Navigating the AI ETF Landscape

A deep dive into the evolving AI ETF sector reveals a market dominated by tech giants and the dynamic performance

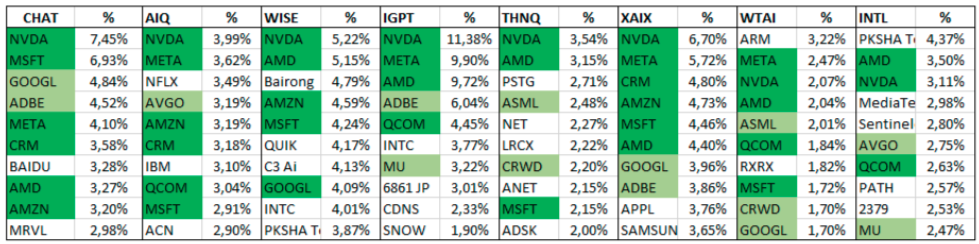

There are few ETFs on the market whose underlying assets are companies working in the artificial intelligence sector. Some of them have only recently been launched. For example, the CHAT fund started trading in May 2023, and the WISE fund entered the market only in December 2023. However, some funds have been trading for over three years, specifically AIQ, IGPT, and THNQ. Let's examine the dynamics of these funds' quotes, compare them with the main stock market index SP500, and understand which companies these funds are investing in. In the comparative table below, we have selected the main ETFs. The column under the ticker presents companies in the Top-10 of each fund in descending order of their portfolio shares. The column with percentages accordingly indicates their weight:

The first thing that immediately catches the eye (highlighted in green) is the repetitiveness of the top ten holdings. Almost all funds hold a similar set: NVDA, MSFT, META, AMD, AMZN, and QCOM. These companies are currently on everyone's lips, and they, to a greater extent, have been driving up the stock indices in 2023-24. NVDA occupies the first place and has the largest share.

Here, it is essential to note the intense concentration of weight in the top 10 companies:

The top ten leaders account for, on average, 30% to 50% of the entire portfolio. Such a significant overweight indicates low competition in the AI sector today from the perspective of distributing investment interest in the final product. Of course, this situation is temporary, and competition will quickly increase. But today, investing in AI ETFs effectively means investing in a narrow set of technology giants. Its presence in the top 10 companies, such as NVDA, AMD, and QCOM, is also worth noting. Indeed, their products are fundamental to the development of the AI sector. But with this, I want to highlight that there currently need to be ETFs on the market solely focused on AI model developers. Moreover, upon a more detailed examination of the ETFs above, we see that they primarily hold companies that use AI rather than develop it.

Let's examine the dynamics of these funds compared to the SP500 index. Three-year period (from March 2021):

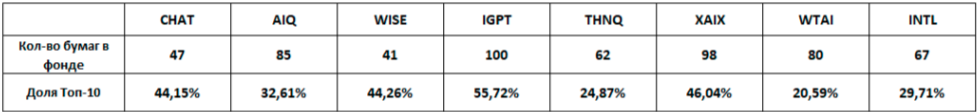

If one had invested precisely three years ago in the AIQ, IGPT, and THNQ funds, the return would have been lower than that of the SP500 index. This is explained by corrections in the stock market in 2022. Significant lagging of AIQ, IGPT, and THNQ during this period is observed. Technology companies typically have higher volatility (β) and decline more during correction periods, especially in a rising interest rate phase.

Dynamics for the year 2022:

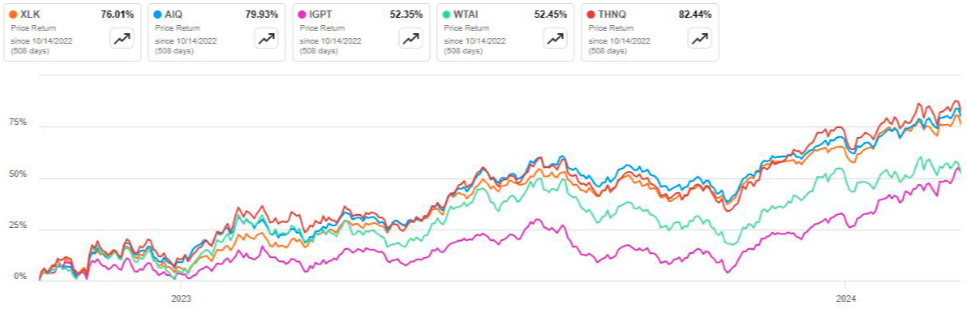

In October 2022, the stock market reversed and grew by 41.75% on the SP500 (as of March 5, 2024). During this period, all ETFs showed better performance. For instance, the AIQ fund would have yielded 79.93%, and the THNQ fund 82.44%.

Since their market debut, let's examine the performance of the two youngest AI ETFs, CHAT, and WISE. CHAT vs SP500. Since its debut (May 18, 2023), CHAT has outperformed the stock market benchmark by almost double: 37.64% versus 20.98%.

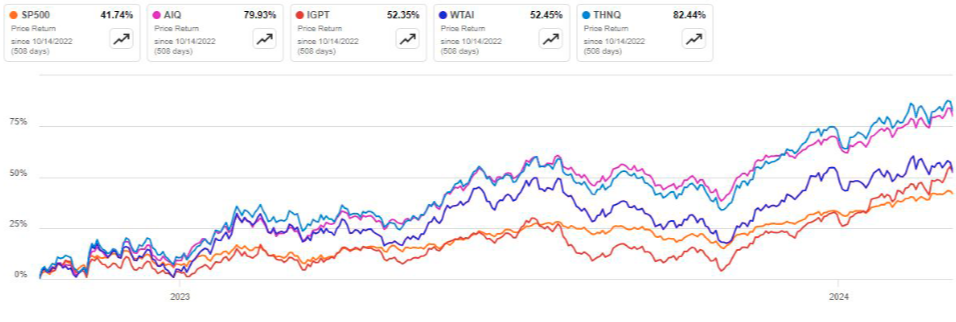

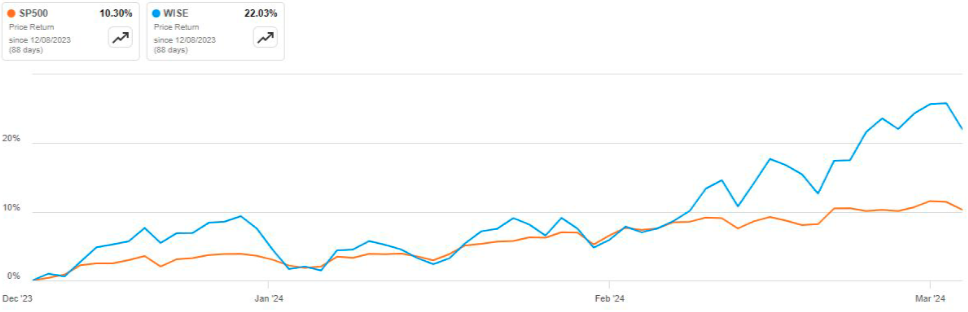

A similar trend is observed when comparing WISE (since December 8, 2023) and SP500: 22.03% vs. 10.30%.

Now, let's compare “our” ETFs with one of the most popular ETFs for the technology sector, XLK.

This fund's Top-10 includes the same companies: MSFT, NVDA, AVGO, AMD, CRM, ADBE, etc. It's worth noting that, as of today, the fund also has an extreme overweight in two companies, MSFT and AAPL, with a total share of (!) 40.61% (22.46% and 18.15%, respectively).

Let's consider the same three-year period. The XLK fund showed significantly better performance than AI ETFs. The main laggards were IGPT and WTAI, with a performance gap of 73.48% and 73.26% respectively:

Since October 2022 (the last period of stock market growth), the AIQ and THNQ funds have had dynamics almost similar to the XLK fund. The laggards continue to be the IGPT and WTAI funds, trailing by 24%:

As for the "young" ETFs, the CHAT fund (I remind you, the performance since its debut.

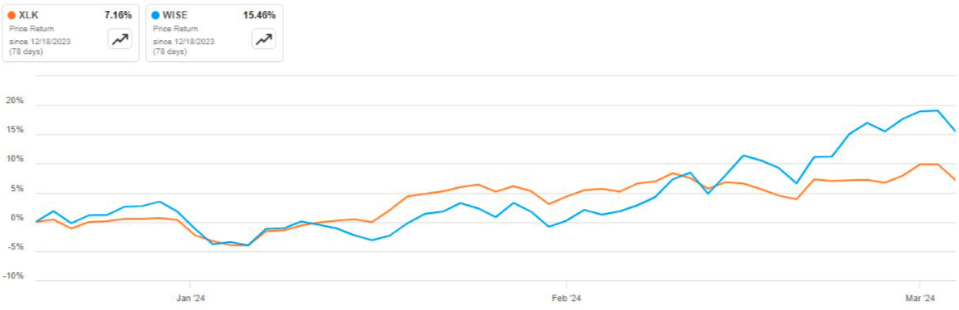

The WISE fund (since December 8, 2023) outperformed XLK by almost double, 15.46% vs. 7.16% (but this is still too short a period for assessment):

In summary, it can be said that ETFs “focused” on the AI sector, when compared to the SP500, show better dynamics during market growth periods and lag during corrections. Overall, AI ETFs reflect the dynamics of the technology sector due to the intense concentration in their portfolios of major technology players. As for the distribution of investment interest, specifically in the field of AI developers in the public market, it all boils down to just four companies: MSFT, GOOGL, META, and AMZN.

Қазақша

Қазақша