November 18 — November 22: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (YoY) (Sept): 3.3%, (pre: 3.3%),

- Consumer Price Index (CPI) (YoY) (Sept): 2.6%, (pre: 2.4%).

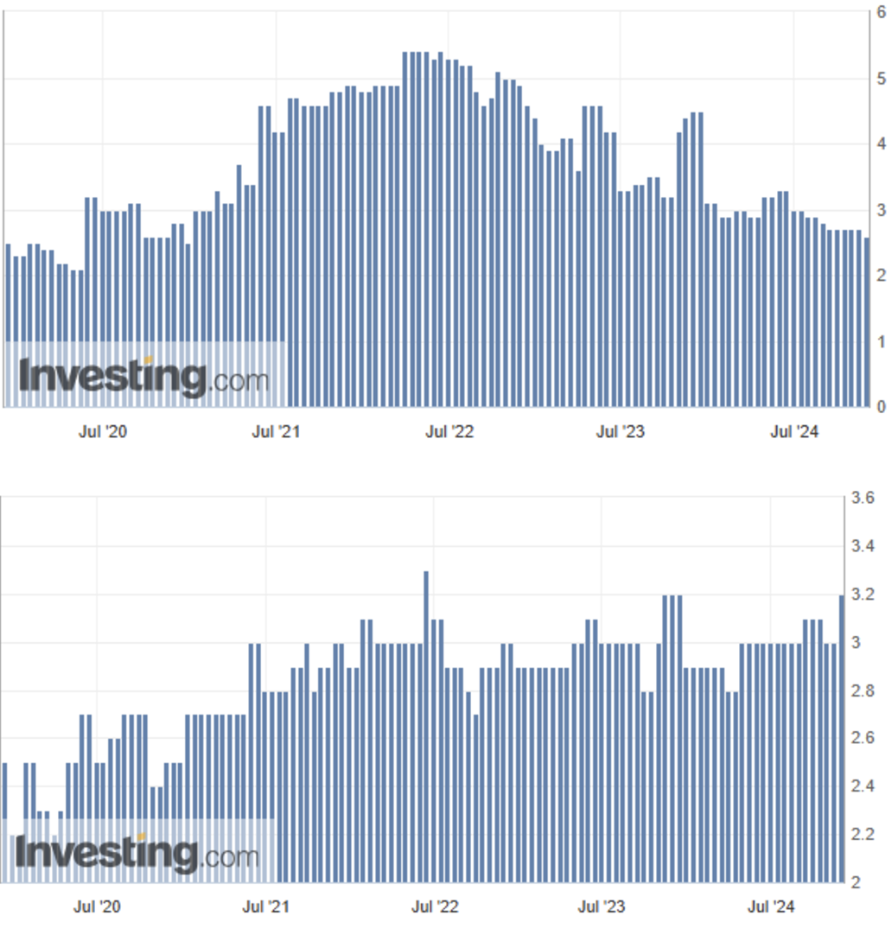

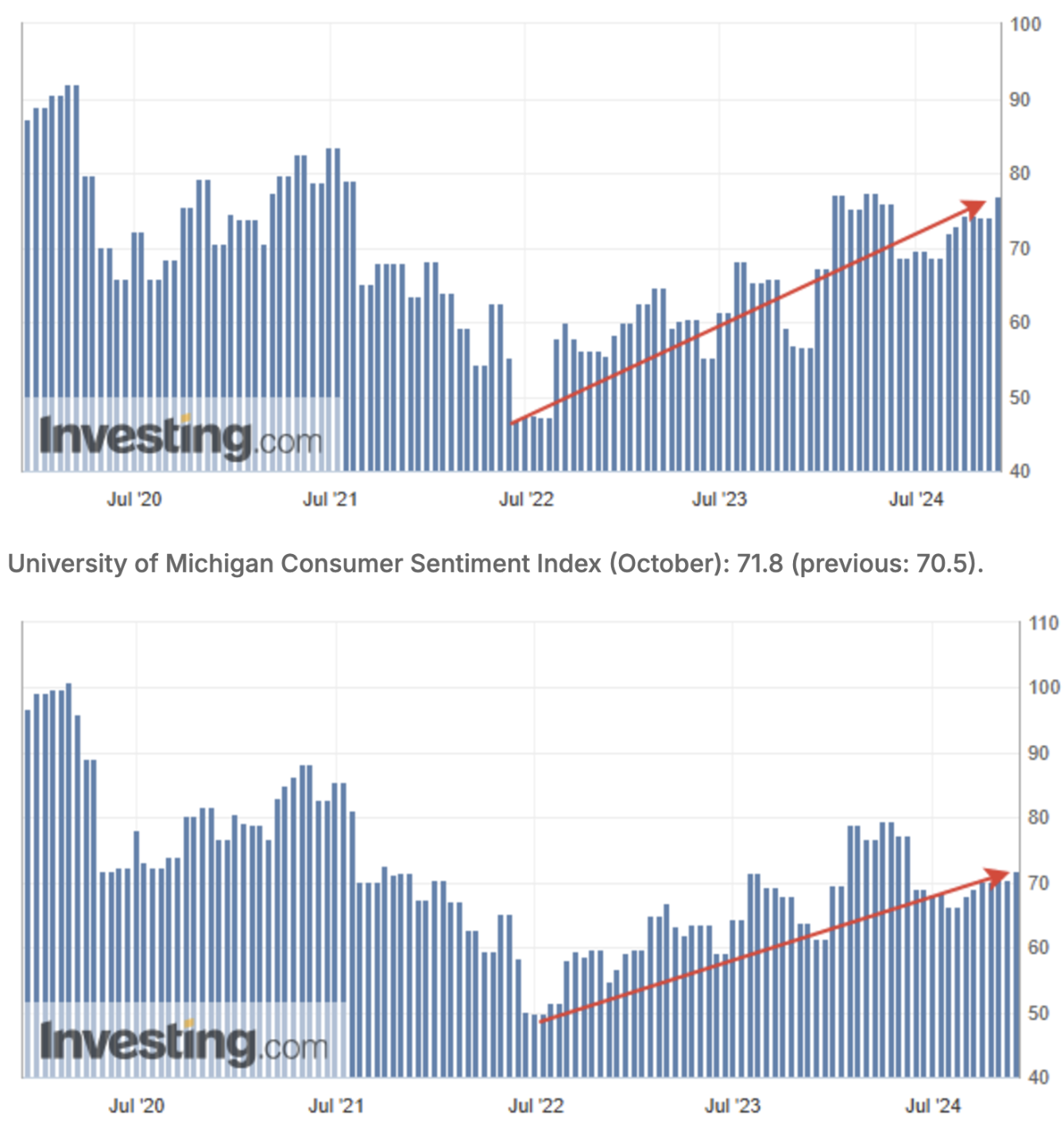

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (Sept): 2.6%, pre: 2.7%;

- 5-year expected inflation (Sept): 3.2% pre: 3.0%.

University of Michigan Consumer Expectations Index (October): 76.9 (prev: 74.1):

BEA GDP (Bureau of Economic Analysis, USA)

- Quarterly (Q3 Preliminary Estimate): 2.8% (previous: 3.0%).

- GDP Deflator (Q3): 1.8% (previous: 2.5%).

Atlanta Fed GDP Forecast

- Short-term forecast: 2.6% (previous: 2.5%).

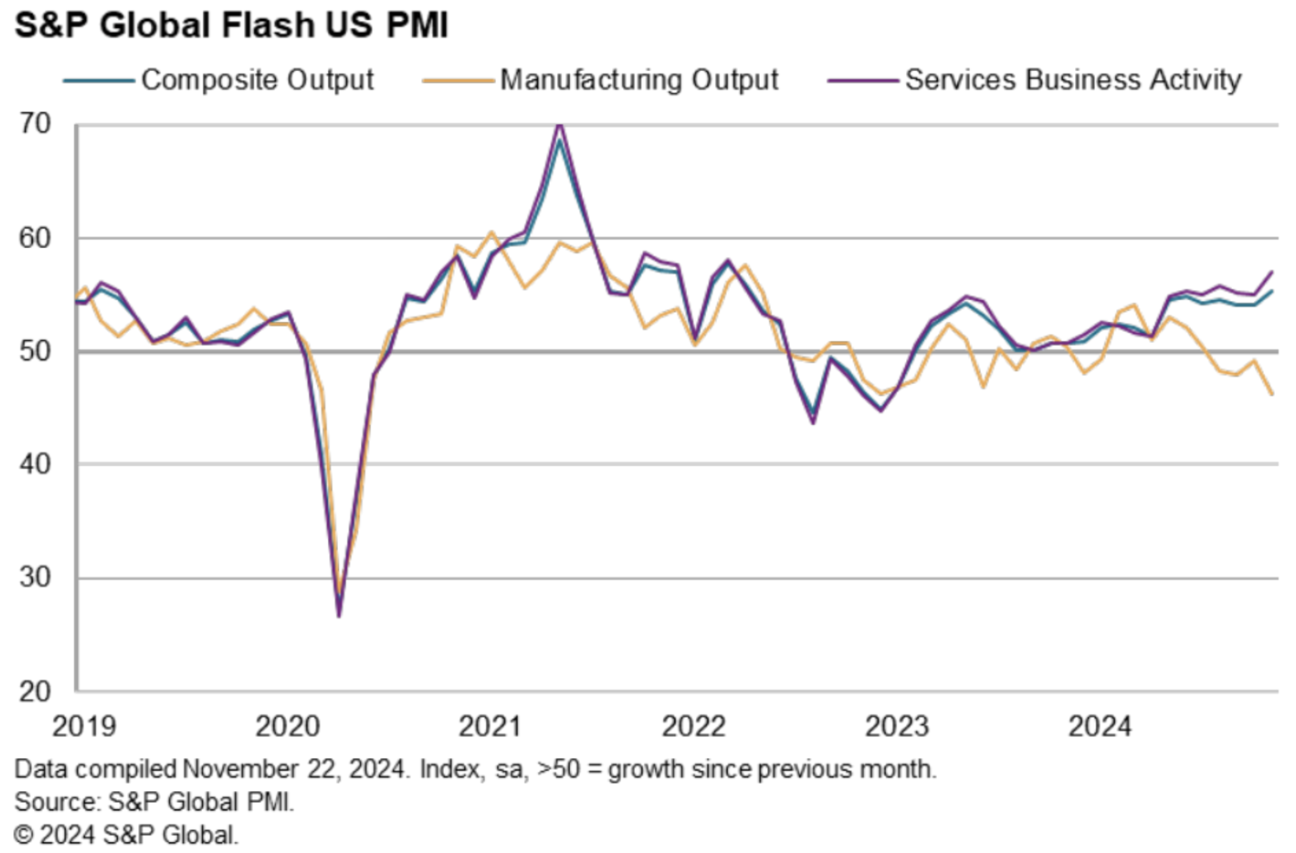

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (November): 57.0 (October: 55.0).

- Manufacturing sector ISM (November): 46.3 (October revised: 49.0).

- S&P Global Composite (November): 55.3 (October: 54.1).

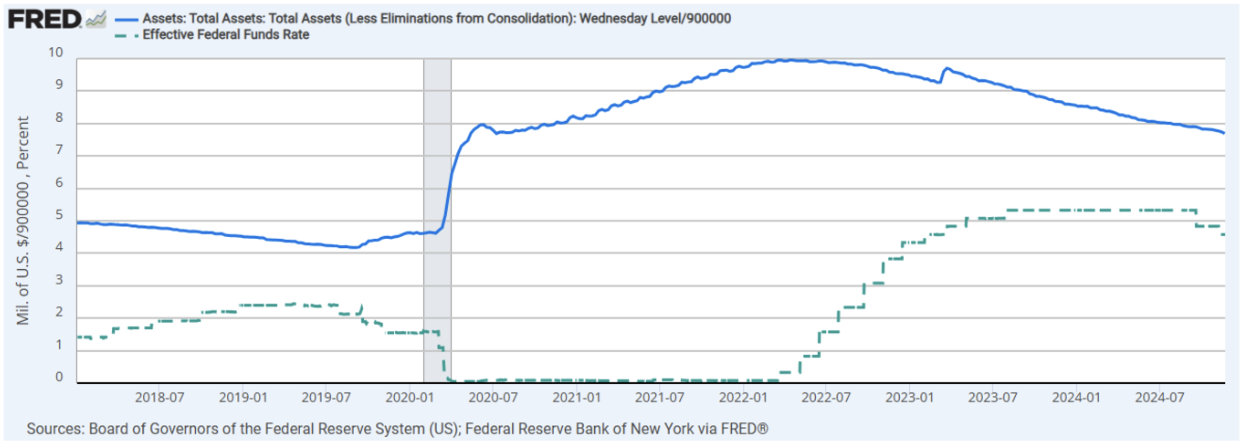

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.50% – 4.75%;

- Federal Reserve Balance Sheet: $6.923 trillion (compared to last week: $6.967 trillion, blue).

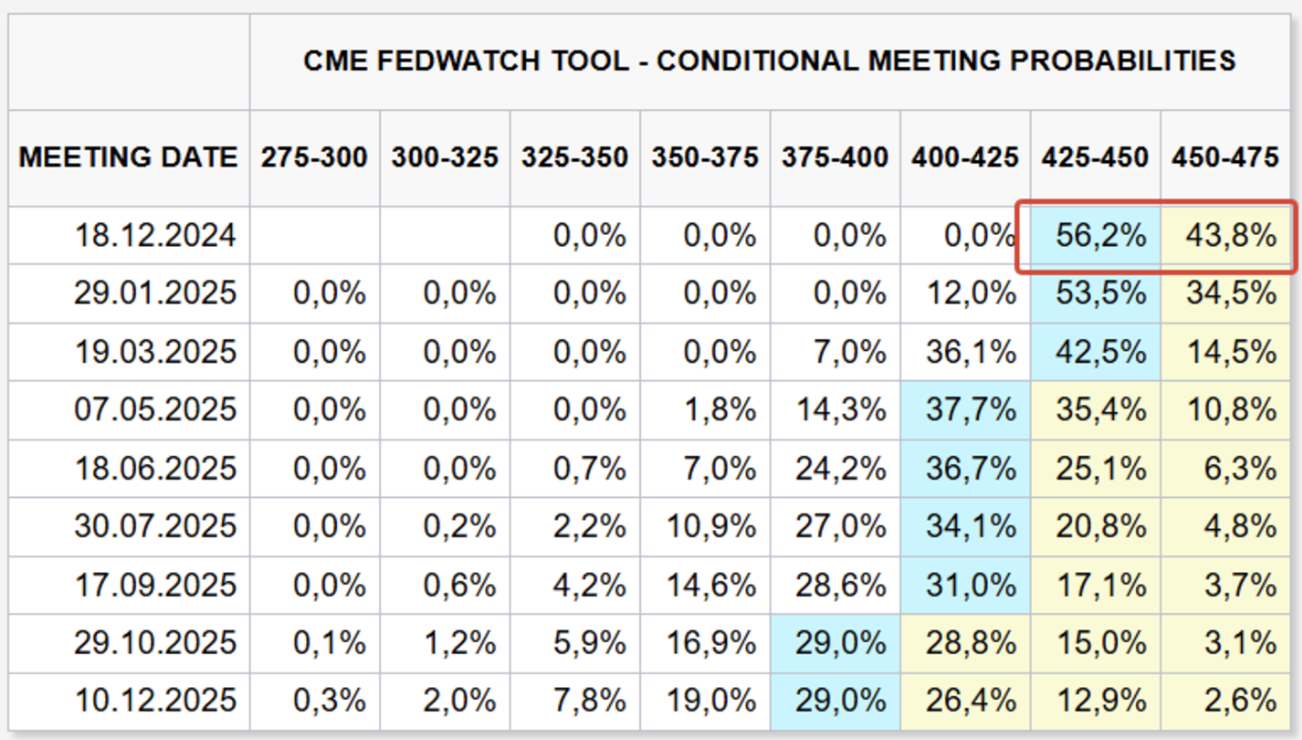

MARKET FORECAST FOR RATE

Commentary:

Inflation in the U.S. based on the Consumer Price Index (CPI) is at 3.3%.

Short-term inflation expectations have decreased, while long-term expectations continue to rise, increasing by 0.2% over the past week. Inflation remains the number one risk in the markets today.

Consumer Sentiment and Expectations Indices have increased by 2.80% and 1.30%, respectively. These indices measure the level of consumer confidence in economic activity. They are leading indicators predicting future consumer spending. Growth in these indicators signals optimism among economic agents, which is a pro-inflationary factor.

PMI business activity data indicate a noticeable increase in activity in November, reaching a two-year high in the composite calculation (purple line). Within the index, the services sector continues to grow, while the manufacturing sector is slowing down. The services sector in U.S. GDP far exceeds manufacturing, making it more significant in this context.

In conclusion, last week’s macroeconomic statistics do not indicate an economic slowdown, which does not favor a rapid rate-cutting cycle.

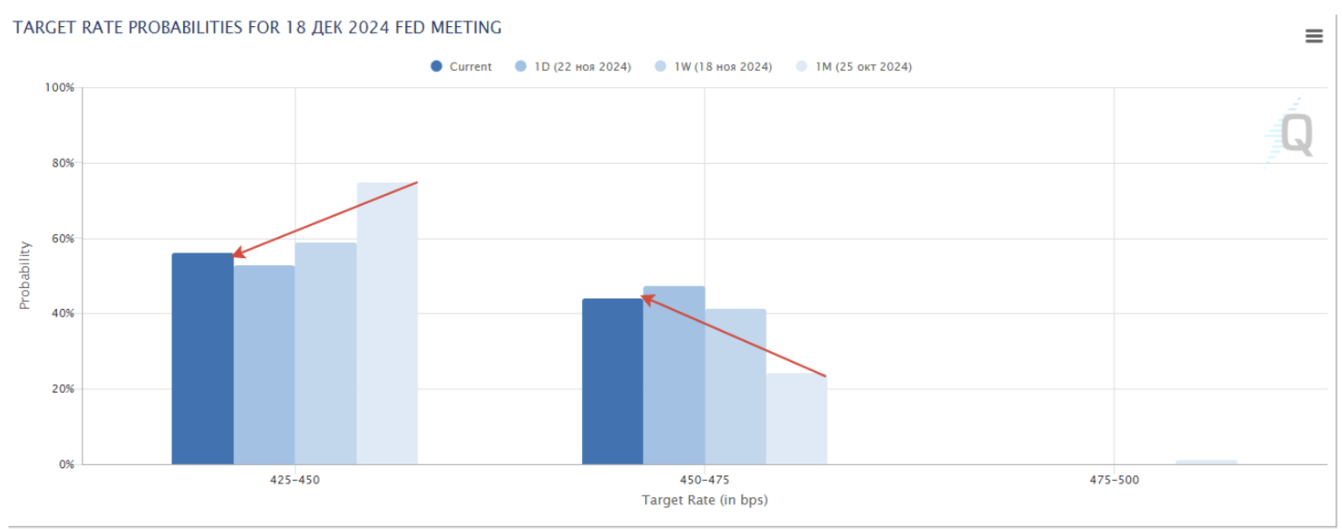

FedWatch for the upcoming December meeting: another rate cut to the range of 4.25%-4.50%. However, looking at the lower chart, expectations have decreased to 50%.

Long-term expectations: two cuts of 0.25% each to the range of 3.75%-4.00%. Overall, the market expects the rate to remain above 4.00% practically until the end of 2025.

MARKET

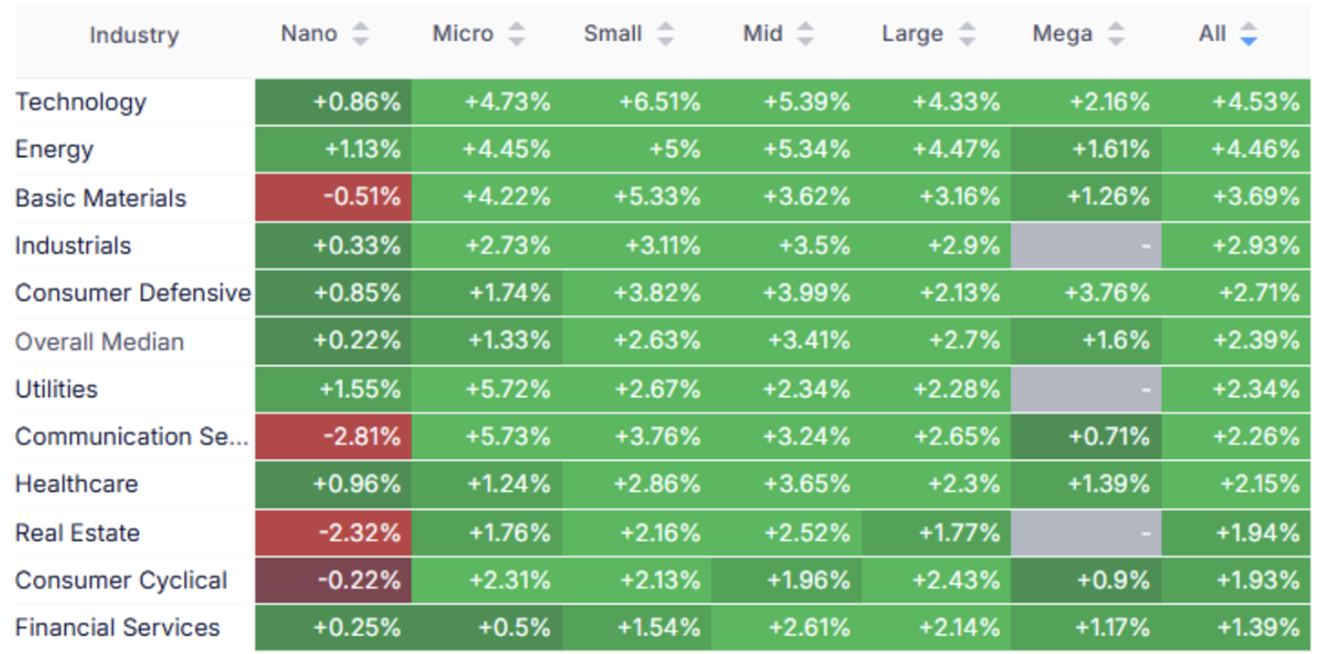

MARKET CAP PERFORMANCE

Last week, the entire stock market experienced growth, with a median increase of +2.39%. The leaders were the technology, energy, and basic materials sectors.

SP500

S&P 500 Index: +1.66%

NASDAQ100

Nasdaq100: +1,63%

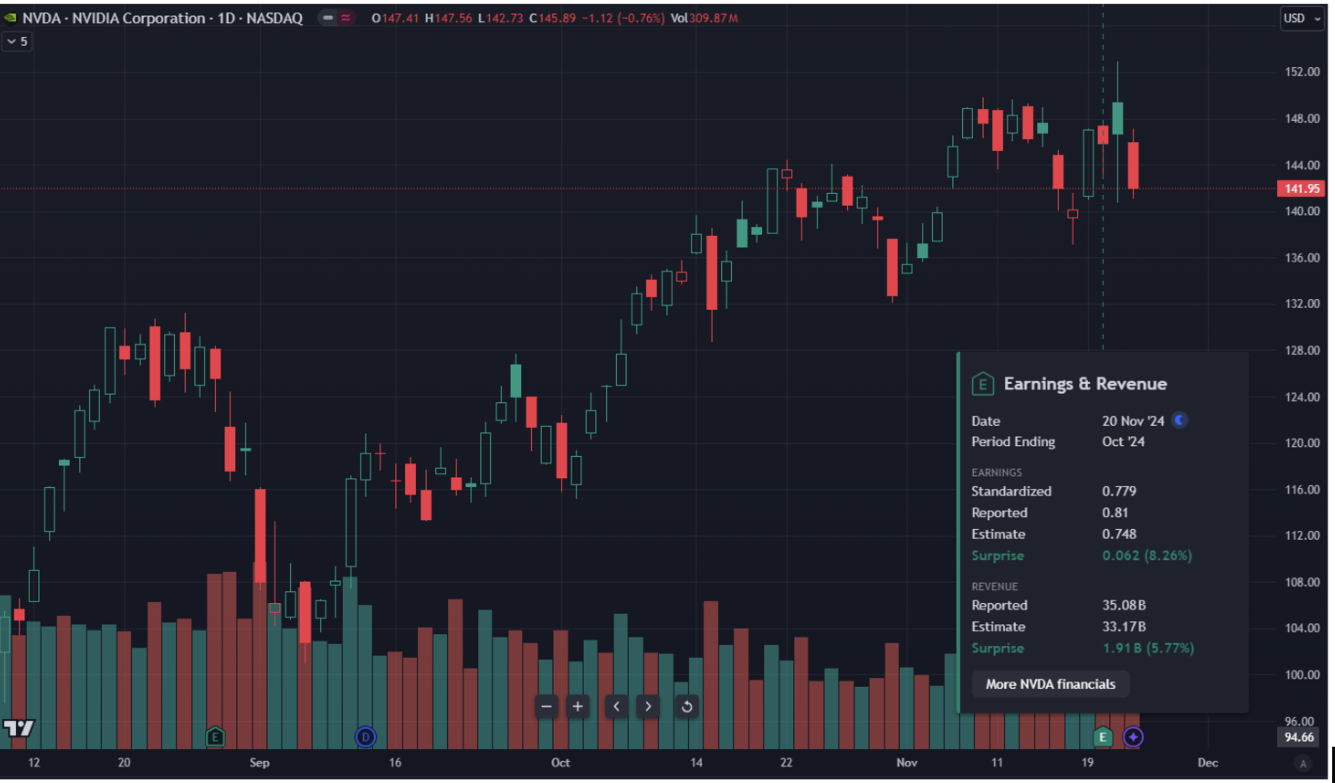

NVDA

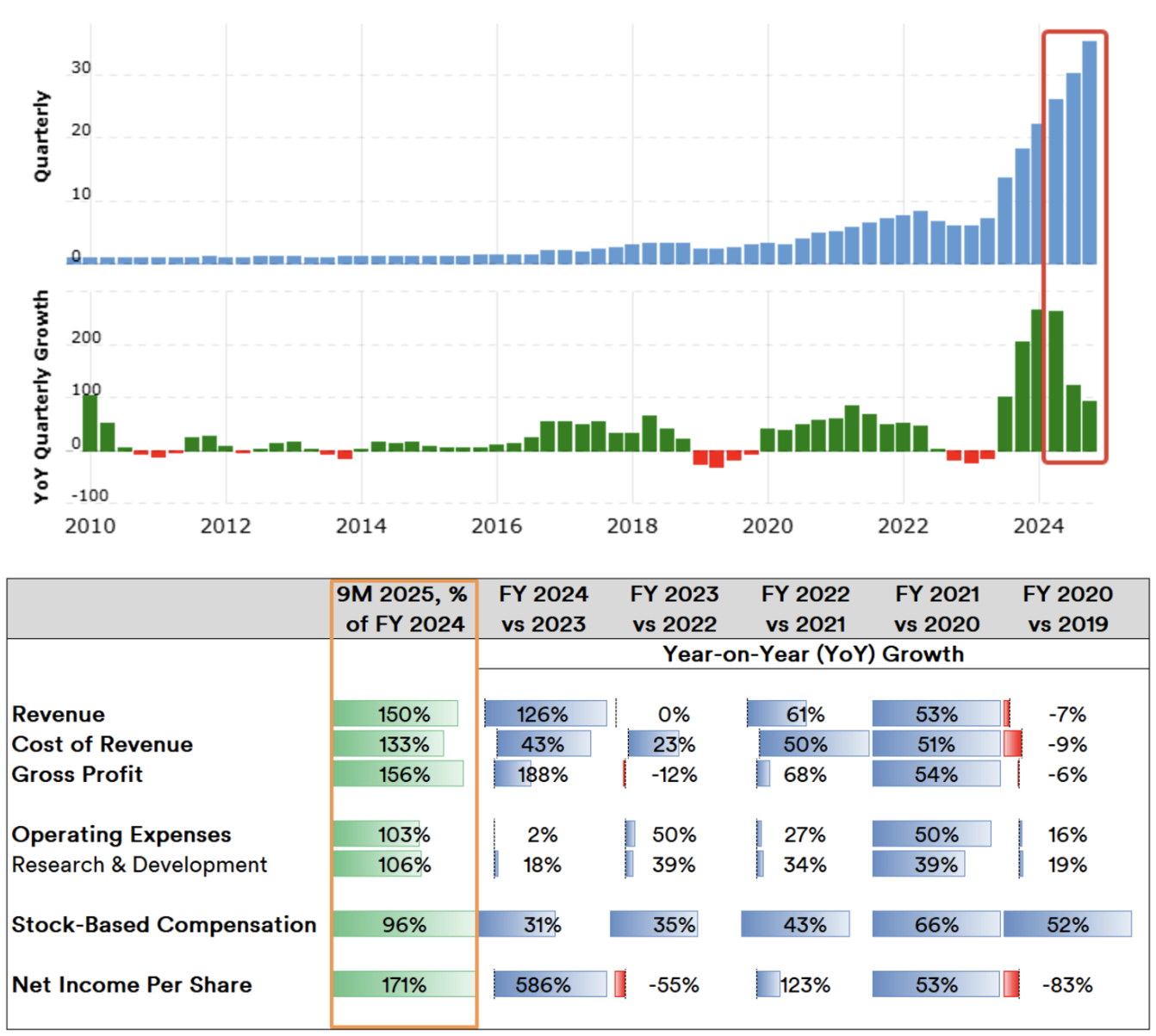

The financial report for the third quarter of 2024 exceeded expectations. Adjusted earnings per share (EPS) came in at $0.81 compared to the forecast of $0.75, and revenue reached a record $35.08 billion versus the expected $33.16 billion.

Gross profit growth rate:

Growth rates are slowing down, particularly in gross and net profit. It is also important to note a significant increase in expenses across all categories, which puts pressure on business margins. Furthermore, management's forecast for future earnings was slightly below expectations. As a result, the stock price fell by 2.60% after the report. The current valuation based on multiples remains high.

Forecasted target prices provided after the report exceed the current price by more than 20%, with an average range of $170–$180.

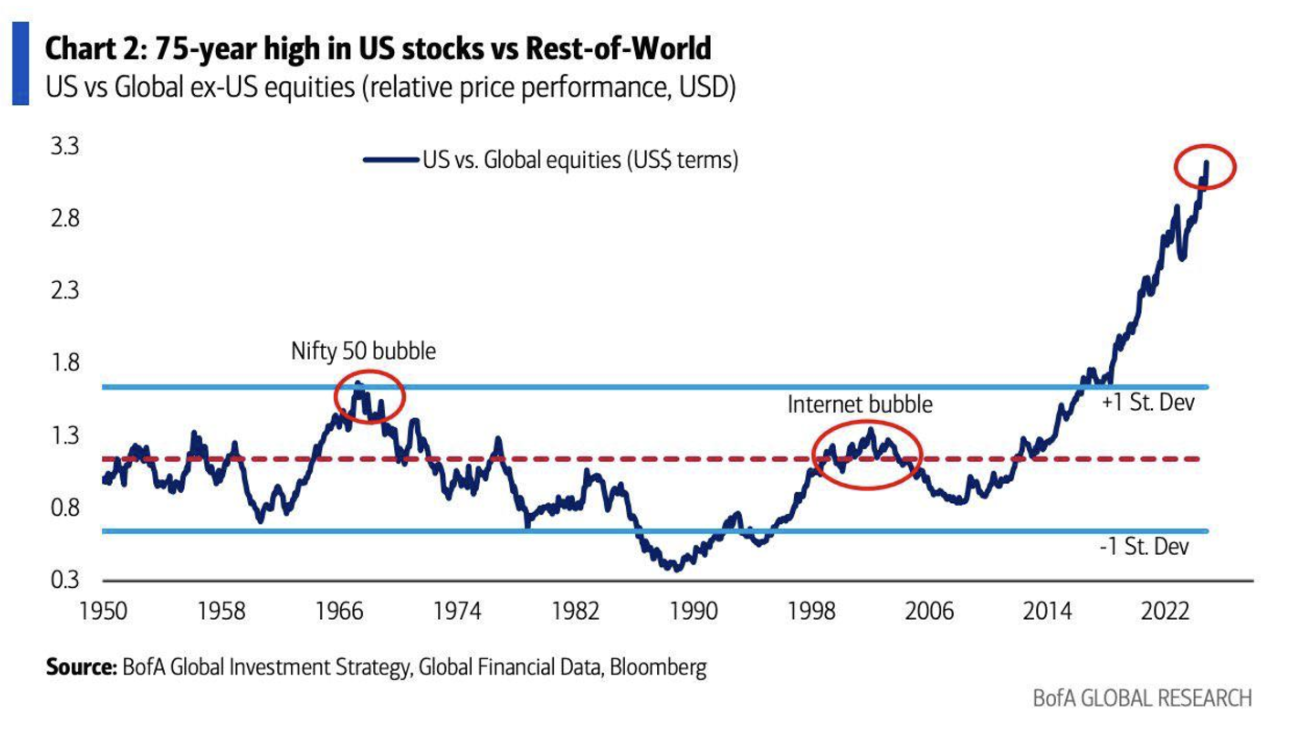

The market capitalization of the U.S. stock market relative to the global stock market capitalization. Currently, the U.S. stock market is nearly three times larger than the global stock market capitalization:

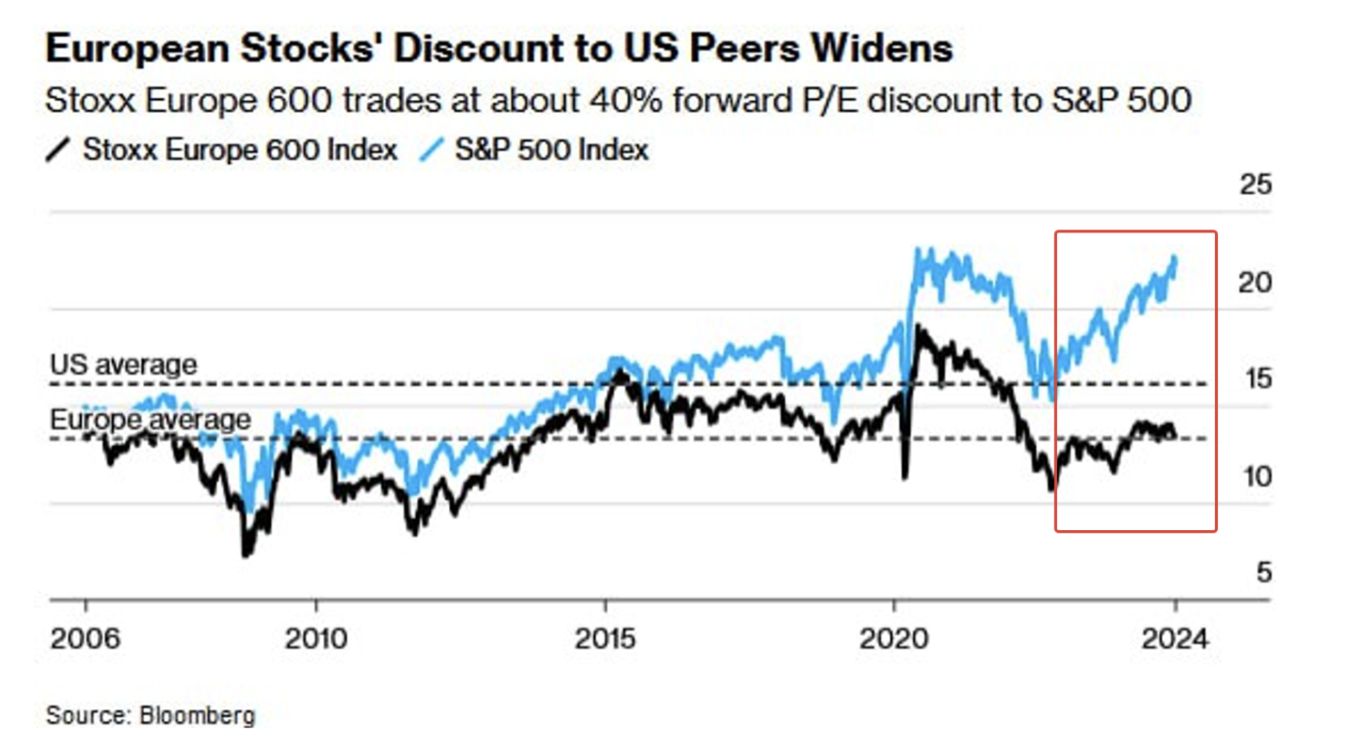

Comparison with the European stock market. Based on forward P/E, the U.S. stock market is 40% more expensive than the European stock market:

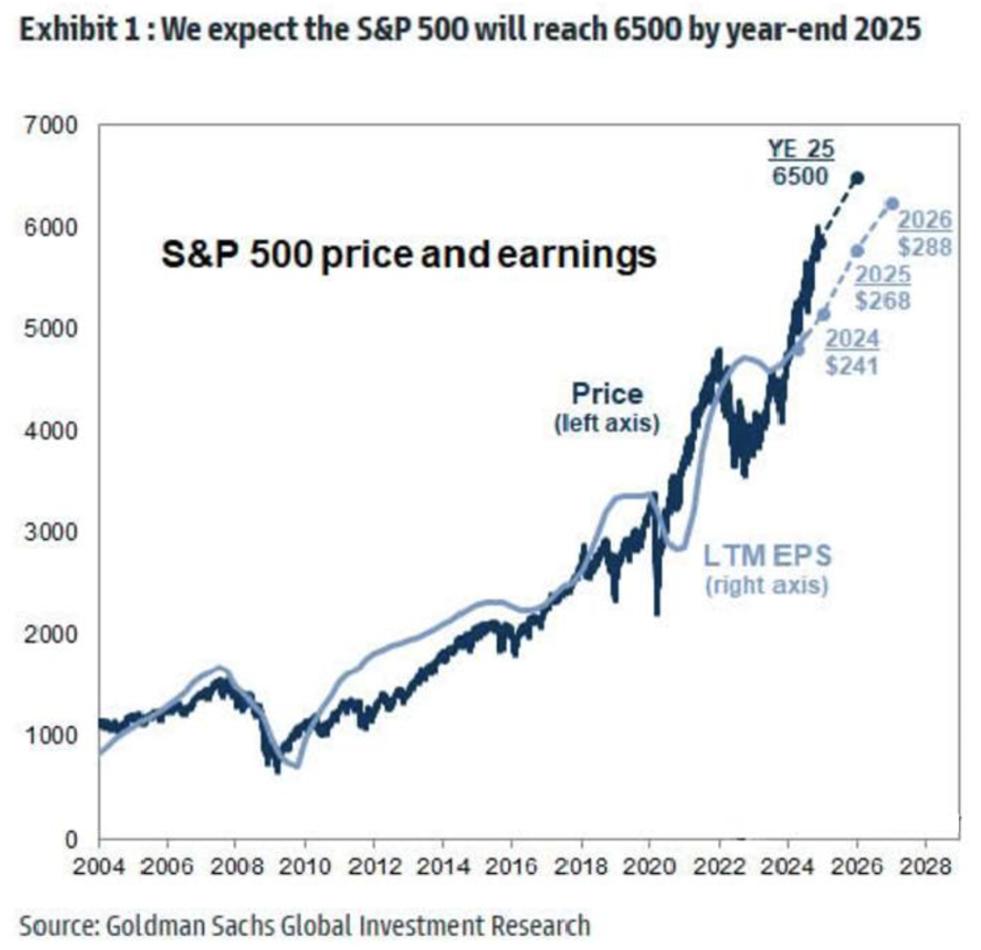

Another optimistic forecast from Goldman Sachs. According to the latest estimates, the bank predicts the S&P 500 index will rise to 6,500 points by 2025, representing approximately +8.5%. The bank expects further sustainable growth in corporate earnings:

TREASURY MARKET

Treasury Bonds UST2: -0,05%

Treasury Bonds UST10: +0,71%

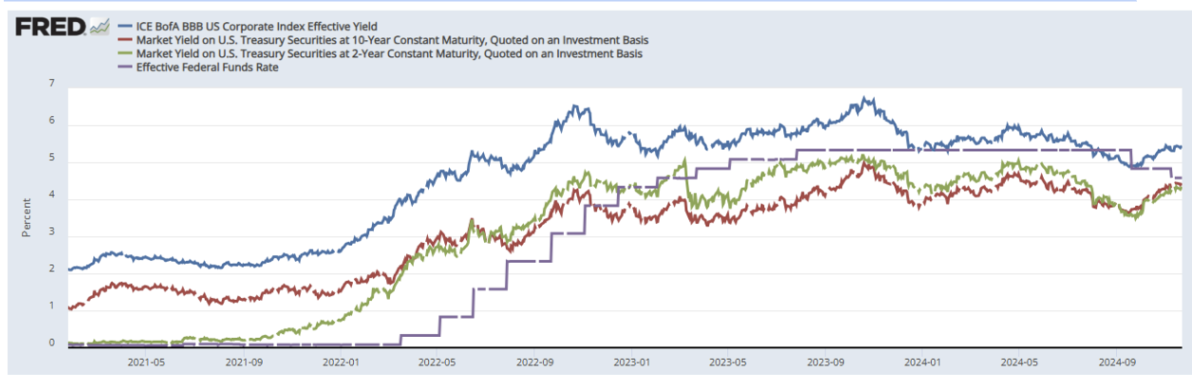

Yields and Spreads

- The spread between the 10-Year Treasury and the Corporate Index BBB US is 1.01%:

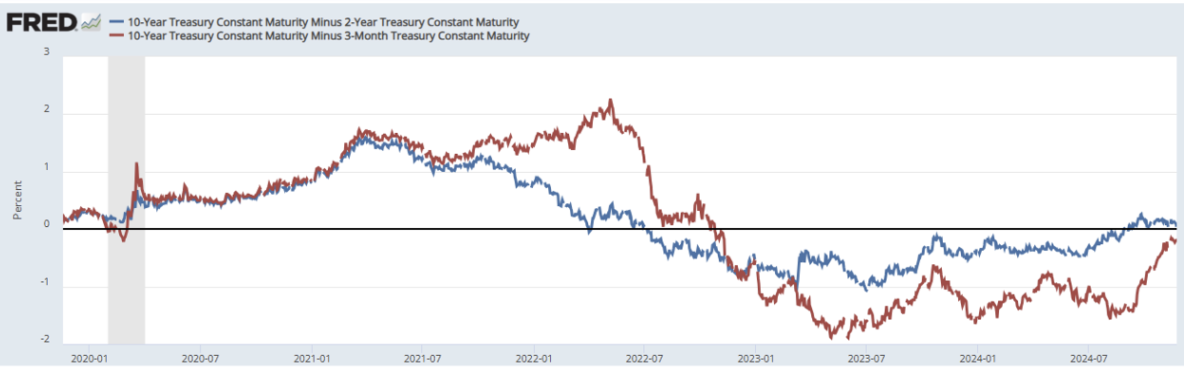

- 10-Year Treasury minus 2-Year Treasury: 0,04%;

- 10-Year Treasury Constant Maturity Minus 3-Month Treasury: -0,22%:

GOLD FUTURES

For the past week: +5.73%, today since the opening: -1.89%. The growth is linked to geopolitical escalation in Eastern Europe.

DOLLAR FUTURES (DX)

+0,7%.

Gold and the dollar are consolidating near their resistance levels, with investors focusing on Trump’s future policies.

BTC

Bitcoin Futures: All-time high $100,170 (November 22), weekly close $99,815 (increase: +8.74%):

ETH

Ethereum futures: Weekly close $3,332 (decline: -7.56%):

MARKET OUTLOOK

Market capitalization: $3.35 trillion (coinmarketcap.com). Bitcoin's dominance in the cryptocurrency market is increasing, with its share reaching 57.9% today. The share of other cryptocurrencies, including Ethereum, is declining relative to the total market.

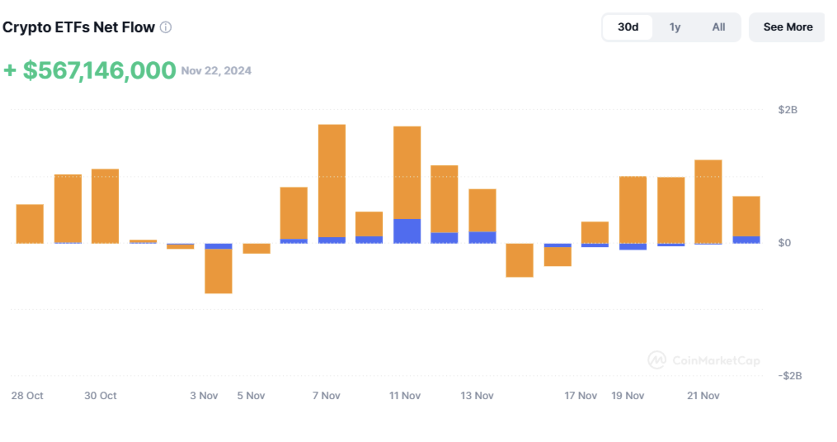

Inflows into ETF funds exceeded $500 million last week:

Қазақша

Қазақша