September 9 — 13: Weekly economic update

Key market insights

In our weekly column, we share with you the main macroeconomic indicators for the market.

MACROECONOMIC STATISTICS

INFLATION

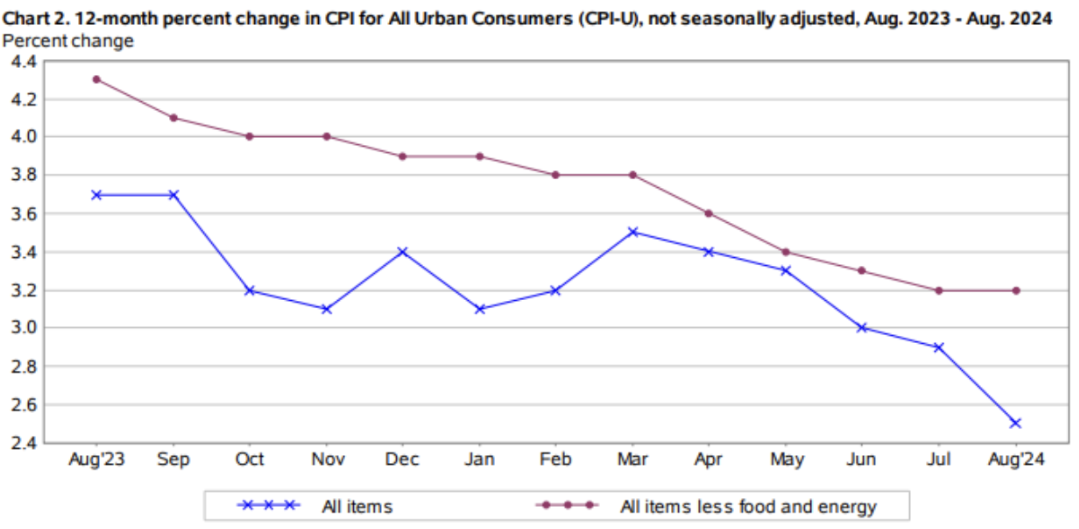

- Core Consumer Price Index (CPI) (YoY) (June): 3.2%, (pre: 3.2%);

- Consumer Price Index (CPI) (YoY) (June): 2.5%, (pre: 2.9%).

THE FED'S INFLATION TARGET

- Core price index of personal consumption expenditure PCE (YoY) (July): 2.6% (pre: 2.6%);

- The price index of personal consumption expenditures (YoY) (July): 2.5%, (pre: 2.5%)

INFLATION EXPECTATIONS

- 12-month expected inflation (August): 2.7%, (pre: 2.8%);

- 5-year expected inflation (August): 3.1% (pre: 3.0%).

GDP (q/q) (2Q.) (second estimate): 3.0% (first: 2.8%, pre: 1.4%), GDP deflator (q/q) (2 Q.): 2.5% (pre: 3.1%).

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (June): 55.7 (pre: 55.0);

- Manufacturing sector (August): 47.9 (pre: 49.6, review).

- S&P Global Composite (June): 54.6 (pre: 54.3, review).

LABOR MARKET

-

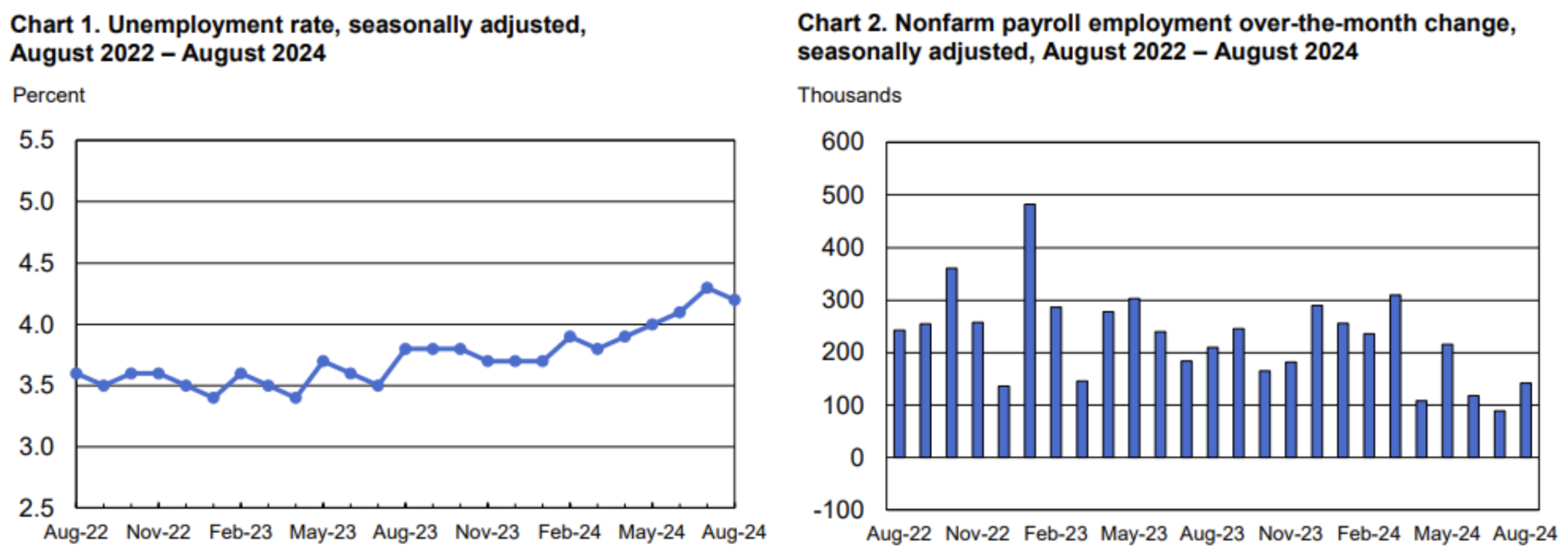

Unemployment rate (August): 4.2% (pre: 4.3%);

-

Non-farm Payrolls (August): 142K (pre: 89K, review);

-

Change in non-farm private sector employment (August): 118K, (pre: 74K, review);

-

Average hourly earnings (August, YoY): 3.8%, (pre: 3.3%);

-

Number of initial applications for unemployment benefits: 230K, (pre: 227K)

MONETARY POLICY

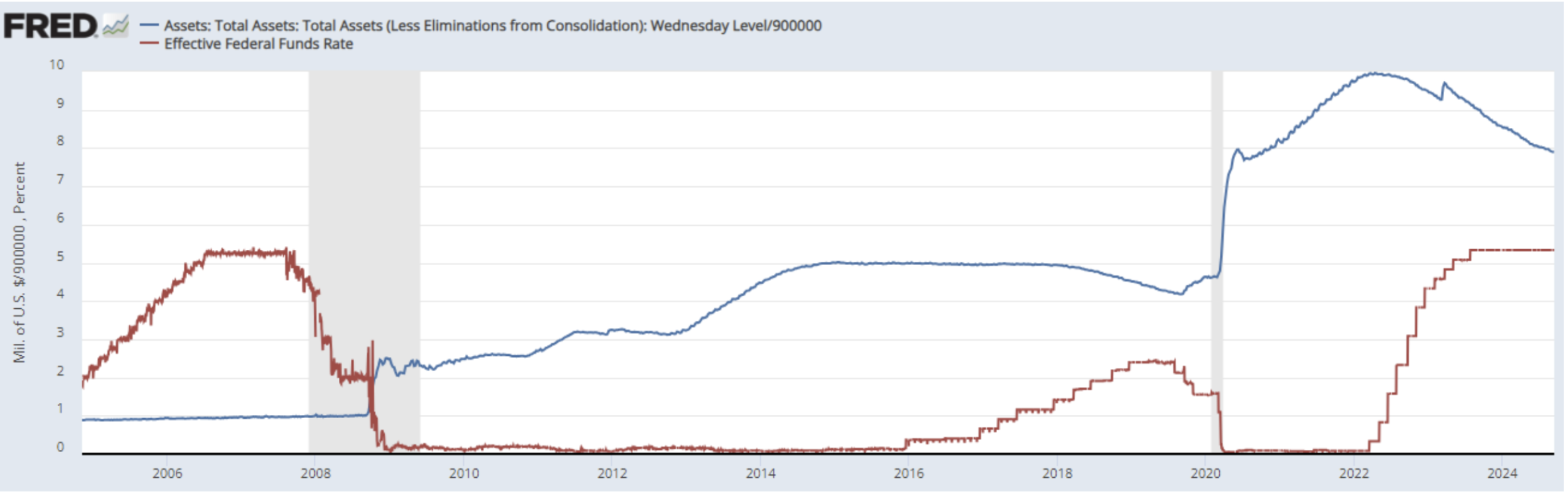

- Federal Funds Rate (EFFR) — 5.25-5.50% (in red line);

- Fed balance sheet (blue) declined from the previous week: $7.115 trillion (prev: $7.112 trillion).

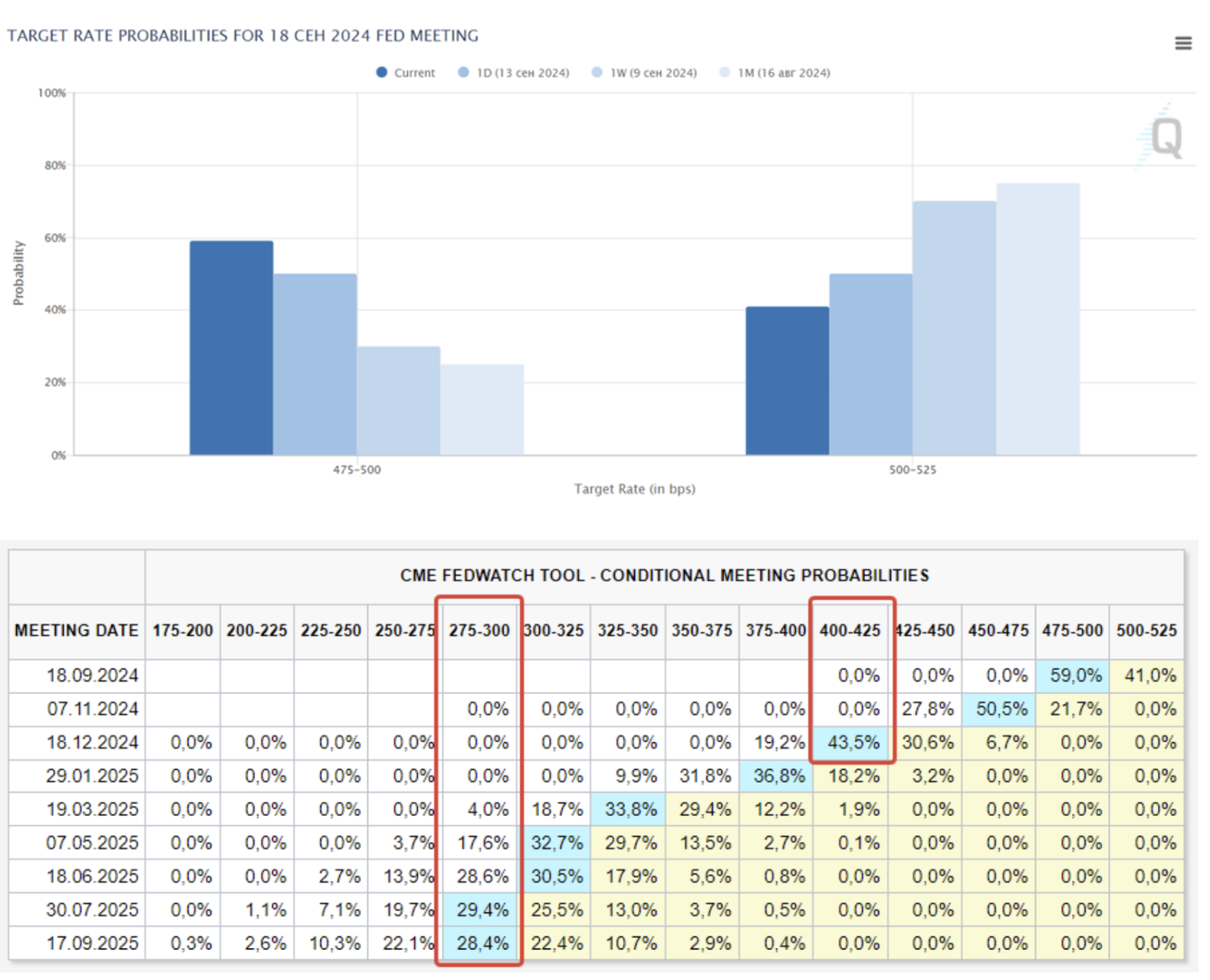

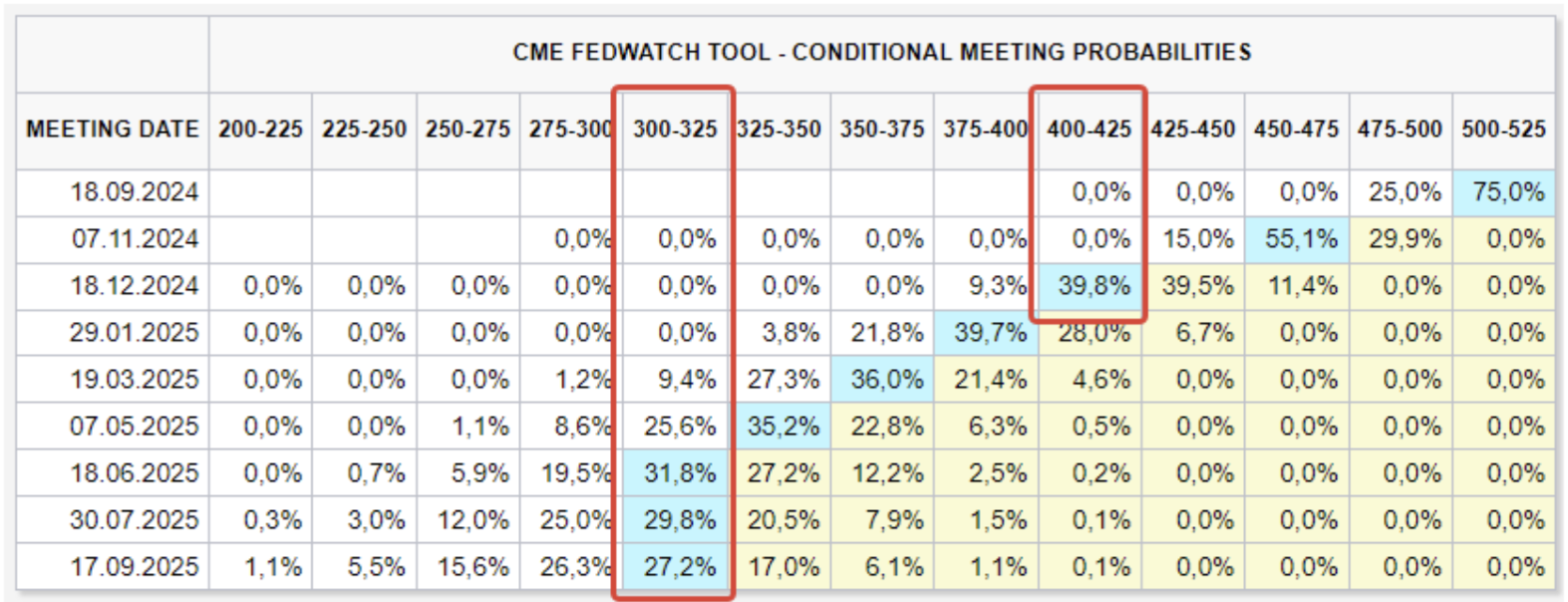

MARKET FORECAST RATE (FEDWATCH)

Today:

A week ago:

COMMENTARY

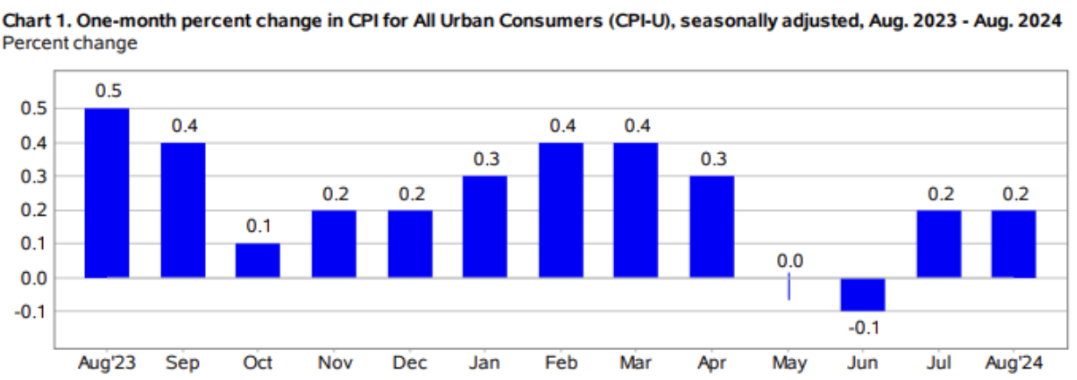

- Last week, annual CPI inflation significantly decreased to 2.5% from 2.9% the previous month. Core CPI (excluding energy and food) remained unchanged at 3.2%.

- In monthly terms, core CPI increased by 0.1% (from 0.2% to 0.3%).

- These data confirm a reduction in inflationary pressure, allowing the Fed to begin a cycle of rate cuts, which will be the main event of this week.

- According to the FedWatch tool, the likelihood of a rate cut at the September 18 meeting increased to 60%, with a 50 basis points cut compared to a 41% chance of a 25 basis points cut.

- By the end of the year, a rate cut of 1.25% is expected, and in the next 12 months, the market anticipates a rate reduction by 2.50% (range 2.75-3.00%).

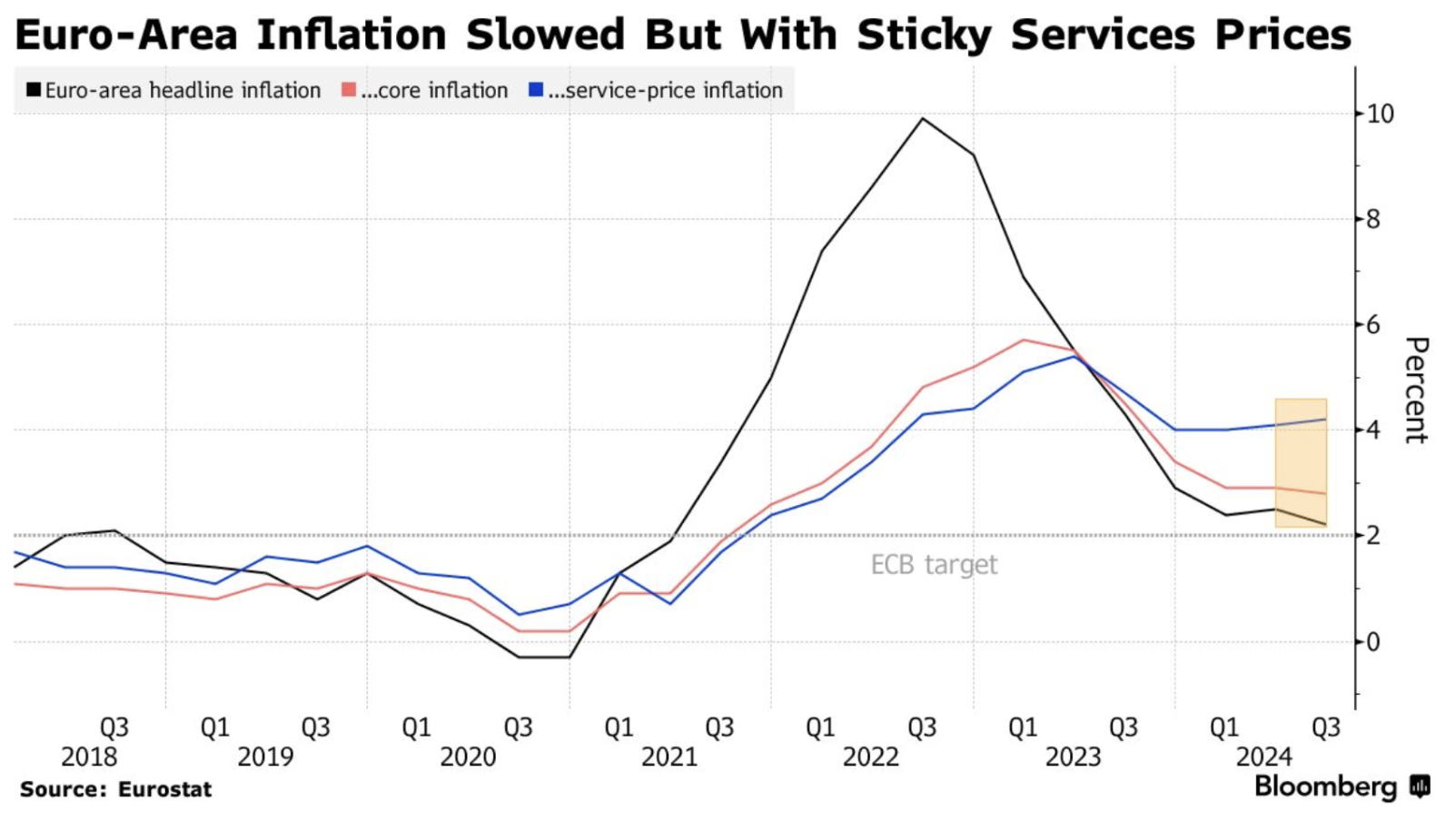

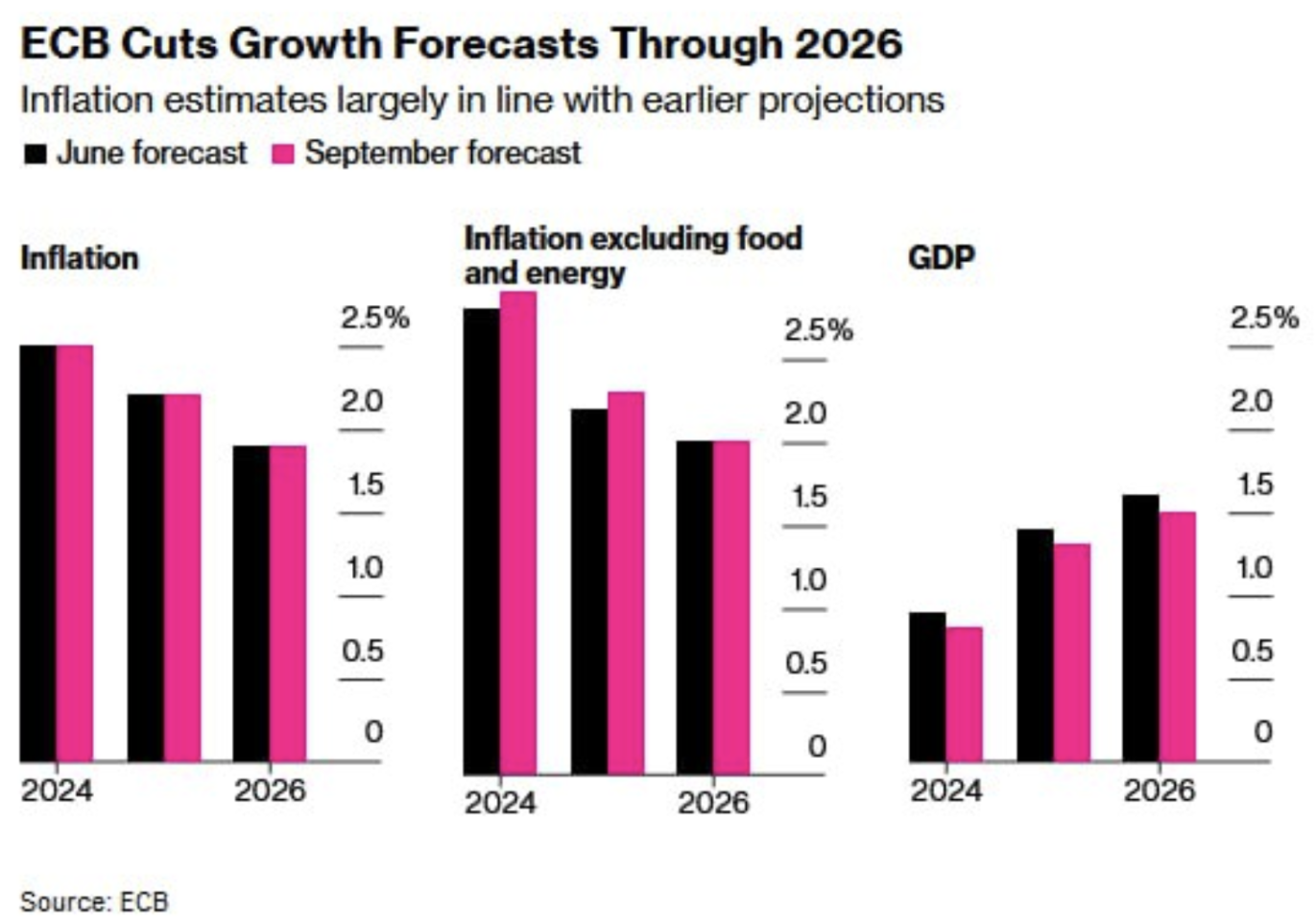

ECB

Last week, the ECB cut interest rates for the second time this year due to declining inflation and a slowing economy. Inflation in the services sector today is at 4.2%, with core inflation at 2.9%.

The ECB expects to achieve its 2% inflation target by 2026 with low GDP growth of 1.5%. GDP targets were lowered for 2025 (to 1.3% from 1.6%) and for 2026 (to 1.5% from 1.6% in the previous forecast).

The key deposit rate was reduced by 25 basis points to 3.5%, which matched market expectations.Markets are also expecting the ECB to cut rates by one or two more cuts this year.

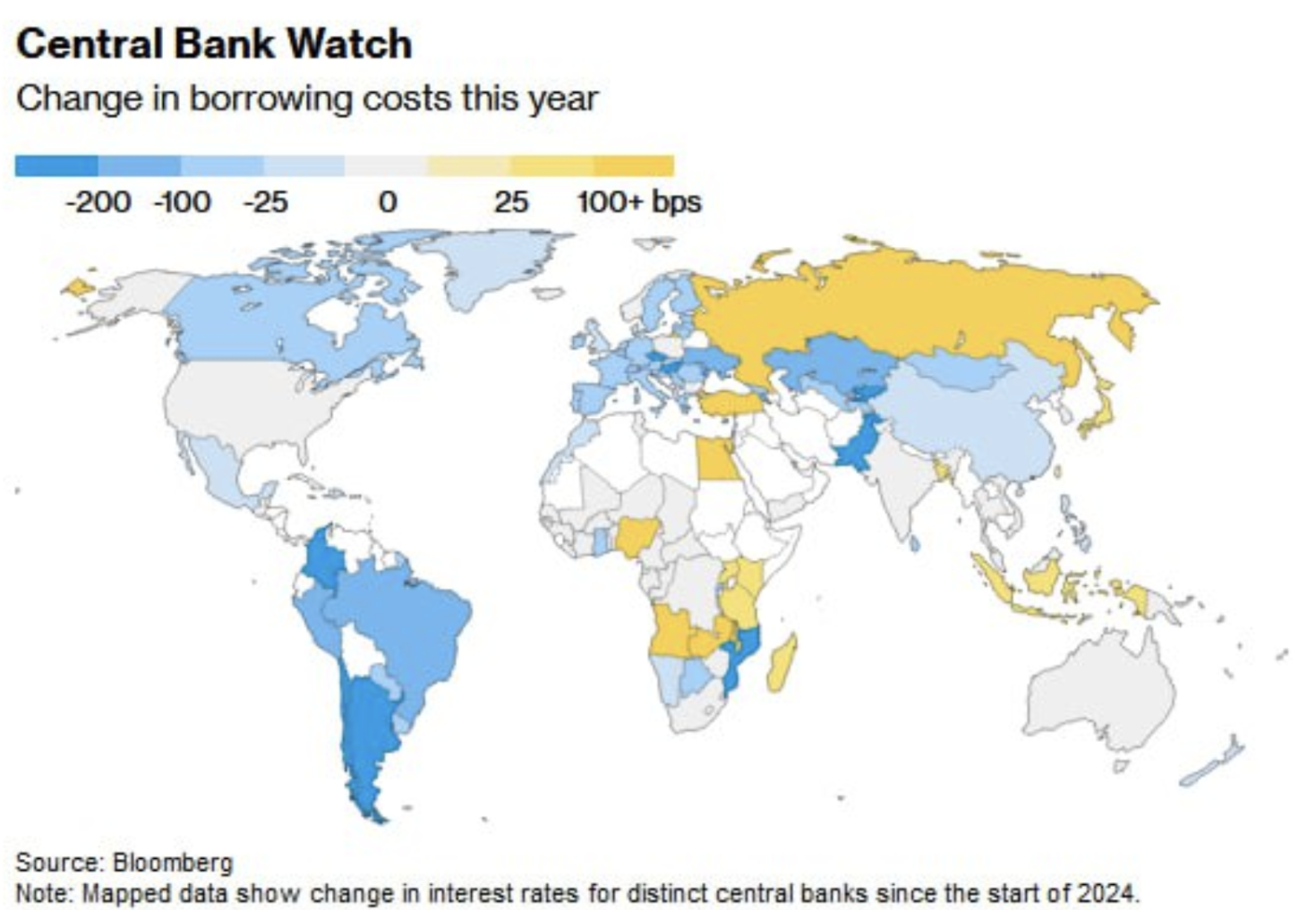

Central Bank Actions in 2024 around the globe:

With the rate cut in the US this week, it can be said that most countries have already switched to rate cuts, particularly in developed economies. Borrowing costs continue to rise in Russia, some African countries, and Southeast Asia.

MARKET

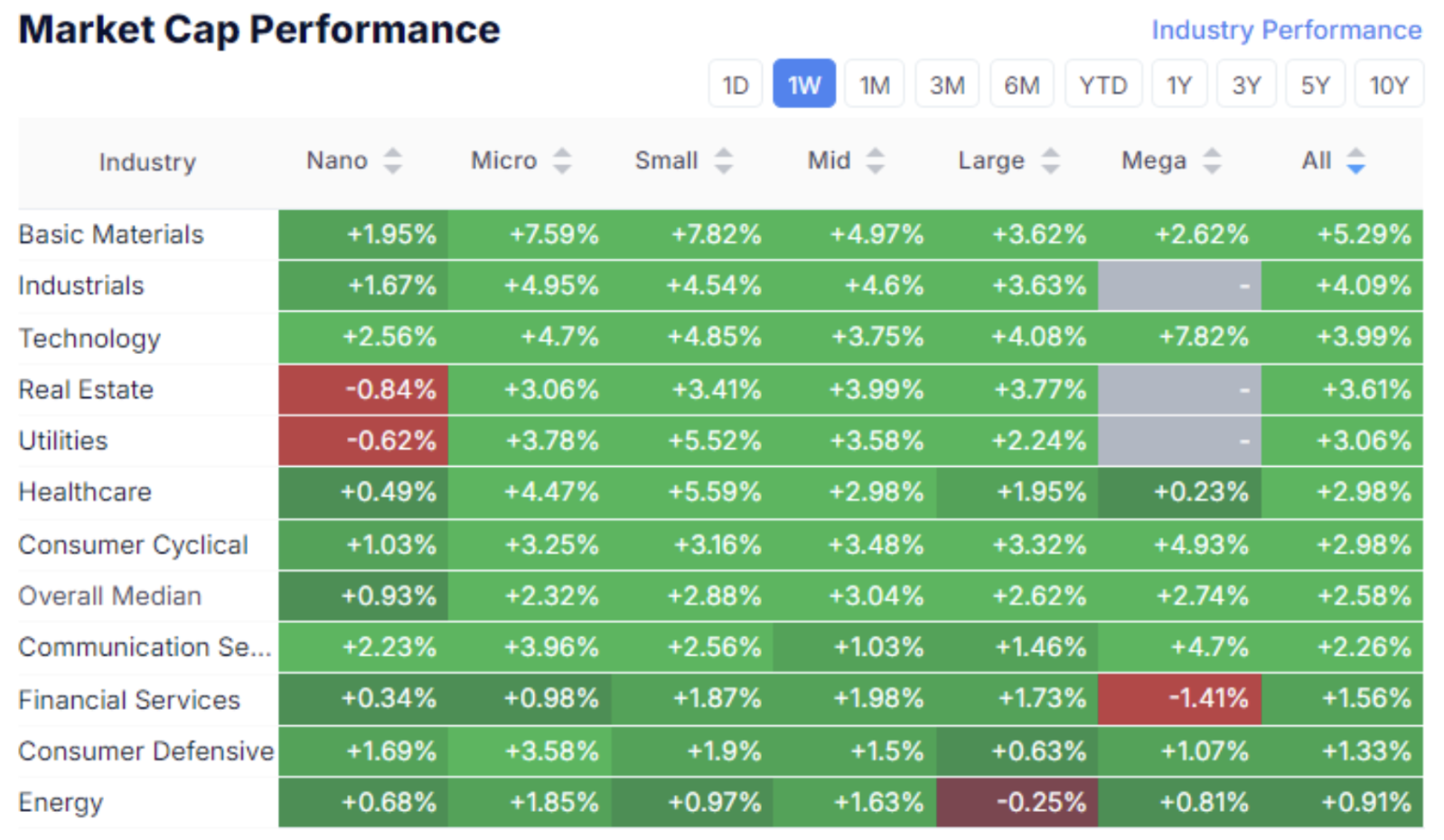

MARKET CAP PERFORMANCE

The stock market:

Comparing the last two weeks, market sentiment has shifted significantly depending on macroeconomic statistics, which in turn influence Fed decisions. While labor market data caused a sell-off the week before last, last week saw organic growth in the US stock market across the capitalization spectrum, supported by CPI data. Median growth was 2.58%, with leaders in the basic materials, industrial, and technology sectors.

SP500

VIX

The S&P 500 index rose by 3.40% over the week and is now just 0.73% below its all-time high. The price range of 5650-70 will serve as resistance level, while the nearest support level is at 5380-5410. The "fear index" (VIX) continues to decline and is at a calm level of 16.9.

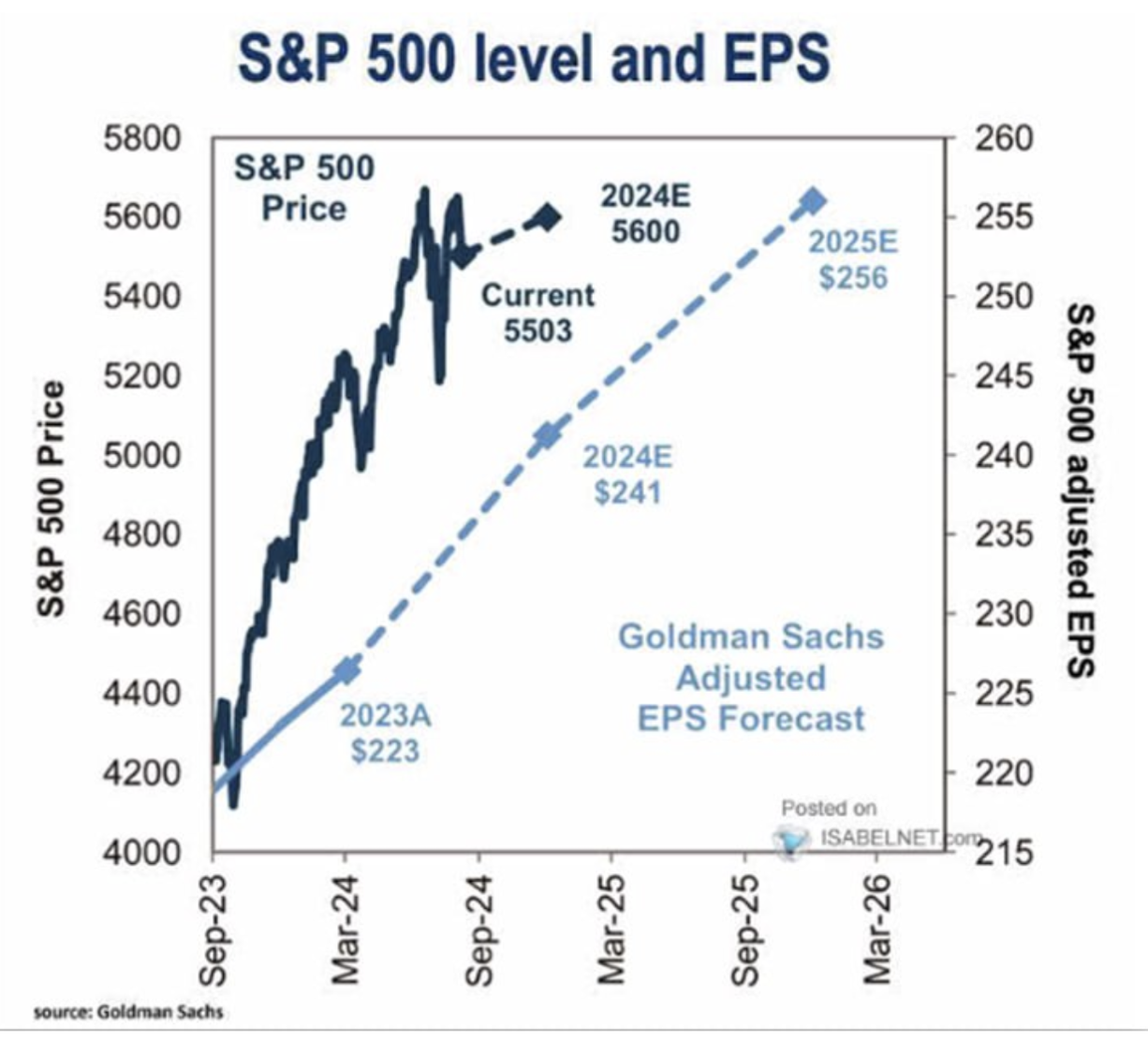

S&P 500 Forecast from Goldman Sachs

Goldman Sachs confirmed its S&P 500 year-end forecast. The base scenario is 5600, which corresponds to current levels.

TREASURY MARKET

Treasury Bonds UST10:

The bond market naturally continues to grow amid expectations of rate cuts. 10-year Treasuries rose by 0.39% over the week.

The market yield on 10-year US Treasuries (blue line) decreased by 0.08% to 3.68%. The yield on the BBB-rated corporate index (red line) decreased by 0.06% to 4.97%.

Compared to the previous week, the spread between them narrowed by 0.01% to 1.29%. Yields on both of these instruments are below the federal funds rate.

DXY

GOLD

The dollar index (see the upper graph) broke the lower boundary of a three-year horizontal channel. The dollar will remain under pressure until the end of this year. Gold is hitting new all-time highs. The future dynamics of all markets will depend not only on the size of rate cuts but also on regulators' forecasts and Powell's rhetoric at the press conference.

BTC

Bitcoin grew by 10% amid optimistic sentiment, returning to its horizontal channel, which from a technical analysis perspective opens the path for further growth. The informational background regarding the main cryptocurrency remains positive.

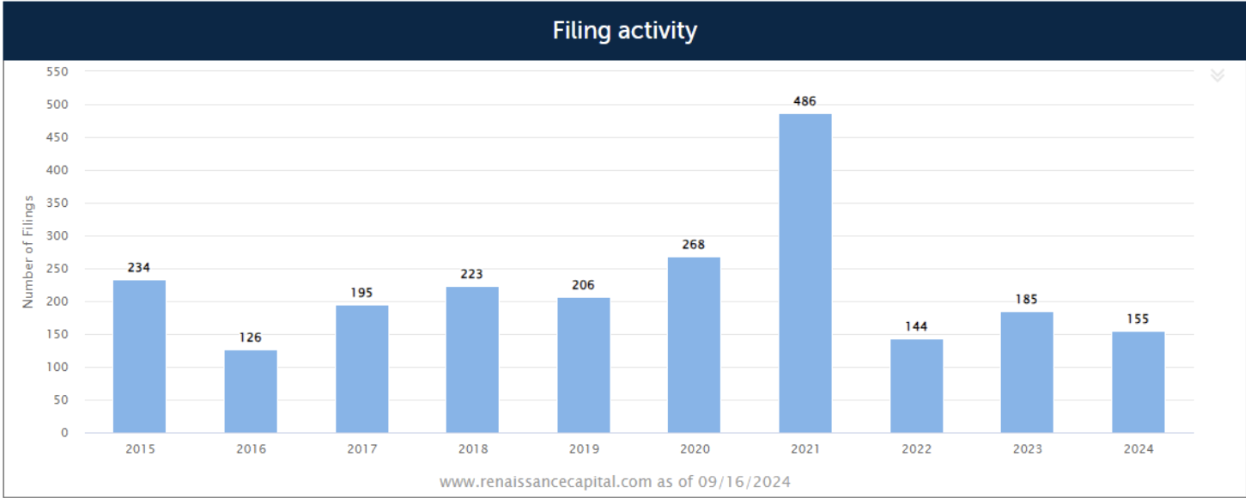

IPO

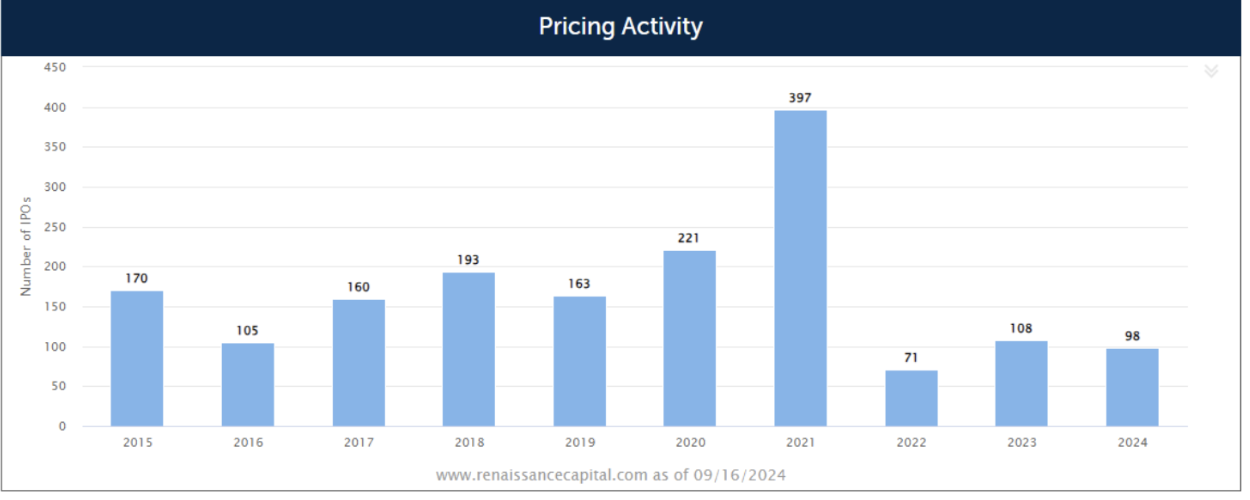

The IPO market continues to open up. This year, 155 IPO filings have been made, which is 27.0% more than at the same date last year.

There have been 98 IPOs, up 30.7% from the same date last year.

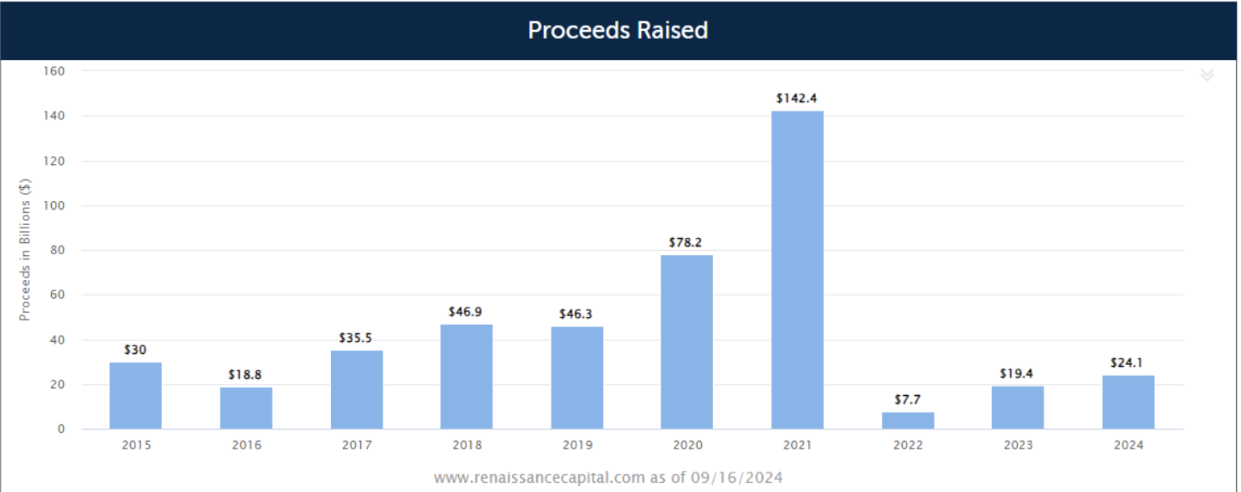

Total funds raised this year amounted to $24.1 billion, up 56.8% from the same date last year.

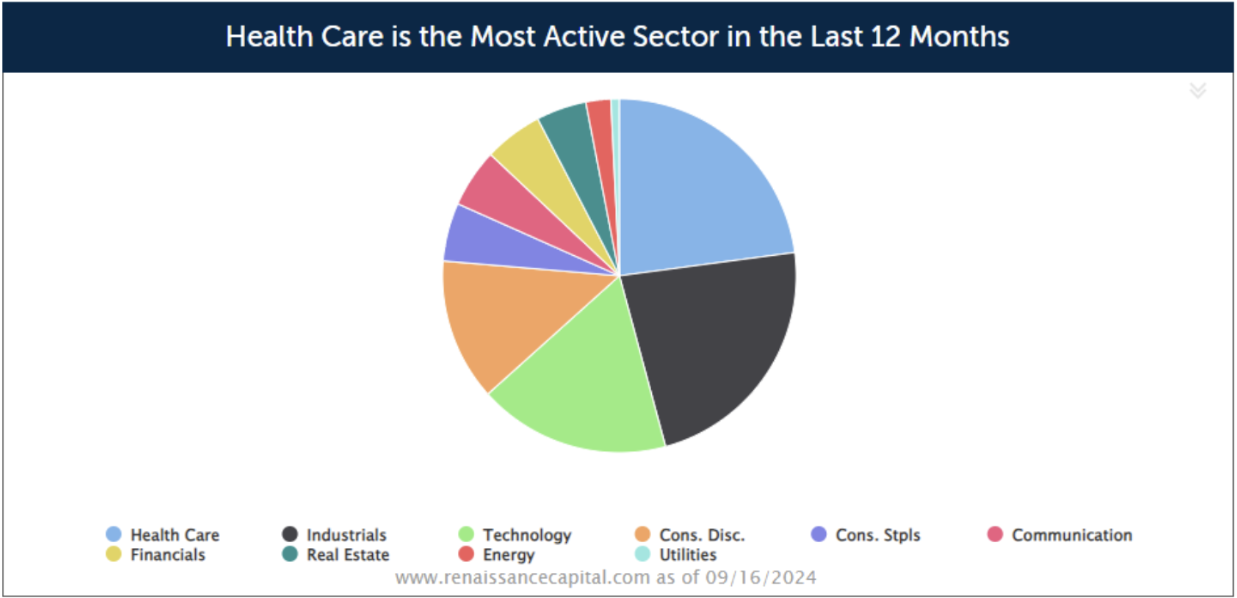

IPO industry breakdown:

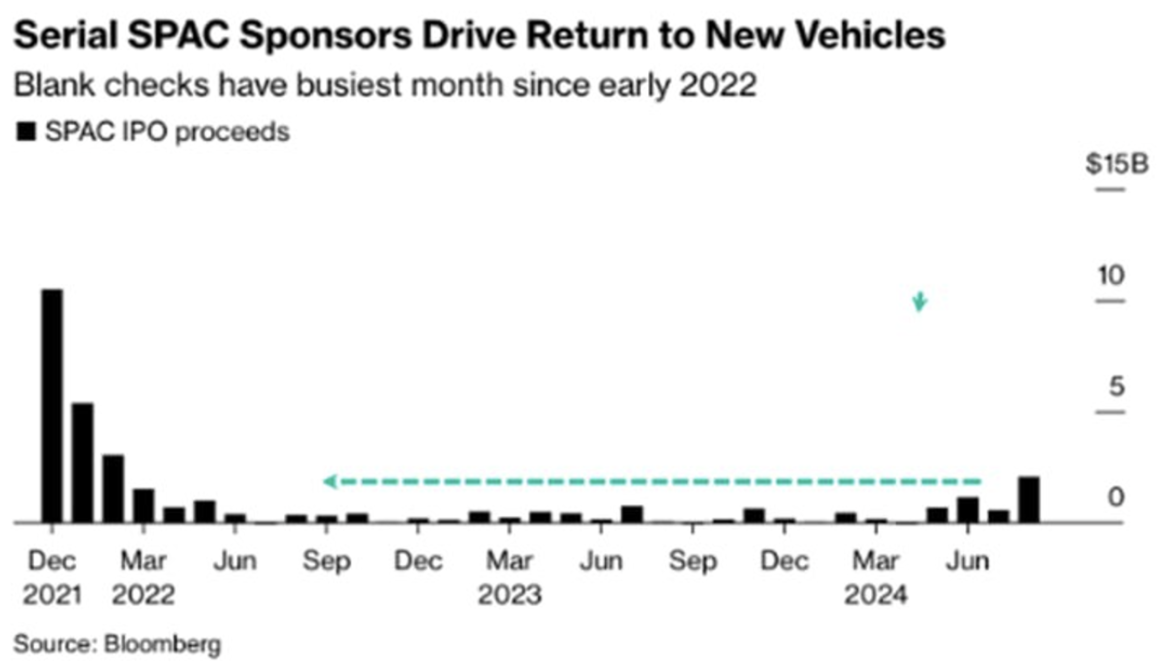

Dynamics of exit through SPAC.

The SPAC boom peaked in 2021 during the period of high monetary stimulus. Over the next two years, SPAC listings on public markets nearly disappeared.

However, as the Fed prepares to start a cycle of rate cuts, SPACs have begun to return. According to Bloomberg, in August, 9 SPAC companies conducted listings, raising $2.0 billion, marking the largest capital raise since March 2022.

SPAC deals are risky, but the growing volumes indicate that investors are willing to take risks. Overall, this is a positive indicator of IPO market recovery.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities".

Қазақша

Қазақша