November 11 — November 15: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

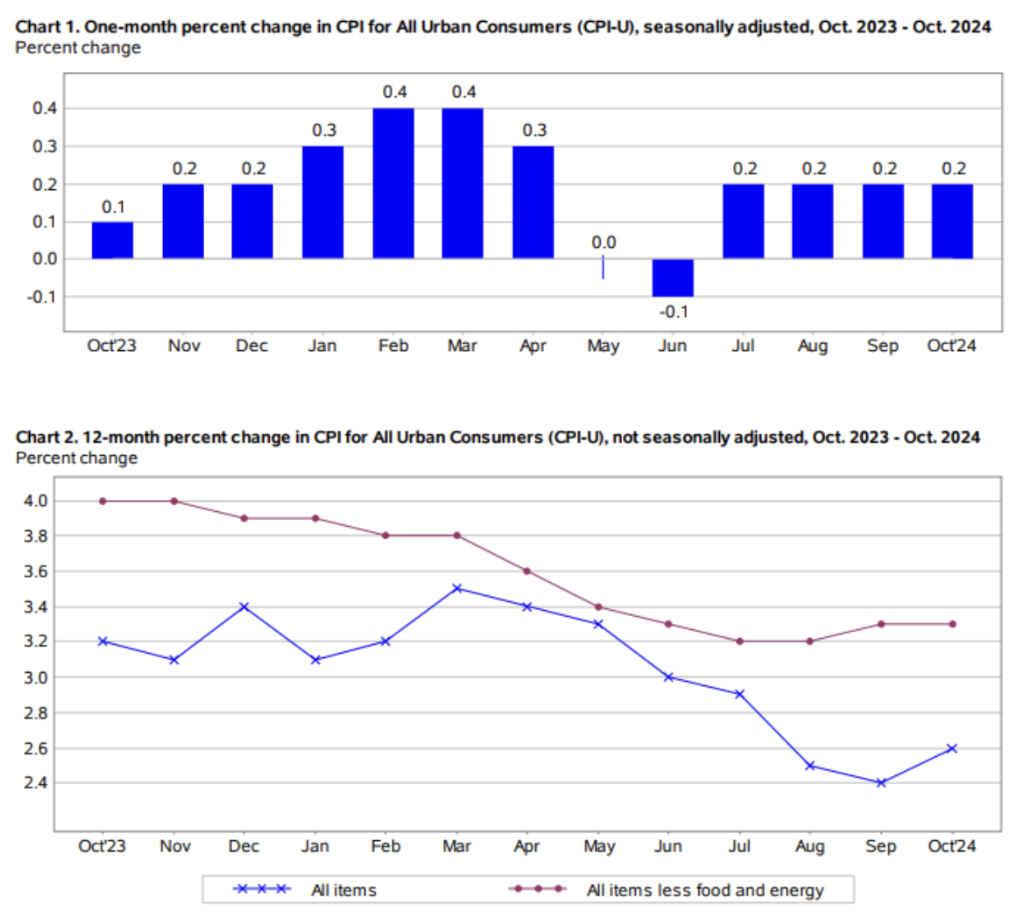

- Core Consumer Price Index (CPI) (YoY) (Sept): 3.3%, (pre: 3.3%),

- Consumer Price Index (CPI) (YoY) (Sept): 2.6%, (pre: 2.4%).

THE FED'S INFLATION TARGET

- Core Personal Consumption Expenditures (PCE) Index (YoY) (September): 2.7% (previous: 2.7%);

- Personal Consumption Expenditures Index (YoY) (September): 2.1%, (previous: 2.3%);

- Disposable Personal Income (DPI) (September 2024): +0.3%;

- Personal Consumption Expenditures (sum of personal consumer expenditures (PCE)) (September 2024): +0.5%;

- Personal Savings (as a percentage of disposable personal income): +4.6%.

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (Sept): 2.7%, pre: 2.7%;

- 5-year expected inflation (Sept): 3.1% pre: 3.0%.

Retail Sales:

-

US retail sales volume (MoM): 0.4% (pre: 0.8%);

-

Core US retail sales index (MoM): 0.1% (pre: 1.0%).

GDP (Bureau of Economic Analysis - BEA):

-

GDP (QoQ) (Q3 preliminary estimate): 2.8% (pre: 3.0%);

-

GDP deflator (QoQ) (Q3): 1.8% (pre: 2.5%).

Atlanta Fed GDPNow Short-Term Forecast: Up to 2.5%.

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (October): 55.0 (pre: 52.5).

- Manufacturing sector (October): 46.5 (pre: 47.2, revised).

- S&P Global Composite (September): (October): 54.1 (pre: 54.0, revised).

LABOR MARKET

- Unemployment rate (August): 4.1% (previous: 4.1%);

- Change in employment in the private non-farm sector (October): -28K, (previous 192K revised);

- Average hourly earnings (August, YoY): 4.0% (previous: 3.9%).

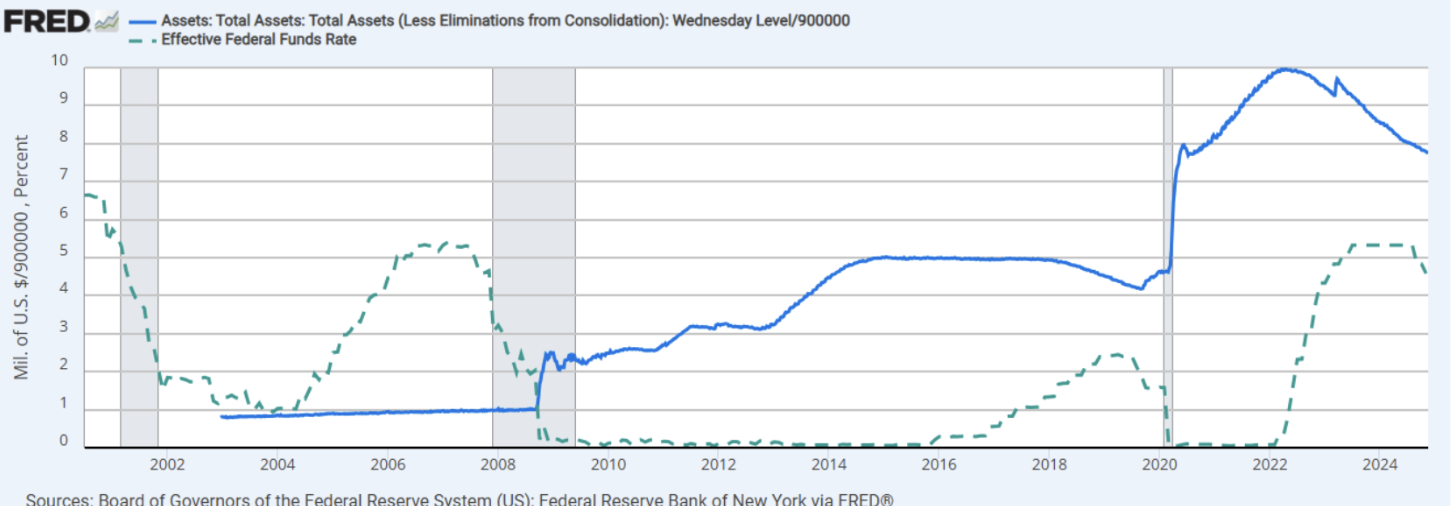

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.50% – 4.75% (in red);

- Fed Balance Sheet (in blue): $6,967 trillion (vs previous week: $6,994 trillion).

Federal Reserve Board Commentary:

Minneapolis Fed President Neel Kashkari: "Only inflation data can prevent a December rate cut. Core data from the latest CPI report confirms that inflation is moving toward the central bank's 2% target." Fed Chair Jerome Powell: "The economy shows no signs of a need to rush into rate cuts."

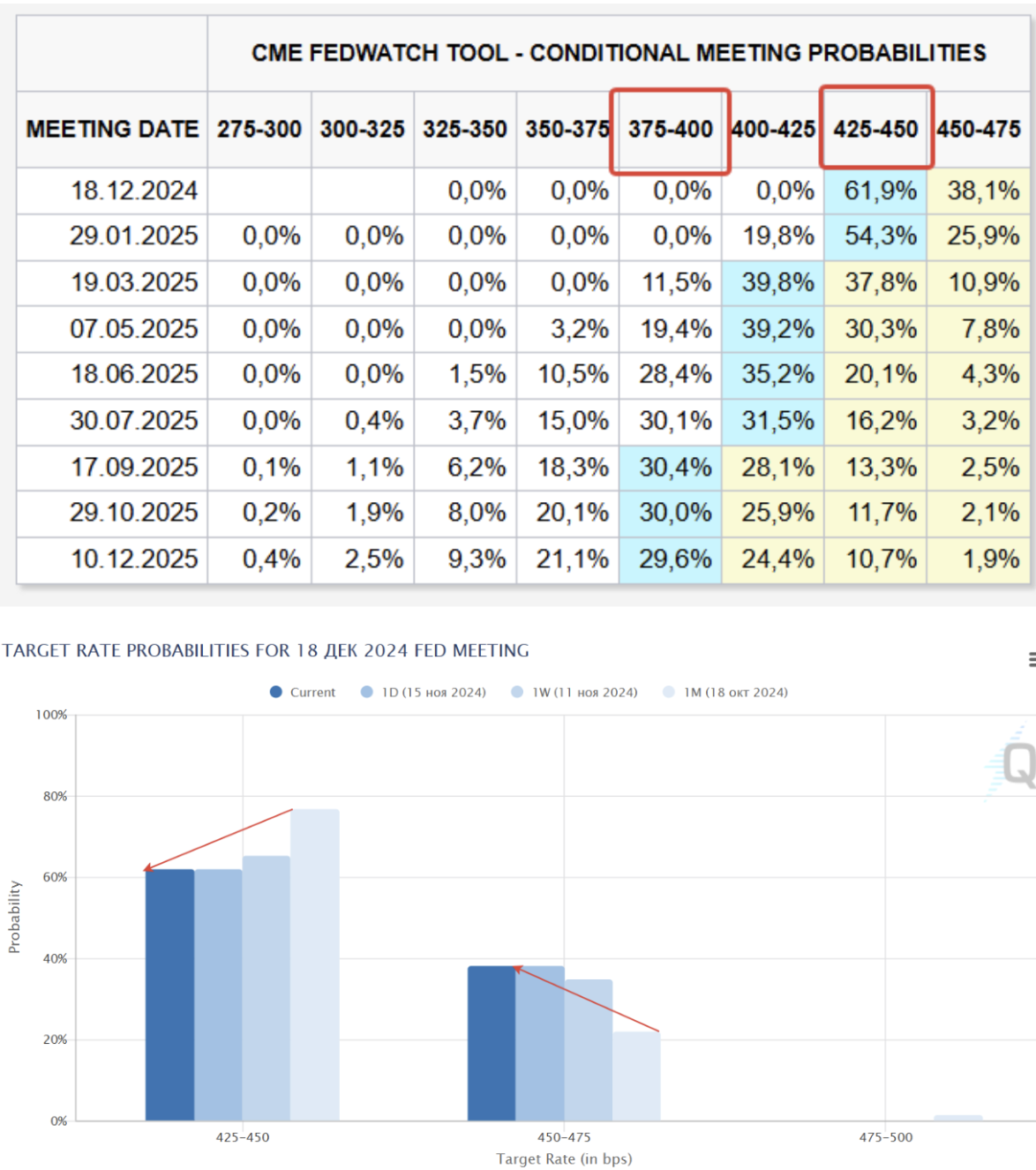

MARKET FORECAST FOR RATE

Commentary:

Consumer inflation data does not indicate further decline. Core CPI remains unchanged at 3.3%, while the volatile CPI rose to 2.6%.

- More than half of the monthly increase across all categories was driven by the housing price index (+0.4%).

- The food price index increased by 0.2% for the month.

- The energy index remained unchanged for the month after a 1.9% decrease in September.

According to Bank of America surveys, the biggest current market risk is rising inflation, followed by recession, and then geopolitical risks. Regarding the Fed's rhetoric, the market interpreted it as aggressive. As a result, market expectations for rate cuts have worsened.

FedWatch by the end of the year: another rate cut to the range of 4.25%-4.50%. Long-term expectations: two 0.25% cuts to the range of 3.75%-4.00%. The next FOMC meeting is scheduled for December 17-18. Over the past month, expectations for a rate cut at the next meeting have decreased from 82% to 62%.

MARKET

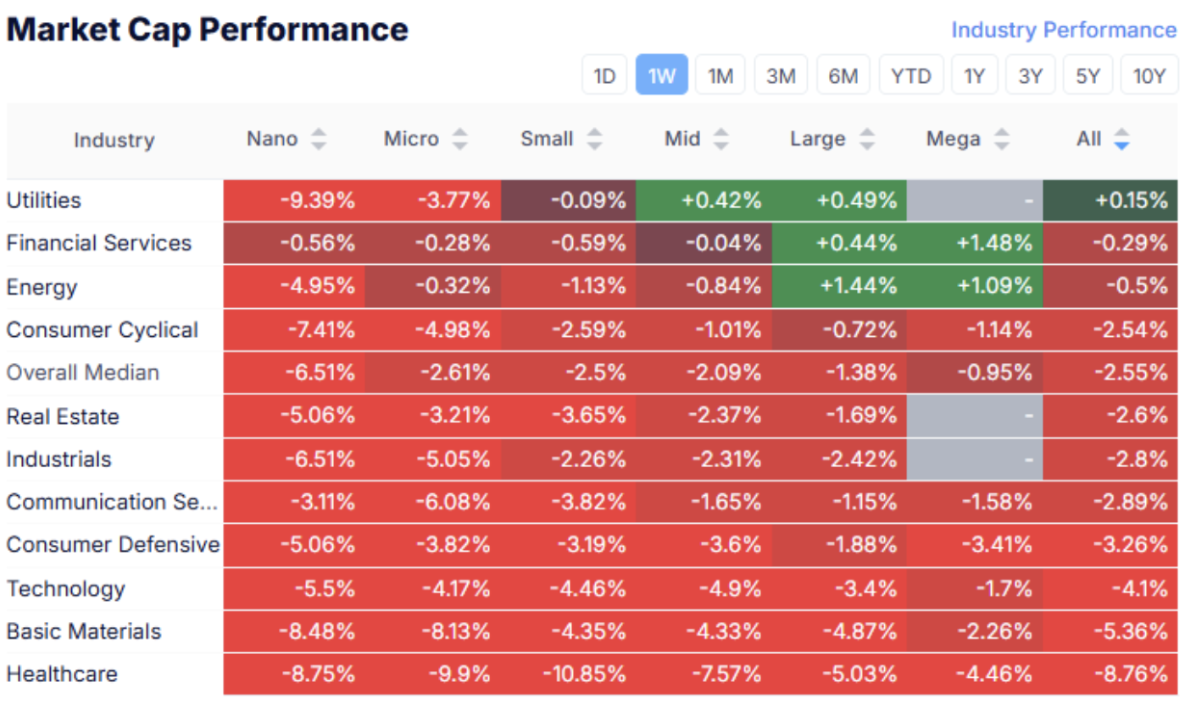

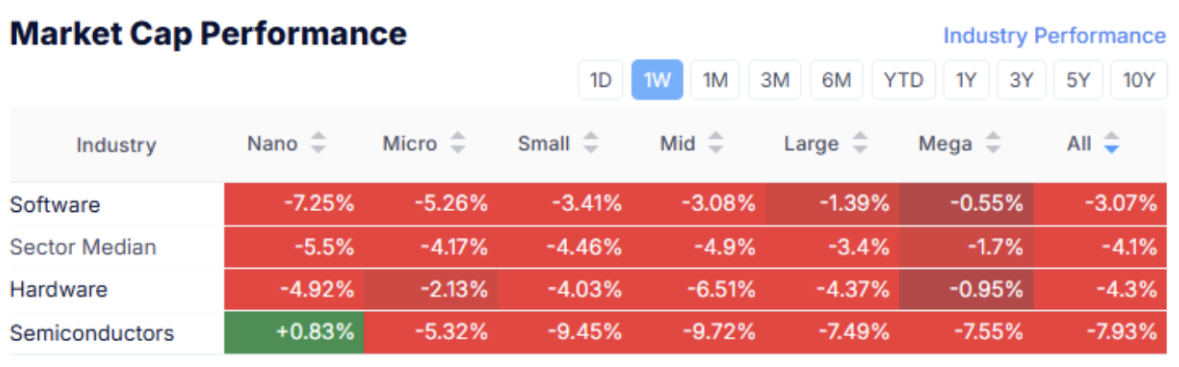

MARKET CAP PERFORMANCE

The stock market:

Technology market:

The median was -2.55%. The utilities sector showed a slight gain (+0.15%), while all other sectors exhibited negative dynamics. In the technology sector, semiconductor companies experienced the largest sell-off.

SP500

S&P 500 Index: -2.29%

NASDAQ100

Nasdaq100: -3,65%:

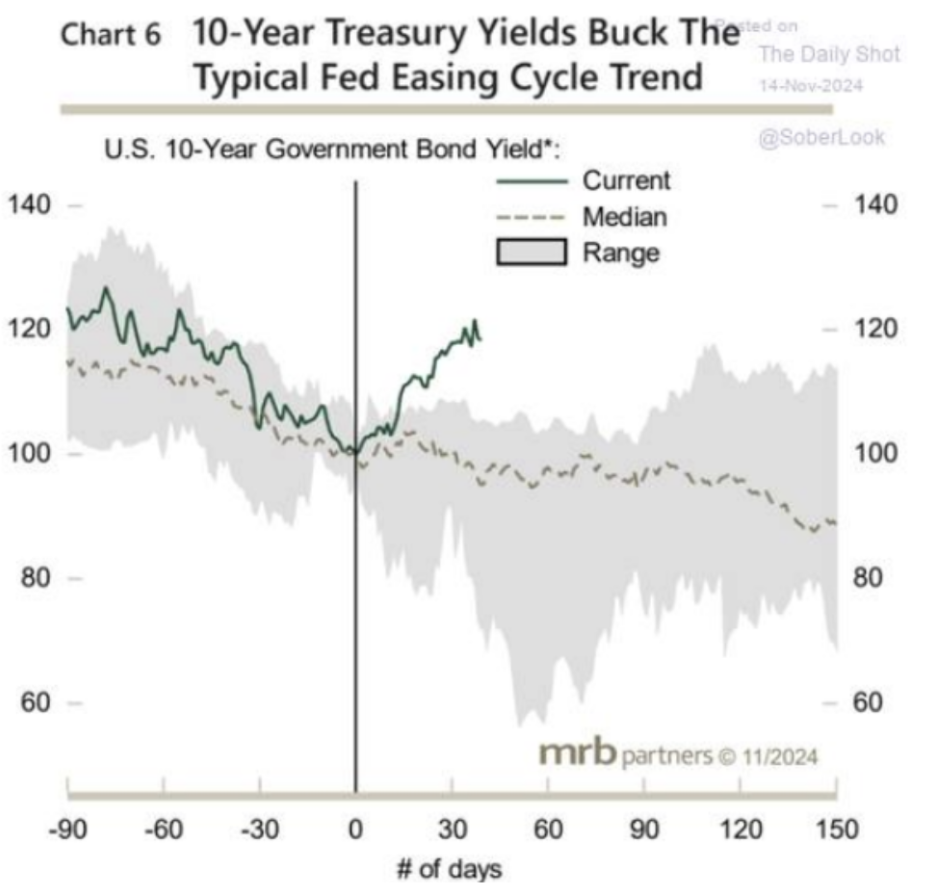

The market reaction was quite strong—on Friday, following Powell's speech, the stock market opened with a downward gap. Amid risks of a second wave of inflation and the Federal Reserve's rhetoric, Treasury bonds continued to decline accordingly.

TREASURY MARKET

Treasury Bonds UST10: -0,57%

Treasury Bonds UST2: -0,1%

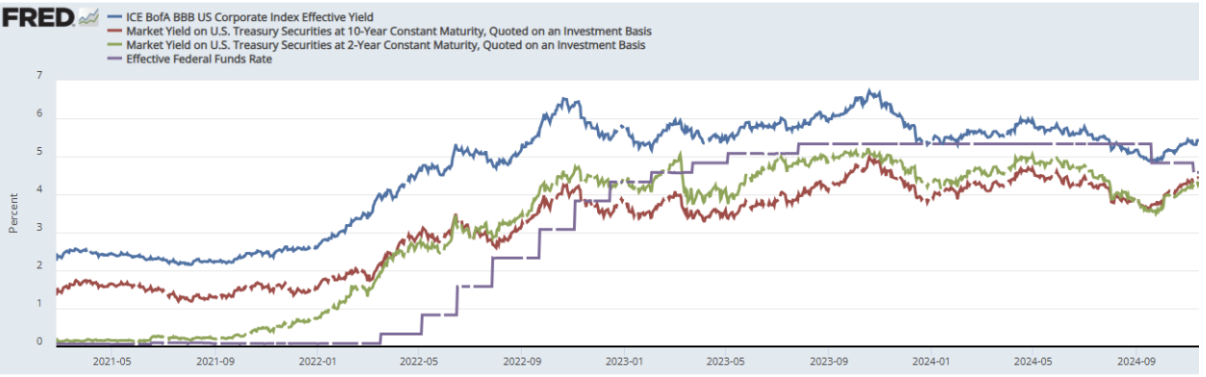

Yields and Spreads

- 10-Year Treasuries: 4.43% (prev week: 4.31%);

- 2-Year Treasuries: 4.34% (prev week: 4.21%);

- BBB-rated Corporate Index: 5.44% (prev week: 5.33%);

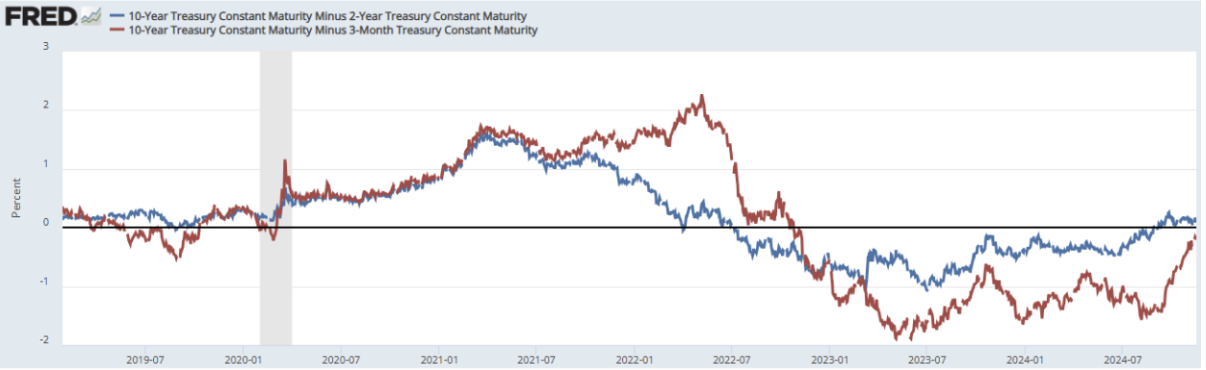

- 10-Year Treasury minus 2-Year Treasury: 0.12%;

- 10-Year Treasury Constant Maturity Minus 3-Month Treasury: -0.17%.

Historical Deviations:

The decline in earnings revisions relative to the index historically showed strong correlation. Since mid-2024, a divergence has been observed, driven by high risk appetite. Considering that the Federal Reserve may slow the pace of monetary policy easing, this divergence is more likely to signal a market correction scenario rather than the likelihood of rising corporate earnings.

}

}

Historically, Treasury bond yields tended to decline after the start of rate cuts. In this cycle, the rise in yields is driven by the risks of a new wave of inflation and extreme government debt issuance.

GOLD

- 4,54%:

Gold is in a correction phase under the pressure of a strong dollar and reduced expectations for Federal Reserve rate cuts.

DOLLAR FUTURES (DX)

+1,56%.

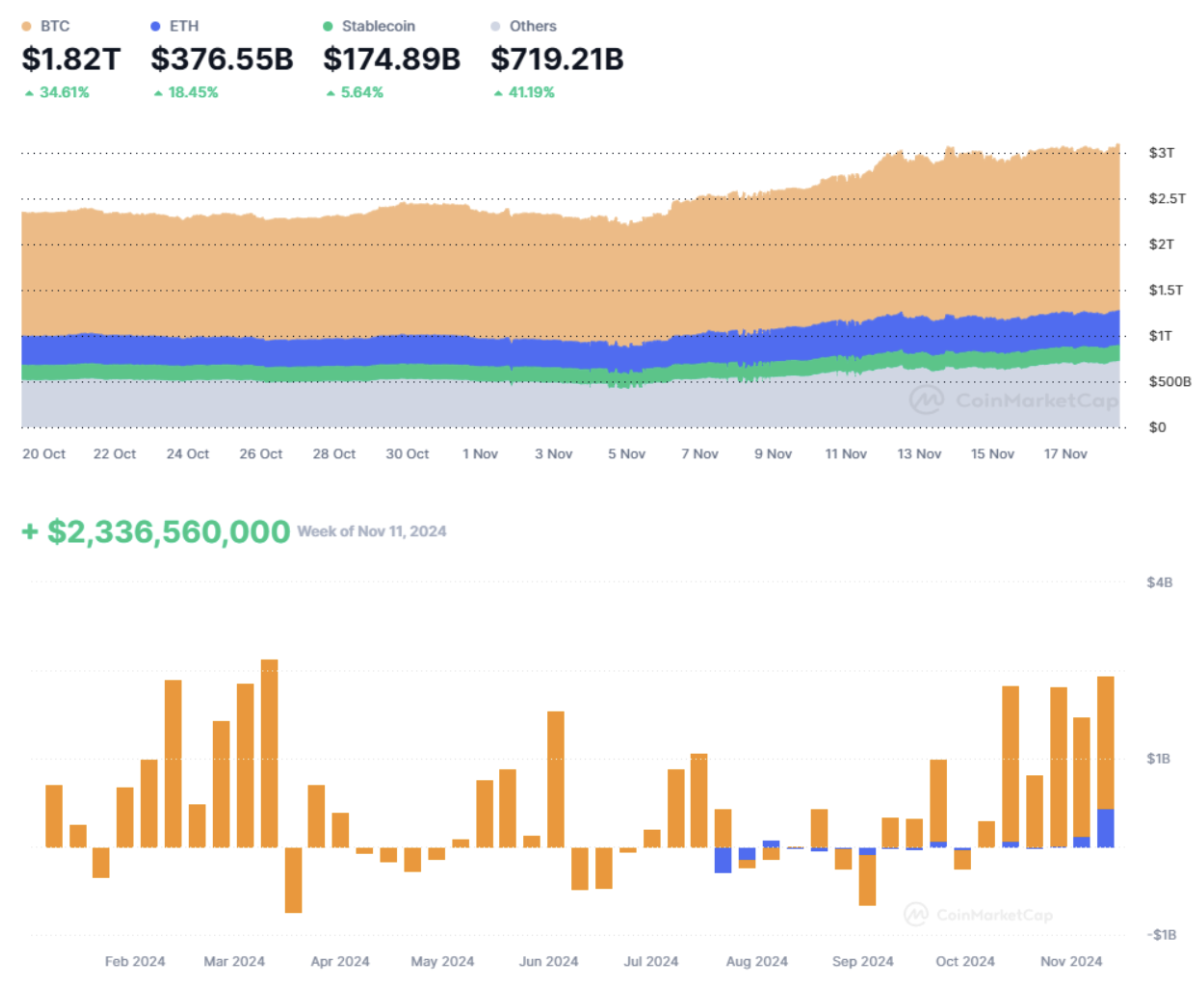

The cryptocurrency market showed significantly better performance last week compared to other markets.

BTC

Bitcoin futures: all-time high of $94,065 (November 13), weekly close at $91,985 (+19.45%).

ETH

Ethereum futures: Weekly close: $3,109 (-3.31%).

MARKET OUTLOOK

Market capitalization: $3.09 trillion.

Bitcoin 58,9%; Ethereum: 12,2%; Others: 28,9%.

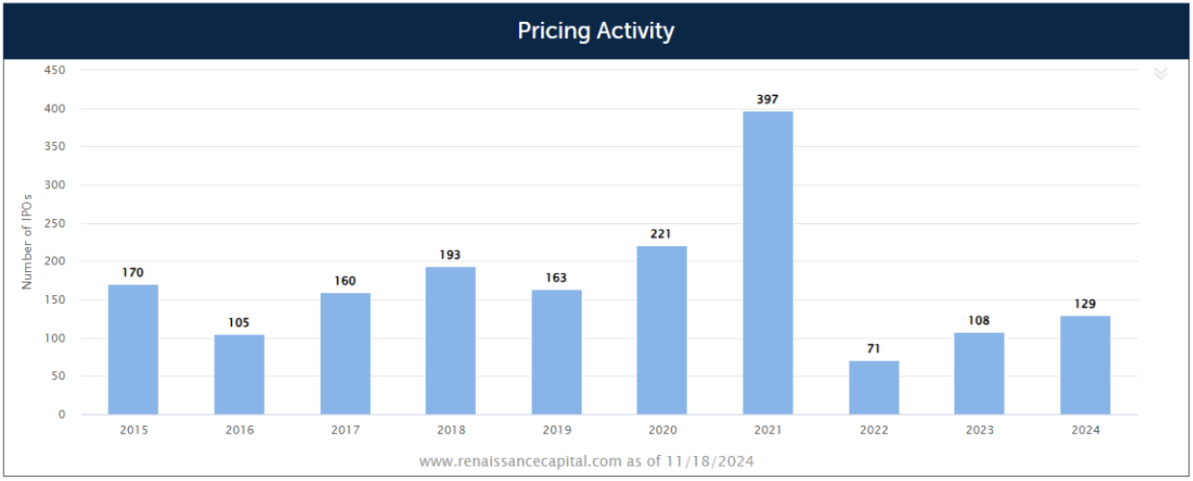

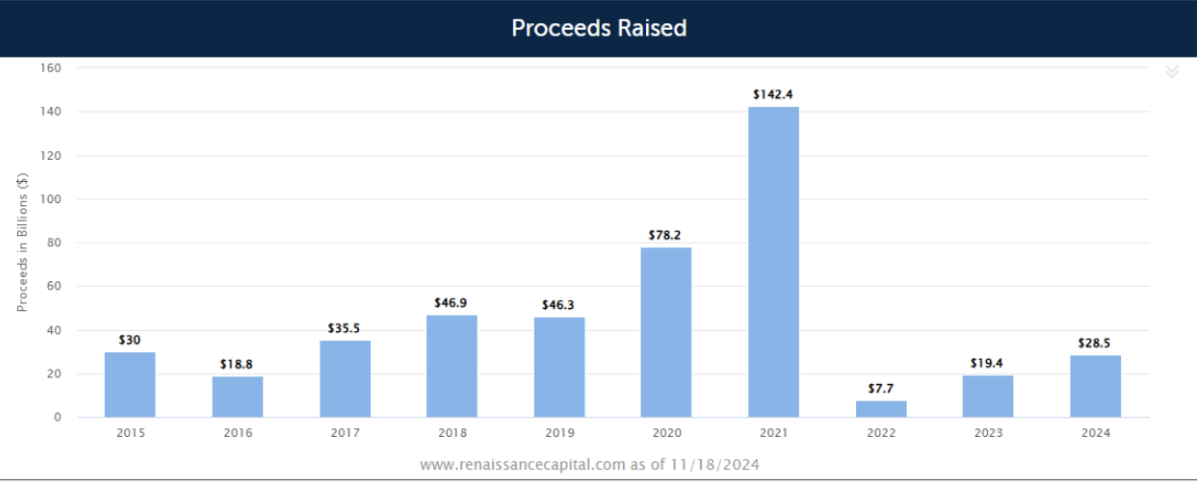

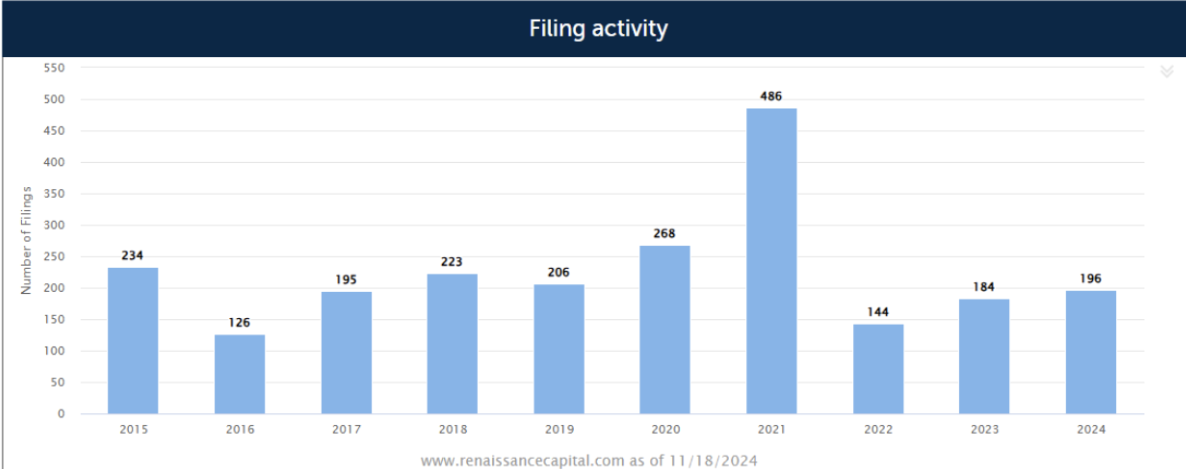

The IPO market continues to recover. 2024 IPO Market Stats (renaissancecapital.com) 129 IPOs evaluated (+26.5% YoY):

Total funds raised: $28.5 billion (+47.3% YoY):

Number of filings: 196 (+21.0% YoY).

Қазақша

Қазақша