September 29–October 3, 2025: Weekly economic update

Key market updates

Macroeconomic Statistics

INFLATION

- Core Consumer Price Index (CPI) (m/m) (August): 0,3% (previous: 0.3%)

- Consumer Price Index (CPI) (m/m) (August): 0.4% (previous: 0.2%)

- Core Consumer Price Index (CPI) (y/y) (August): 3.1% (previous: 2.9%)

- Consumer Price Index (CPI) (y/y) (August): 2.9% (previous: 2.7%)

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (August): 4.7% (prev: 4.8%)

- 5-year expected inflation (August): 3.7% (prev: 3.5%)

PRODUCER PRICE INDEX (PPI)

- PPI (m/m) (August): -0.1%, prev: 0.7%

- Core PPI (m/m) (August): -0.1%, prev: 0.7%

GDP (U.S. Bureau of Economic Analysis, BEA) (Q2 2025, annualized, second estimate): +3.8% (advance estimate: 3.30%; Q1 2024: – 0.5%):

Atlanta Fed GDPNow estimate (Q2): 3.8% (vs. 3.9%).

(The GDPNow forecasting model provides a “real-time” estimate of official GDP growth ahead of its release, using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.) The Federal Reserve’s preferred inflation gauge — the Personal Consumption Expenditures (PCE) index — for August:

- PCE: 2.7% (vs. 2.6%); Core PCE: 2.9% (vs. 2.9%)

Business Activity Index (PMI):

(Above 50 indicates expansion; below 50 indicates contraction)

- Services sector (August): 54.2 (previous: 54.5)

- Manufacturing sector (July): 52.0 (previous: 53,0)

- S&P Global Composite (August): 53.9 (previous: 53.6)

LABOR MARKET:

- Unemployment rate (August): 4.3% (previous: 4.2%)

- Change in nonfarm payrolls (August): 22K (previously revised: 79K)

- Change in U.S. private nonfarm payrolls (August): 38K (previous: 77K)

- Average hourly earnings (August, y/y): +3.7% (previous: +3.9%)

- JOLTS job openings (August): 7.227M (vs. 7.181M)

- Total number of individuals receiving unemployment benefits in the US: 1,926K (vs 1,920K).

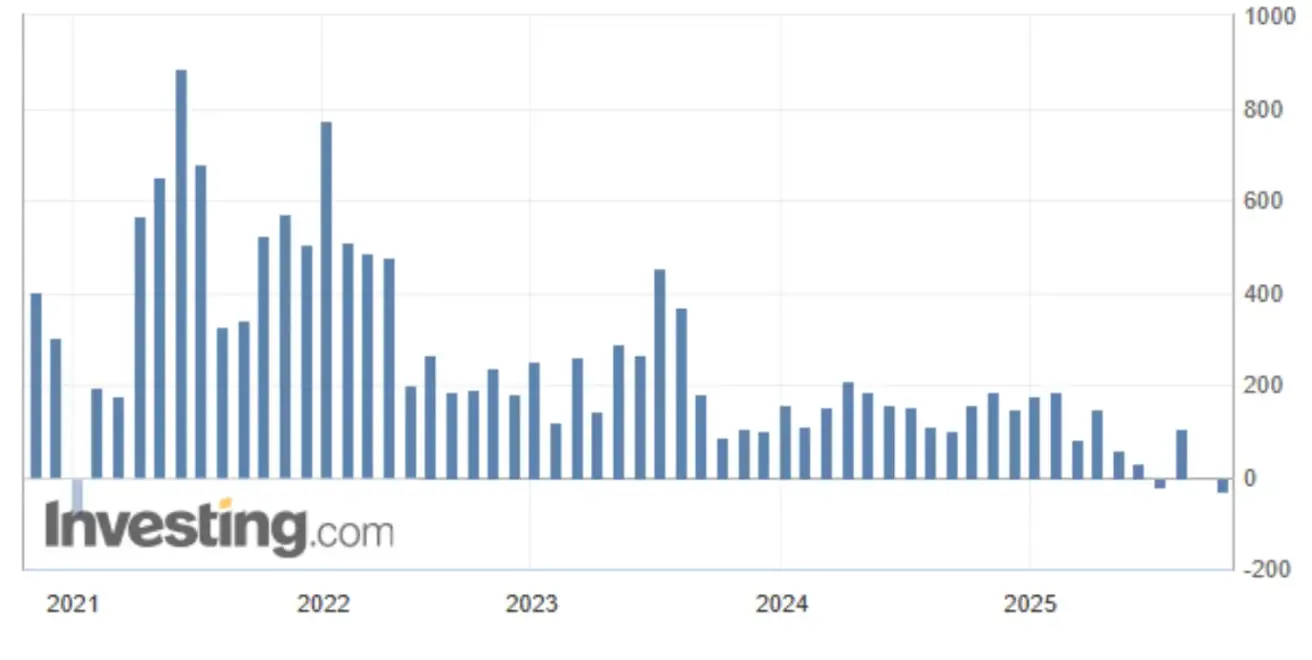

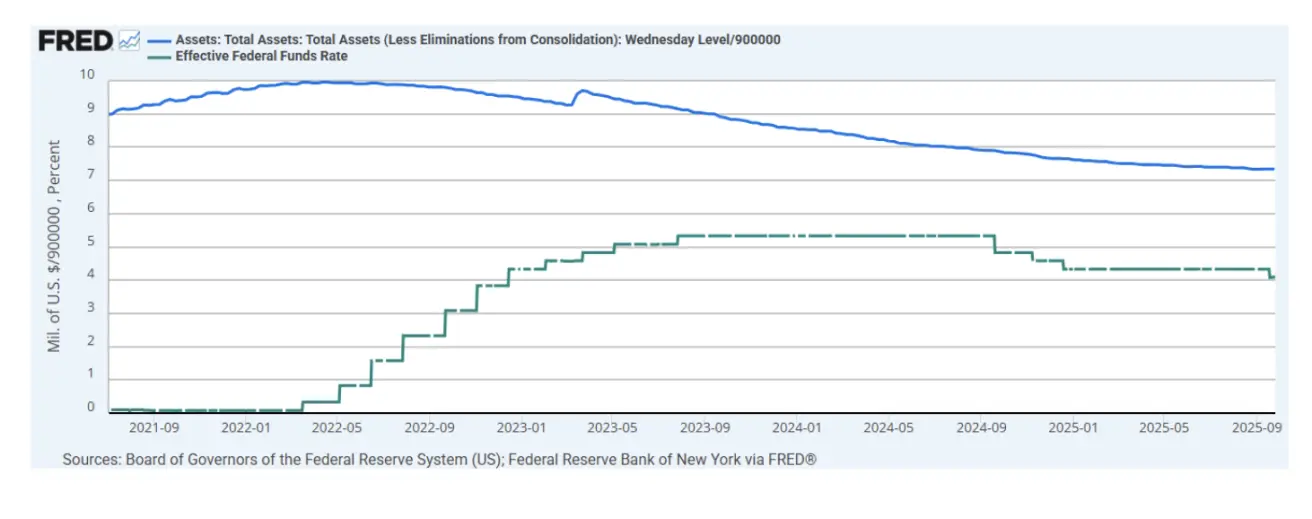

MONETARY POLICY

- Federal Funds Effective Rate (EFFR): 4.00% - 4.25% (unchanged)

- Federal Reserve balance sheet increased: $6,587T (vs. previous week: $6,608T)

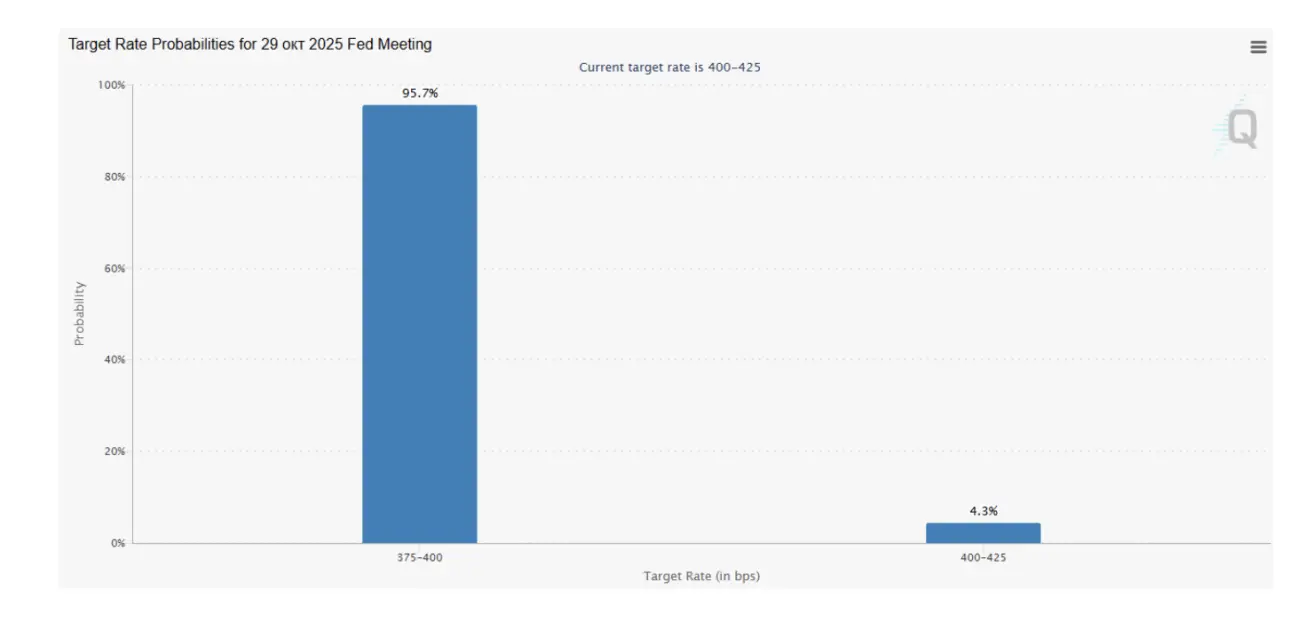

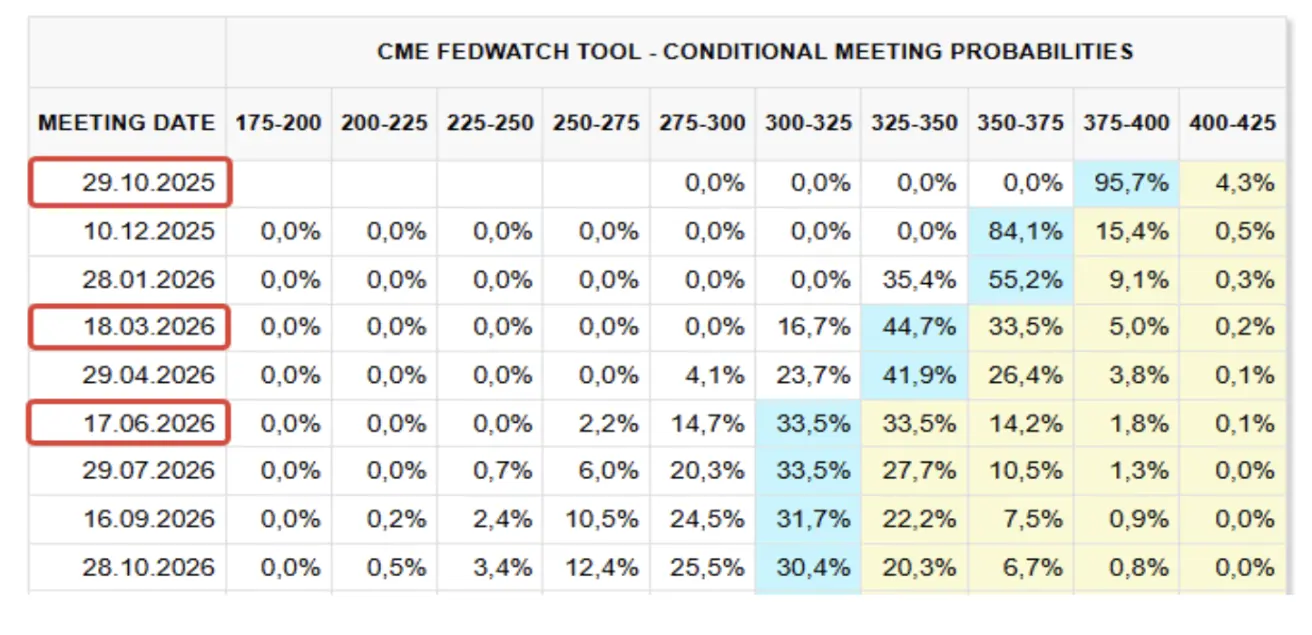

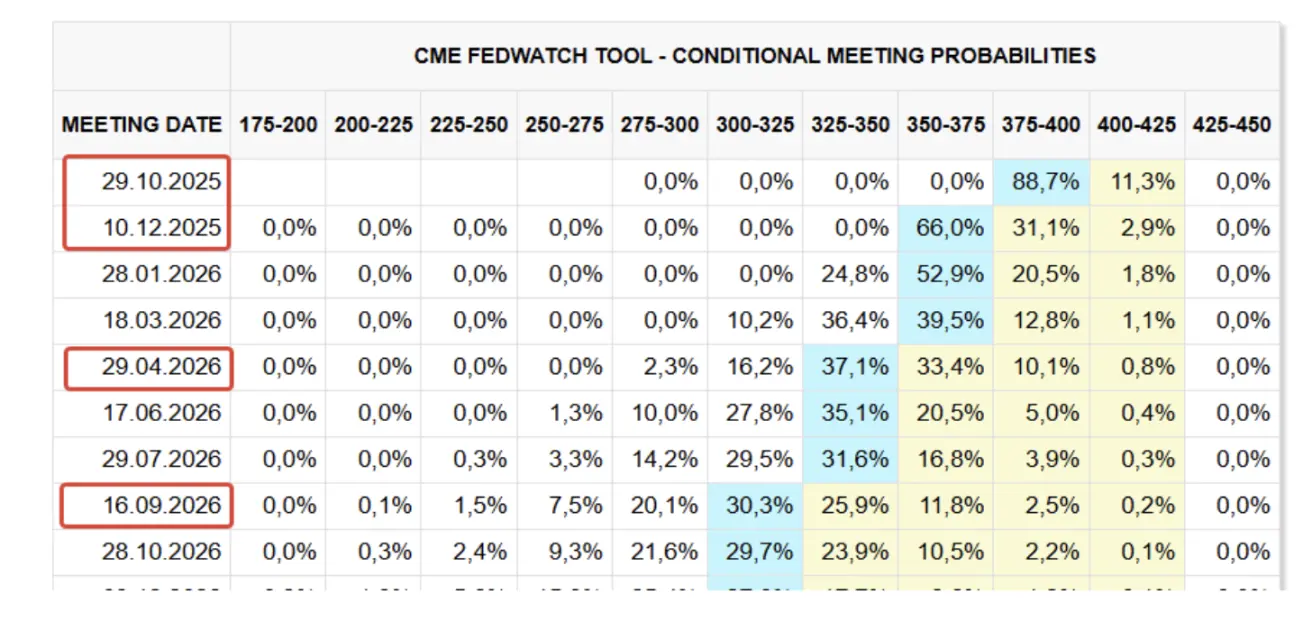

MARKET FORECAST FOR RATE (FEDWATCH)

Expectations for the upcoming FOMC meeting on October 29:

Today:

А week earlier:

Commentary

Last week, a broadly sustained risk-on sentiment persisted across most markets, despite the announcement of a government shutdown in the United States. The federal government has officially suspended operations after Congress missed the funding deadline, triggering the first shutdown in seven years.

Cause: The two parties failed to reach an agreement on healthcare funding.

During Trump’s first term in 2018, there were two shutdowns, and this marks the third in the current administration. Approximately 750,000 federal employees have been placed on unpaid leave, and many public services have been halted. A vote on reopening the government is scheduled for Wednesday, the day after tomorrow.

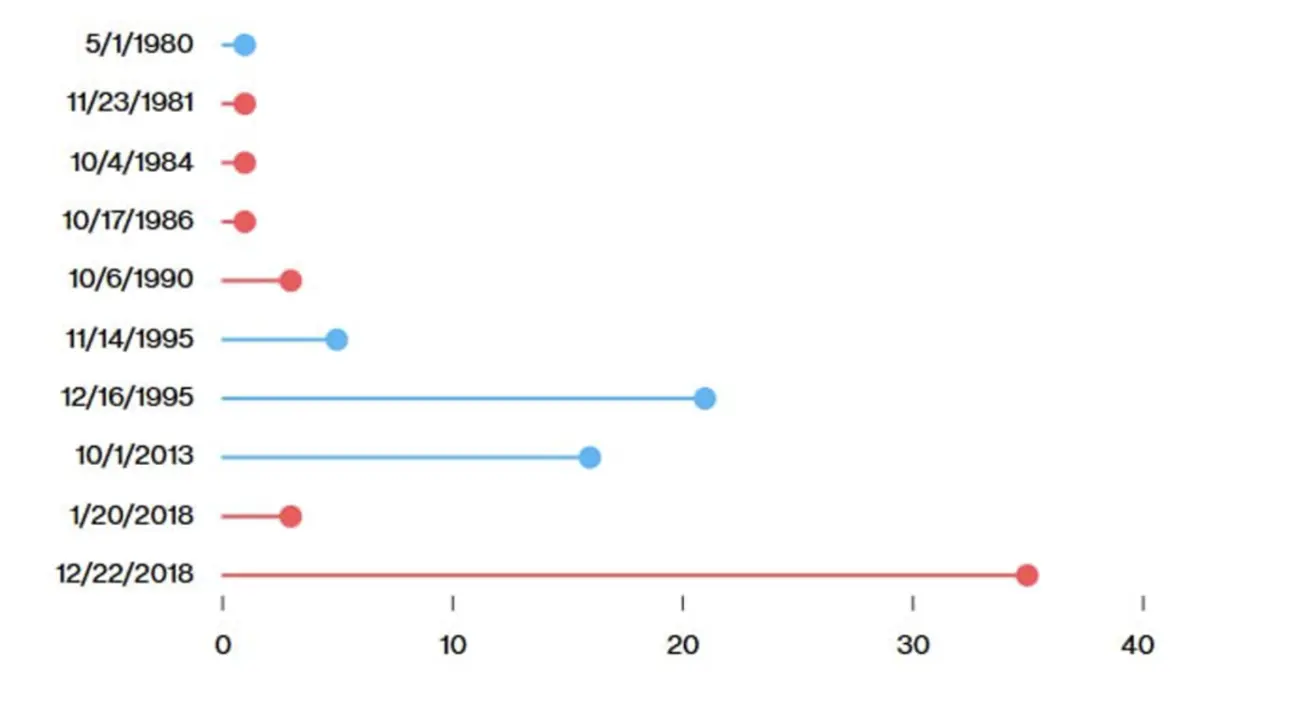

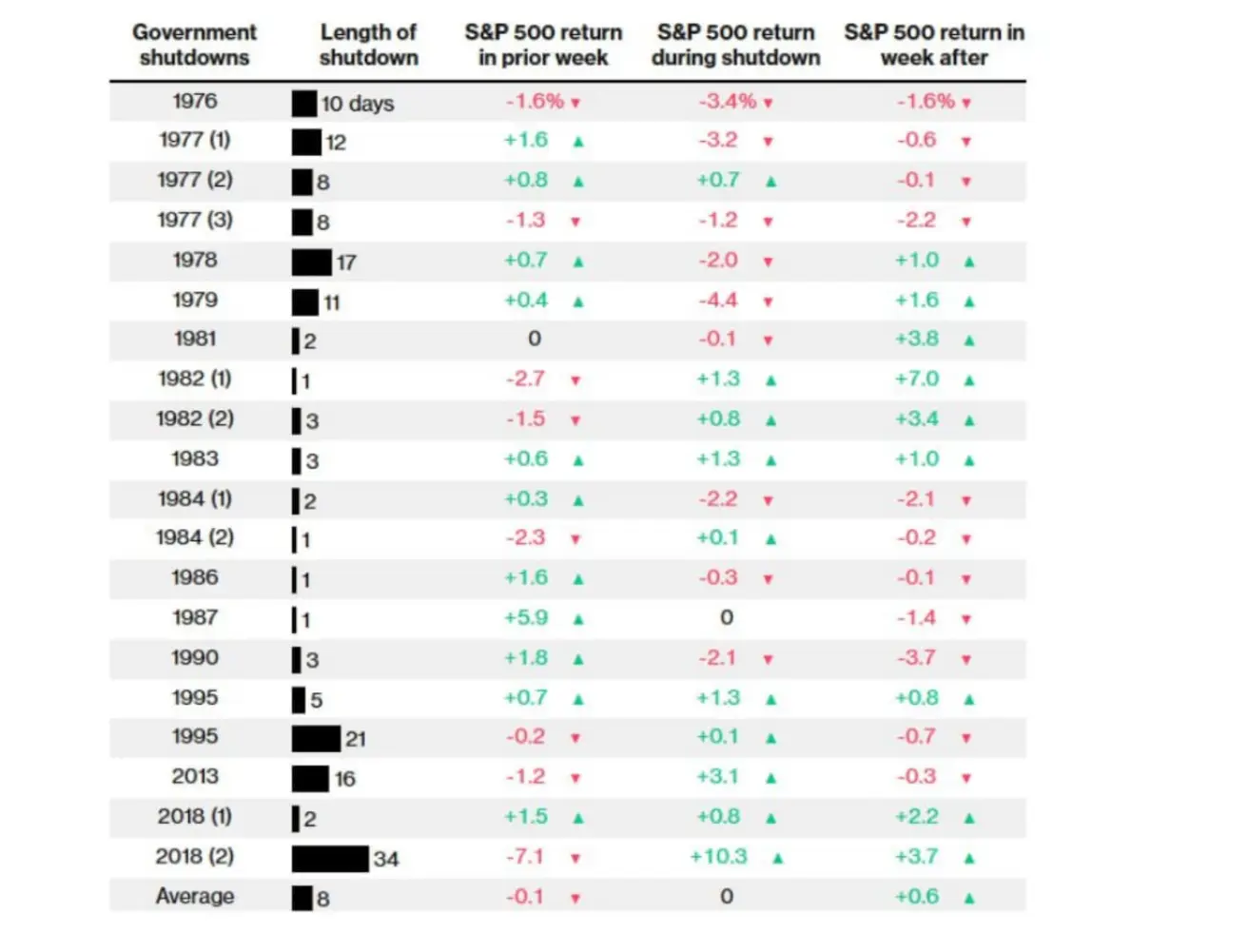

Historically, government shutdowns last from one week to a month on average. Blue indicates Democratic administrations; red represents Republican administrations. The horizontal axis reflects duration in days.

Source: Congressional Research Service.

The release of new macroeconomic data — including inflation, labor market indicators, and other key statistics — may now be delayed. According to some estimates, a three-week shutdown could push unemployment from 4.3% to 4.7%. At this point, the risk balance for the Federal Reserve has clearly shifted toward labor-market conditions.

In addition to the Bureau of Labor Statistics (BLS), data is also published by the ADP Research Institute. Private employers cut 32,000 jobs in September (vs. -3,000 in August). The release notes that the underlying trend remains unchanged: the labor market continues to cool, job creation is slowing across most sectors, and employers are becoming more cautious in hiring. In the absence of BLS data, these figures support the case for rate cuts.

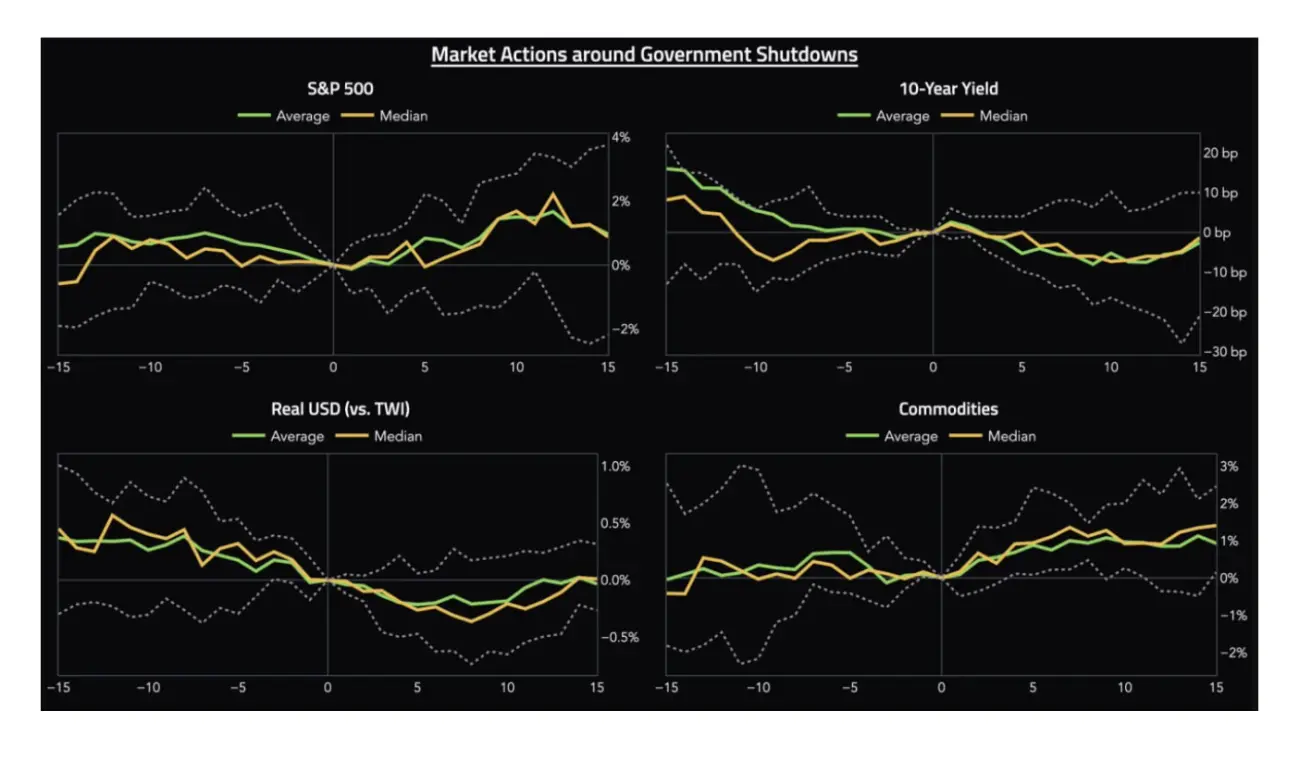

The shutdown naturally adds uncertainty, particularly under a Trump presidency. The duration remains unclear, but historically, shutdowns have not exerted significant negative pressure on financial markets.

Market performance around U.S. government shutdowns since 1976, measured in the days before and after the event, shows a consistent pattern: on both the mean and the median, the S&P 500 gained about 1% over the two-week period, 10-year Treasuries and the dollar remained broadly unchanged, and the commodities sector posted gains slightly above 1%.

Impact of U.S. Government Shutdowns on the S&P 500 by Year

Impact of U.S. Government Shutdowns on the S&P 500 by Year

Source: Truist.

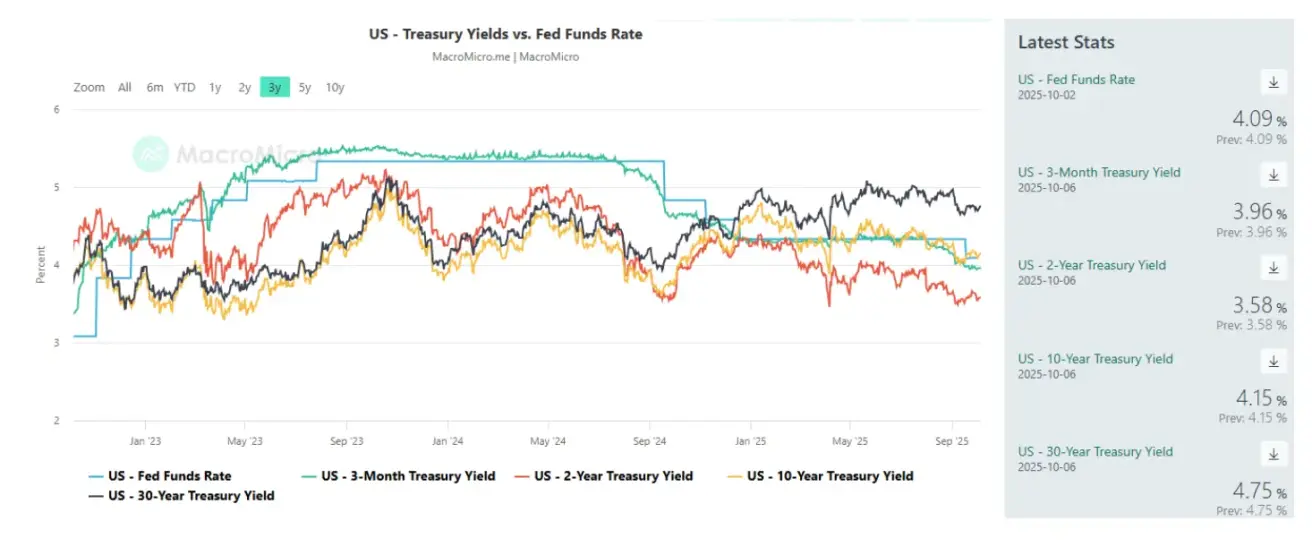

The Federal Reserve continues to reduce its balance sheet, albeit at a slower pace, and the federal funds rate currently stands at 4.00–4.25%.

Susan M. Collins, President of the Federal Reserve Bank of Boston, has noted that further moderate monetary easing in 2025 may be appropriate.

Market Expectations — FedWatch:

-

Next FOMC meeting (29 October): the implied probability of a 25 bps rate cut is 95.7%, indicating one reduction by year-end.

-

Next 12 months: markets are pricing in three 25 bps cuts, bringing the target range to 3.00–3.25%.

Market

For the week, the market posted a median decline of +0.55%. The strongest performance came from the Energy, Basic Materials, and Utilities sectors, while the Consumer Staples, Real Estate, and Technology sectors lagged behind.

Year to date (YTD), the market is up +4.35%. The top-performing sectors are Basic Materials, Communication Services, and Utilities, while the laggards are Consumer Staples, Health Care, and Technology.

SP500

The S&P 500 index ended the week up +1,08%, closing at 6,715.78. Year to date, the index is up +13.76%.

NASDAQ100

The Nasdaq 100 ended the week up +1,15%, closing at 24785,52. Year to date, the index is up +17.36%.

Euro Stoxx 600

The Euro Stoxx 600 has broken through a seven-month resistance level and also reached a new all-time high of 572 points. ended the week up 2.68%, closing at 571.8. Year to date, the index has gained +10.15%.

CSI 300 Index

The CSI 300 Index closed the week at 4,640.69, up 0.45%, with a year-to-date gain of 18.05%.

Hang Seng TECH Index (HSTECH.HK)

The Hang Seng TECH Index (HSTECH.HK) opened Monday up 4.72%, at 6622,85. Year to date, the index has advanced +49.27%.

BOND MARKET

The 20+ Year U.S. Treasury Bond ETF (TLT) ended the week up 0.54%, closing at 89.38. Year to date, the fund is up +1.80%.

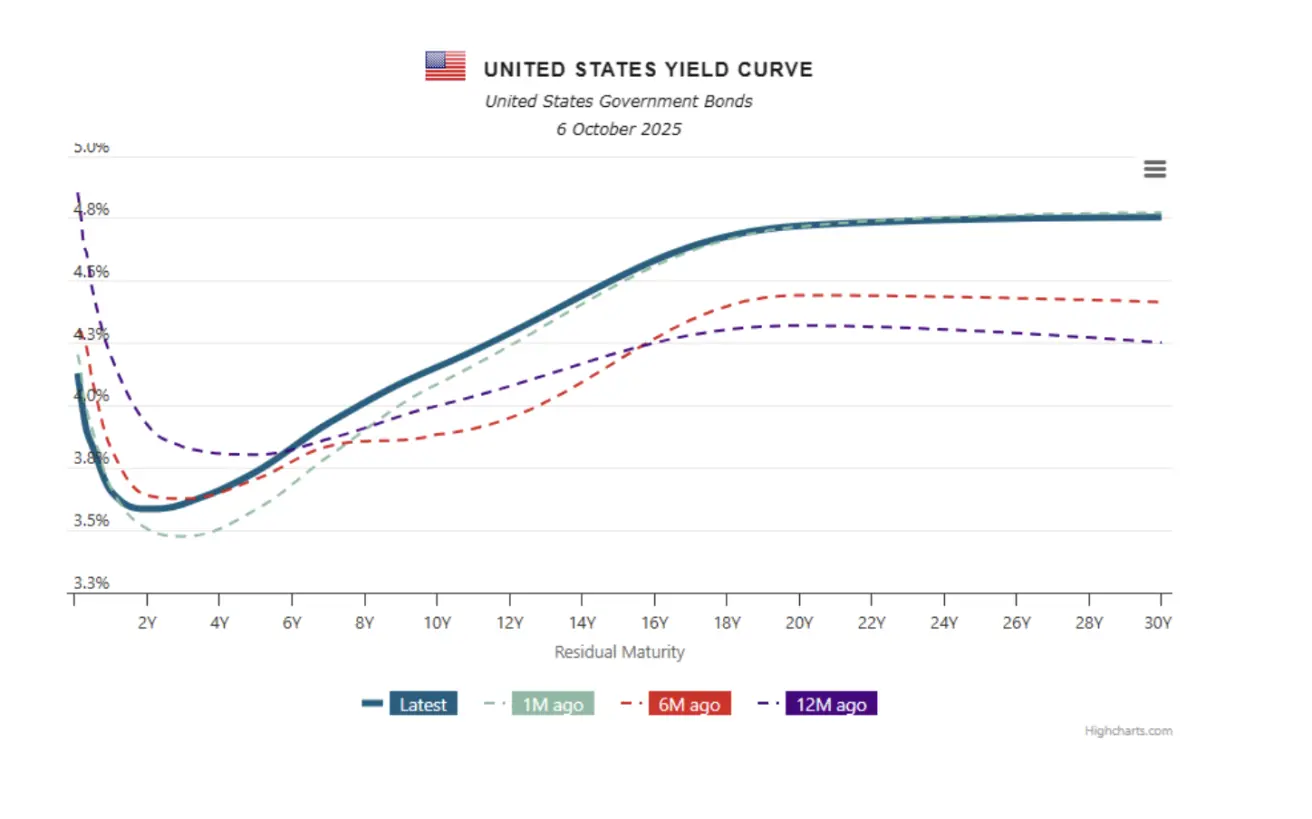

YIELDS AND SPREADS

-

Market yield on U.S. Treasury securities (10-year constant maturity): 4.15% (vs. 4.16%).

-

ICE BofA BBB U.S. Corporate Index effective yield: 4.95% (vs. 4.97%).

-

Yield spread — 10-year vs. 2-year Treasuries: 57.0 bps (vs. 53.0 bps).

-

Yield spread — 10-year vs. 3-month Treasuries: 19.0 bps (vs. 19.0 bps).

The cost of a 5-year U.S. Credit Default Swap (CDS) is 37.30 basis points.

GOLD FUTURES (GC)

The gold futures (GC) contract ended the week up 3.23%, closing at $3,912.1 per troy ounce. Year to date, it has gained +48.13%.

DOLLAR INDEX FUTURES (DX)

The U.S. Dollar Index futures (DX) ended the week down 0.44%, closing at 97.410. Year to date, the index is down –10.08%.

OIL FUTURES

The crude oil futures (CL) contract ended the week down -6.90%, closing at $60.69 per barrel. Year to date, it is down –15.53%.

BTC FUTURES

Bitcoin ended the week up 13.22%, closing at $12445. Year to date, it has gained +30.62%.

ETH FUTURES

Ethereum ended the week up 13.29%, closing at $4581.0. Year to date, it has gained +35.37%.

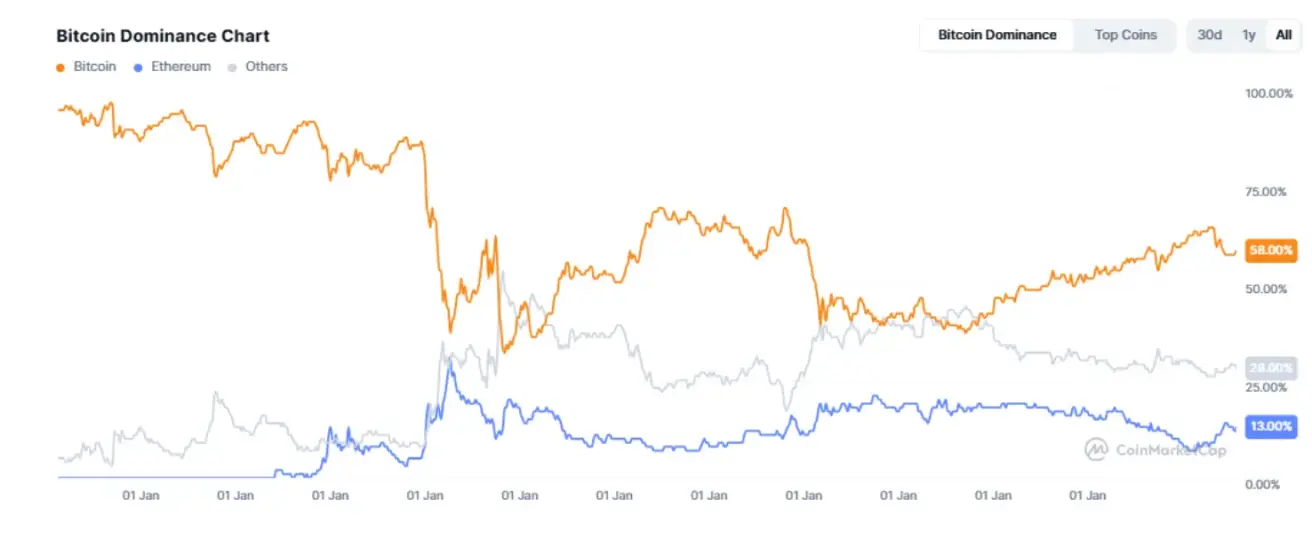

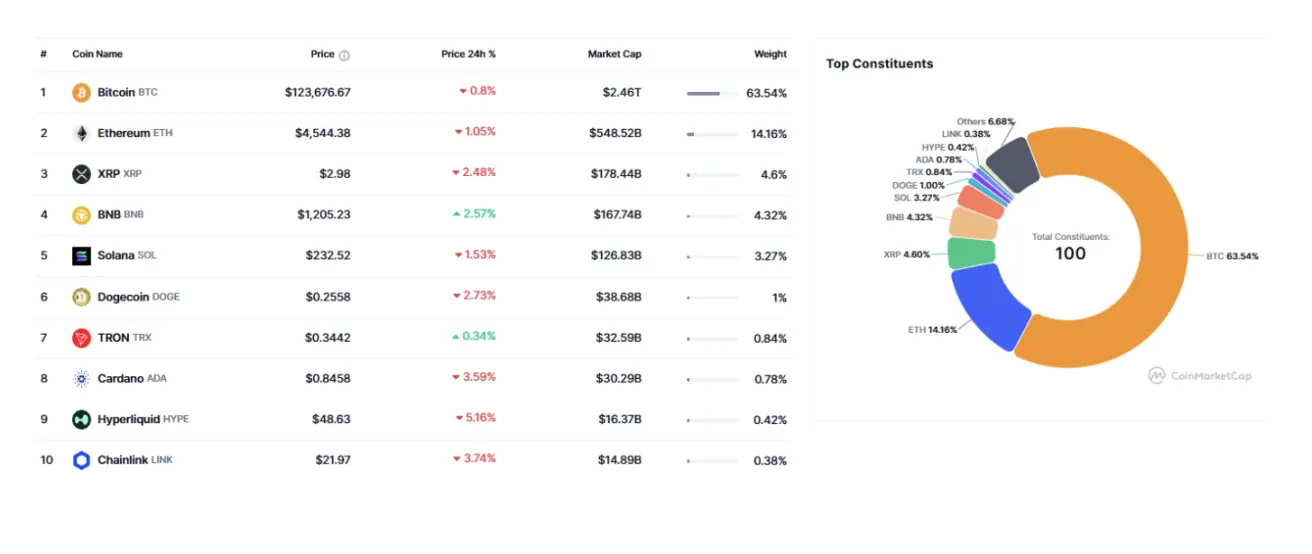

The total cryptocurrency market capitalization stands at $4.22 trillion (vs. $3.86 trillion a week earlier) (source: CoinMarketCap).

- Bitcoin’s share is 57.8% (vs. 57.7%),

- Ethereum’s share is 13.0% (vs. 13.0%),

- Other assets account for 28.7% (vs. 29.3%).

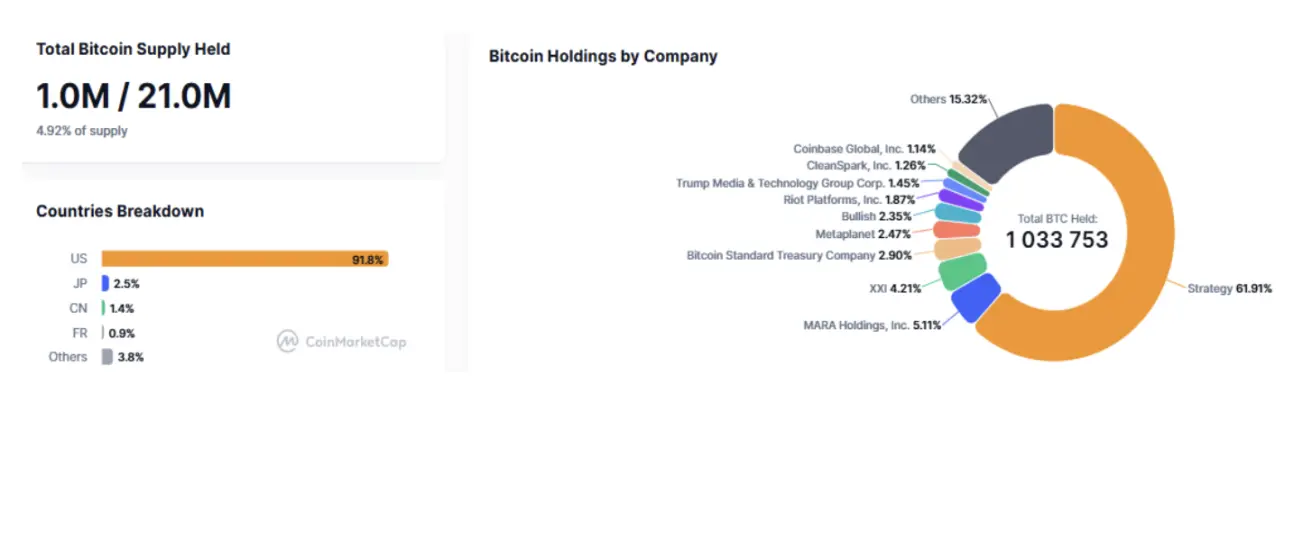

Public companies with a Bitcoin treasury strategy hold 4.92% of the total Bitcoin supply (vs. 4.92% a week earlier) — the share remained unchanged from the prior week’s level.

CoinMarketCap Top 10 Index Constituents:

Massachusetts will hold hearings on the Bitcoin Strategic Reserve bill on October 7.

English

English Қазақша

Қазақша