The second FED meeting in 2024

Raison financial analyst's key insights

On Wednesday, the second Federal Open Market Committee (FOMC) meeting on monetary policy of the year took place. The main points are as follows:

- The Committee kept the rate at the current level of 5.25-5.50%;

- The Committee will continue to reduce the balance sheet according to previously announced plans ($95 billion per month);

- The Federal Reserve notes economic activity is expanding at a confident pace.

- Job growth is slowing, but the unemployment rate remains low. Inflation over the past year has decreased but remains high.

The FED's updated forecasts for 2024:

- GDP forecast raised from 1.4% to 2.1%;

- Unemployment forecast lowered to 4.0% from 4.1%;

- For core PCE (consumer inflation), the regulator expects growth to 2.6% from 2.4%;

- The forecast for the ERFF rate level in 2024 remains unchanged at 4.6% but was raised for 2025 and 2026 from 3.6% to 3.9% and from 2.9% to 3.1%, respectively.

Federal Reserve Chairman Jerome Powell's press conference main points:

- The Committee observes progress in reducing inflation, but the final result still needs to be guaranteed. Recent inflation data were slightly above expectations;

- The rate is at its peak in the current cycle and will likely be lowered later this year, but decisions will depend on incoming data. The focus for further rate actions shifts to the labor market — a significant weakening in the labor market would signal the start of a rate decrease, and conversely, high hiring rates could delay the beginning of the rate decrease;

- The Committee began discussing slowing the pace of balance sheet reduction, but there is no specific timing for the start of this process yet;

- Risks to achieving the Fed's goals are gradually becoming more balanced.

Comments

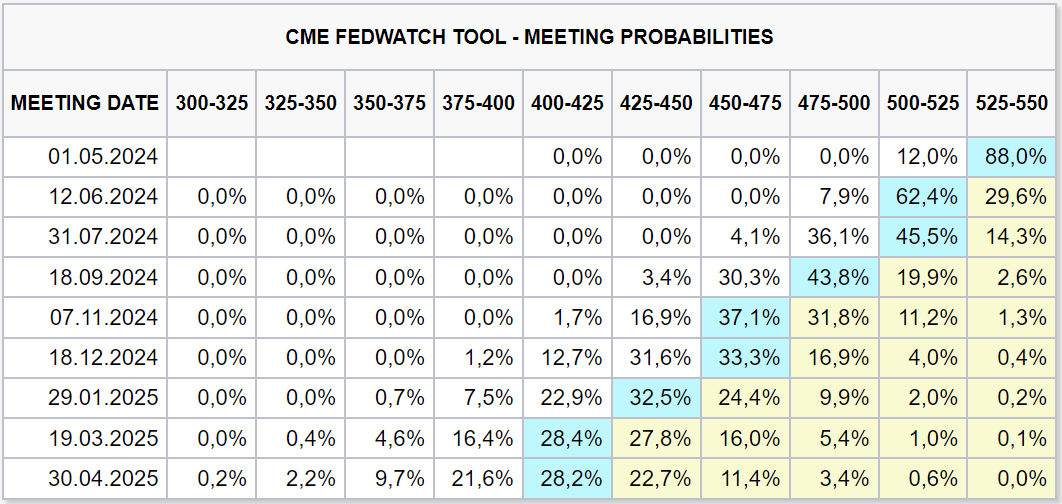

Powell's rhetoric was moderately dovish, “without surprises,” and essentially no different from the January press conference. First, it's worth noting that the Fed does not see a significant increase in inflationary risks based on the latest CPI data. Powell confirmed the likelihood of a reversal in monetary policy in 2024 but again did not specify any particular timelines (this was question #1 for markets). The Fed's forecasts suggest three rate cuts this year by 0.75% to 4.50-4.75%. This level matches market expectations for the end of 2024, while the FedWatch tool indicates the beginning of the rate cut at the June meeting (chart below).

Nothing specific was said regarding the start and pace of balance sheet reduction (QT). However, this process will likely be initiated soon. Since June 2023, the market value of US Treasury debt has increased by more than $2 trillion. The US Treasury's appetite was primarily covered by reverse repo liquidity, which has decreased by 77% from $2.16 trillion to $0.496 trillion. If the borrowing pace continues, this resource will be depleted around the middle of the year. A likely gap in demand and supply will force the Fed to roll back the quantitative tightening (QT) program. Based on this, the regulator can expect to make certain statements at the next FOMC meeting.

Market reaction to the FOMC meeting results:

*The SP500 rose by 1.5% and reached another all-time high of 5315.75; *Futures on long-term Treasury bonds rose by 0.4%; *The dollar index fell by 0.36%; *The strongest reaction was in gold. GS futures surged by 3.03% at one point — such a reaction to a safe-haven asset may indicate worsening market expectations regarding an “economic soft landing.”

Қазақша

Қазақша