June 9 - 13, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

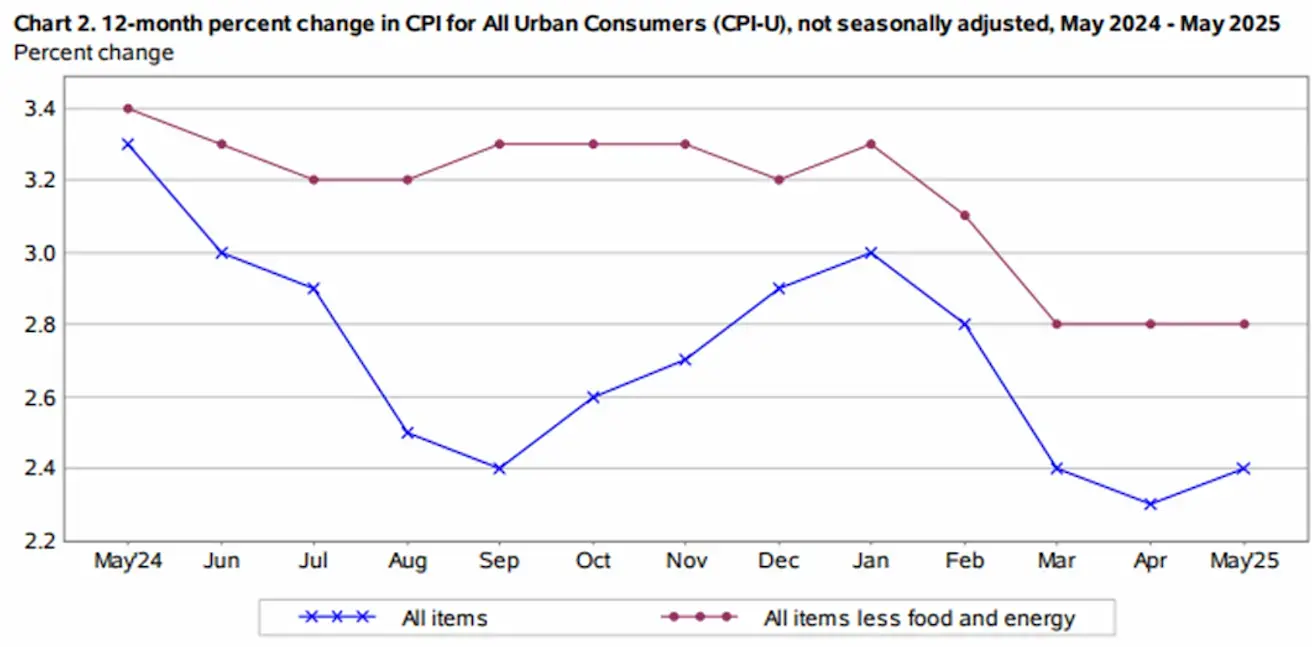

INFLATION

- Core Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Core Consumer Price Index (CPI) (y/y) (May): 2.8% (previous: 2.8%)

- Consumer Price Index (CPI) (y/y) (May): 2.4% (previous: 2.3%)

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (May): 5.1% (prev: 6.6%)

- 5-year expected inflation (April): 4.1% (prev: 4.2%)

GDP (U.S. Bureau of Economic Analysis, BEA)

- -0.2%; (Q4 2024: 2.4%)

Atlanta Fed GDPNow Indicator (Q2): 3.8% (vs. 3.8%)

(The GDPNow forecasting model provides a "real-time" estimate of GDP growth prior to the official release, utilizing a methodology similar to that of the BEA.)

Business Activity Index (PMI):

(Above 50 indicates expansion; below 50 indicates contraction)

- Services sector (May): 53.7 (previous: 50.8)

- Manufacturing sector (May): 52.3 (previous: 50.7)

- S&P Global Composite (May): 53.0 (previous: 50.6)

LABOR MARKET:

- Unemployment rate (April): 4.2% (previous: 4.2%)

- Nonfarm payroll employment change (May): 139K (previous: 147K revised)

- Average hourly earnings (May, y/y): 3.9% (previous: 3.8%)

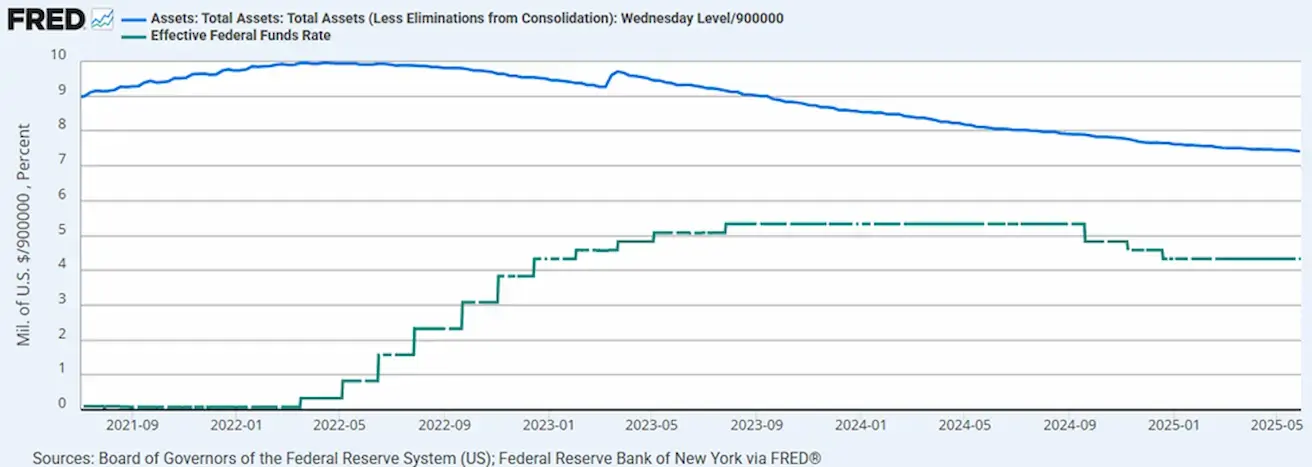

MONETARY POLICY

- Federal Funds Effective Rate (EFFR): 4.25% - 4.50% (unchanged)

- Federal Reserve balance sheet (blue) increased: $6.677 trillion (vs. previous week: $6.673 trillion)

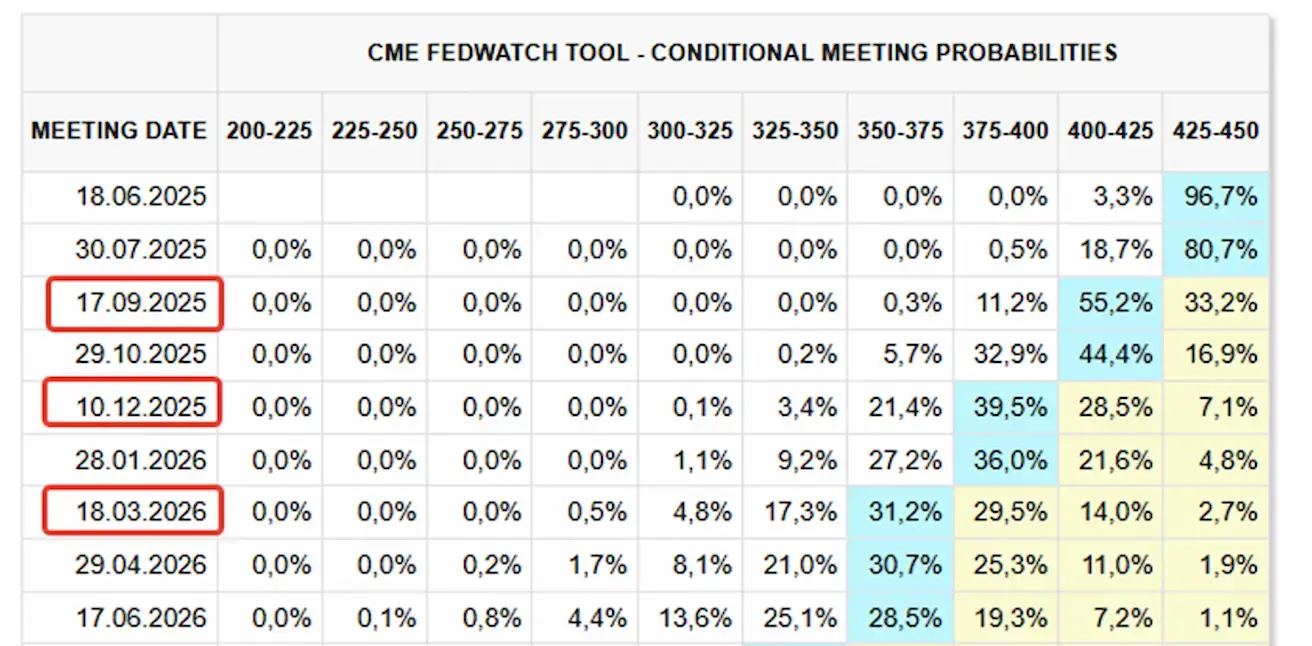

MARKET FORECAST FOR RATE

Today:

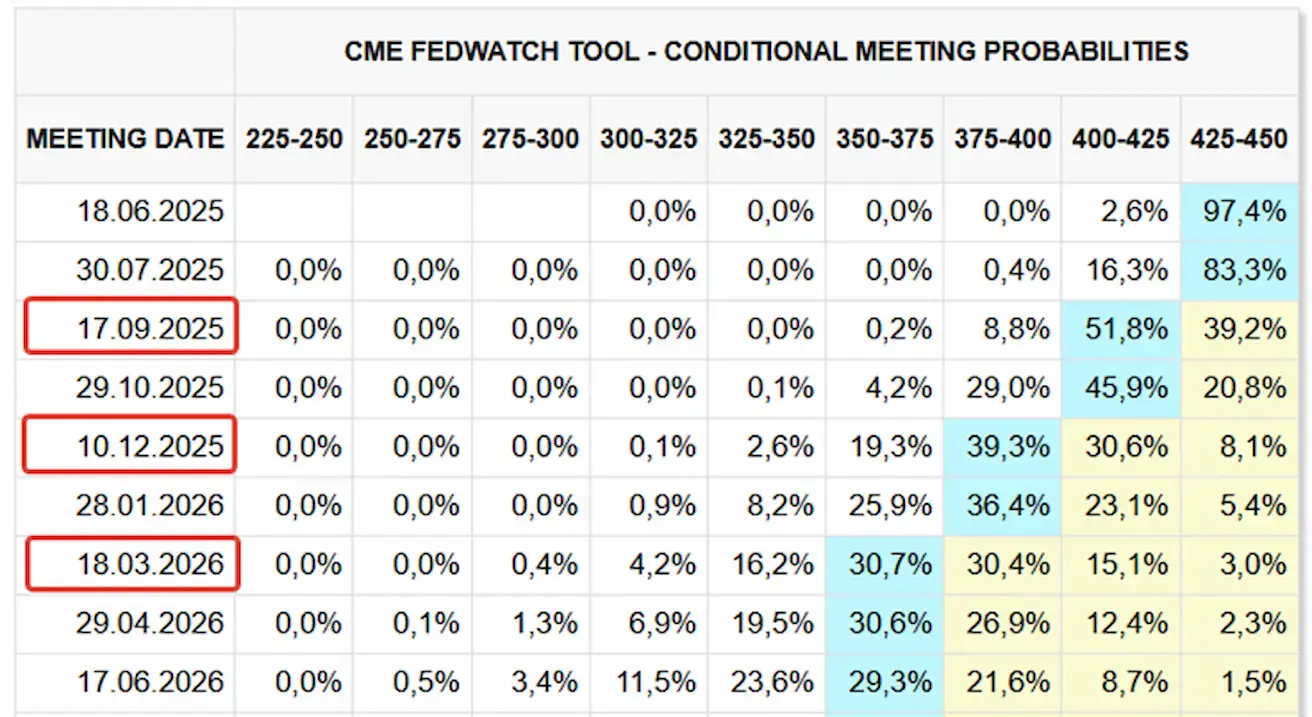

А week earlier:

А week earlier:

Commentary

CPI increased by 0.1% seasonally adjusted in May, following a 0.2% rise in April. Over the last 12 months, the CPI rose 2.4% (before seasonal adjustment). The primary contributors were housing prices and food, each up 0.3%. The energy index dropped by 1.0% in May, driven by a decline in gasoline prices. Core inflation (y/y) remained unchanged at 2.8%. All CPI readings came in below expectations. However, overall, the inflation data had little to no impact on the markets. The Federal Reserve's balance sheet increased by $4 billion over the past week. Market expectations (FedWatch) for the next 12 months remain unchanged: three 25 basis-point rate cuts, bringing the range to 3.50–3.75%. The first cut is expected in September this year. The next Fed meeting is scheduled for June 18, at which the market currently anticipates rates to remain unchanged within the 4.25–4.50% range. The probability of holding steady, per FedWatch, is 96.7%.

Trade Wars

- The U.S. and China concluded two days of trade negotiations in London, agreeing on a plan to resume shipments of sensitive goods. The U.S. will ease export controls, while China will accelerate the supply of rare earth elements critical to the American automotive and defense industries. Both parties described the talks as candid. Final approval must come from both presidents.

- Treasury Secretary Scott Bessent indicated that the Trump administration might extend the 90-day pause on mutual tariffs for countries demonstrating "good faith" in trade talks.

Equity Market

Last week’s median decline: -1.26%. Only the utilities and energy sectors posted positive performance.

YTD performance: -4.48%

YTD performance: -4.48%

MARKET

SP500

Weekly: -0.39% (weekly close: 5976.96), 2025 YTD: +1.25%

NASDAQ100

Weekly: -0.60% (weekly close: 21631.04), YTD: +2.42%

Euro Stoxx 50 (top 50 Eurozone companies):

Weekly: -2.89% (weekly close: 5269), YTD: +7.88%

CSI 300

Weekly: -0.23% (weekly close: 3864), YTD: -1.70%

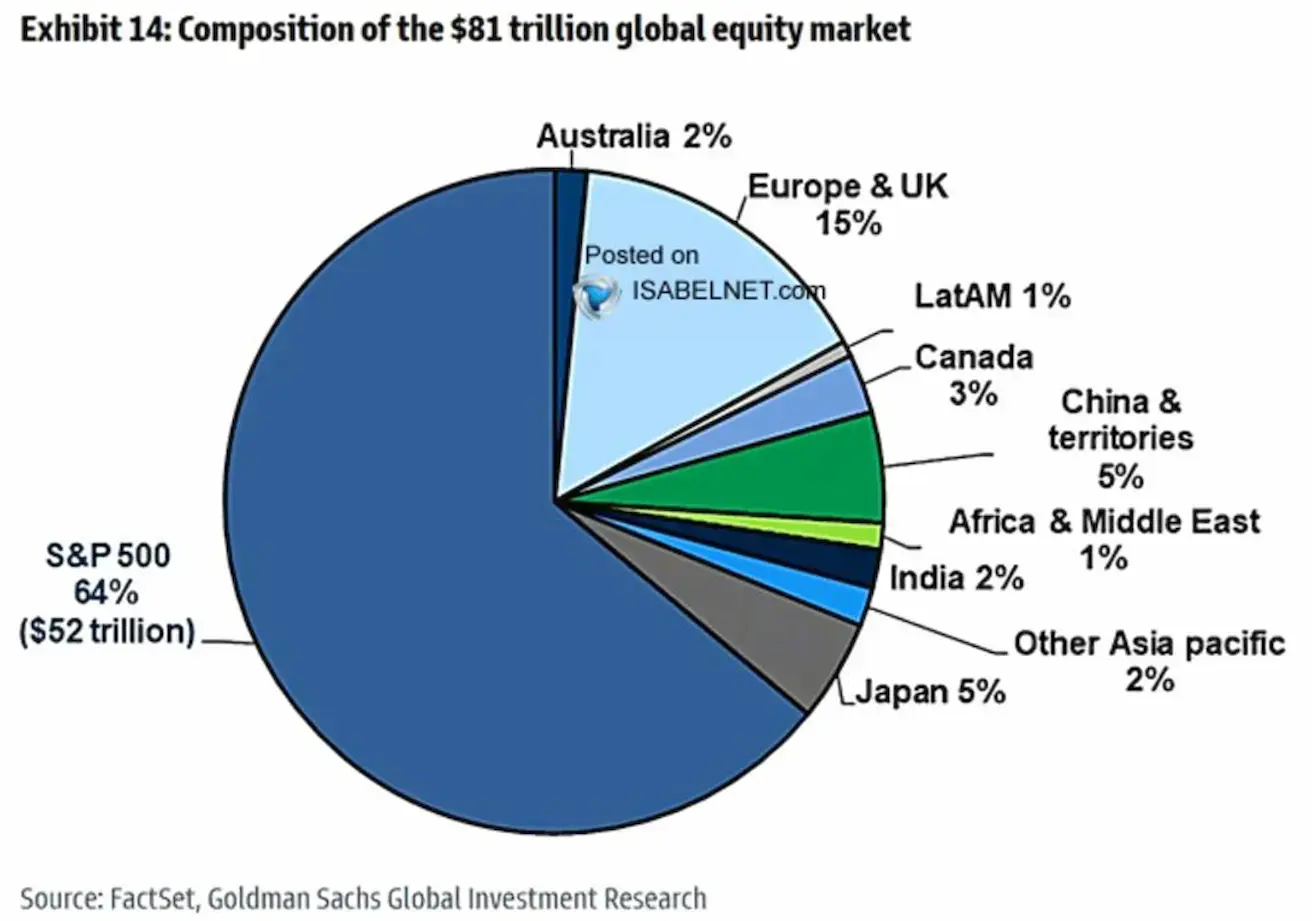

The U.S. stock market, with a capitalization of $52 trillion, accounts for 64% of global equity market capitalization. Europe comprises 15%, while China and Japan each represent 5%.

BOND MARKET

20+ Year U.S. Treasury Bonds (ETF TLT): +1.15% (weekly close: $86.33)

YTD: -1.67%:

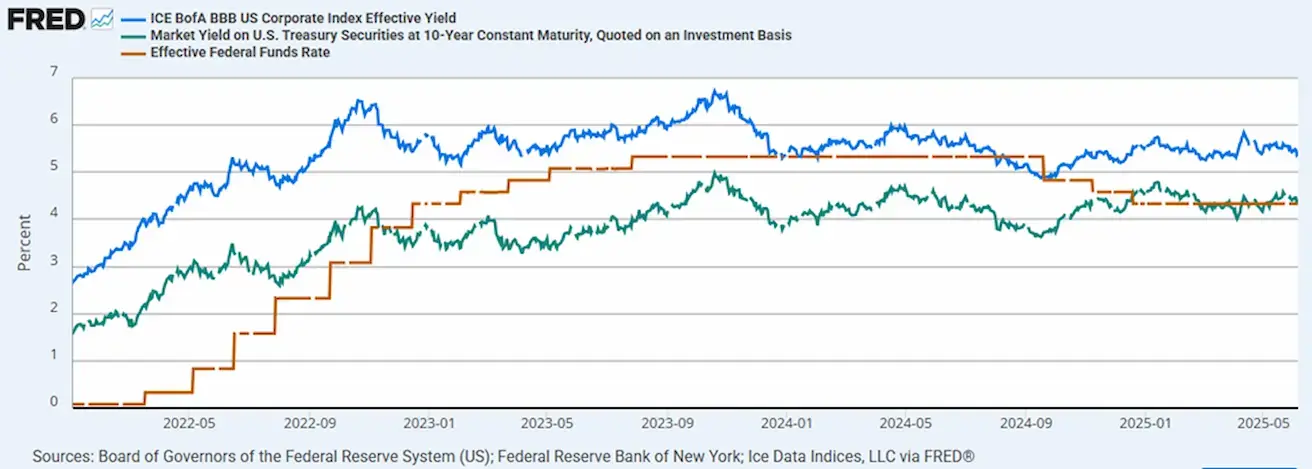

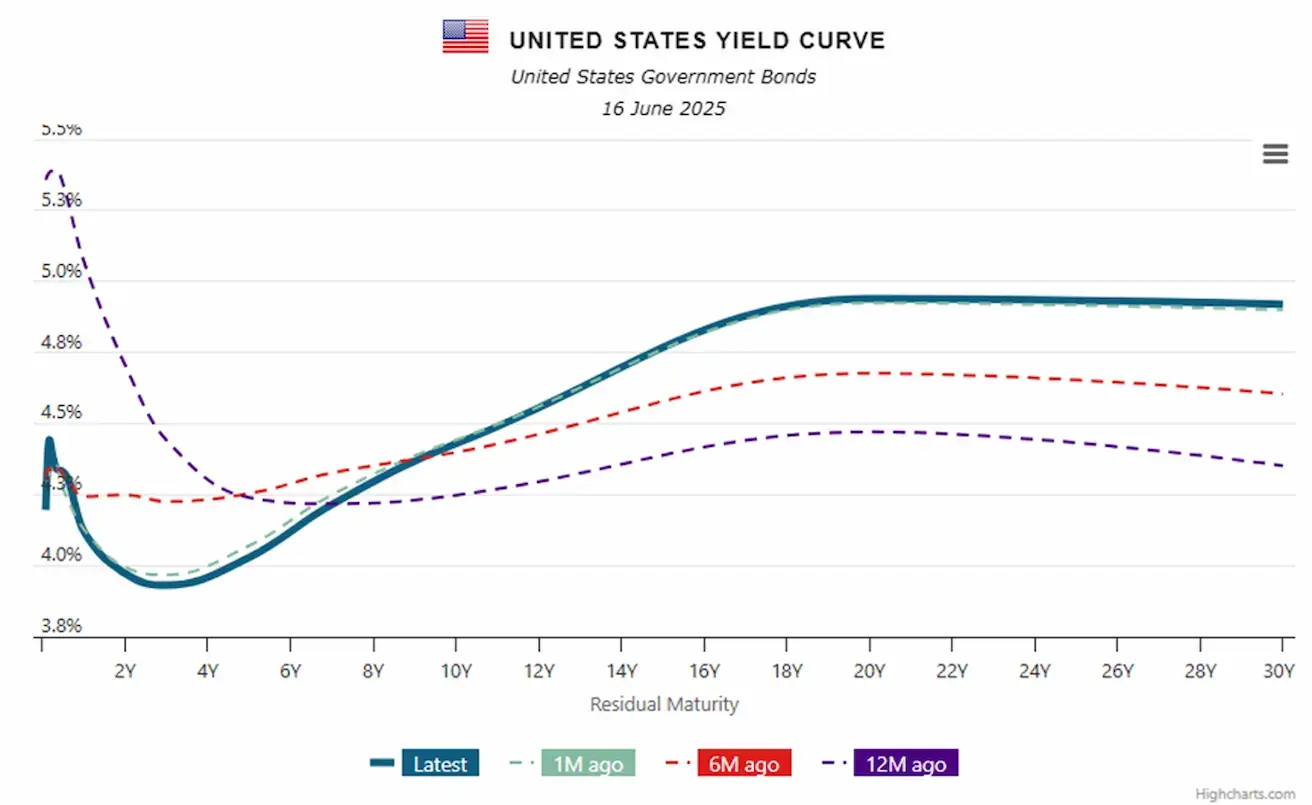

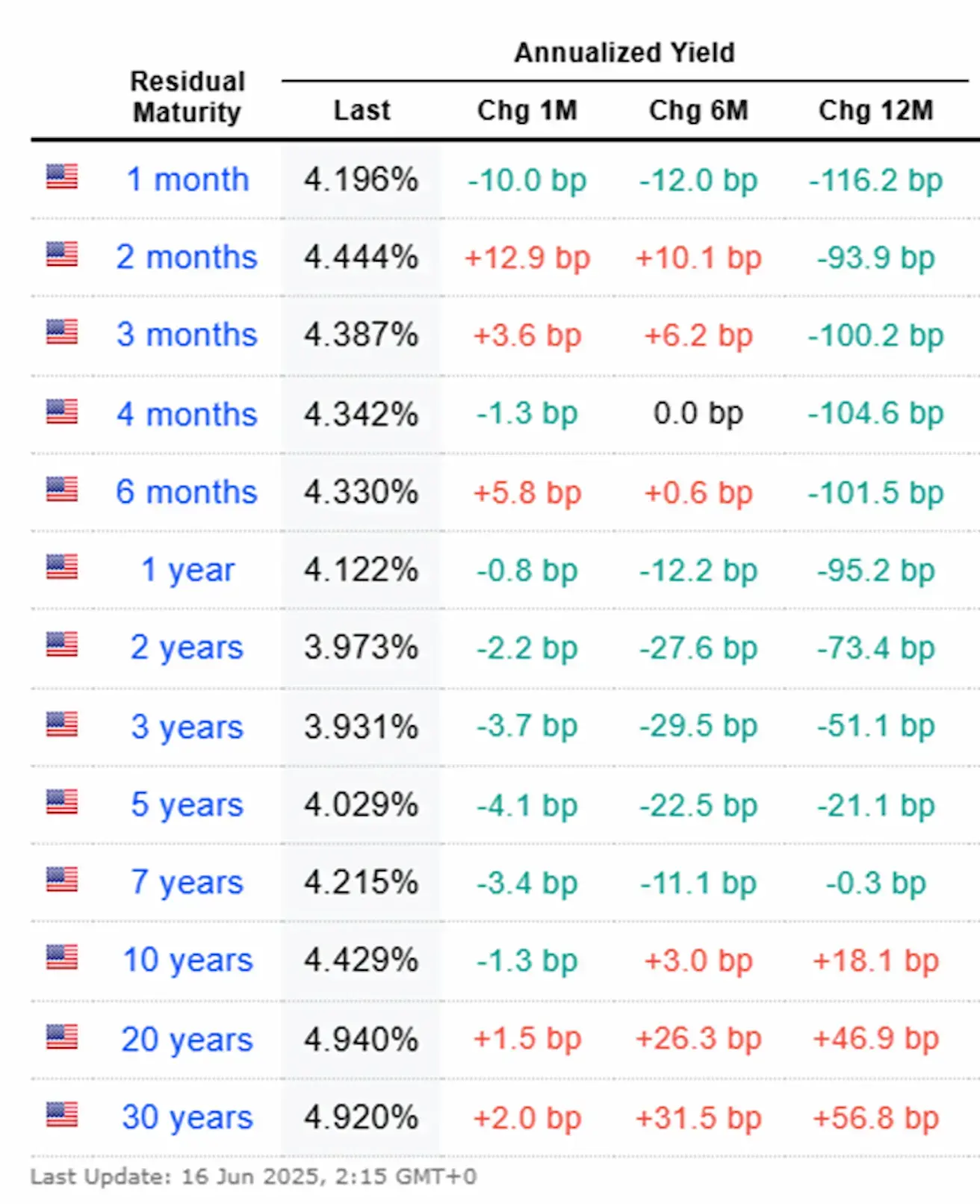

YIELDS AND SPREADS 2025/06/16 vs 2025/06/09

- Market Yield on 10-Year U.S. Treasuries: 4.429% (vs. 4.505%)

- ICE BofA BBB U.S. Corporate Index Effective Yield: 5.36% (vs. 5.42%)

- Yield Spread: 10-year vs. 2-year Treasuries: 45.6 vs. 46.9 bps

- Yield Spread: 10-year vs. 3-month Treasuries: 4.2 vs. 16.4 bps

GOLD FUTURES (GC)

Weekly: +3.65%, weekly close: $3,452.6/oz, YTD: +30.73%

DOLLAR INDEX FUTURES (DX)

Weekly: -1.49%, weekly close: 97.695, YTD: -9.82%

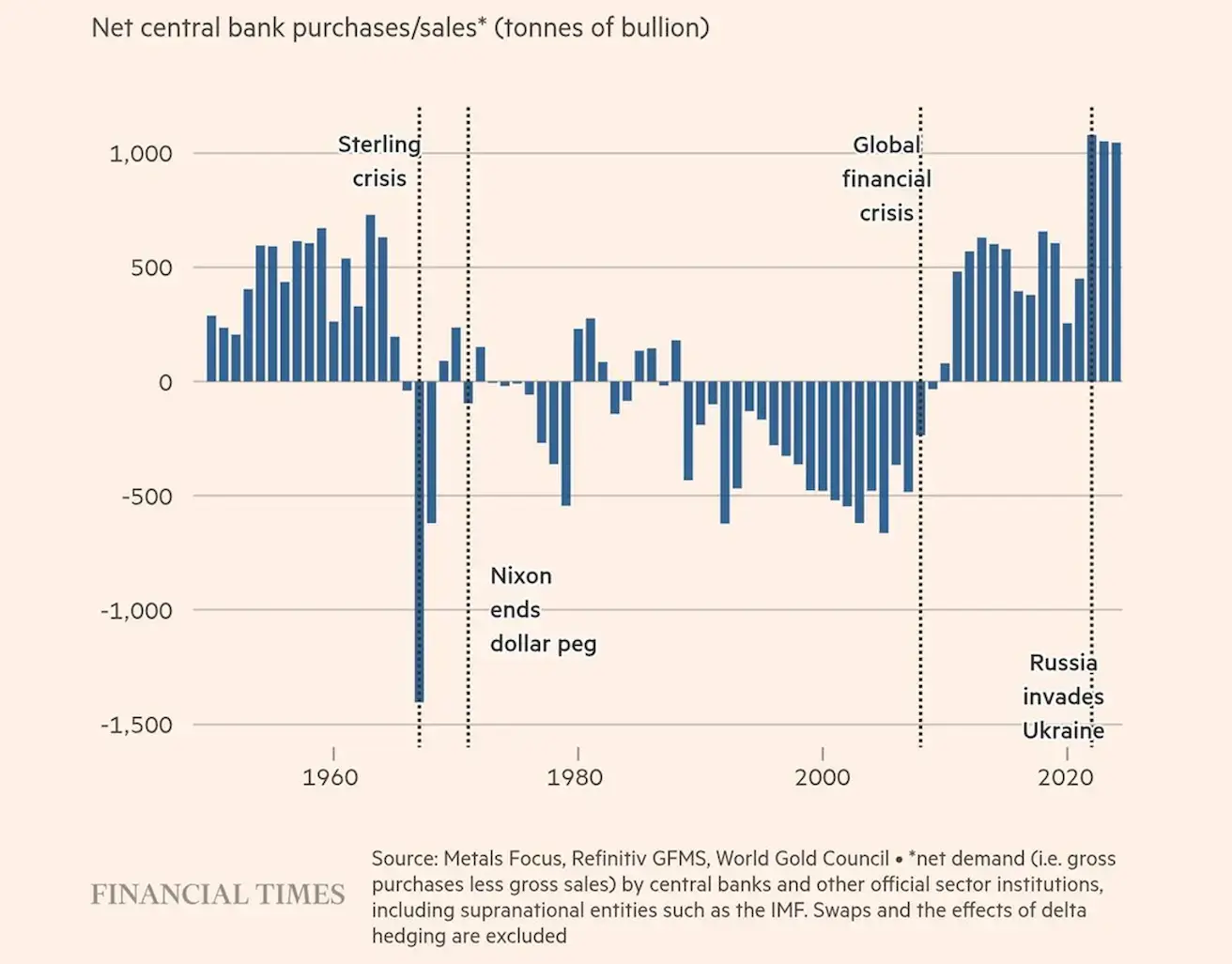

Since the beginning of large-scale quantitative easing (QE) in response to the 2008 financial crisis, central banks have been accumulating gold for their reserves. After unprecedented monetary stimulus during the pandemic, the pace of gold purchases reached historical highs, exceeding even the period following President Nixon’s decision to unpeg the dollar from gold.

The logic is straightforward: the more aggressively an economy is stimulated via fiat issuance, the more those currencies are devalued, increasing the need for hard reserves—historically represented by gold.

Moreover, the past three years have introduced additional geopolitical and geoeconomic risks. As a result, the pace of gold purchases is likely to remain elevated.

Gold has surpassed the euro as the world’s second-largest reserve asset, now accounting for 20% of global reserves, while the euro has declined to 16%. The U.S. dollar remains the top reserve currency at 46%:

Gold has surpassed the euro as the world’s second-largest reserve asset, now accounting for 20% of global reserves, while the euro has declined to 16%. The U.S. dollar remains the top reserve currency at 46%:

OIL FUTURES

Driven by geopolitical tensions, oil prices jumped 12.98% during the week, peaking at $77.5/barrel. Weekly close: $73.18/barrel, YTD: +1.85%:

The Strait of Hormuz—one of the world’s most strategically vital maritime chokepoints connecting the Persian Gulf and Arabian Sea—has come under threat. Over 20% of global oil exports pass through it. Iran has threatened to shut the strait, a scenario that could disrupt global oil supplies and trigger an inflation surge.

The Strait of Hormuz—one of the world’s most strategically vital maritime chokepoints connecting the Persian Gulf and Arabian Sea—has come under threat. Over 20% of global oil exports pass through it. Iran has threatened to shut the strait, a scenario that could disrupt global oil supplies and trigger an inflation surge.

BTC FUTURES

Weekly: +0.62%, weekly close: $105,715, YTD: +10.96%

ETH FUTURES

Weekly: +1.75%, weekly close: $2,555.00, YTD: -24.50%

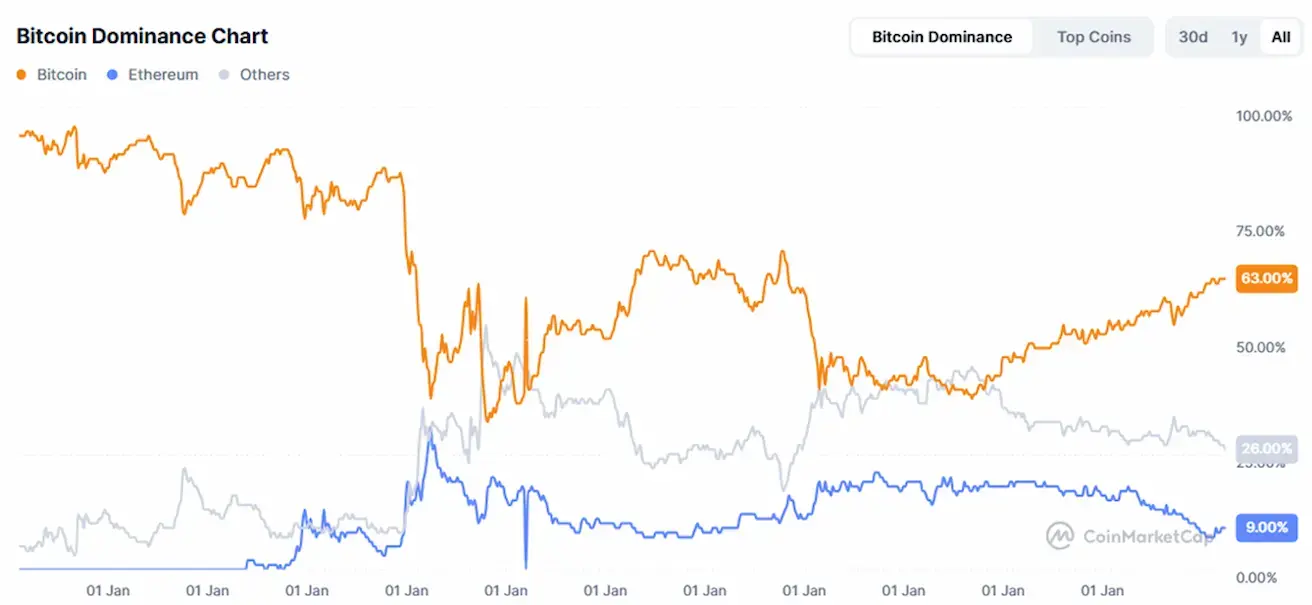

Cryptocurrency Market Capitalization:

- $3.34 trillion (vs. $3.29 trillion a week earlier) (coinmarketcap.com)

- Bitcoin dominance: 63.7% (unchanged), Ethereum: 9.5% (up from 9.2%), others: 26.8% (down from 27.1%):

Crypto Market News:

- The CEO of Bank of America stated that the bank is developing a stablecoin both independently and in partnership with industry collaborators.

- The SEC and Ripple filed a joint motion to lift the injunction in their ongoing case.

- They also proposed a split of the $125 million civil penalty: $50 million to the SEC and $75 million to Ripple.

- SEC Chair Atkins stated that Bitcoin self-custody and proof-of-work mining do not violate securities laws.

- The Marindae Solana ETF has been registered in Delaware.

- The U.S. Senate will hold a final vote on the GENIUS Act on June 17.

Қазақша

Қазақша