekly close: 4014), YTD: +2.11%

Hang Seng

Weekly: +0.36% (weekly close: 5248,48), YTD: +18.30%

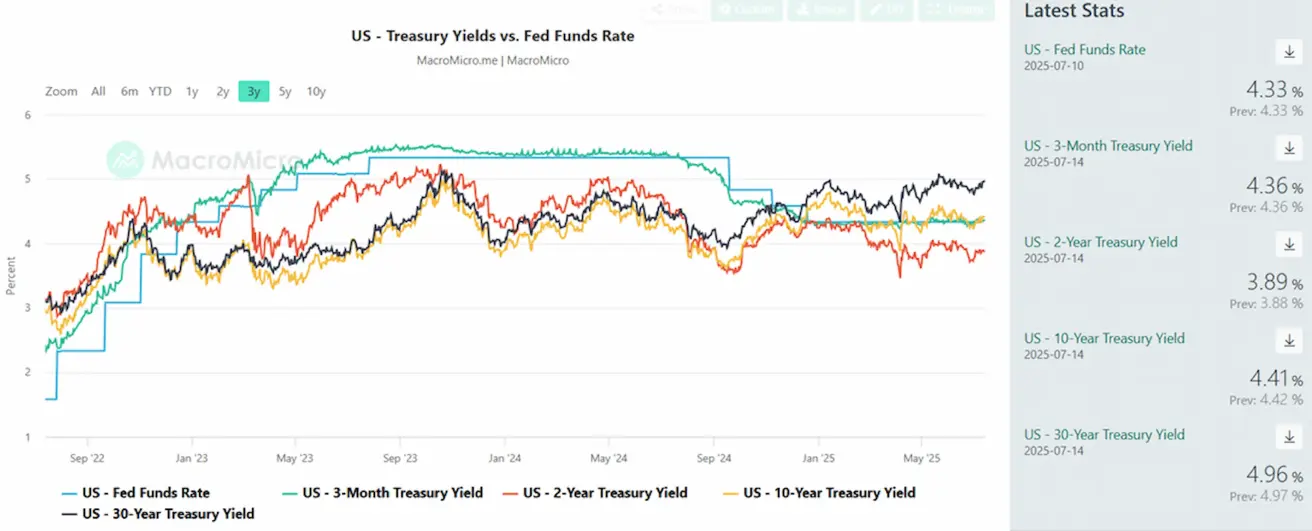

BOND MARKET

20+ Year U.S. Treasury Bonds (ETF TLT): -1.36% (weekly close: $85.79). YTD: 2.29%:

YIELDS AND SPREADS 2025/06/30 vs 2024/07/07

- Market Yield on 10-Year U.S. Treasuries: 4.41% (vs. 4.33%)

- ICE BofA BBB U.S. Corporate Index Effective Yield: 5.28% (vs. 5.22%)

- Yield Spread: 10-year vs. 2-year Treasuries: 52.0 vs. 47.0 bps

- Yield Spread: 10-year vs. 3-month Treasuries: 0.5 vs. -4.0 bps

GOLD FUTURES (GC)

Weekly: +1.02%, weekly close: $3,370.3/oz, YTD: +27.60%

DOLLAR INDEX FUTURES (DX)

Weekly: + 0.94%, weekly close: 97.555, YTD: -9.95%

OIL FUTURES

Weekly: +2.34%, weekly close: 68.75, YTD: -4.31%

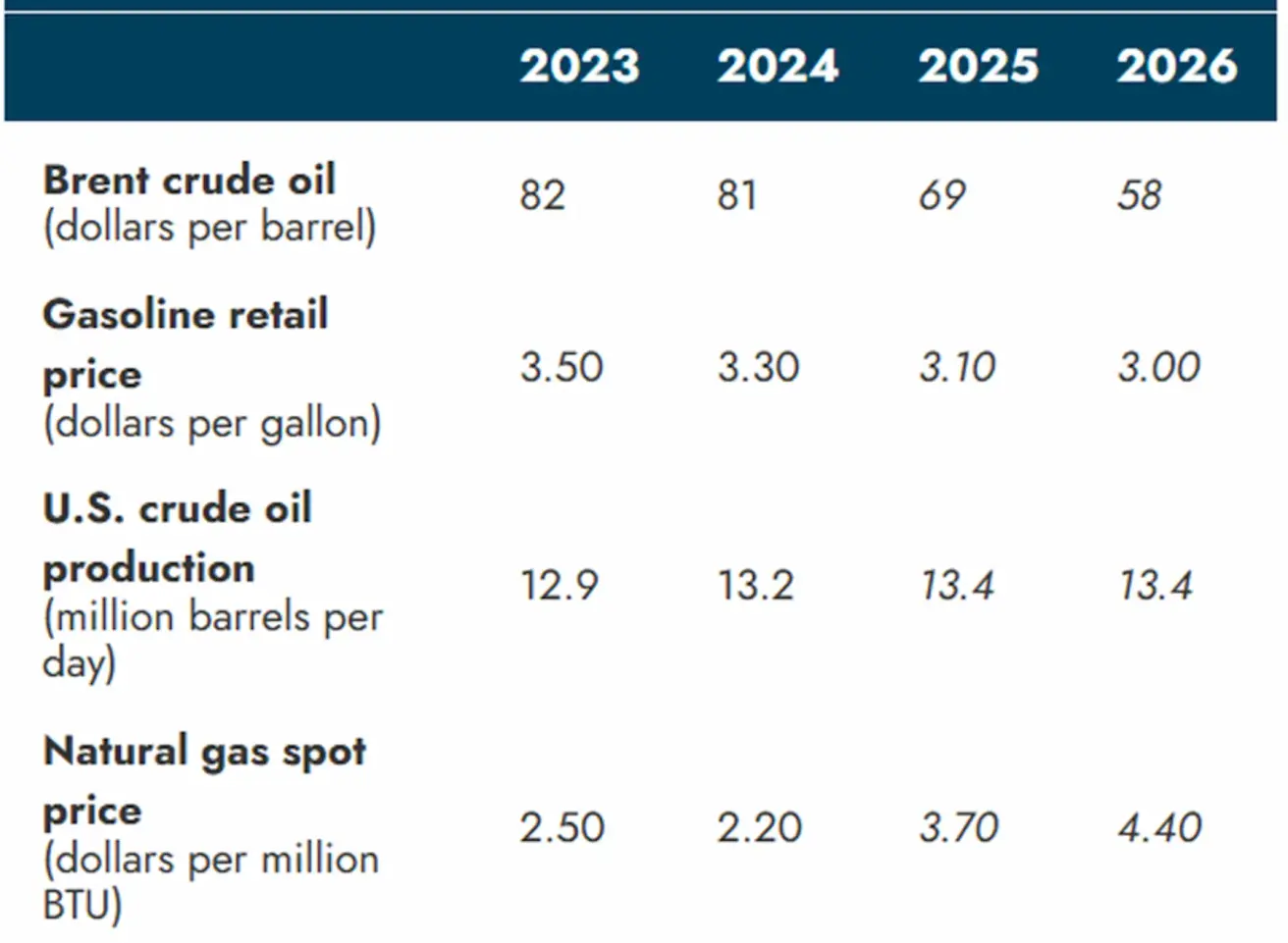

Short-Term Energy Market Outlook by the EIA (U.S. Energy Information Administration): Global Oil Prices

- The average Brent crude price is projected at $69 per barrel for this year — $3 higher than the estimate in last month’s STEO, which was released just prior to the escalation of tensions surrounding Iran’s nuclear program in mid-June (current Brent price: $71).

- The upward revision is primarily driven by a short-term increase in the geopolitical risk premium linked to the conflict.

- Despite the elevated risk premium, the agency expects a substantial build in global oil inventories to exert persistent downward pressure on prices throughout the forecast period, with Brent projected to average $58 per barrel in 2026.

Monthly Oil Market Report – International Energy Agency (IEA):

- Global oil demand is projected to rise by 700,000 barrels per day (bpd) in 2025, marking the slowest annual growth since 2009, excluding the 2020 COVID-19 downturn. Demand is expected to increase by a further 720,000 bpd to reach 104.4 million bpd in 2026.

- Global oil supply surged by 950,000 bpd in June, reaching 105.6 million bpd, largely driven by a sharp increase in output from Saudi Arabia. Year-over-year production rose by 2.9 million bpd, of which 1.9 million bpd came from OPEC+ members.

- Following the announcement of higher OPEC+ targets for August, global oil supply is now forecast to grow by 2.1 million bpd this year (to 105.1 million bpd) and by an additional 1.3 million bpd in 2026. Non-OPEC+ countries are expected to contribute 1.4 million bpd in 2025 and 940,000 bpd in 2026.

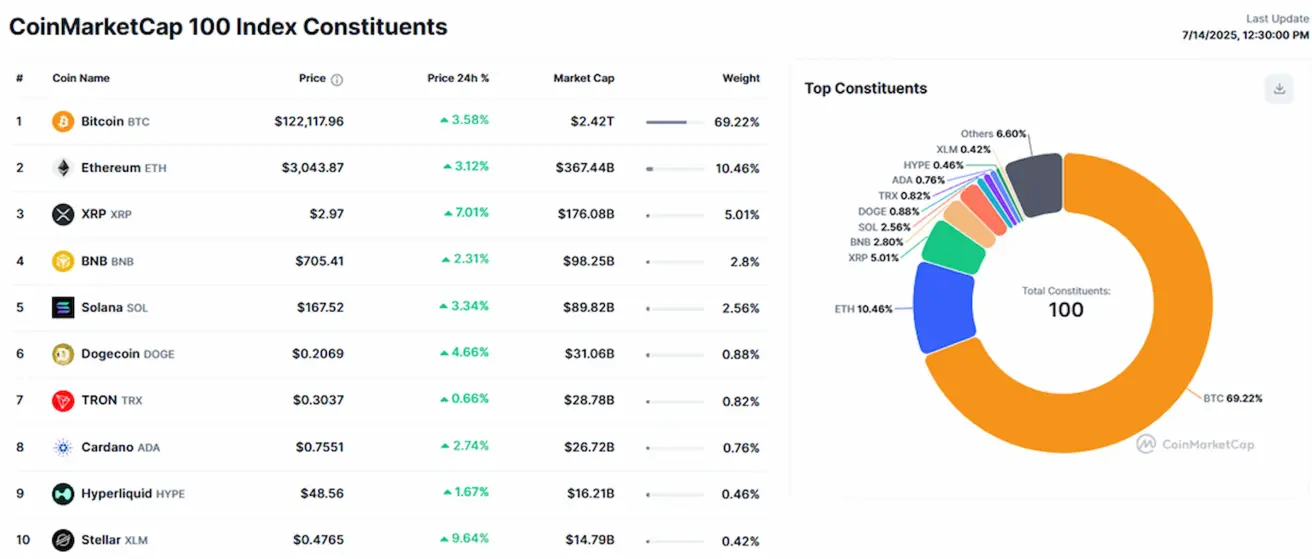

BTC FUTURES

The third retest successfully broke through the resistance level. Over the past week, Bitcoin futures gained +6.81%, closing at $118,140. As of Monday, Bitcoin is already up 4% intraday, briefly touching $123,500. Year-to-date return for 2025: +16.10%

ETH FUTURES

Weekly: +14.39%, weekly close: $2,989.00, YTD: -11.67%

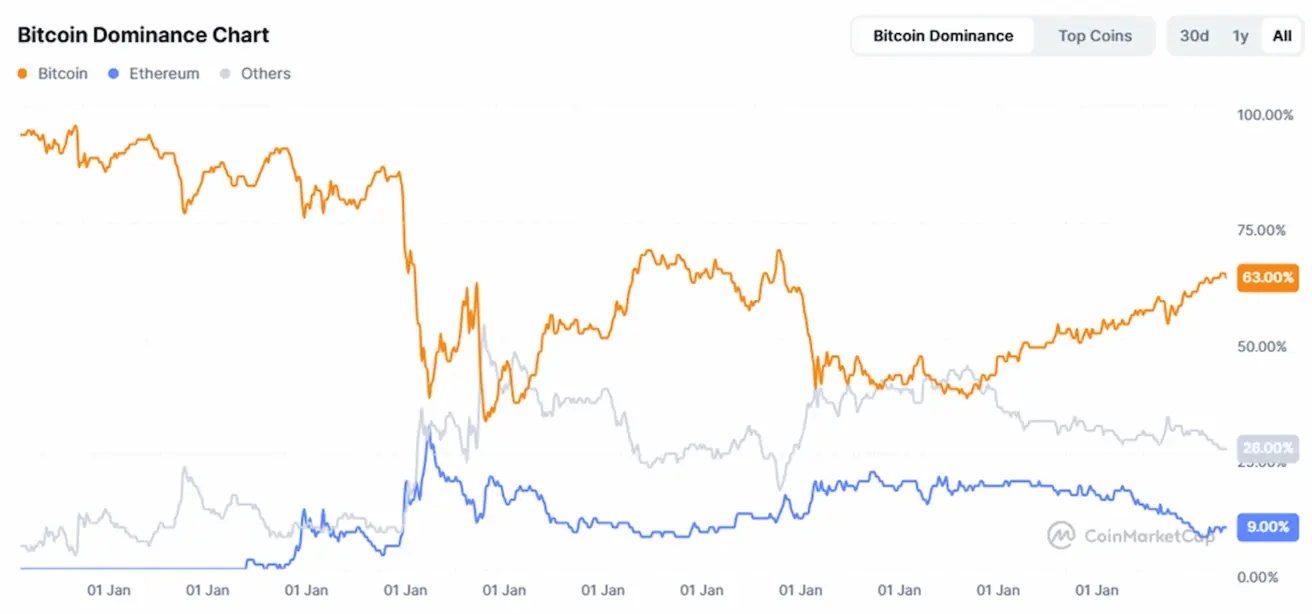

Crypto Market Capitalization:

The total market cap rose to $3.82 trillion (vs. $3.35 trillion a week earlier) (source: coinmarketcap.com).

- Bitcoin dominance edged lower to 63.8% (from 64.4%)

- Ethereum’s share increased to 9.6% (from 9.2%)

- Altcoins remained largely unchanged at 26.5% (vs. 26.4%)

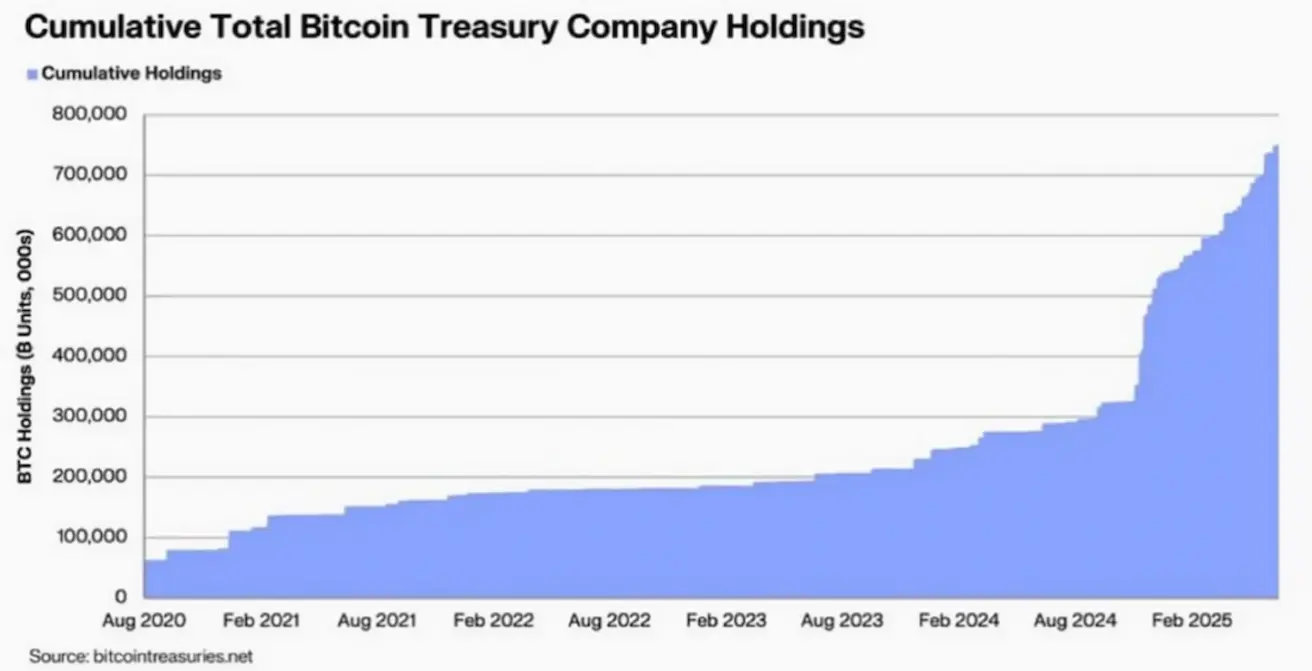

Corporate Bitcoin Treasuries continue to expand steadily, with total holdings surpassing 700,000 BTC:

Қазақша

Қазақша