June 16 - 20, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Consumer Price Index (CPI) (m/m) (May): 0.1% (previous: 0.2%)

- Core Consumer Price Index (CPI) (y/y) (May): 2.8% (previous: 2.8%)

- Consumer Price Index (CPI) (y/y) (May): 2.4% (previous: 2.3%)

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (May): 5.1% (prev: 6.6%)

- 5-year expected inflation (April): 4.1% (prev: 4.2%)

GDP (U.S. Bureau of Economic Analysis, BEA)

- -0.2%; (Q4 2024: 2.4%)

- Atlanta Fed GDPNow Indicator (Q2): 3.4% (vs. 3.8%) (The GDPNow forecasting model provides a "real-time" estimate of GDP growth prior to the official release, utilizing a methodology similar to that of the BEA.)

Business Activity Index (PMI):

(Above 50 indicates expansion; below 50 indicates contraction)

- Services sector (May): 53.7 (previous: 50.8)

- Manufacturing sector (May): 52.3 (previous: 50.7)

- S&P Global Composite (May): 53.0 (previous: 50.6)

LABOR MARKET:

- Unemployment rate (April): 4.2% (previous: 4.2%)

- Nonfarm payroll employment change (May): 139K (previous: 147K revised)

- Average hourly earnings (May, y/y): 3.9% (previous: 3.8%)

MONETARY POLICY

- Federal Funds Effective Rate (EFFR): 4.25% - 4.50% (unchanged)

- Federal Reserve balance sheet (blue) increased: $6.681 trillion (vs. previous week: $6.677 trillion)

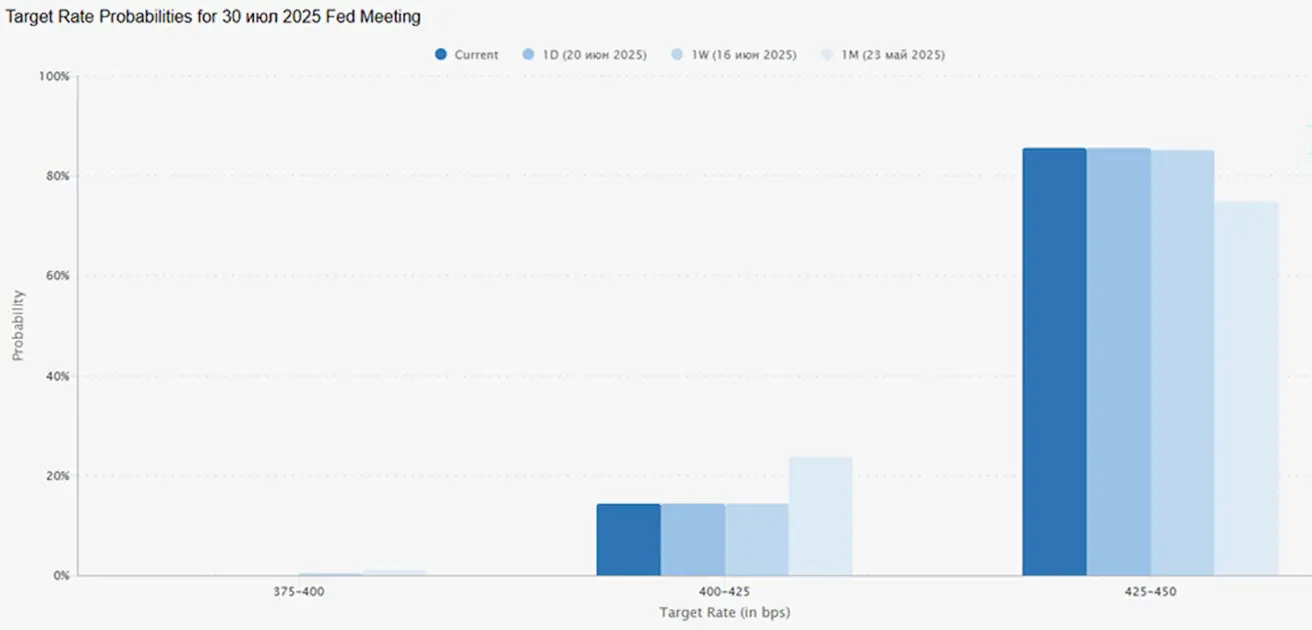

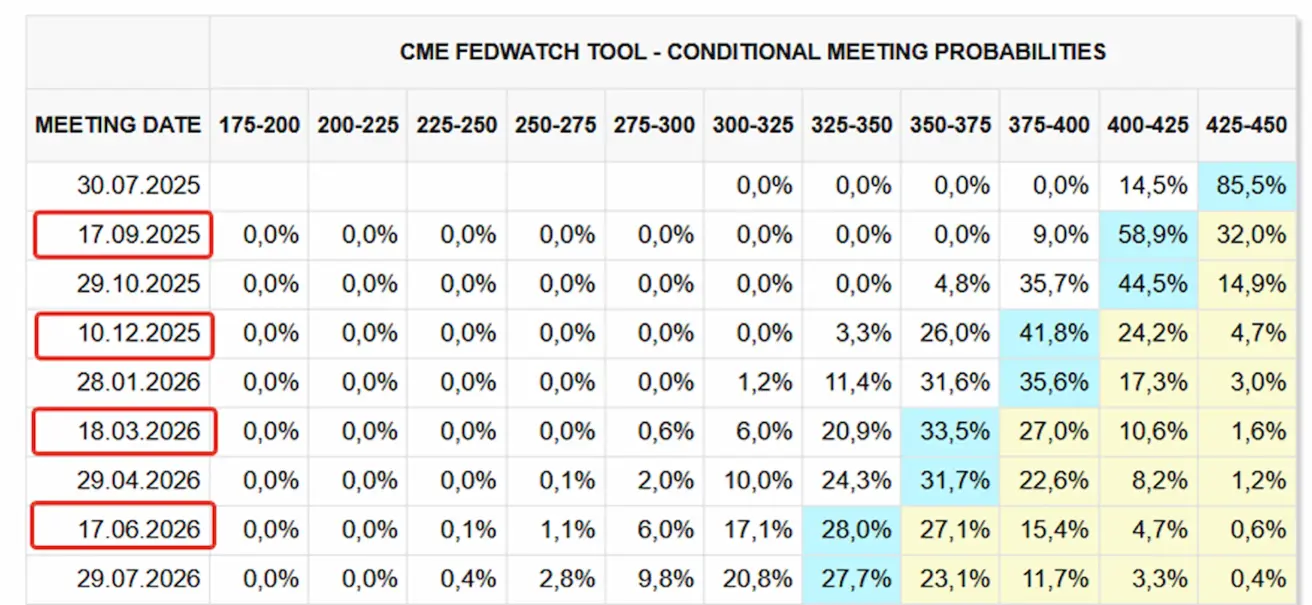

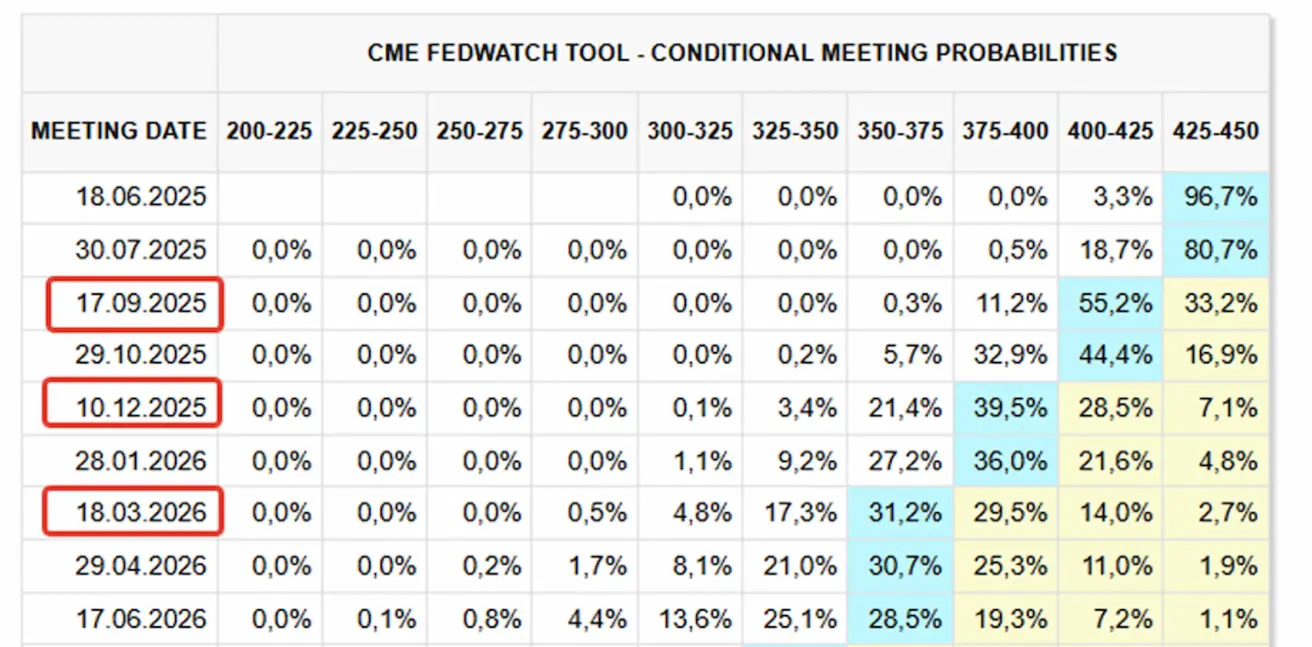

MARKET FORECAST FOR RATE

Today:

А week earlier:

Commentary

The Dominant Narrative Today: The U.S. Has Entered a Military Conflict with Iran

On Saturday, the United States launched a surprise military strike involving B-2 bombers, which deployed bunker-busting munitions against three key nuclear facilities in Iran: Fordow, Natanz, and Isfahan. This escalation came unexpectedly, as President Donald Trump had stated on Friday that a decision regarding potential military action would be made "within the next two weeks." In a nationally televised address from the White House—delivered in strikingly aggressive rhetoric—Trump declared: "Iranian sites have been destroyed. Iran must now make peace. Any future retaliation will be met with far greater force." As of Monday morning, reciprocal missile strikes between Iran and Israel are ongoing.

Last Week’s Key Macroeconomic Data Eurozone: Inflation continued to ease across the bloc:

- Core Consumer Price Index (YoY, May): 2.3% (vs 2.7%)

- Headline Consumer Price Index (YoY, May): 1.9% (vs 2.2%)

China:

- Industrial Production (YoY, May): 5.8% (vs 6.1%)

- Unemployment Rate (May): 5.0% (vs 5.1%)

United States:

- GDPNow Forecast (as of June 18, 2025, for Q3): 3.4% (vs 3.8%)

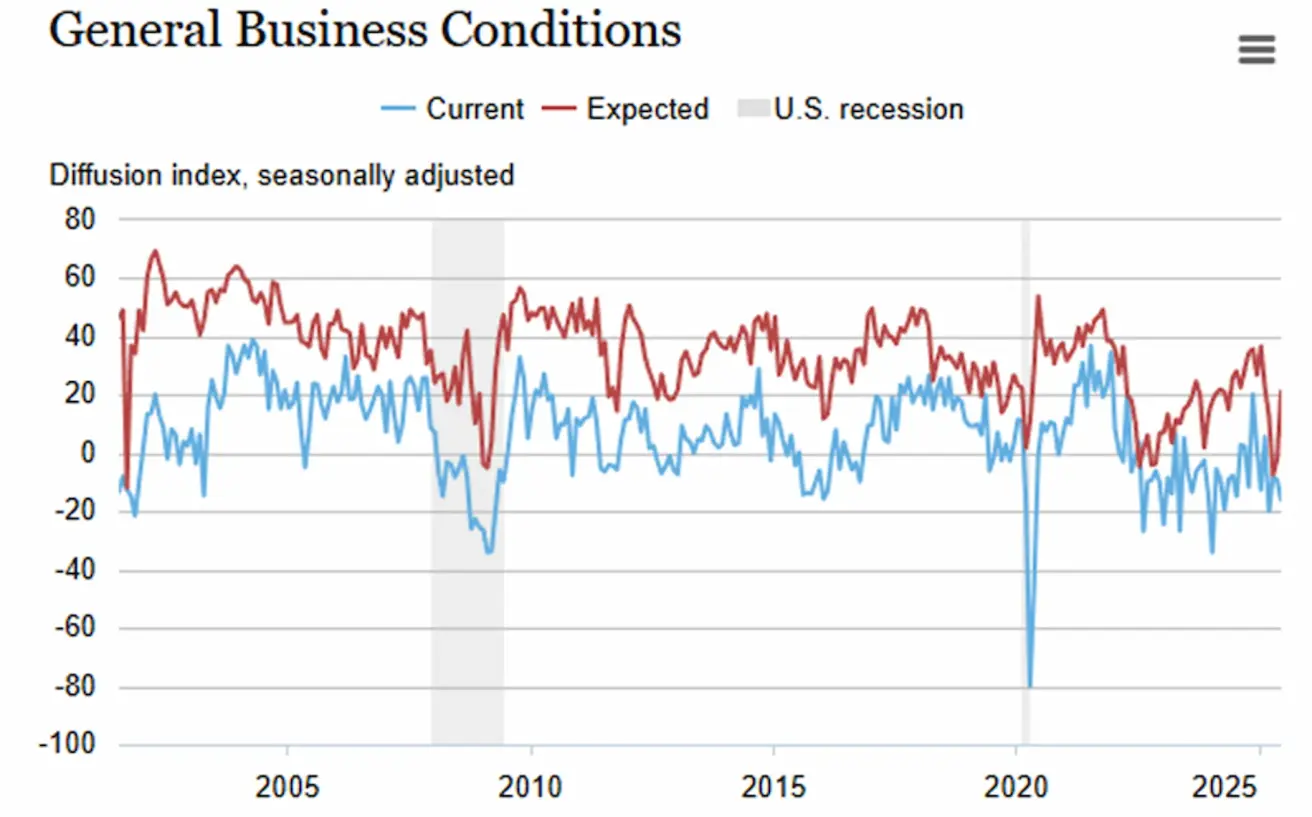

- NY Empire State Manufacturing Index: dropped seven points to -16.0, signaling a further slowdown in economic activity. New orders and shipments declined, delivery times remained unchanged, and supply availability deteriorated. Inventories were largely stable. However, forward-looking expectations remained in positive territory and are trending upward.

Federal Reserve Meeting Summary: The Fed held interest rates steady at 4.25%–4.50%. The central bank revised its forecasts downward for GDP growth, inflation, and unemployment. Chair Jerome Powell’s tone signaled a preference for prolonged rate stability rather than a near-term easing.

FedWatch Market Outlook (Post-FOMC):

- July 30 meeting: Markets assign an 80%+ probability of no rate cut.

- 12-month horizon: Markets are pricing in four 25-bps cuts, bringing the rate down to a range of 3.25%–3.50%. The first cut is anticipated as early as September 2025.

Trade Tensions Escalate The G7 Leaders’ Summit in Canada concluded with few tangible outcomes.

- The U.S. and the U.K. signed an agreement to implement the trade framework established last month.

- Canada and the U.S. agreed to pursue a bilateral trade agreement within the next 30 days.

- No formal trade deals were announced with other member nations.

Meanwhile, the European Union has suspended economic and trade dialogue with China, citing a lack of progress in resolving ongoing disputes. In a further move, the EU plans to restrict China’s access to medical equipment procurement markets, signaling a tougher stance on strategic sectors.

Equity Market

Sector performance in the U.S. was mixed last week, with a median return of -0.21%. The strongest gains were observed in Communication Services, Consumer Discretionary, and Technology, which outperformed the broader market and helped offset declines across more defensive and cyclical industries.

Year-to-date (YTD) performance stands at -4.45%. Despite the overall decline, positive momentum since the beginning of the year has been observed in Utilities, Basic Materials, Energy, and Financials, which have shown relative strength compared to the broader market.

MARKET

SP500

Weekly: -0.15% (weekly close: 5967.85), 2025 YTD: +1.09%

NASDAQ100

Weekly: -0.02% (weekly close: 21626.39), YTD: +2.40%

Euro Stoxx 50 (top 50 Eurozone companies):

Weekly: -0.59% (weekly close: 5238), YTD: +7.25%

Since May, the CSI Index has been trading within a narrow range, ending the week down 0.18% at 3,857. Year-to-date, the index has declined by 1.88%. The market remains in a holding pattern, awaiting further developments on trade tariff policies.

Hang Seng

Weekly: -1.52% (weekly close: 23530), YTD: +19.05%

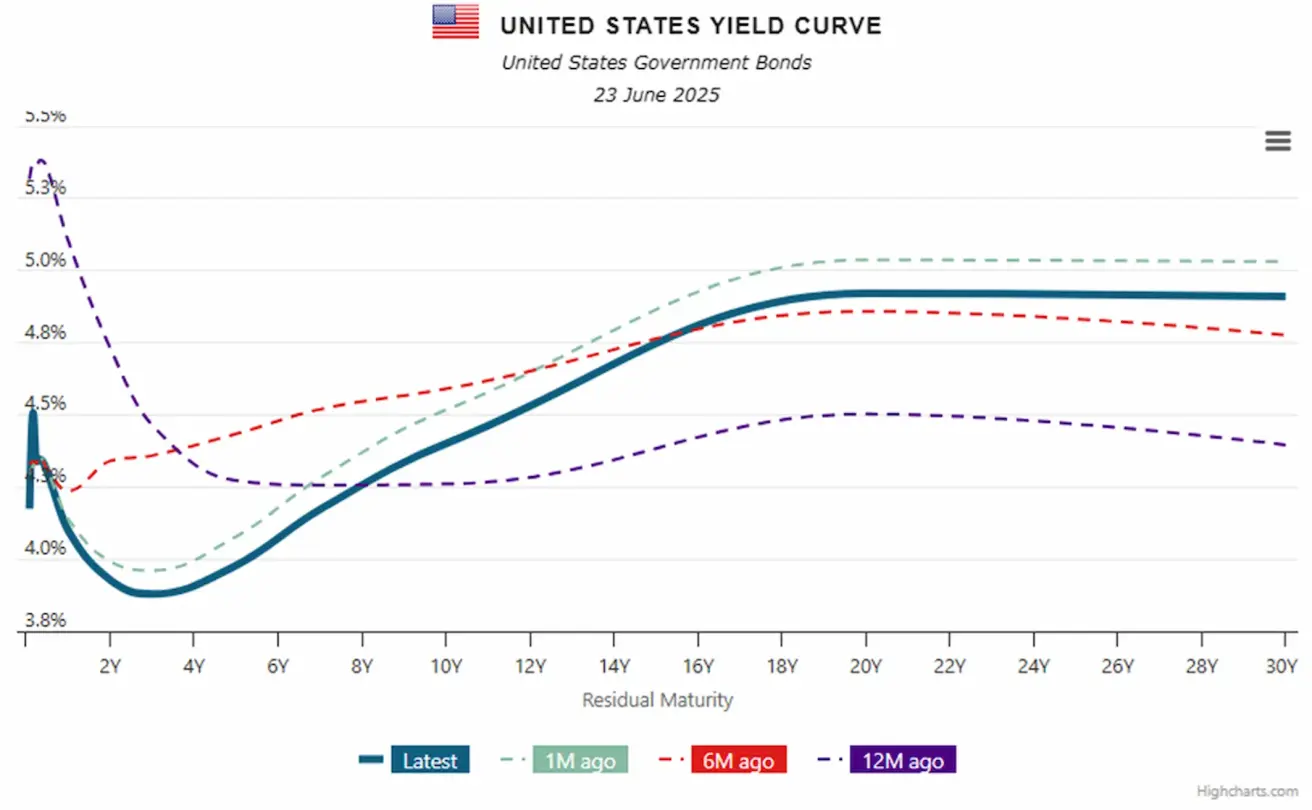

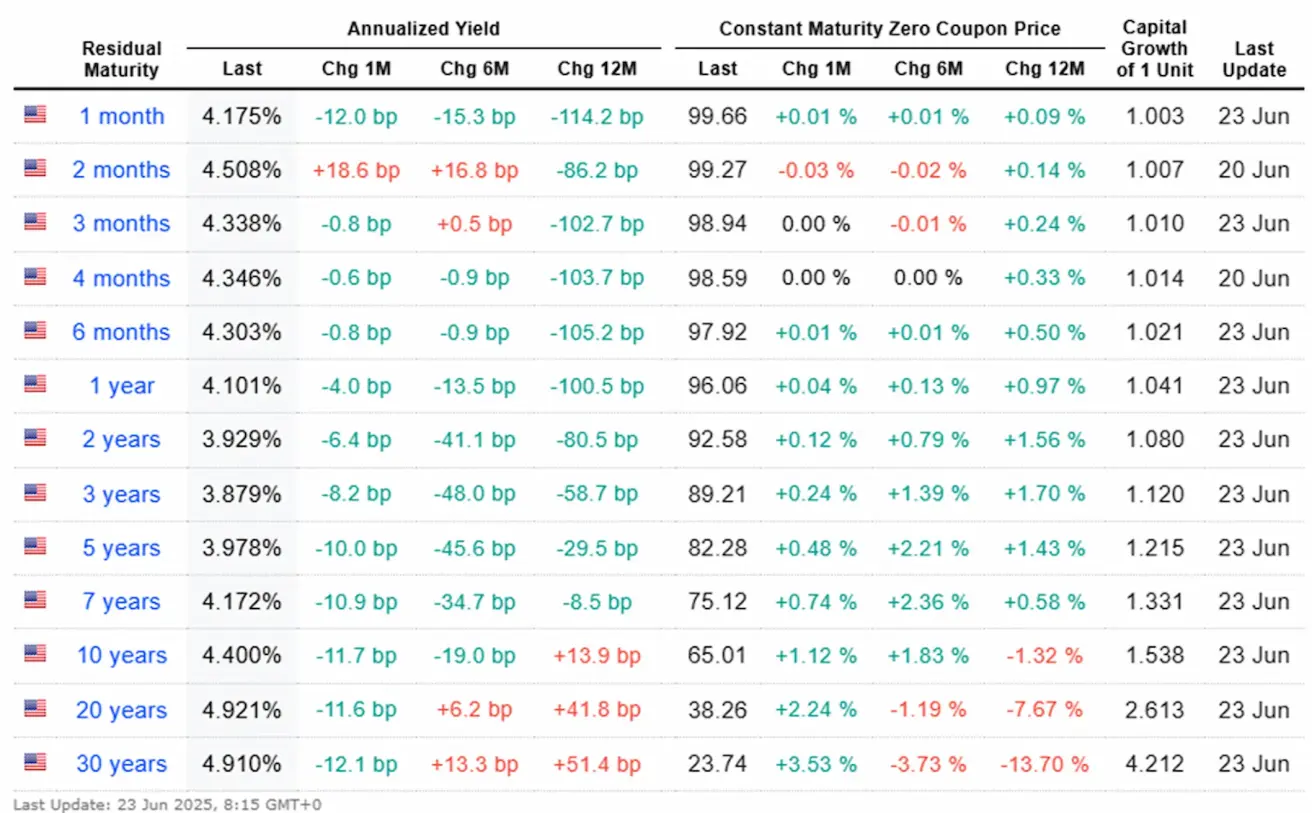

Bond Market 20+ Year U.S. Treasury Bonds (ETF TLT): +0.19% (weekly close: $86.49) YTD: -1.49%:

YIELDS AND SPREADS 2025/06/23 vs 2025/06/16

- Market Yield on 10-Year U.S. Treasuries: 4.40% (vs. 4.429%)

- ICE BofA BBB U.S. Corporate Index Effective Yield: 5.38% (vs. 5.36%)

- Yield Spread: 10-year vs. 2-year Treasuries: 47.1 vs. 45.6 bps

- Yield Spread: 10-year vs. 3-month Treasuries: 6.2 vs. 4.2 bps

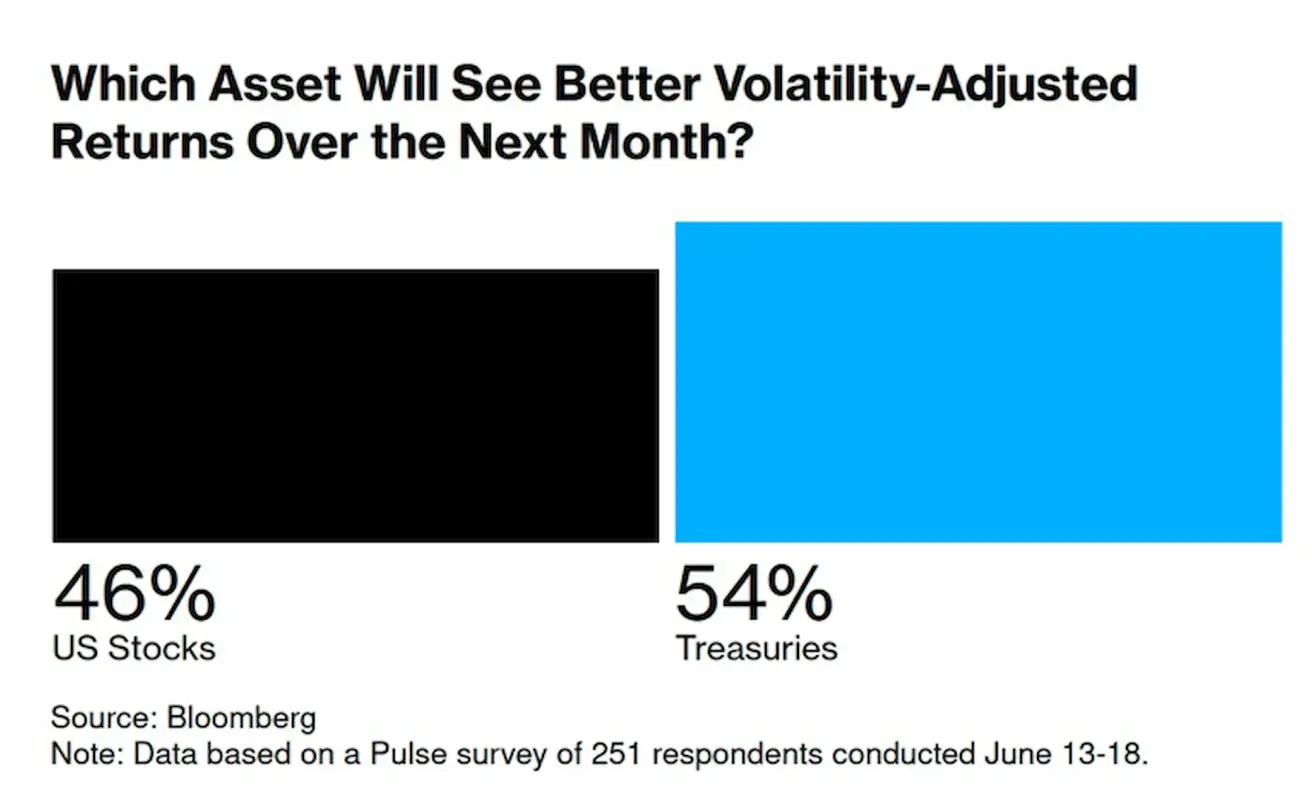

According to a Bloomberg survey, 251 respondents believe that Treasury bonds will outperform equities over the next month. This suggests that investors continue to anticipate a shift toward defensive assets.

GOLD FUTURES (GC)

Weekly: -1.98%, weekly close: $3,384.4/oz, YTD: +28.15%

DOLLAR INDEX FUTURES (DX)

Weekly: + 0.66%, weekly close: 98.34, YTD: -9.22%

The current movements in equity indices, gold, and the U.S. dollar show no clear signs of capital flight from risk assets. However, geopolitical tensions remain elevated, and should Iran choose to retaliate, markets may shift decisively into a risk-off mode.

OIL FUTURES

Weekly: + 1.18%, weekly close: 74.04, YTD: +3.05%

Oil Market in the Spotlight Today Oil futures have surged nearly 30% from their May lows, placing the energy market at the center of investor attention. According to Iranian state media, on Sunday the country’s parliament voted in favor of closing the Strait of Hormuz in response to U.S. strikes. However, the final decision lies with Iran’s Supreme National Security Council and the Supreme Leader. Foreign Minister Abbas Araghchi stated that Iran reserves all options for retaliation. As of now, however, there are no confirmed disruptions to physical oil flows. The Persian Gulf’s Strategic Importance:

- Holds 55% of global oil reserves and 39% of natural gas reserves.

- Accounts for 42% of global oil exports and 17% of gas production.

- Key exporters: Saudi Arabia, Iraq, Kuwait, UAE, Qatar, and Iran.

A Historic Shift in Oil Trade Patterns: Between 2001 and 2022, oil exports from the Persian Gulf to the U.S. declined by 72%, and to the EU by 37%. In contrast, exports to China soared by 800%, with China now consuming 55% of the region’s oil exports. Implications: The U.S. has become significantly more energy-independent, while China has grown heavily reliant on imports. As a result, Iranian pressure through the Strait of Hormuz has a reduced impact on Western economies but poses a major threat to China, giving Beijing a vested interest in regional stability.

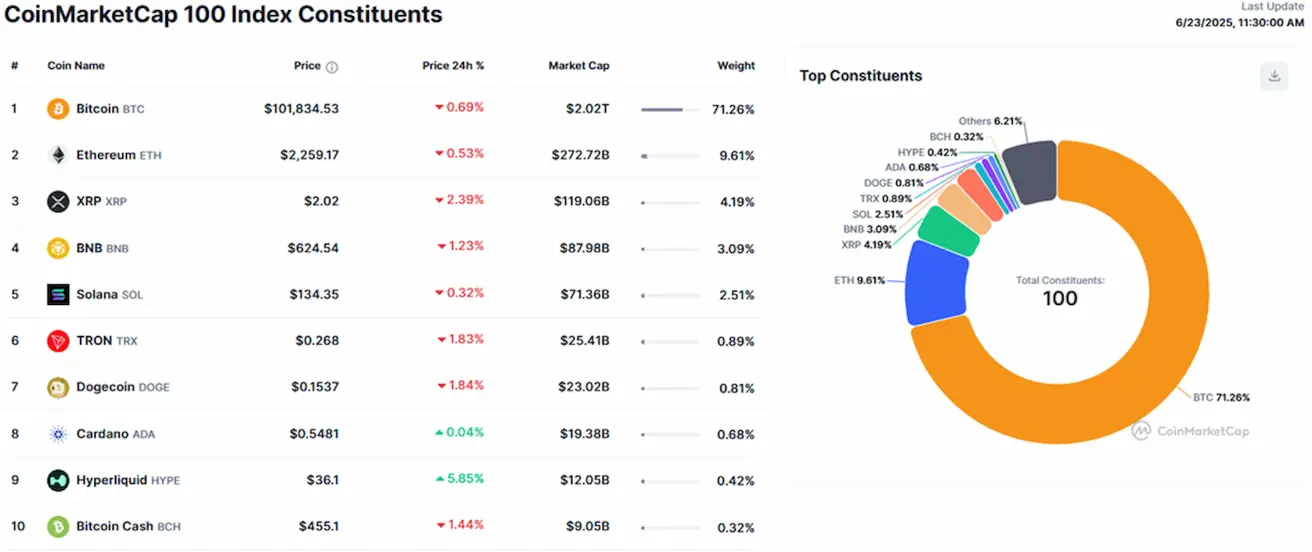

BTC FUTURES

Weekly: -1.88%, weekly close: $103,730, YTD: 8.88%

ETH FUTURES

Weekly: -4.94%, weekly close: $2,429.00, YTD: -28.22%

Cryptocurrency Market Capitalization:

- $3.12 trillion (vs. $3.34 trillion a week earlier) (coinmarketcap.com)

- Bitcoin dominance: 64.9% (63,7%)), Ethereum: 8.8% (up from 9.5%), others: 26.4% (down from 26.8%):

Crypto Market News:

The U.S. Senate has passed the GENIUS stablecoin bill with a 68–30 vote. The legislation will now move to the House of Representatives, where Republicans also hold a slim majority over Democrats. Key provisions include:

- 1:1 Reserve Requirement: Every issued stablecoin must be fully backed by liquid assets—specifically U.S. dollars or U.S. Treasuries—on a one-to-one basis.

- Transparency: Monthly reserve disclosures are mandatory, along with annual audits for issuers with a market capitalization exceeding $50 billion.

- Licensing Framework: Issuers may include federally or state-chartered entities, banks, or specially authorized non-governmental entities. Foreign issuers may also participate, provided they meet regulatory standards.

The bill marks a significant step toward a structured and regulated stablecoin framework in the United States, with implications for market infrastructure, institutional adoption, and global interoperability.

Қазақша

Қазақша