June 23 - 27, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

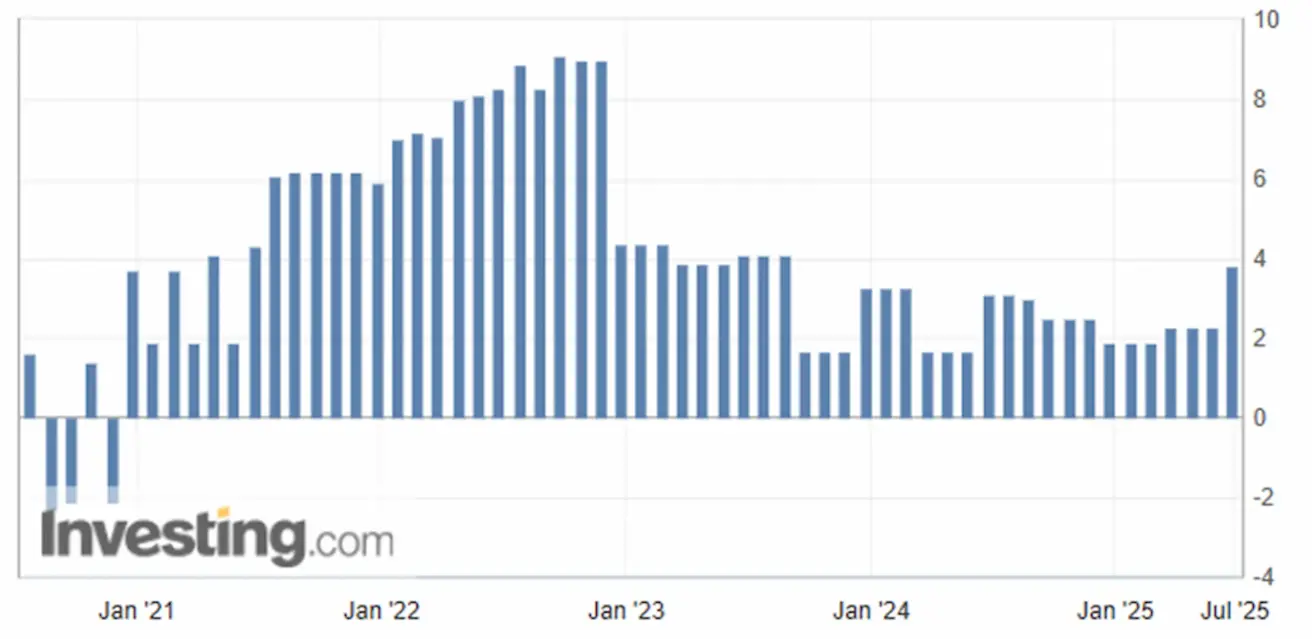

INFLATION

- Core Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Core Consumer Price Index (CPI) (y/y) (May): 2.8% (previous: 2.8%)

- Consumer Price Index (CPI) (y/y) (May): 2.4% (previous: 2.3%)

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (May): 5.0% (prev: 6.6%)

- 5-year expected inflation (April): 4.0% (prev: 4.2%)

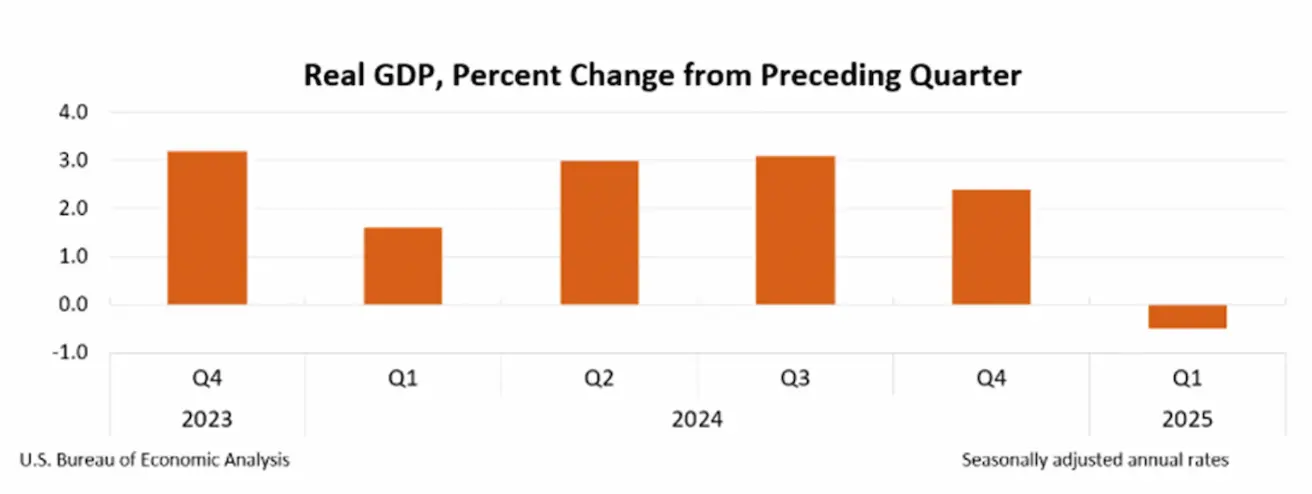

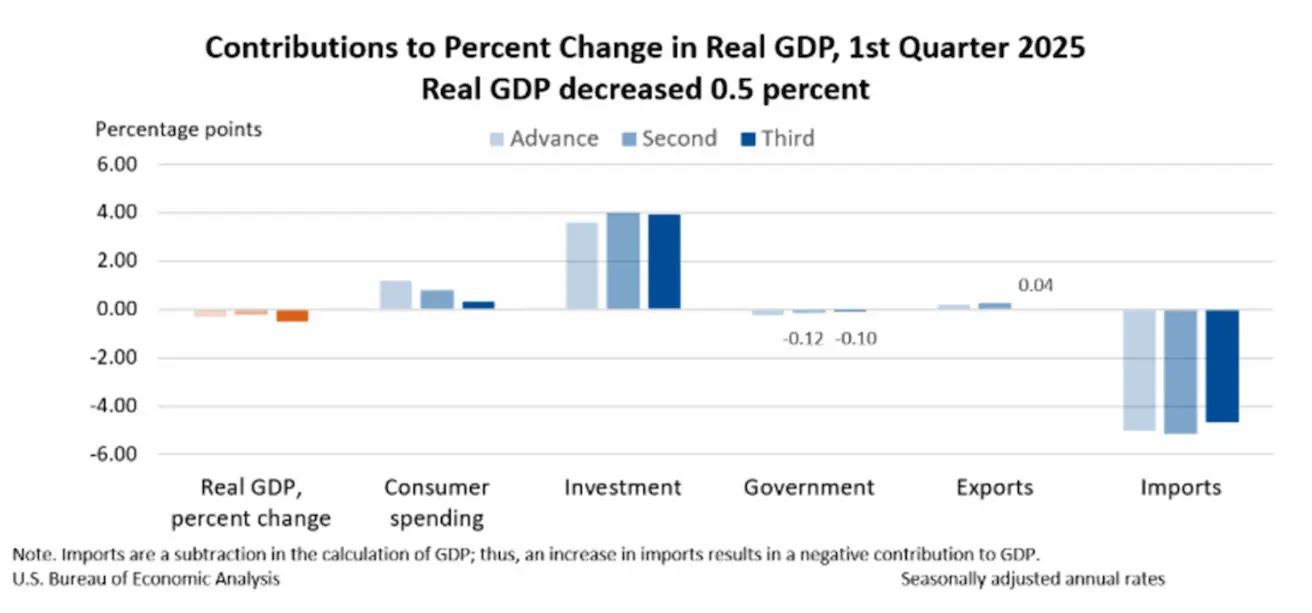

GDP (U.S. Bureau of Economic Analysis, BEA)

-

-0.2%; (Q4 2024: 2.4%)

-

U.S. GDP deflator (q/q) (Q1): 3.8% (Q4 2024: 2.3%)

*The GDP deflator – a price index for GDP – is one of the key indicators of inflation.

Atlanta Fed GDPNow Indicator (Q2): 2.9% (vs. 3.4%)

(The GDPNow forecasting model provides a "real-time" estimate of GDP growth prior to the official release, utilizing a methodology similar to that of the BEA.)

*The GDP deflator – a price index for GDP – is one of the key indicators of inflation.

Atlanta Fed GDPNow Indicator (Q2): 2.9% (vs. 3.4%)

(The GDPNow forecasting model provides a "real-time" estimate of GDP growth prior to the official release, utilizing a methodology similar to that of the BEA.)

Business Activity Index (PMI):

(Above 50 indicates expansion; below 50 indicates contraction)

- Services sector (May): 53.1 (previous: 53.7)

- Manufacturing sector (May): 52 (previous: 52)

- S&P Global Composite (May): 52.8 (previous: 53)

LABOR MARKET:

- Unemployment rate (April): 4.2% (previous: 4.2%)

- Nonfarm payroll employment change (May): 139K (previous: 147K revised)

- Average hourly earnings (May, y/y): 3.9% (previous: 3.8%)

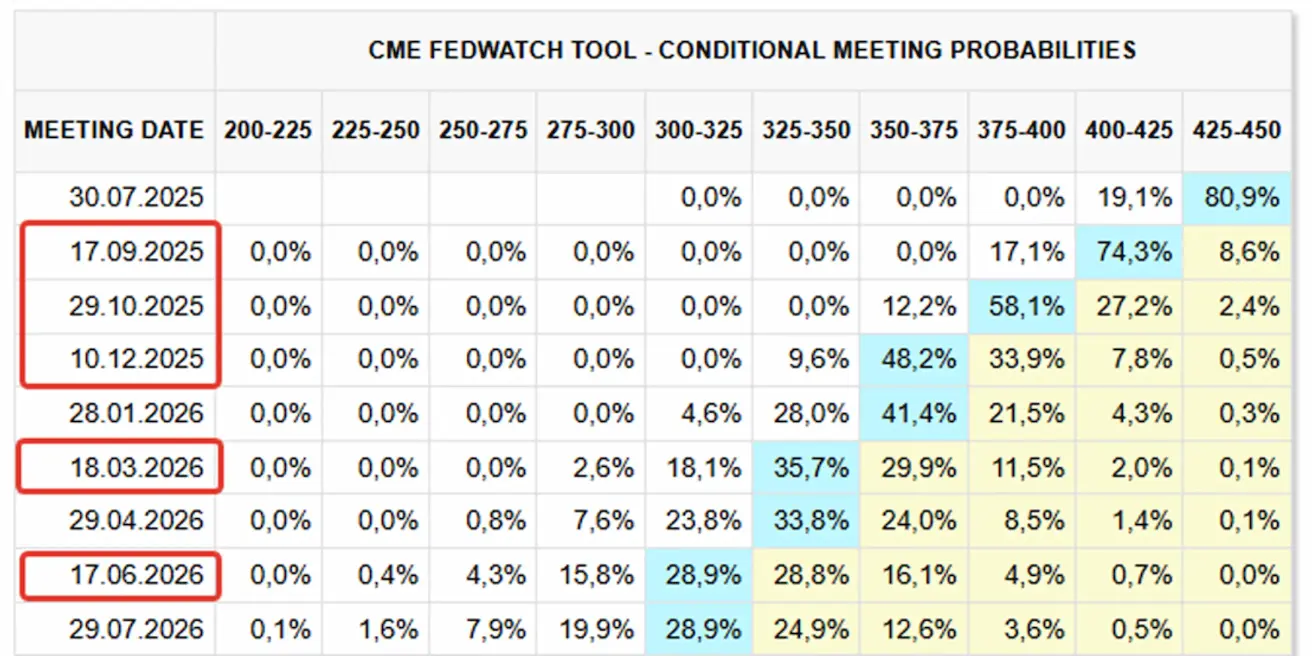

MONETARY POLICY

- Federal Funds Effective Rate (EFFR): 4.25% - 4.50% (unchanged)

- Federal Reserve balance sheet (blue) increased: $6.681 trillion (vs. previous week: $6.677 trillion)

MARKET FORECAST FOR RATE

Today:

А week earlier:

Commentary

Risk-on sentiment has returned to the markets amid a relative easing of geopolitical tensions, with the S&P 500 and Nasdaq 100 reaching all-time highs. The VIX fear index fell to 16.43 (-22%). Markets interpreted Iran’s retaliatory strike (June 21–22) on U.S. bases as largely symbolic. According to a report by the Pentagon’s Defense Intelligence Agency, the bombardment of nuclear sites likely did not damage the core underground components of Iran’s program, including its centrifuges. Meanwhile, the IAEA reported that 400 kg of enriched uranium have gone missing without a trace, suggesting that the strikes may have only temporarily delayed Iran’s nuclear program. According to the third estimate released by the Bureau of Economic Analysis, U.S. GDP contracted by an annualized 0.5% in Q1 2025 (January–March), compared to the second estimate of a 0.2% decline. The decrease in real GDP primarily reflected higher imports, which subtract from GDP calculations, as well as reduced government spending. These negative factors were partially offset by growth in private investment and consumer expenditures. U.S. business activity indices softened in June: the services PMI fell by 0.6 points to 53.1, while the composite PMI declined by 0.2 points to 52.8. In contrast, the Eurozone saw a marginal uptick in services activity, rising by 0.1 points to 50.0.

Key excerpts from Chair Powell’s testimony to the House of Representatives:

- Further softening in the labor market would strengthen the case for an earlier rate cut.

- We may see inflation come in weaker than expected, and if that happens, we would consider cutting rates sooner.

- A substantial majority of policymakers believe rate cuts will be appropriate later this year.

- I wouldn’t say I’m concerned about the quality of the current data, but the direction is worrying.

- We do expect tariff-driven inflation to become more pronounced.

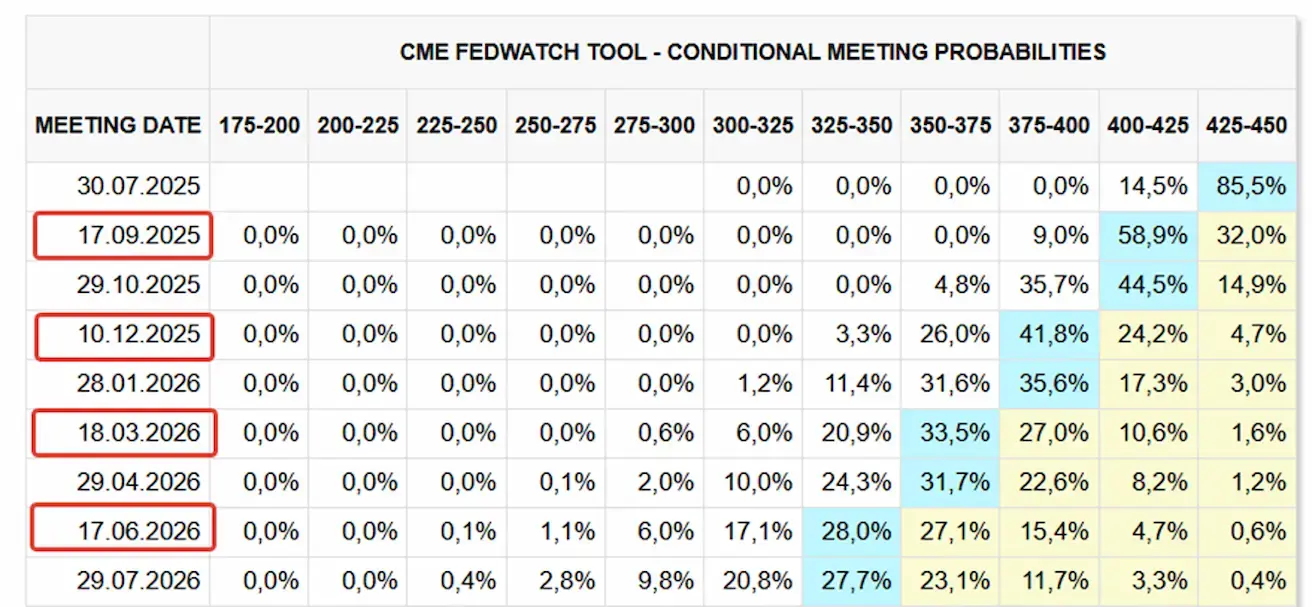

Market expectations (CME FedWatch):

- For the upcoming meeting on July 30: no change expected, with over 80% probability of rates remaining on hold.

- Over the next 12 months: markets are pricing in five 25 basis point cuts, bringing the federal funds rate down to a range of 3.00–3.25%, with the first cut anticipated in September.

U.S. fiscal policy:

- Donald Trump’s $4.5 trillion tax cut bill passed a key Senate vote (51–49). The legislation includes: Permanent extension of the 2017 tax cuts

- Repeal of green energy subsidies (wind, solar, EVs) starting in 2027

- Creation of a $25 billion support fund for rural hospitals

- An increase in the SALT deduction cap to $40,000 for five years

- A $5 trillion debt ceiling increase to avert default

Trade developments:

- The U.S. and China signed a framework agreement, under which Beijing committed to supplying rare earth metals, while the U.S. pledged to lift countermeasures — but only after deliveries commence.

- Commerce Secretary Lutnik stated that Trump plans to finalize up to 10 trade agreements with key partners by July 9.

- Beijing has vowed to retaliate against Taiwan’s “technological blockade” following the addition of Chinese companies to the blacklist, which prohibits Taiwanese firms from doing business with Huawei and SMIC without a license and risks cutting them off from TSMC technologies.

- Canada’s Ministry of Finance announced it will scrap its digital services tax to advance trade negotiations with the U.S. Prime Minister Carney and President Trump are expected to resume talks with the goal of reaching an agreement by July 21, 2025.

Market

S&P500

Weekly: -3.44% (weekly close: 6173,08), 2025 YTD: +4.57%

NASDAQ100

Weekly: -4.20% (weekly close: 22534.20), YTD: +6.70%

Euro Stoxx 600:

Weekly: -1.59% (weekly close: 544,6), YTD: +7.71%

The CSI Index:

-2.44% (weekly close: 3951), YTD: +0.51%

Hang Seng

Weekly: -2.95% (weekly close: 24224), YTD: +21.53%

According to a former senior official, China’s advantages in artificial intelligence development will soon trigger a wave of innovations, leading to over 100 breakthroughs similar to DeepSeek within the next 18 months. “These new software products will fundamentally transform the technological nature of the entire Chinese economy,” said Zhu Min, former Deputy Governor of the People’s Bank of China, speaking on Tuesday at the World Economic Forum in Tianjin.

IPO/SPAC

Gemini Space Station, Inc., a leading cryptocurrency exchange and custodial services provider, announced today that it has confidentially submitted a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (“SEC”) for a proposed initial public offering (IPO) of its Class A common stock. The number of Class A common shares to be offered and the price range for the proposed offering have not yet been determined. The IPO is expected to proceed following the completion of the SEC’s review process, subject to market conditions and other relevant factors.

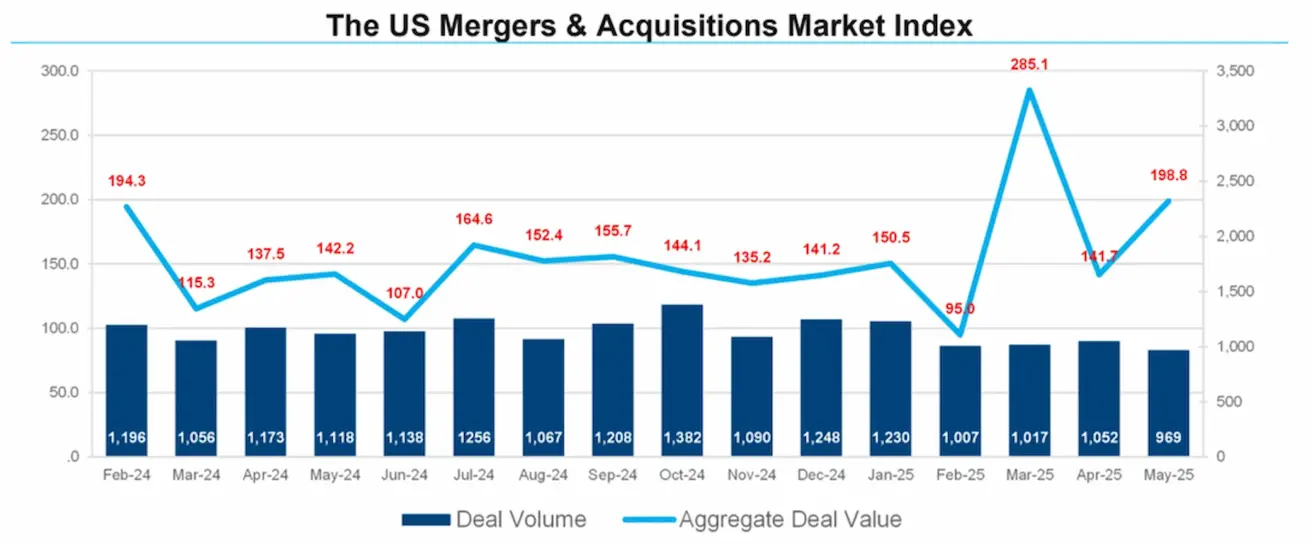

U.S. Mergers and Acquisitions Monthly Review: May 2025 (FactSet Insight / June 23, 2025)

- U.S. M&A activity experienced a decline in May, with deal announcements dropping by 7.9%, from 1,052 in April to 969. Despite the reduction in deal volume, aggregate M&A spending surged, increasing by 40.3% compared to the previous month.

- Sector Activity: Over the past three months, five of the 21 sectors tracked by FactSet reported an increase in M&A activity compared to the same three-month period a year earlier. These sectors include Technology Services (764 deals vs. 636), Transportation (78 vs. 66), Electronic Technology (73 vs. 69), Miscellaneous (16 vs. 14), and Process Industries (70 vs. 68).

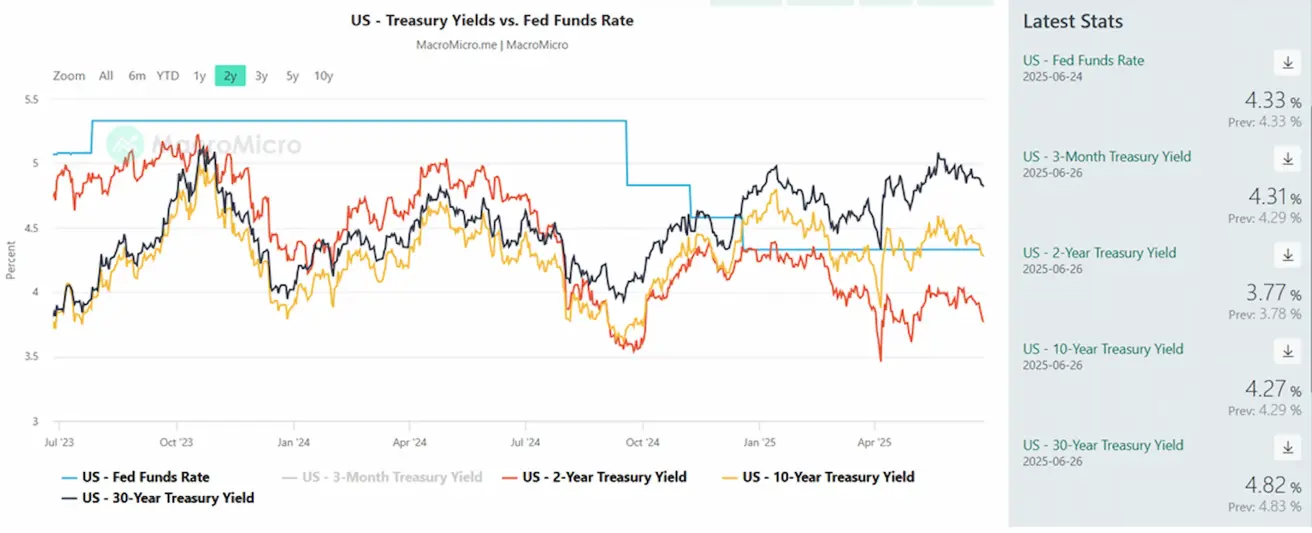

BOND MARKET – yields declining

20+ Year U.S. Treasury Bonds (ETF TLT): +0.04% (weekly close: $87.39). YTD: -0.47%:

YIELDS AND SPREADS 2025/06/23 vs 2025/06/16

- Market Yield on 10-Year U.S. Treasuries: 4.47% (vs. 4.40%)

- ICE BofA BBB U.S. Corporate Index Effective Yield: 5.38% (vs. 5.36%)

- Yield Spread: 10-year vs. 2-year Treasuries: 50.0 vs. 47.1 bps

- Yield Spread: 10-year vs. 3-month Treasuries: 4.0 vs. 6.2 bps

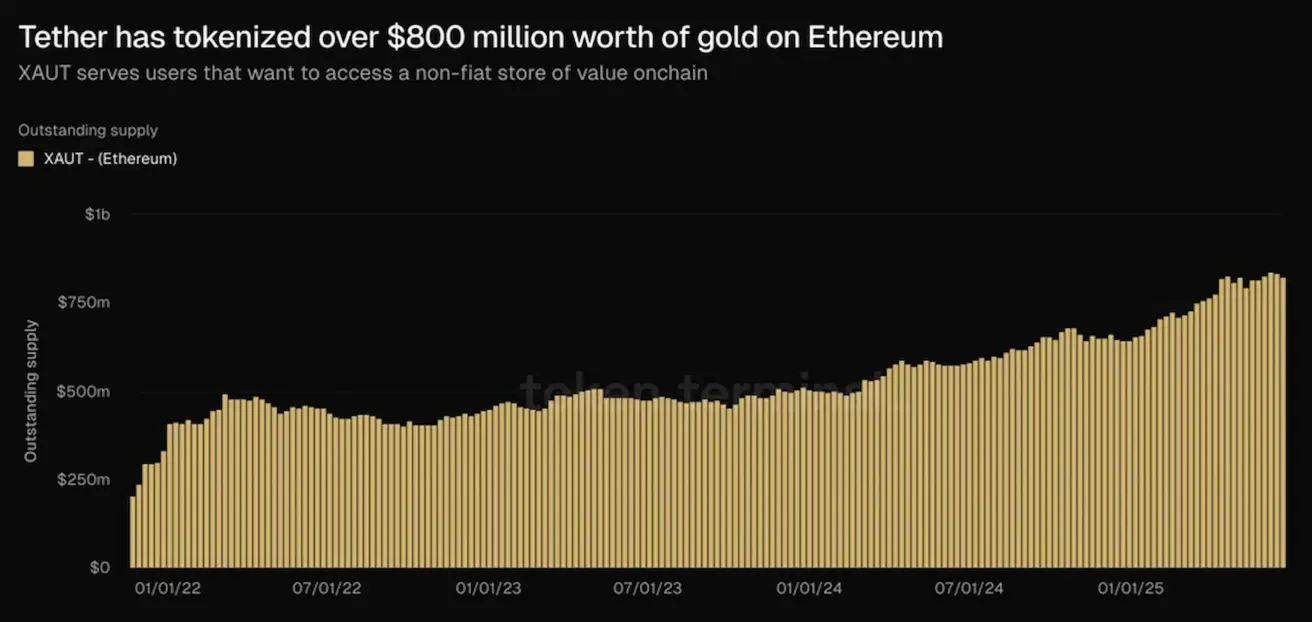

GOLD FUTURES (GC)

Weekly: -2.90%, weekly close: $3,286.1/oz, YTD: +24.43%

Tether has tokenized over $800 million worth of gold on the Ethereum blockchain.

Tether Gold (XAUT) is a token backed by physical gold stored in Swiss vaults, functioning as a digital equivalent of the physical asset and enabling gold trading on the blockchain.

1 XAUT represents one troy ounce of gold (approximately 31.1 grams).

DOLLAR INDEX FUTURES (DX)

Weekly: - 1.49%, weekly close: 96.875, YTD: -10.75%

OIL FUTURES

Weekly: - 12.12%, weekly close: 65.07, YTD: -9.44%

The OPEC+ alliance is expected to increase supply in the coming months, leading to a build-up in global inventories, a decline in oil prices, and potentially easing inflationary pressures.

The OPEC+ alliance is expected to increase supply in the coming months, leading to a build-up in global inventories, a decline in oil prices, and potentially easing inflationary pressures.

BTC FUTURES

Weekly: +3.87%, weekly close: $107,740, YTD: 13.09%

ETH FUTURES

Weekly: -0.45%, weekly close: $2,440.00, YTD: -27.90%

Cryptocurrency Market Capitalization:

$3.31 trillion (vs. $3.12 trillion a week earlier) (coinmarketcap.com)

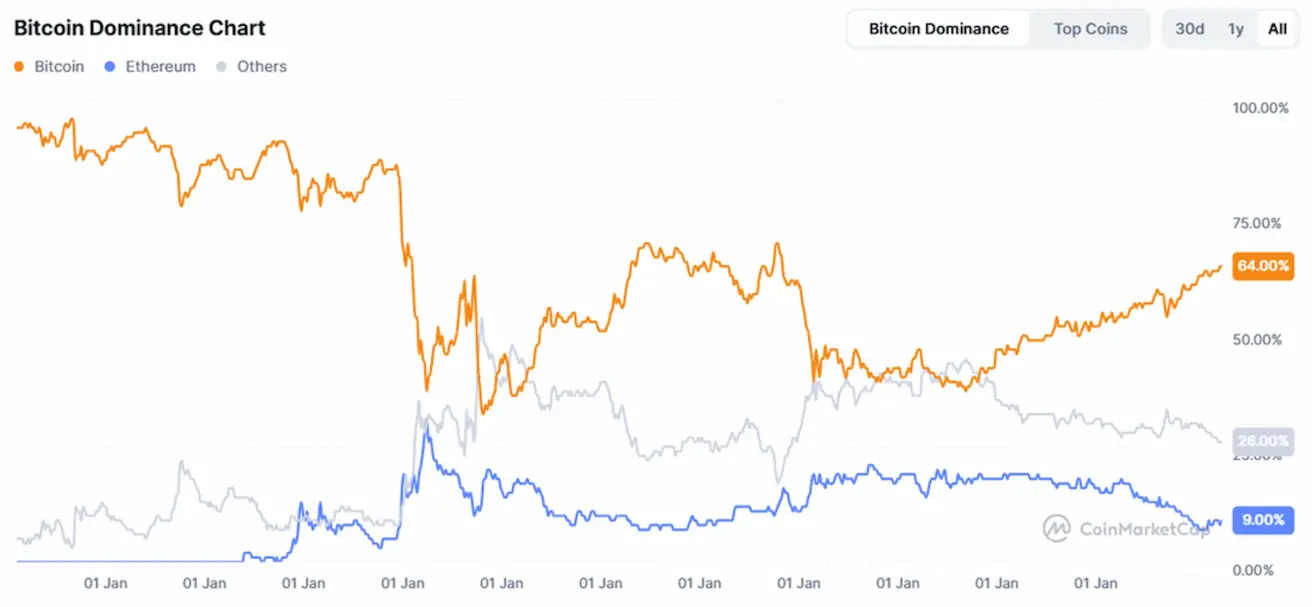

Bitcoin dominance: 64.6% (64,9%)), Ethereum: 9% (up from 8.8%), others: 26.4% (26.4%):

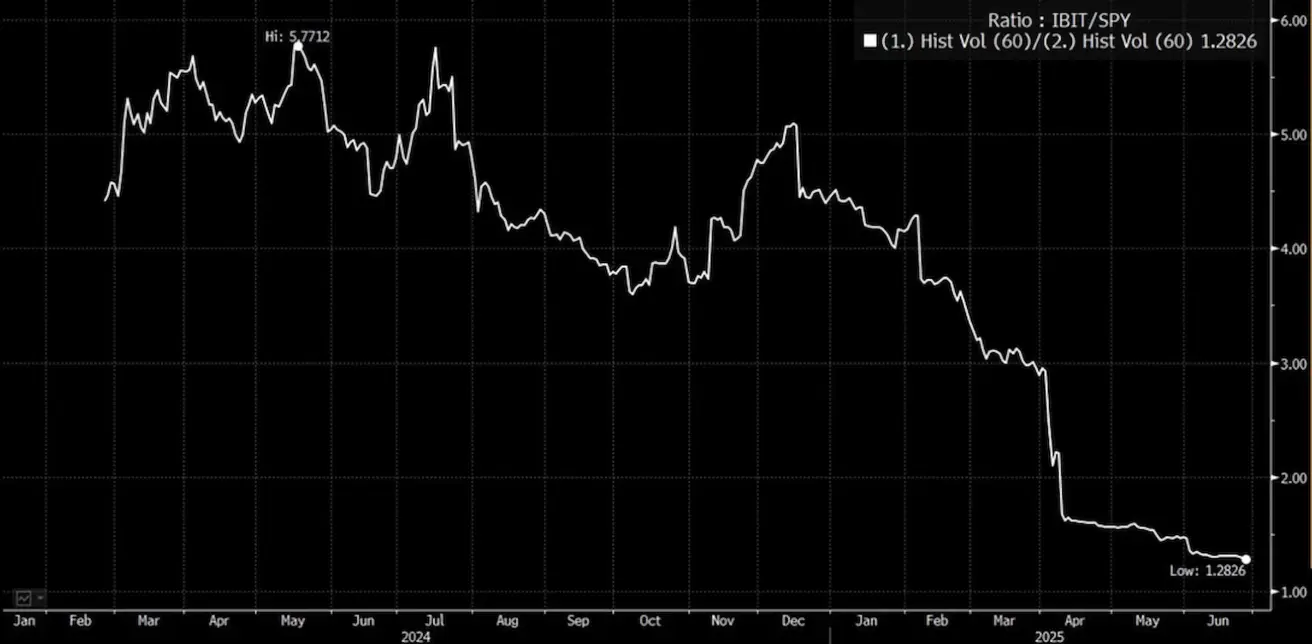

The 60-day volatility ratio between IBIT and the SPX has declined to around 1 today, compared to its 2023–2024 range of 4–6. This indicates that Bitcoin’s volatility is now approaching that of U.S. equities.

Ranking of the 60 largest publicly listed companies by their Bitcoin holdings as of June 26, 2025. Over the past seven days, 11 companies have increased their Bitcoin assets:

Crypto Market News:

- Texas has become the first U.S. state to establish a state-funded Bitcoin reserve, allocating $10 million for purchases.

- The U.S. House of Representatives has passed the “Deploying American Blockchain Act of 2025” (HR1664), which now moves to the Senate for consideration.

- Pradeep Bhandari, a representative of India’s ruling party, has proposed exploring the creation of a strategic Bitcoin reserve.

- Invesco Galaxy has filed an S-1 registration statement with the SEC for a Solana ETF.

- Bitwise has submitted amended S-1 filings for its proposed spot Dogecoin and Aptos ETFs.

Hong Kong has published its “Digital Assets Policy Statement 2.0,” with key initiatives including:

- Expansion of real-world asset tokenization

- Streamlined licensing for exchanges, stablecoin issuers, and custodians

- Clarified tax framework for tokenized ETFs

- Support for secondary trading of tokenized assets

An article in the Financial Times (published June 25, 2025) reports that the European Commission plans to ignore warnings from the European Central Bank (ECB) regarding stablecoin regulation.

- The Commission’s proposal would treat stablecoins issued outside the EU as equivalent to their European counterparts, simplifying their use within the bloc.

- The ECB has raised concerns that such regulation could undermine financial stability and monetary policy control.

- Context: The decision reflects the growing popularity of stablecoins and the need to harmonize crypto asset regulations across the EU.

- Potential implications: Easier access to stablecoins could drive innovation but also heighten risks to the banking system and supervisory frameworks.

Қазақша

Қазақша