1–5 сентября 2025 года: Еженедельный экономический обзор

Ключевые обновления по рынкам

Макроэкономическая статистика

ИНФЛЯЦИЯ

- Базовый индекс потребительских цен (CPI) (м/м) (июнь): 0,3% (предыдущее значение: 0.2%)

- Индекс потребительских цен (CPI) (м/м) (июнь): 0.2% (предыдущее значение: 0.3%)

- Базовый индекс потребительских цен (CPI) (г/г) (июнь): 3.1% (предыдущее значение: 2.9%)

- Индекс потребительских цен (CPI) (г/г) (июнь): 2.7% (предыдущее значение: 2.7%)

ИНФЛЯЦИОННЫЕ ОЖИДАНИЯ (МИЧИГАН)

- Ожидаемая инфляция на горизонте 12 месяцев (август): 4.8% (пред.: 4.9%)

- Ожидаемая инфляция на горизонте 5 лет (август): 3.5% (пред.: 3.4%)

ИНДЕКС ЦЕН ПРОИЗВОДИТЕЛЕЙ (PPI):

- PPI (м/м) (август): 0.9%, пред.: 0.0%

- Базовый PPI (м/м) (август): 0.9%, пред.: 0.0%

ВВП (Бюро экономического анализа США, BEA) (2 кв. 2025, в годовом выражении, вторая оценка): +3.30% (предварительная оценка: 3.0%; 1 кв. 2024: –0.5%):

Прогноз Atlanta Fed GDPNow (2 кв.): 3.0% (против 3.5%).

*(Модель прогнозирования GDPNow предоставляет «оперативную» оценку официального роста ВВП до его публикации, используя методологию, аналогичную методологии Бюро экономического анализа США.)

Индекс деловой активности (PMI):

(Выше 50 — расширение; ниже 50 — сокращение)

- Сектор услуг (август): 55.4 (предыдущее значение: 55.7)

- Обрабатывающий сектор (июль): 53.0 (предыдущее значение: 53,3)

- S&P Global Composite (август): 54.6 (предыдущее значение: 55.4)

РЫНОК ТРУДА:

- Уровень безработицы (август): 4.3% (предыдущее значение: 4.2%)

- Изменение занятости в несельскохозяйственных отраслях (август): 22 тыс. (предыдущее значение: 79 тыс., пересмотрено)

- Изменение занятости в частном несельскохозяйственном секторе США (август): 38 тыс. (пред.: 77 тыс.)

- Средняя почасовая заработная плата (август, г/г): 3.7% (предыдущее значение: 3.9%)

- Вакансии по данным JOLTS (август): 7.181 млн (против 7.357 млн)

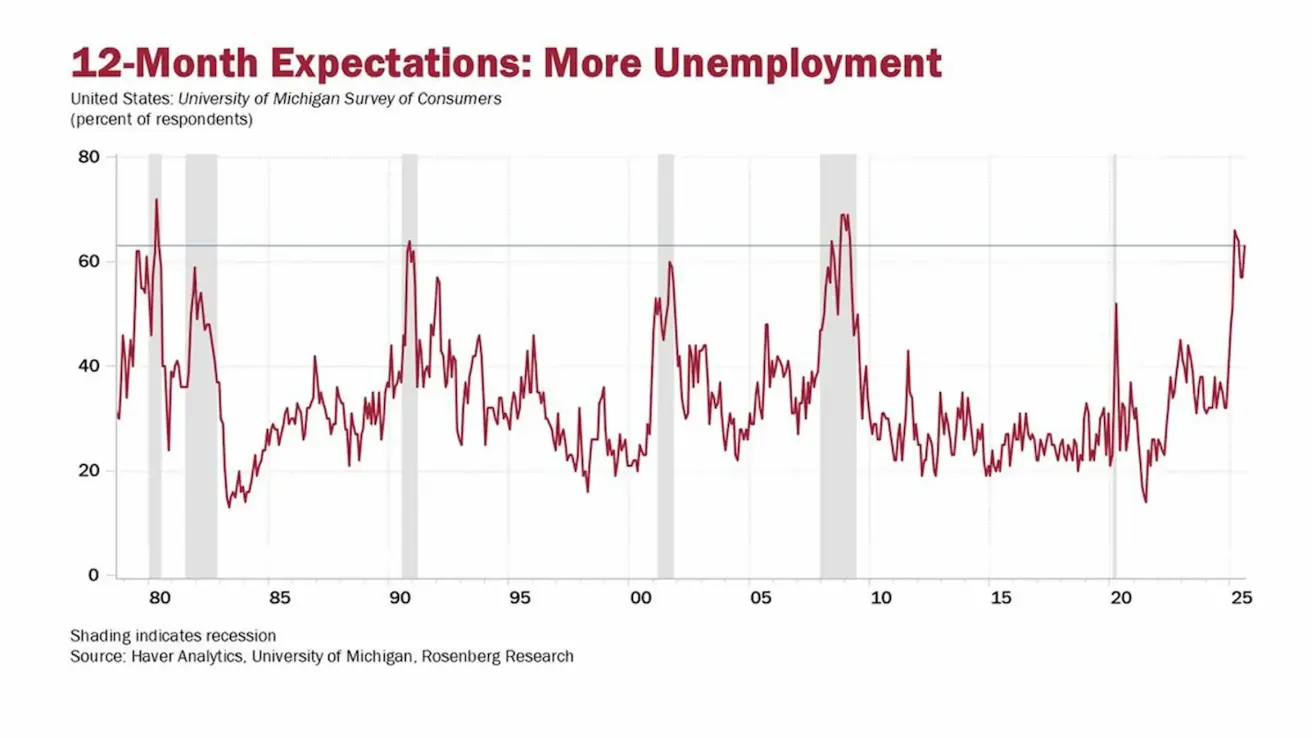

Согласно опросам, более 62% экономических агентов ожидают роста безработицы.

ДЕНЕЖНО-КРЕДИТНАЯ ПОЛИТИКА

- Эффективная ставка по федеральным фондам (EFFR): 4.25%–4.50% (без изменений)

- Баланс Федеральной резервной системы увеличился: $6,602T (против предыдущей недели: $6,603T)

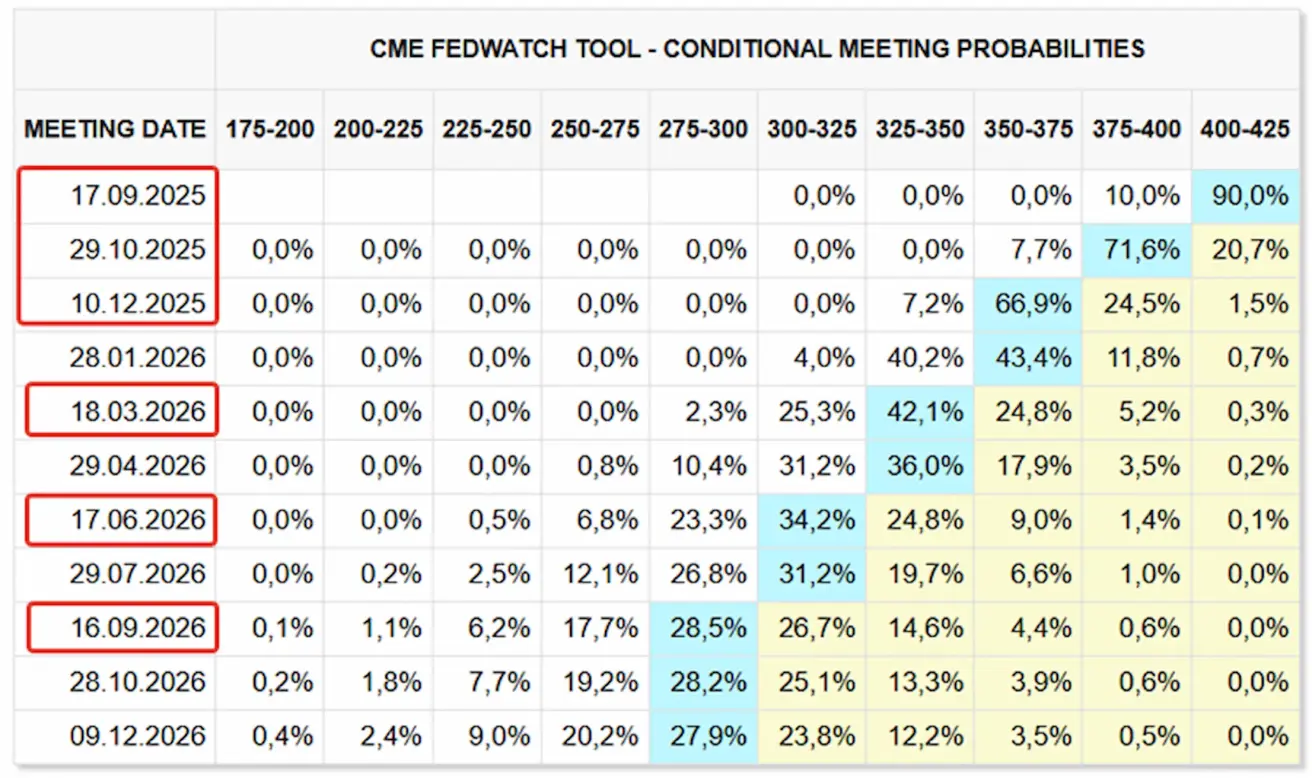

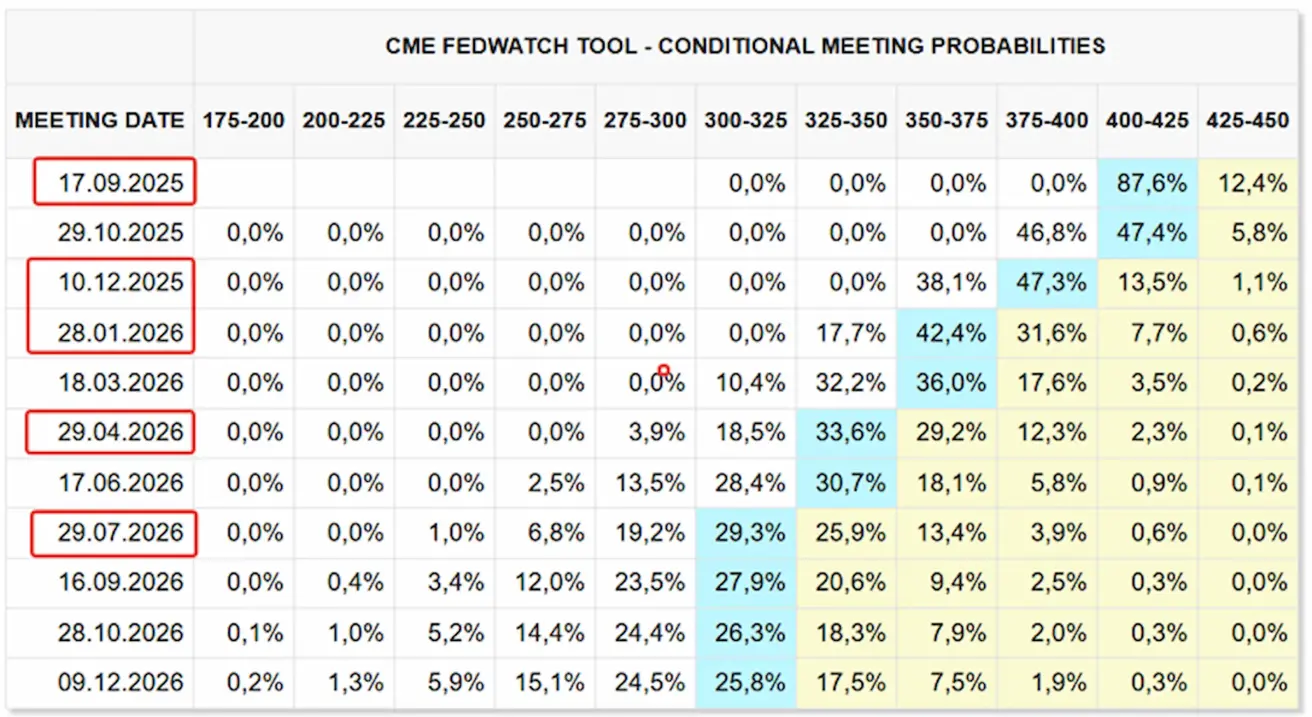

РЫНОЧНЫЙ ПРОГНОЗ ПО СТАВКЕ

На сегодня:

Неделей ранее:

Комментарий

Данные по рынку труда США (второй мандат ФРС) продемонстрировали заметное охлаждение.

Уровень безработицы вырос на 0.1 п.п., до 4.3% — не критично, но все же рост. Занятость в частном секторе увеличилась всего на 38 тыс., значительно ниже ожиданий. Количество вакансий продолжило сокращаться, а первичные заявки на пособие по безработице — расти.

Опросы Javier и Мичиганского университета указывают на пиковые ожидания роста безработицы, что согласуется с недавними комментариями корпоративных руководителей о сокращении численности персонала в последнем отчетном периоде.

Bottom line: вероятность одновременного роста инфляции и безработицы повышена. Доминирующий рыночный сценарий по-прежнему сосредоточен на снижении ставки ФРС.

Рыночные ожидания по данным FedWatch:

- К ближайшему заседанию (17 сентября): подразумеваемая вероятность снижения ставки составляет 90.0%.

- На горизонте следующих 12 месяцев: закладывается шесть снижений по 25 б.п., что опустит целевой диапазон до 2.75–3.00%.

- К концу года: уже ожидаются три снижения.

«Beige Book» ФРС:

- В большинстве из 12 округов были зафиксированы «минимальные или отсутствующие изменения» экономической активности; лишь немногие отметили умеренный рост.

- Во всех округах контакты сообщили о снижении потребительских расходов, так как рост заработной платы домохозяйств отстает от роста цен.

- Тарифы президента США Дональда Трампа оказали давление на экономику: 10 из 12 округов сообщили о «умеренной до умеренно высокой» инфляции, в то время как в двух оставшихся были зафиксированы «значительные повышения цен на сырье и материалы».

- Респонденты часто называли экономическую неопределенность и тарифы ключевыми встречными ветрами.

Ключевые выводы по итогам заседания Национального банка Казахстана – риторика стала немного более жесткой

- Центральный банк принял решение сохранить базовую ставку на уровне 16.5% (коридор ±1 п.п.) с учетом все еще повышенной инфляции, которая в настоящее время составляет 11.8% г/г.

- Регулятор отметил, что вклад продовольственных товаров в годовую инфляцию сейчас превысил вклад услуг, которые ранее оставались основным драйвером роста цен. Инфляция в секторе услуг замедлилась, частично вследствие более медленного роста регулируемых тарифов.

- Месячная инфляция снизилась до 0.7%, но остается значительно выше долгосрочного среднего значения 0.4% (2015–2024 годы).

- Среднесрочные прогнозы оставлены без изменений: инфляция ожидается на уровне 11–12.5% в 2025 году, 9.5–11.5% в 2026 году и 5.5–7.5% в 2027 году.

- Прогноз роста ВВП на 2025 год был пересмотрен вверх до 5.5–6.5%, прогноз на 2026 год сохранен на уровне 4–5%.

- Отсутствие существенного замедления инфляции в ближайшие месяцы станет основанием для дальнейшего ужесточения монетарных условий в целях возвращения инфляции к среднесрочной цели в 5%. Исходя из этого, Комитет по монетарной политике на предстоящих заседаниях рассмотрит целесообразность повышения ставки.

Рынок

По итогам недели медианное изменение составило +0.07%. Лидирующие сектора: базовые материалы, недвижимость и сектор потребительских товаров третьей необходимости.

Доходность с начала года (YTD): +3.58%. Лидирующие сектора по-прежнему коммунальные услуги, базовые материалы и коммуникационные услуги. Основные аутсайдеры — технологии (-5.33%) и здравоохранение (-8.68%).

SP500

Недельный рост: +0.33% (неделя закрылась на уровне 6,481.51). Доходность с начала 2025 года: +9.80%.

NASDAQ100

Недельный результат: +1.01% (неделя закрылась на уровне 23,652.44). С начала года: +11.99%.

Euro Stoxx 600

Недельный результат: +0.15% (неделя закрылась на уровне 552.0). Рост с начала года: +9.18%.

Индекс CSI

На понедельник: +1.60% (неделя закрылась на уровне 4,467.47). Рост с начала года: +13.65%.

Индекс Hang Seng TECH (HSTECH.HK)

На понедельник: -0.83% (5,750.69).

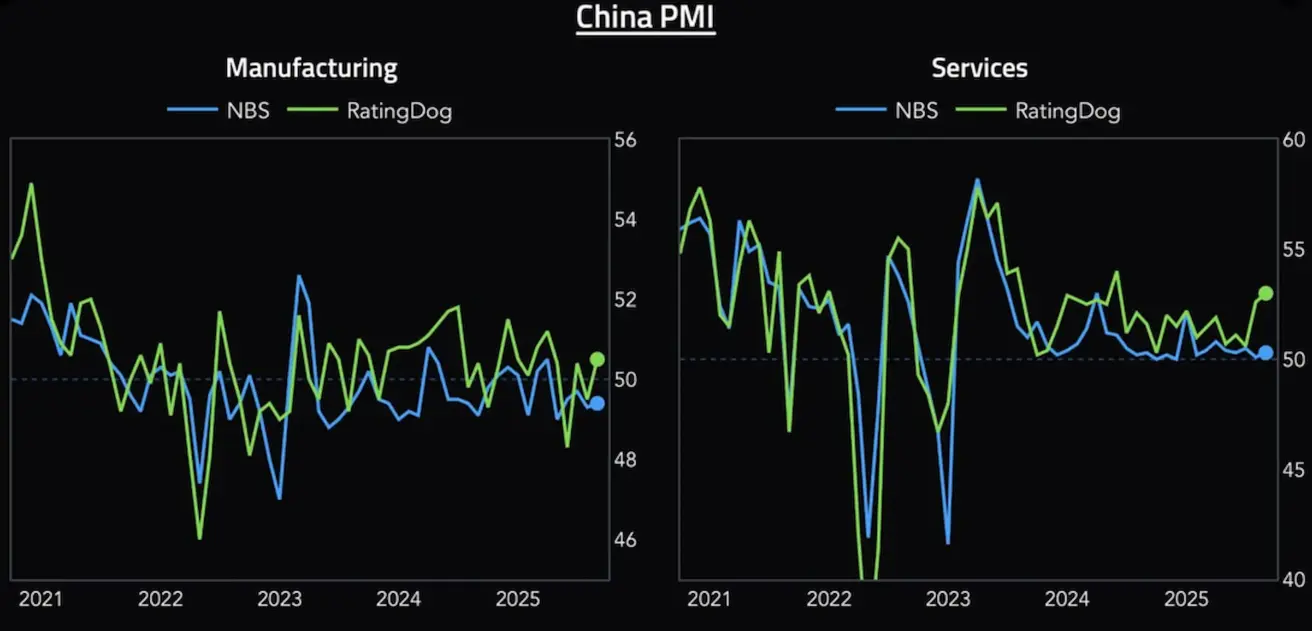

Производственный PMI Китая (RatingDog, ранее Caixin) вернулся в зону расширения, поднявшись до пяти-месячного максимума 50.5 на фоне самого сильного с марта роста новых заказов. Подъем был обусловлен внутренним спросом, поскольку новые экспортные заказы продолжали сокращаться. Индекс деловой активности в секторе услуг также вновь перешел к росту.

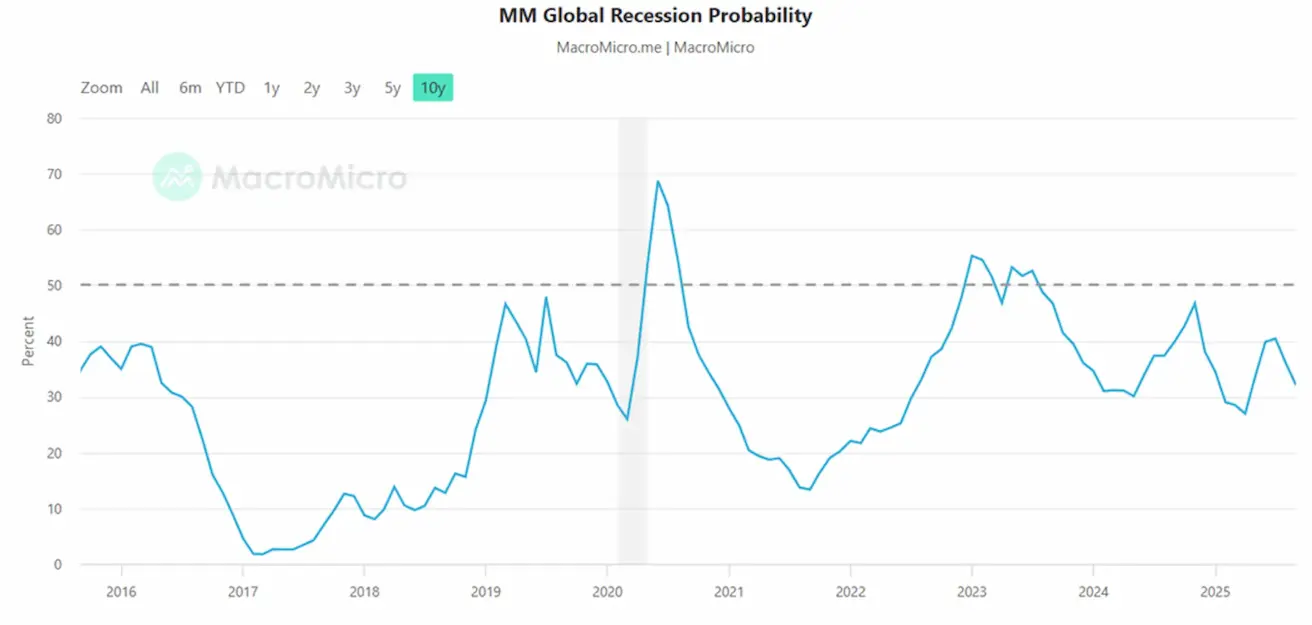

Согласно данным MacroMicro, вероятность глобальной рецессии в августе снизилась до 32%.

Индикатор оценивает вероятность ухудшения глобальных экономических перспектив, включая США, при базовом уровне 50%. Значение значительно выше 50% в течение длительного периода сигнализирует о высокой вероятности глобальной рецессии. Соответственно, текущее значение указывает на низкий риск рецессии.

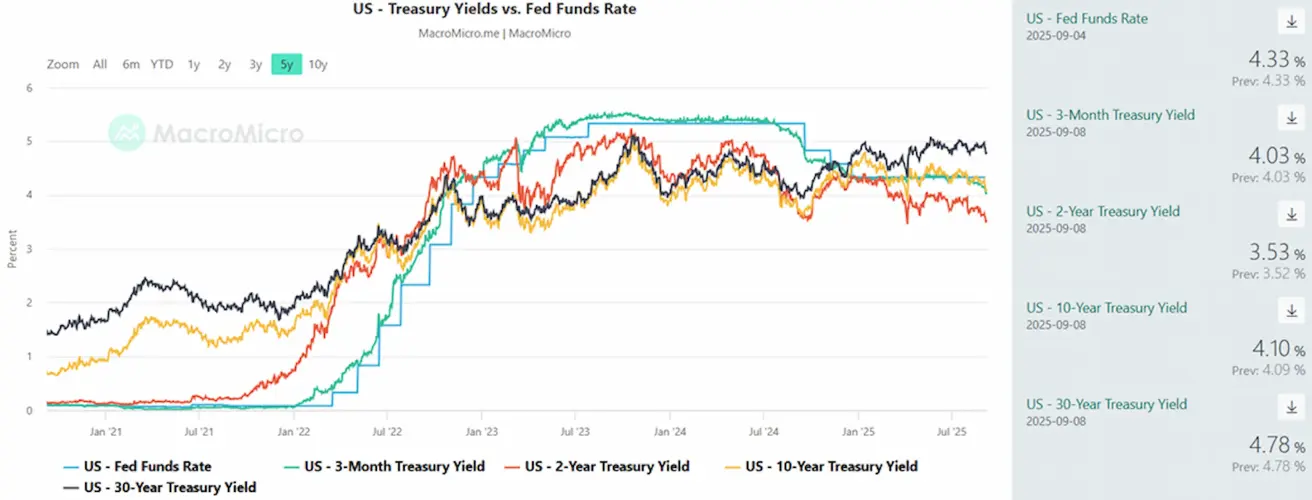

ДОЛГОВОЙ РЫНОК

Итоги недели – резкое снижение доходностей. U.S. Treasury Bonds 20+ (ETF TLT): недельный результат +2.26% (неделя закрылась на уровне 88.56). Доходность с начала 2025 года: +0.87%.

ДОХОДНОСТИ И СПРЕДЫ 2025/08/25 против 2025/08/18

- Рыночная доходность 10-летних казначейских облигаций США (постоянная дюрация 10 лет): 4.10% (против 4.24%).

- Эффективная доходность индекса ICE BofA BBB U.S. Corporate Index: 5.03% (против 5.06%).

- Спред доходностей между 10-летними и 2-летними казначейскими облигациями США: 57.0 б.п. против 62.0 б.п.

- Спред доходностей между 10-летними и 3-месячными казначейскими облигациями США: 16.52 б.п. против 9.0 б.п.

ФЬЮЧЕРСЫ НА ЗОЛОТО (GC)

Недельный результат: +3.71% (очередной исторический максимум, неделя закрылась на $3,646.5/oz). Рост с начала года: +38.07%.

Goldman Sachs прогнозирует рост золота до $4,000 к середине 2026 года в базовом сценарии, до $4,500 в сценарии с низким риском и почти до $5,000 в случае перераспределения 1% частного рынка казначейских облигаций в золото. Goldman рассматривает золото как свою наиболее сильную долгосрочную рекомендацию среди сырьевых товаров.

ФЬЮЧЕРСЫ НА ИНДЕКС ДОЛЛАРА (DX)

Недельный результат: -0.11% (неделя закрылась на уровне 97.67). С начала 2025 года: -9.84%.

ФЬЮЧЕРСЫ НА НЕФТЬ

Недельный результат: -1.67% (неделя закрылась на $62.94/bbl). С начала года: -12.40%.

Цены на нефть немного выросли сегодня после того, как ОПЕК+ в воскресенье объявила, что в октябре увеличит добычу на 137 тыс. баррелей в сутки — значительно ниже ожиданий. Однако Международное энергетическое агентство прогнозирует рекордный профицит нефти в следующем году, а медвежий сценарий предполагает снижение цен к $50.

ФЬЮЧЕРСЫ НА BTC

Недельный результат: +3.36% (неделя закрылась на $112,060). Доходность с начала 2025 года: +17.62%.

ФЬЮЧЕРСЫ НА ETH

Недельный результат: +0.39% (неделя закрылась на $4,355). Результат с начала года: +28.69%.

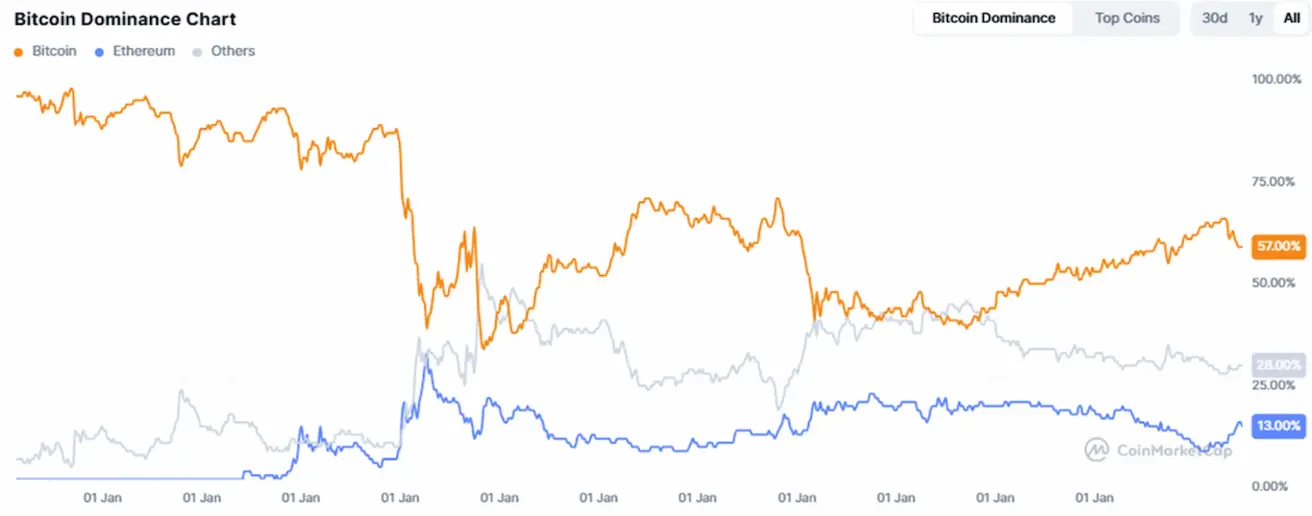

Рыночная капитализация криптовалют

$3.85 трлн (против $3.77 трлн неделей ранее) (coinmarketcap.com).

Рыночная доля:

- Bitcoin – 57.7% (против 57.4%),

- Ethereum – 13.5% (против 14.1%),

- прочие – 28.8% (против 28.5%).

Публичные компании со стратегиями хранения Bitcoin в казначейских активах держат на своих балансах 4.66% от общего объема предложения Bitcoin.

English

English Қазақша

Қазақша