March 31 - April 04, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (February): 0.2% (prev: 0.4%);

- Consumer Price Index (CPI) (m/m) (February): 0.2% (prev: 0.5%);

- Core Consumer Price Index (CPI) (y/y) (February): 3.1% (prev: 3.3%);

- Consumer Price Index (CPI) (y/y) (February): 2.8% (prev: 3.0%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (March): 5.0%, prev: 4.3%;

- 5-year expected inflation (March): 4.1%, prev: 3.5%.

- GDP (BEA – U.S. Bureau of Economic Analysis) (4Q24 annualized): (third estimate): 2.4%; second estimate: 2.3%; (3rd quarter: 3.1%).

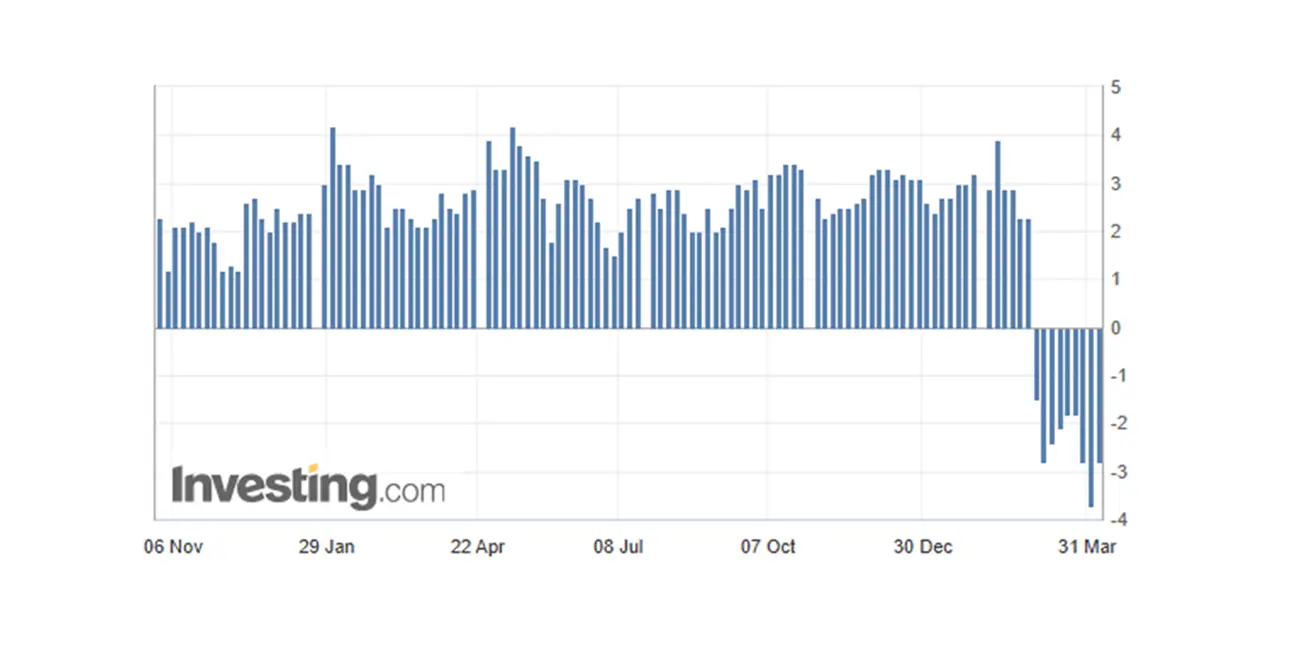

The GDPNow forecasting model provides the "current" version of the official estimate prior to its release, evaluating GDP growth using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.

The GDPNow forecasting model provides the "current" version of the official estimate prior to its release, evaluating GDP growth using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.

BUSINESS ACTIVITY INDEX (PMI):

- Services Sector (March): 54.4 (prev: 51.0);

- Manufacturing Sector (March): 49.8 (prev: 52.7);

- S&P Global Composite (March): 53.5 (prev: 51.5).

LABOR MARKET:

- Unemployment Rate (February): 4.2% (prev: 4.1%);

- The change in non-agricultural employment for February stands at 228K (prev 117K);

- Average Hourly Earnings (March, y/y): 3.8% (prev: 4.0%).

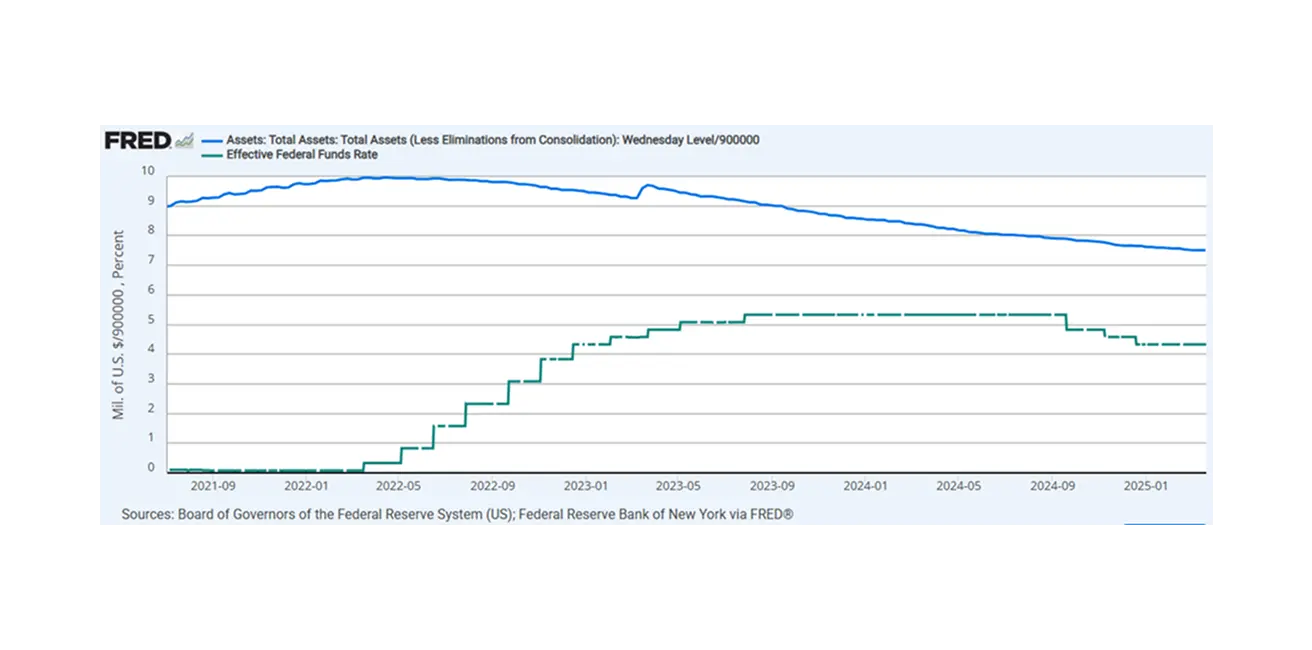

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- Fed Balance Sheet (blue): $6.723 trillion (vs previous week: $6.740 trillion)

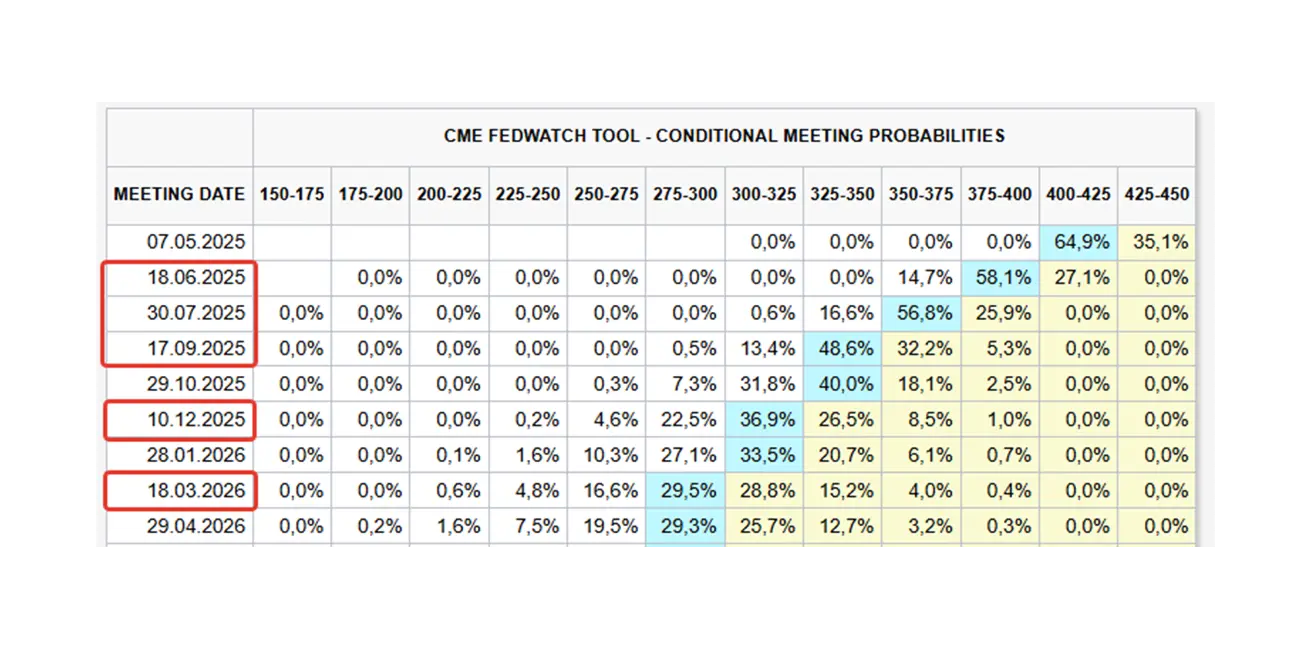

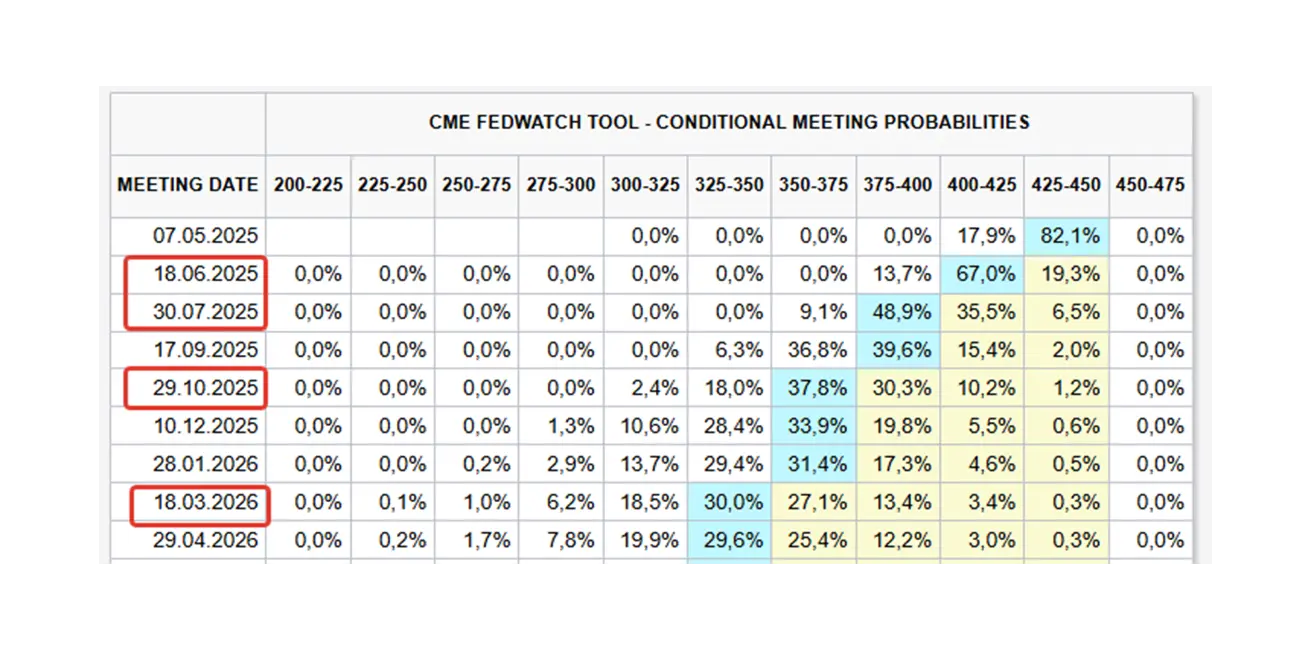

MARKET FORECAST FOR RATE

Today:

А week earlier:

А week earlier:

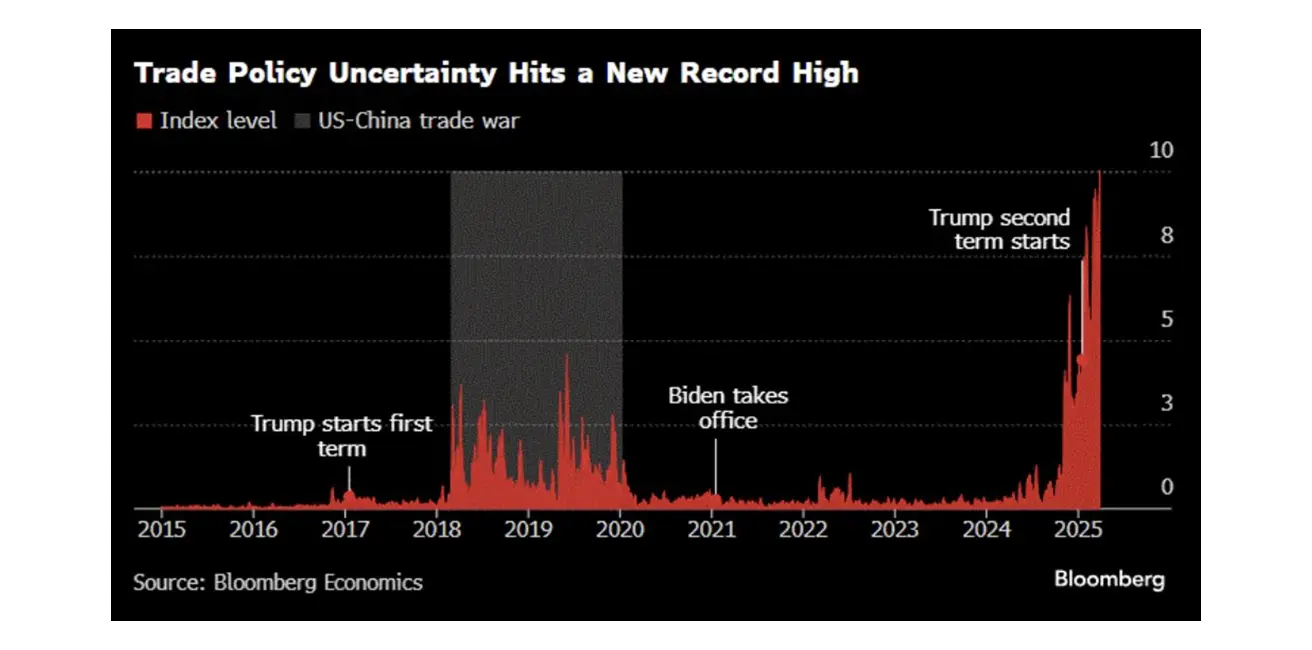

Commentary: The Atlanta Bank model continues to show negative values for the current GDP at -2.8%. Business activity in the U.S. service sector remains in an expansion phase, while the manufacturing sector is experiencing a slowdown. In the labor market, there is a slight increase in unemployment by 0.1%, with the current rate standing at 4.2%, which is not critical. Trade Policy: On April 2nd, the U.S. imposed trade tariffs on nearly all countries with which it conducts trade, including strategic partners. The base tariff is set at 10% for all goods. Key countries affected include: China +34% (on top of existing tariffs, with the average load reaching 67%); the EU +20%; Japan +24%; India +26%; South Korea +25%.

Uncertainty in trade policy: new record levels.

Rhetoric on tariffs:

U.S. Treasury Secretary Scott Bessent urges against retaliatory measures: "As long as you do not take retaliatory actions, this is the upper limit of tariffs."

Trump: "I am open to negotiations."

Retaliatory measures:

China is imposing a reciprocal 34% tariff on all imports from the U.S. starting April 10. Initial estimates suggest that these tariffs could reduce Chinese exports to the U.S. by 80% and lower economic growth by 1-2%. Beijing plans to strengthen economic stimulus measures to offset this impact.

The EU is preparing retaliatory measures and plans to introduce tariffs ranging from 20% to 100%. EU trade ministers will meet today, April 7, to discuss the EU's response, and European Commission President Ursula von der Leyen has promised a firm and proportionate response to the tariffs.

Initial assessments indicate that the EU could lose up to 20% of jobs, leading to a significant economic slowdown.

Tariffs could reduce Japan's economic growth by 0.5% or more (for context, Japan's economy grew by only 0.1% in 2024). Japan has yet to comment on retaliatory measures but has promised internal economic support.

Several countries have refrained from retaliatory actions and are sending their trade ministers to discuss the tariffs.

In conclusion, it can be said that tariff negotiations lie ahead: specifically, U.S. officials have already informed the UK that they are willing to discuss a proposal to reduce tariffs below 10%.

The potential consequences of trade wars:

In its current form, a trade war destabilizes economies and could trigger a global recession, which is causing significant concern among investors.

The impact of tariffs on inflation remains uncertain due to their scale and complexity. Some investment firms are warning of the risk of sustained inflation.

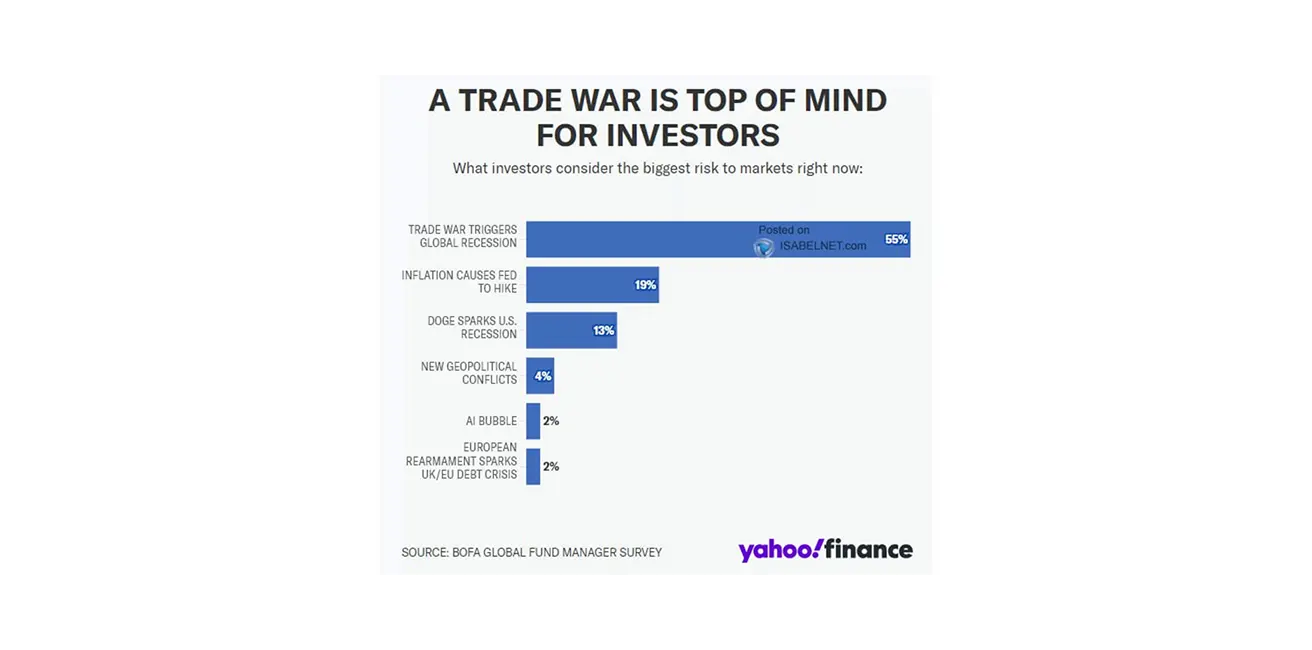

According to the analysis by Isabelnet, investors perceive the primary risks of a trade war as a global recession (55%) and inflation (19%).

Rhetoric on tariffs:

U.S. Treasury Secretary Scott Bessent urges against retaliatory measures: "As long as you do not take retaliatory actions, this is the upper limit of tariffs."

Trump: "I am open to negotiations."

Retaliatory measures:

China is imposing a reciprocal 34% tariff on all imports from the U.S. starting April 10. Initial estimates suggest that these tariffs could reduce Chinese exports to the U.S. by 80% and lower economic growth by 1-2%. Beijing plans to strengthen economic stimulus measures to offset this impact.

The EU is preparing retaliatory measures and plans to introduce tariffs ranging from 20% to 100%. EU trade ministers will meet today, April 7, to discuss the EU's response, and European Commission President Ursula von der Leyen has promised a firm and proportionate response to the tariffs.

Initial assessments indicate that the EU could lose up to 20% of jobs, leading to a significant economic slowdown.

Tariffs could reduce Japan's economic growth by 0.5% or more (for context, Japan's economy grew by only 0.1% in 2024). Japan has yet to comment on retaliatory measures but has promised internal economic support.

Several countries have refrained from retaliatory actions and are sending their trade ministers to discuss the tariffs.

In conclusion, it can be said that tariff negotiations lie ahead: specifically, U.S. officials have already informed the UK that they are willing to discuss a proposal to reduce tariffs below 10%.

The potential consequences of trade wars:

In its current form, a trade war destabilizes economies and could trigger a global recession, which is causing significant concern among investors.

The impact of tariffs on inflation remains uncertain due to their scale and complexity. Some investment firms are warning of the risk of sustained inflation.

According to the analysis by Isabelnet, investors perceive the primary risks of a trade war as a global recession (55%) and inflation (19%).

Goldman Sachs has raised the probability of a recession in the U.S. to 35% and downgraded its GDP growth forecast for 2025 to 1.5%, which is below the Federal Reserve's projections. The bank anticipates three rate cuts by the Fed (in July, September, and November) and has lowered its target for the S&P 500 to 5700 points.

In Europe, Goldman Sachs sees the situation as worse: it forecasts a technical recession (when GDP contracts for two consecutive three-month periods) and predicts a 0.7% decline in Eurozone GDP by 2026 (for reference, Eurozone GDP growth in 2024 is expected to be 0.7%). In the worst-case scenario, the decline could be as much as 1.2%.

Federal Reserve Chairman Powell: It is too early to determine the appropriate policy course;

The Fed can "wait for greater clarity."

Tariffs may have a lasting impact on inflation.

It is necessary to ensure that price growth does not lead to further inflation.

The economic consequences of the tariff imposition have been greater than expected.

Market expectations according to the Fedwatch tool: 5 rate cuts of 0.25% each over the next 12 months, bringing the range to 2.75-3.00%.

President Donald's approval rating has fallen to 43%, the lowest since his return to office.

Goldman Sachs has raised the probability of a recession in the U.S. to 35% and downgraded its GDP growth forecast for 2025 to 1.5%, which is below the Federal Reserve's projections. The bank anticipates three rate cuts by the Fed (in July, September, and November) and has lowered its target for the S&P 500 to 5700 points.

In Europe, Goldman Sachs sees the situation as worse: it forecasts a technical recession (when GDP contracts for two consecutive three-month periods) and predicts a 0.7% decline in Eurozone GDP by 2026 (for reference, Eurozone GDP growth in 2024 is expected to be 0.7%). In the worst-case scenario, the decline could be as much as 1.2%.

Federal Reserve Chairman Powell: It is too early to determine the appropriate policy course;

The Fed can "wait for greater clarity."

Tariffs may have a lasting impact on inflation.

It is necessary to ensure that price growth does not lead to further inflation.

The economic consequences of the tariff imposition have been greater than expected.

Market expectations according to the Fedwatch tool: 5 rate cuts of 0.25% each over the next 12 months, bringing the range to 2.75-3.00%.

President Donald's approval rating has fallen to 43%, the lowest since his return to office.

MARKET

MARKET CAP PERFORMANCE

YTD (Year-to-Date: the period from the beginning of the year to the present date).

SP500

Weekly performance: -9,08% (week's closing at -5074,09). Year-to-date fall in 2025: -14,05%.

NASDAQ100

Nasdaq 100: Weekly performance: -9,77% (week’s closing at 17 397,77). Year-to-date decline in 2025: -17,62%.

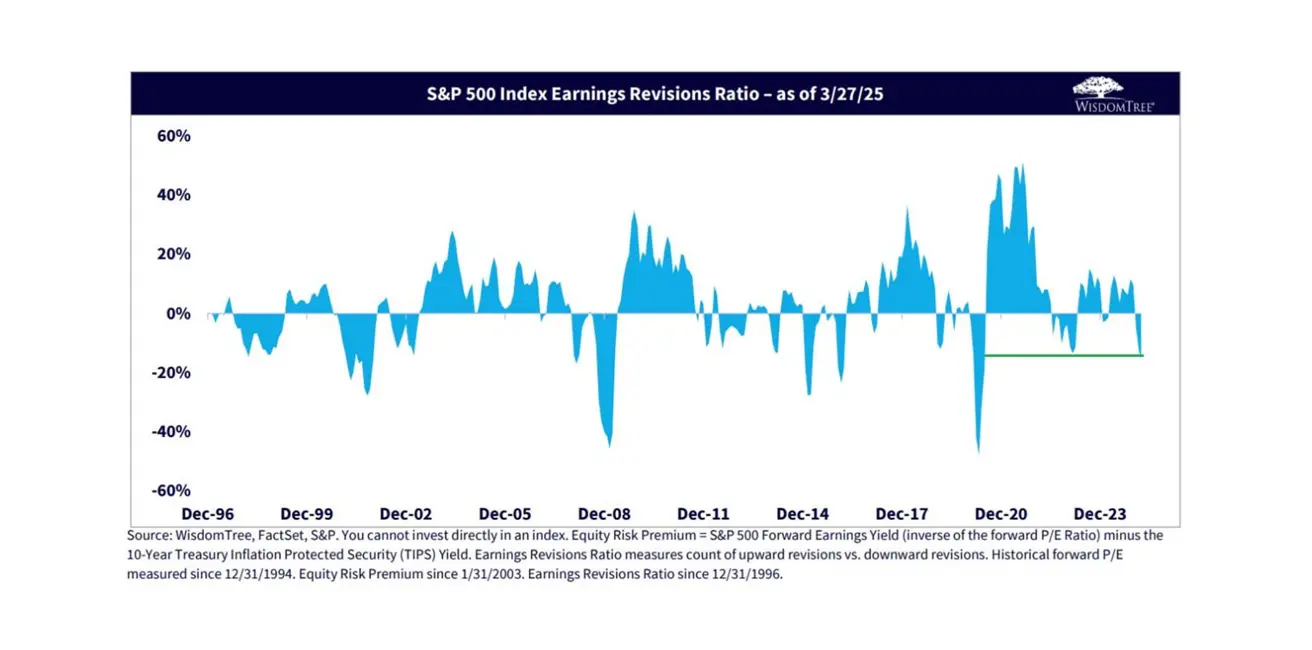

S&P 500 earnings revisions: the worst since 2020 – it can be expected that executives' comments regarding future forecasts will also worsen due to the new tariffs.

BOND MARKET

Treasury Bonds 20+ (ETF TLT): +3,01% (week’s closing at $92,85). Year-to-date performance in 2025: +5,75% .

YIELDS AND SPREADS 2025/03/31 vs 2024/03/24

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 3.939% (vs 4.207%)

- ICE BofA BBB U.S. Corporate Index Effective Yield: 5.32% (vs 5.43%)

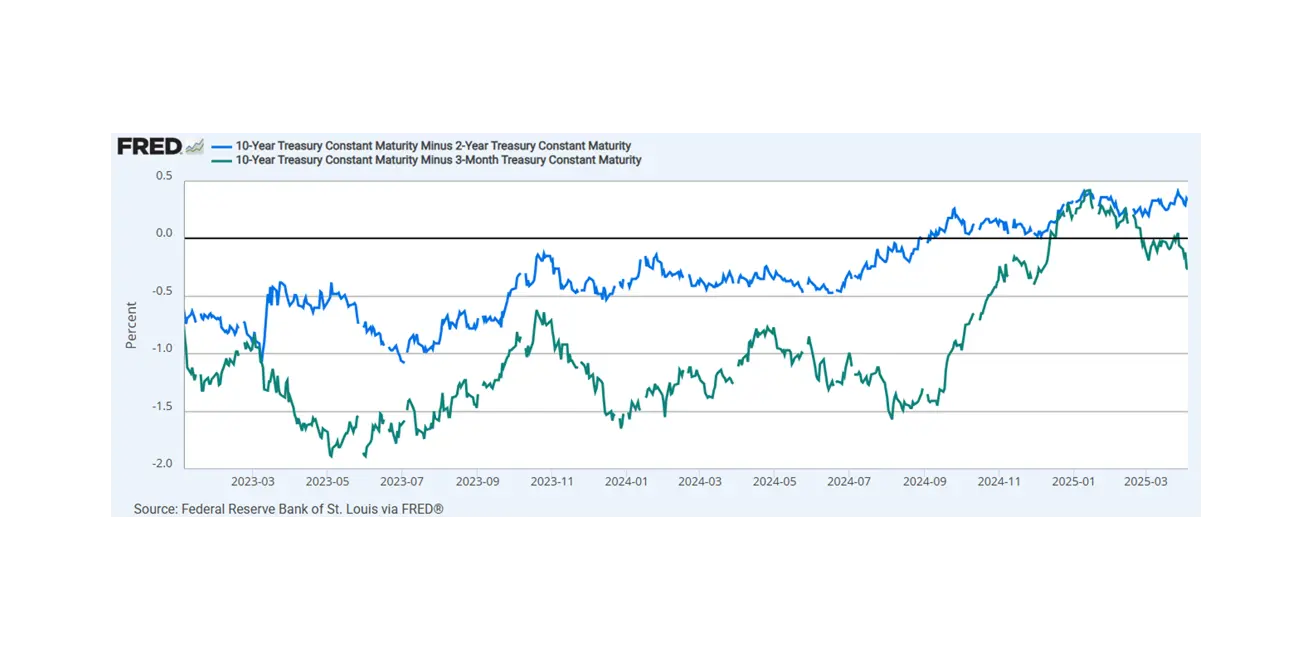

The yield spread between 10-year and 2-year U.S. government bonds stands at 41.3 vs 35.3 basis points (the difference in yield between long-term and short-term debt).

The yield spread between 10-year and 3-month U.S. government bonds is -31.3 basis points – the yield curve has inverted.

The yield spread between 10-year and 2-year U.S. government bonds stands at 41.3 vs 35.3 basis points (the difference in yield between long-term and short-term debt).

The yield spread between 10-year and 3-month U.S. government bonds is -31.3 basis points – the yield curve has inverted.

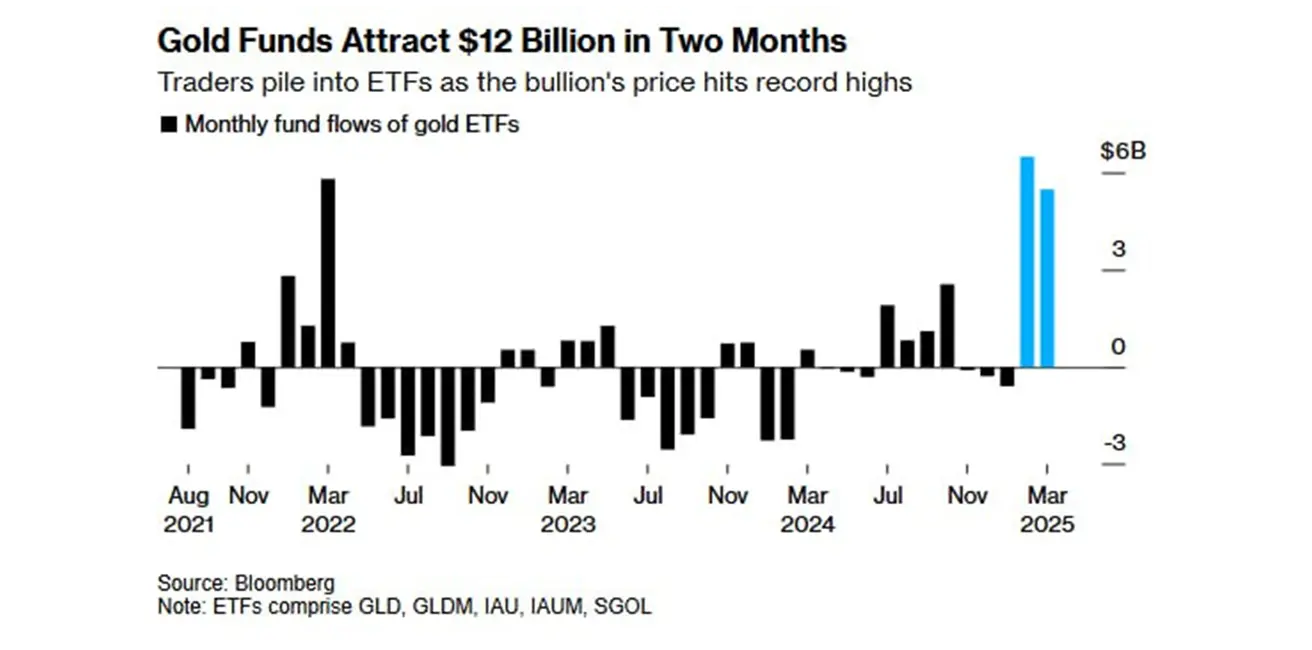

GOLD FUTURES (GC)

- Gold futures: -3,65%, weekly close at $3039,7 per troy ounce.

- Year-to-date 2025: +15,08%.

The inflow of funds into gold ETFs over the past two months amounted to $12 billion, marking the largest figure since 2020.

DOLLAR INDEX FUTURES (DX)

- U.S. Dollar Index futures (DX): -0,93%, weekly close at 102,69.

- Year-to-date 2025: -5,21%.

OIL FUTURES

- Weekly performance: -13,59%, closing at $59,66 per barrel.

- Year-to-date performance: - 16,97%.

OPEC+ announced that it will increase oil production by 411,000 barrels per day in May, significantly higher than the planned 135,000 barrels per day. OPEC cited strong market fundamentals but stated that further production increases could be paused if necessary.

OPEC+ announced that it will increase oil production by 411,000 barrels per day in May, significantly higher than the planned 135,000 barrels per day. OPEC cited strong market fundamentals but stated that further production increases could be paused if necessary.

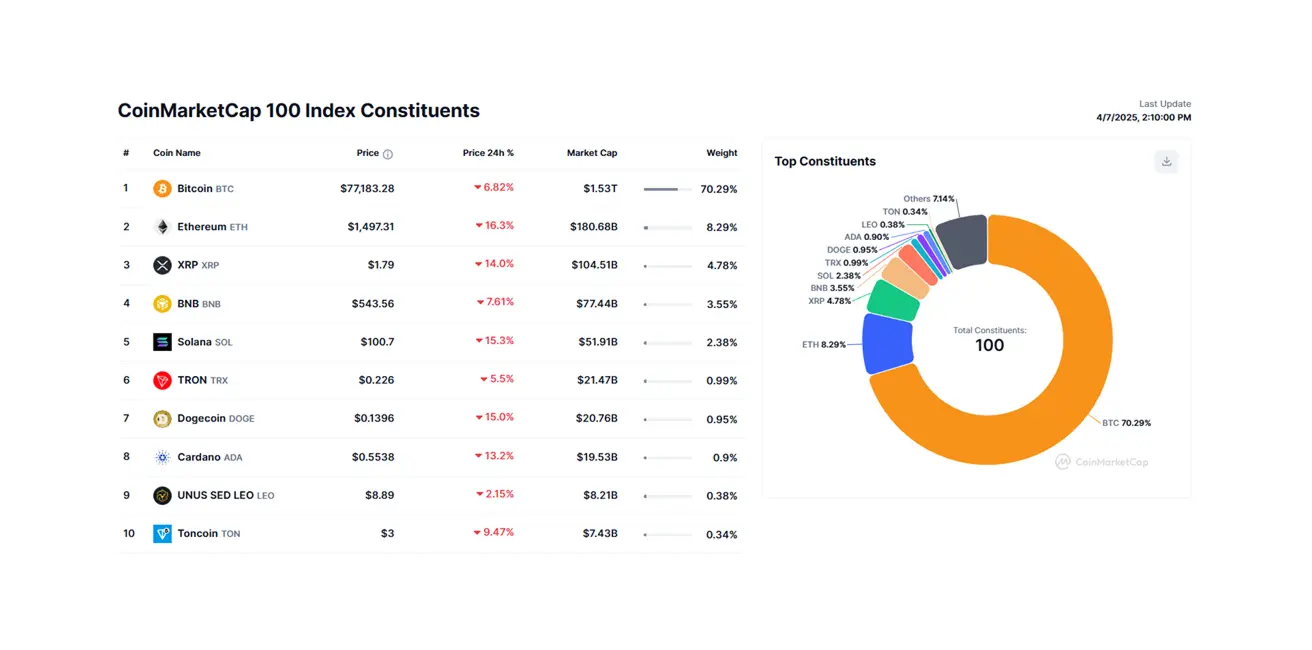

BTC FUTURES

- Weekly performance: -8,79% ($76595).

- Year-to-date performance in 2025: -19,65%.

ETH FUTURES

- Weekly performance: -20,79% ($1490,0).

- Year-to-date performance in 2025: -55,97%.

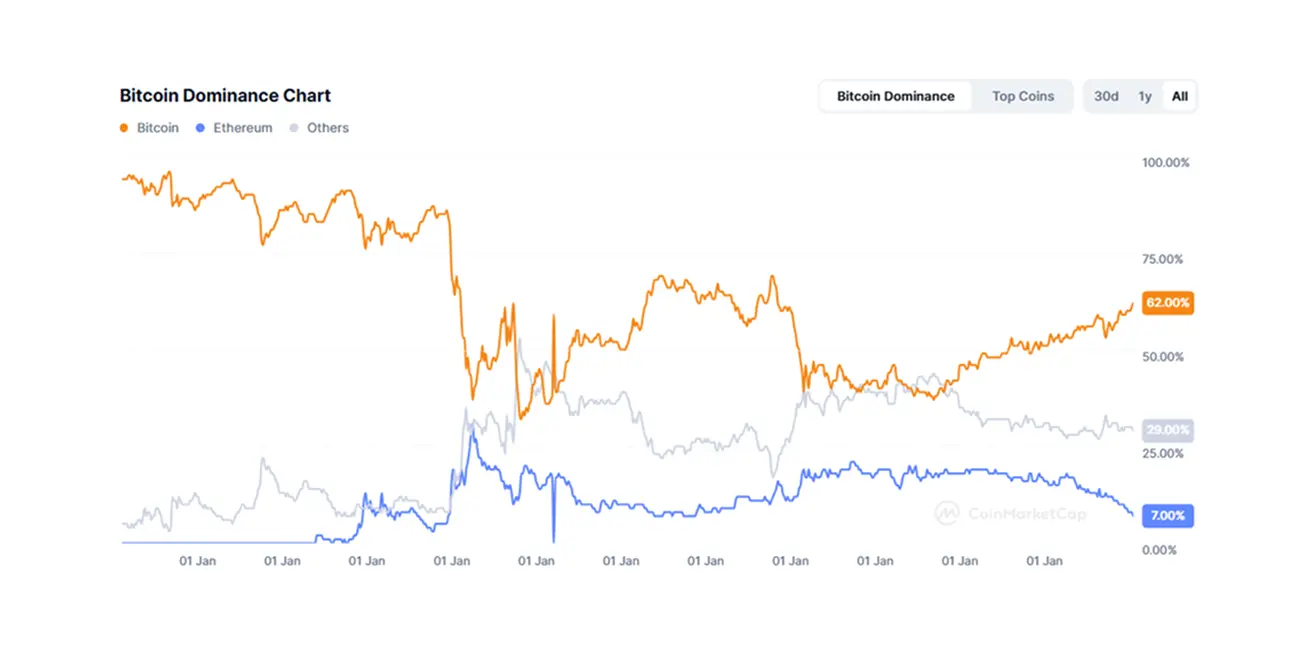

The market capitalization of the cryptocurrency market stands at $2.44 trillion, compared to $2.63 trillion the previous week (coinmarketcap.com).

Bitcoin dominance: 62.9% (previously 61.0%),

Ethereum dominance: 7.4% (previously 8.2%),

Others: 29.7% (previously 30.3%).

Қазақша

Қазақша