8–12 сентября 2025 года: Еженедельный экономический обзор

Ключевые новости рынка

Макроэкономическая статистика

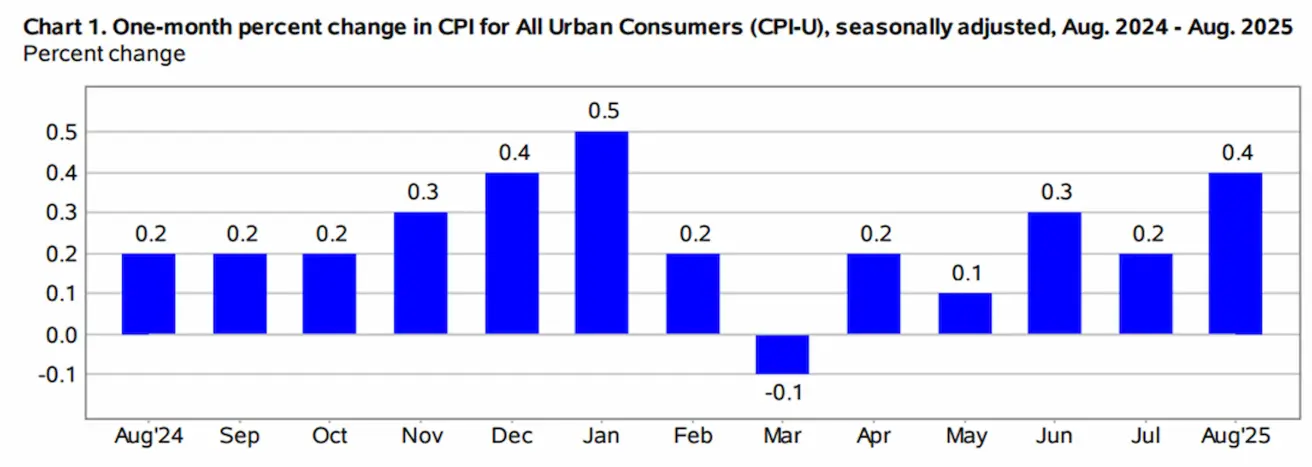

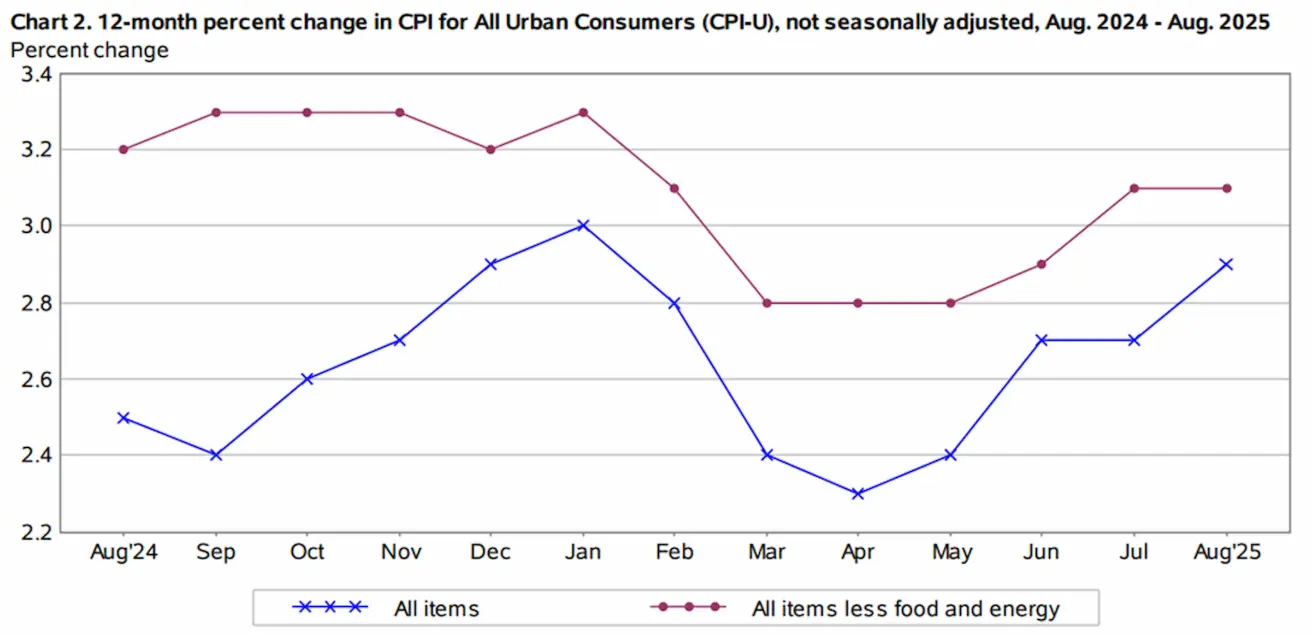

ИНФЛЯЦИЯ

- Базовый индекс потребительских цен (CPI) (м/м) (август): 0,3% (предыдущее значение: 0.3%)

- Индекс потребительских цен (CPI) (м/м) (август): 0.4% (предыдущее значение: 0.2%)

- Базовый индекс потребительских цен (CPI) (г/г) (август): 3.1% (предыдущее значение: 2.9%)

- Индекс потребительских цен (CPI) (г/г) (август): 2.9% (предыдущее значение: 2.7%)

ИНФЛЯЦИОННЫЕ ОЖИДАНИЯ (МИЧИГАН)

- Ожидаемая инфляция на 12 месяцев (август): 4.8% (пред.: 4.8%)

- Ожидаемая инфляция на 5 лет (август): 3.9% (пред.: 3.4%)

ИНДЕКС ЦЕН ПРОИЗВОДИТЕЛЕЙ (PPI):

- PPI (м/м) (август): -0.1%, пред.: 0.7%

- Базовый PPI (м/м) (август): 0.9%, пред.: 0.0%

ВВП (U.S. Bureau of Economic Analysis, BEA) (2 кв. 2025, в годовом выражении, вторая оценка): +3.30% (предварительная оценка: 3.0%; 1 кв. 2024: – 0.5%): оценка Atlanta Fed GDPNow (2 кв.): 3.1% (против 3.0%). *(Модель прогнозирования GDPNow предоставляет «оперативную» оценку официального роста ВВП до его публикации, используя методологию, сходную с применяемой U.S. Bureau of Economic Analysis.)

Индекс деловой активности (PMI)

(Значение выше 50 указывает на расширение; ниже 50 — на сокращение)

- Сектор услуг (август): 54.5 (предыдущее значение: 55.4)

- Обрабатывающая промышленность (июль): 53.0 (предыдущее значение: 53,3)

- S&P Global Composite (август): 54.6 (предыдущее значение: 55.4)

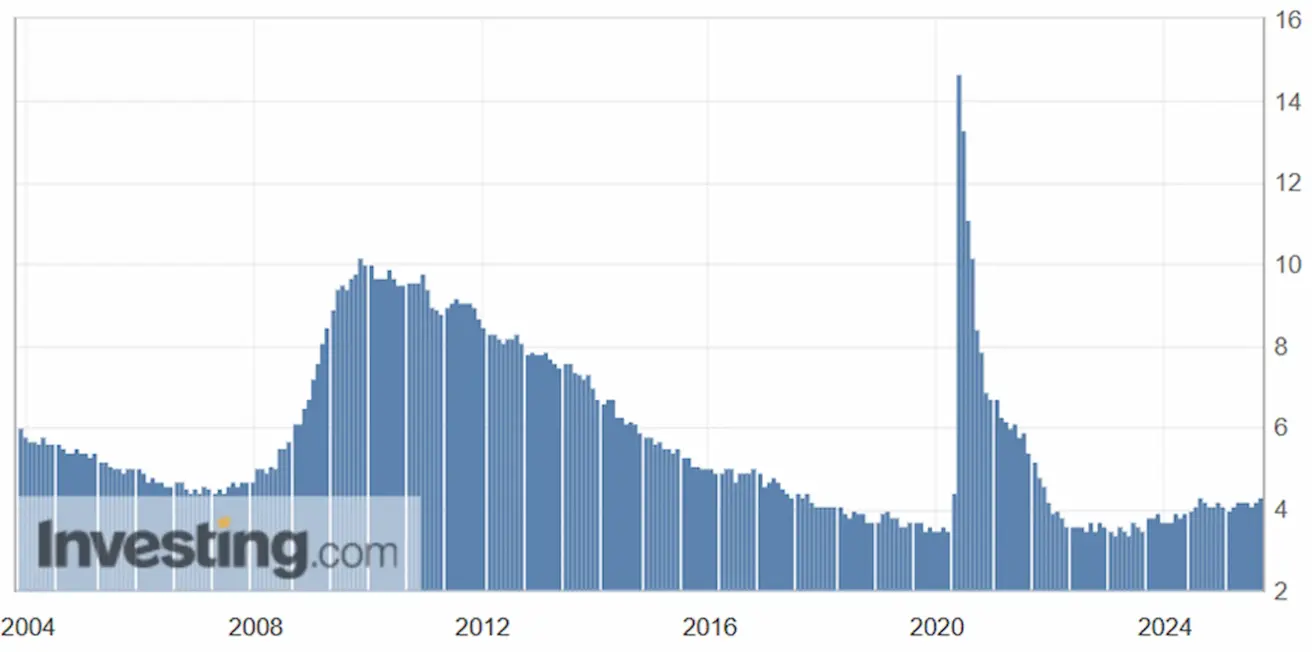

РЫНОК ТРУДА:

- Уровень безработицы (август): 4.3% (предыдущее значение: 4.2%)

- Пересмотр данных по занятости в США (без сезонной корректировки): -911K против -598K.

- Общее число лиц, получающих пособие по безработице: 1.9393K (против 1.939K)

- Изменение числа занятых в несельскохозяйственных отраслях (август): +22K (ранее пересмотрено: +79K)

- Изменение числа занятых в частном несельскохозяйственном секторе США (август): +38K (предыдущее значение: +77K)

- Средняя почасовая заработная плата (август, г/г): +3.7% (предыдущее значение: +3.9%)

- Вакансии по данным JOLTS (август): 7.181M (против 7.357M)

ДЕНЕЖНО-КРЕДИТНАЯ ПОЛИТИКА

- Эффективная ставка по федеральным фондам (EFFR): 4.25% - 4.50% (без изменений)

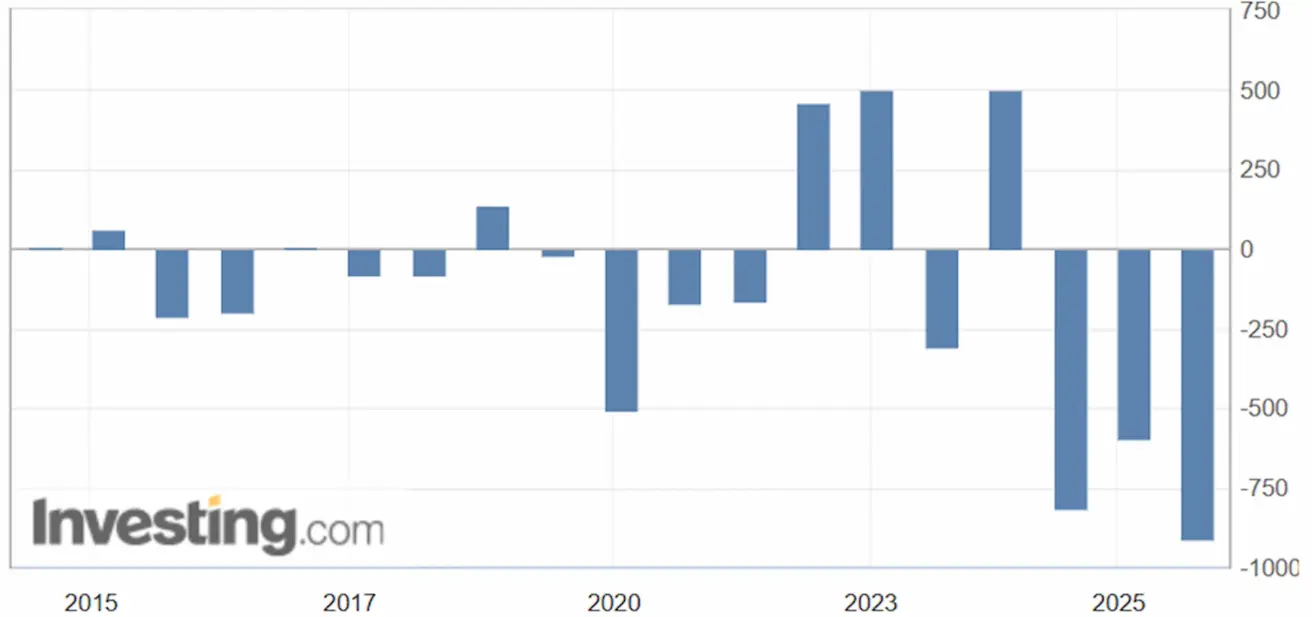

- Баланс Федеральной резервной системы увеличился: $6,605T (против предыдущей недели: $6,602T)

После публикации данных 30-дневные фьючерсы на федеральные фонды поднялись до 95.95, что указывает на то, что рынок уже полностью заложил повышение ставки на 25 б.п. на заседании FOMC в сентябре.

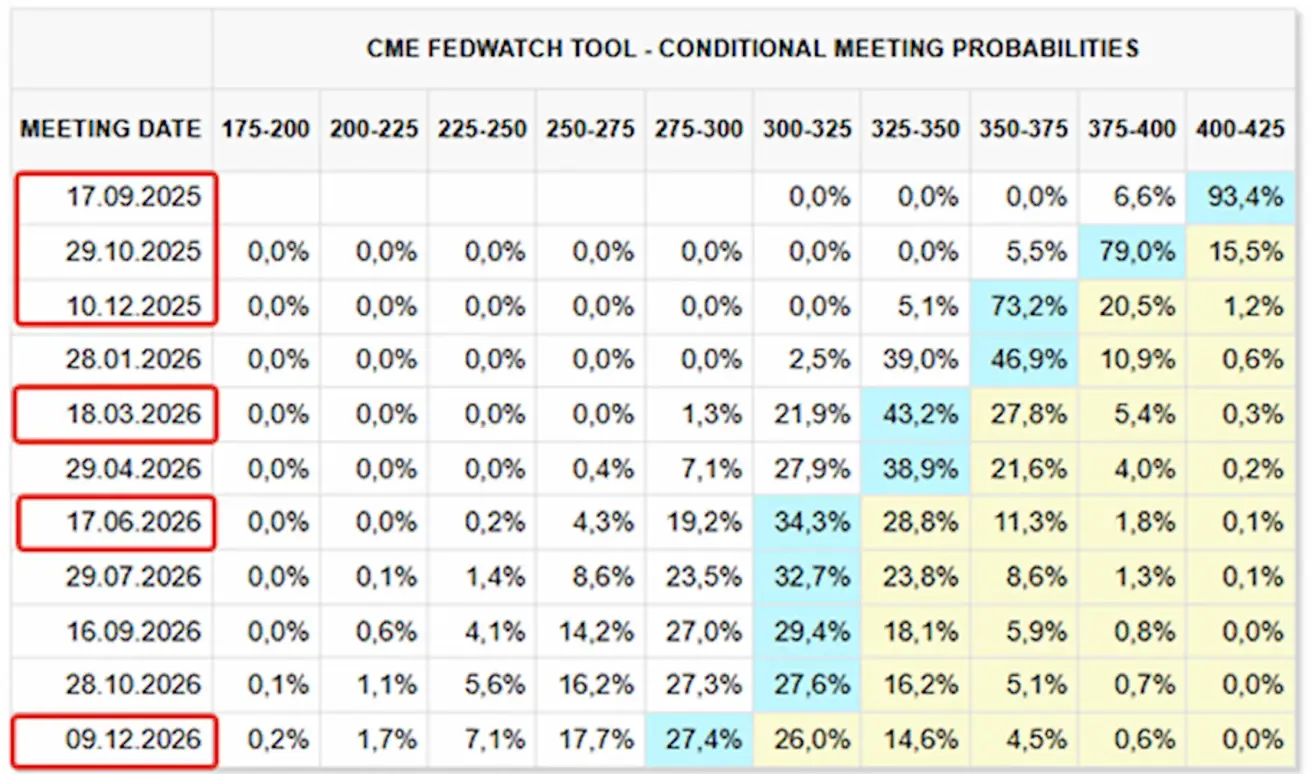

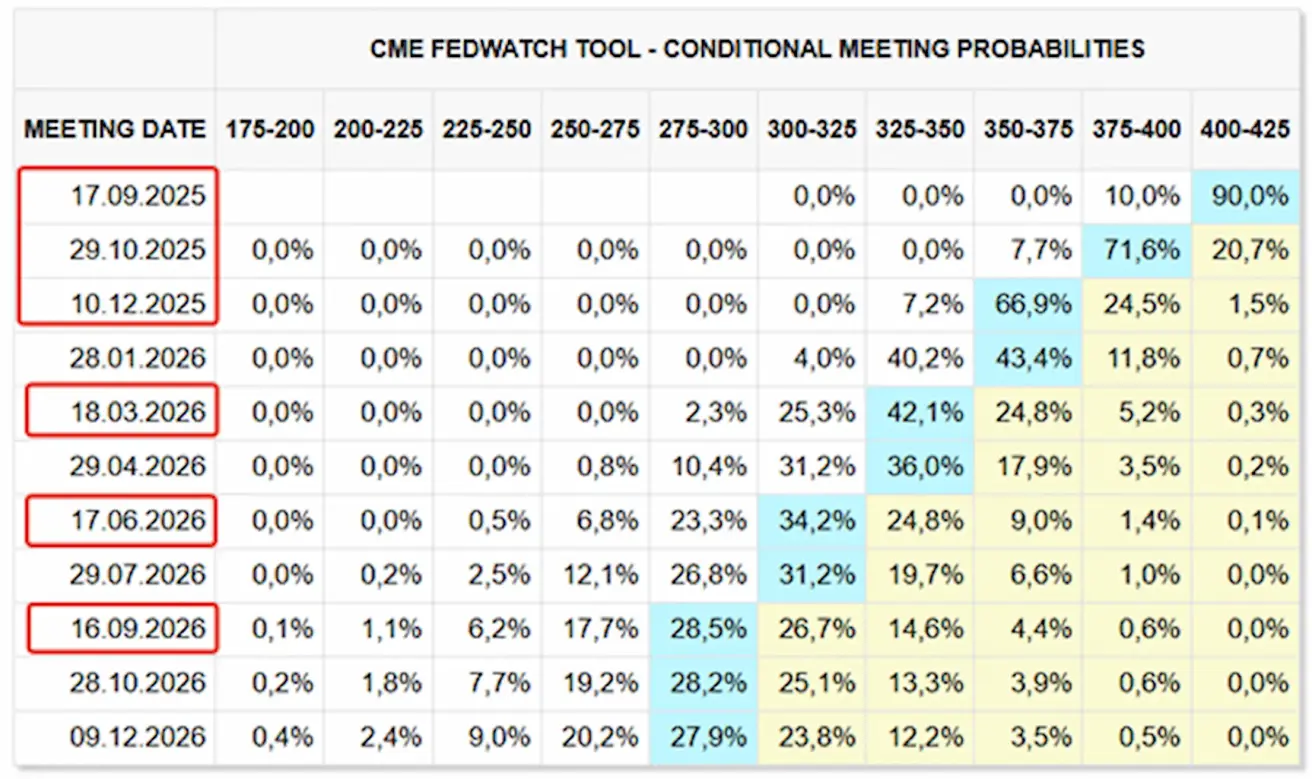

РЫНОЧНЫЙ ПРОГНОЗ ПО СТАВКЕ

Сегодня:

Неделей ранее:

Комментарий

На прошлой неделе основные фондовые рынки двигались вверх на фоне публикации макроэкономических данных и ожиданий потенциального снижения ставки.

США

- Индекс цен производителей (PPI), выступающий опережающим индикатором потребительской инфляции, в августе продемонстрировал дефляцию: –0.1% (предыдущее значение: +0.7%). Базовый PPI (м/м) также составил –0.1% (предыдущее значение: +0.7%). Эта публикация задала позитивный тон в начале недели, что было дополнительно подкреплено отчетом по CPI.

- Базовый CPI остался без изменений, в то время как общий CPI вырос на 0.4% м/м и достиг 2.9% г/г. Хотя эти показатели едва ли свидетельствуют о значимой дезинфляции, рынки интерпретировали их позитивно.

- Однако данные по инфляционным ожиданиям, опубликованные в пятницу, усложнили картину: 5-летние инфляционные ожидания выросли до 3.9% (против 3.4%), тогда как 12-месячные ожидания остались на уровне 4.8% — все еще значительно выше целевого уровня ФРС.

Рынок труда

- Исторический пересмотр данных по занятости в США (без сезонной корректировки) показал снижение на 911K, при этом совокупные понижающие корректировки с февраля 2022 года превысили 1.1 млн рабочих мест.

- Этот пересмотр напрямую отразился на уровне безработицы, который теперь составляет 4.3%. Хотя по историческим меркам это по-прежнему низкий уровень, тенденция указывает на ухудшение ситуации на рынке труда.

ФРС сталкивается с особенно сложным фоном: рост инфляционных ожиданий на фоне признаков ослабления спроса на труд.

Риторика ФРС — по-прежнему неоднозначна

Председатель ФРС Джером Пауэлл — изменение тона:

- Экономика замедляется.

- Изменение баланса рисков потребует корректировки политики.

Бывший президент ФРБ Сент-Луиса (и претендент на пост председателя ФРС):

- Текущая ключевая ставка высока; ее следует снизить в сентябре.

Президент ФРБ Кливленда Лоретта Местер:

- Влияние тарифов и торговых ограничений на экономику только начинает проявляться.

- Ключевой вызов по-прежнему — инфляция, при этом тренд снова разворачивается вверх.

Ожидания рынка по данным FedWatch

- На ближайшем заседании (17 сентября): оценочная вероятность снижения ставки составляет 93.4%.

- До конца года: ожидается три снижения ставки.

- В течение следующих 12 месяцев: заложено шесть снижений по 25 б.п., что приведет целевой диапазон к 2.75–3.00%.

Тарифы

- Верховный суд США рассмотрит дело по тарифам Трампа, слушания запланированы на начало ноября.

- Трамп готов ввести — и призывает ЕС ввести — тарифы в размере 50–100% в отношении Китая и Индии, позиционируя их как элемент более широкой геополитической стратегии, связанной с войной в Восточной Европе.

Рынок

По итогам недели рынок показал медианный рост на +0.27 процента. Лидерами роста стали технологический сектор, сырьевые товары и сектор коммуникационных услуг, а наихудшие результаты показали сектор товаров повседневного спроса, сектор потребительских товаров длительного пользования и здравоохранение.

С начала года (YTD) рынок вырос на +3.89 процента. Наиболее сильную динамику показали сырьевые товары, сектор коммуникационных услуг и коммунальные услуги, в то время как наименее успешными секторами были товары повседневного спроса, здравоохранение и технологии.

SP500

Недельный рост: +1.59% (неделя закрылась на уровне 6,584.28). Доходность с начала 2025 года: +11.54%.

NASDAQ100

Недельная доходность: +1.86% (неделя закрылась на уровне 24,092.19). С начала года: +14.07%.

Euro Stoxx 600

Недельная доходность: +0.53% (неделя закрылась на уровне 554.9). Рост с начала года: +9.75%.

Индекс CSI

По состоянию на понедельник: +1.22% (неделя закрылась на уровне 4,521.99). Рост с начала года: +15.03%.

Индекс Hang Seng TECH

По состоянию на понедельник: +5.09% (6,043.61).

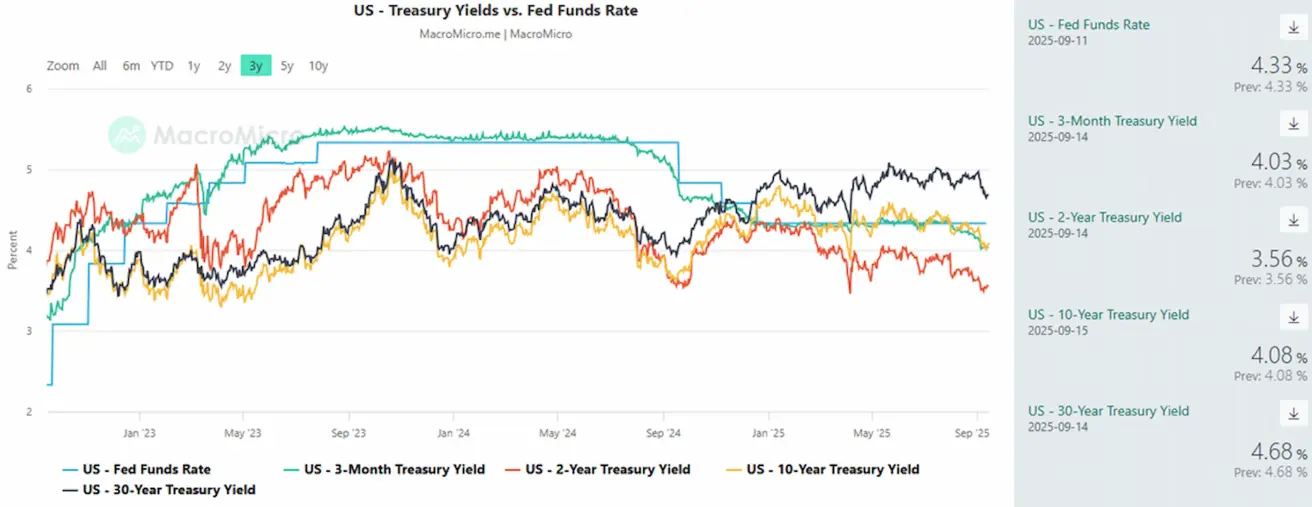

РЫНОК ОБЛИГАЦИЙ

На рынке облигаций неделя завершилась уверенным ралли, что отразилось в снижении доходностей. Казначейские облигации США 20+ (ETF TLT): недельная доходность +1.57% (неделя закрылась на уровне 89.95). С начала 2025 года: +2.45%.

ДОХОДНОСТИ И СПРЕДЫ 2025/08/25 vs 2025/08/18

- Рыночная доходность 10-летних казначейских облигаций США: 4.08% (против 4.10%)

- Эффективная доходность индекса ICE BofA BBB U.S. Corporate Index: 4.91% (против 5.03%)

- Спред 10Y–2Y по казначейским облигациям: 52.0 б.п. (против 57.0 б.п.)

- Спред 10Y–3M по казначейским облигациям: 5.0 б.п. (против 16.52 б.п.)

ФЬЮЧЕРСЫ НА ЗОЛОТО (GC)

Недельная доходность: +0.94% (неделя закрылась на уровне $3,680.7/oz). Рост с начала года: +39.37%.

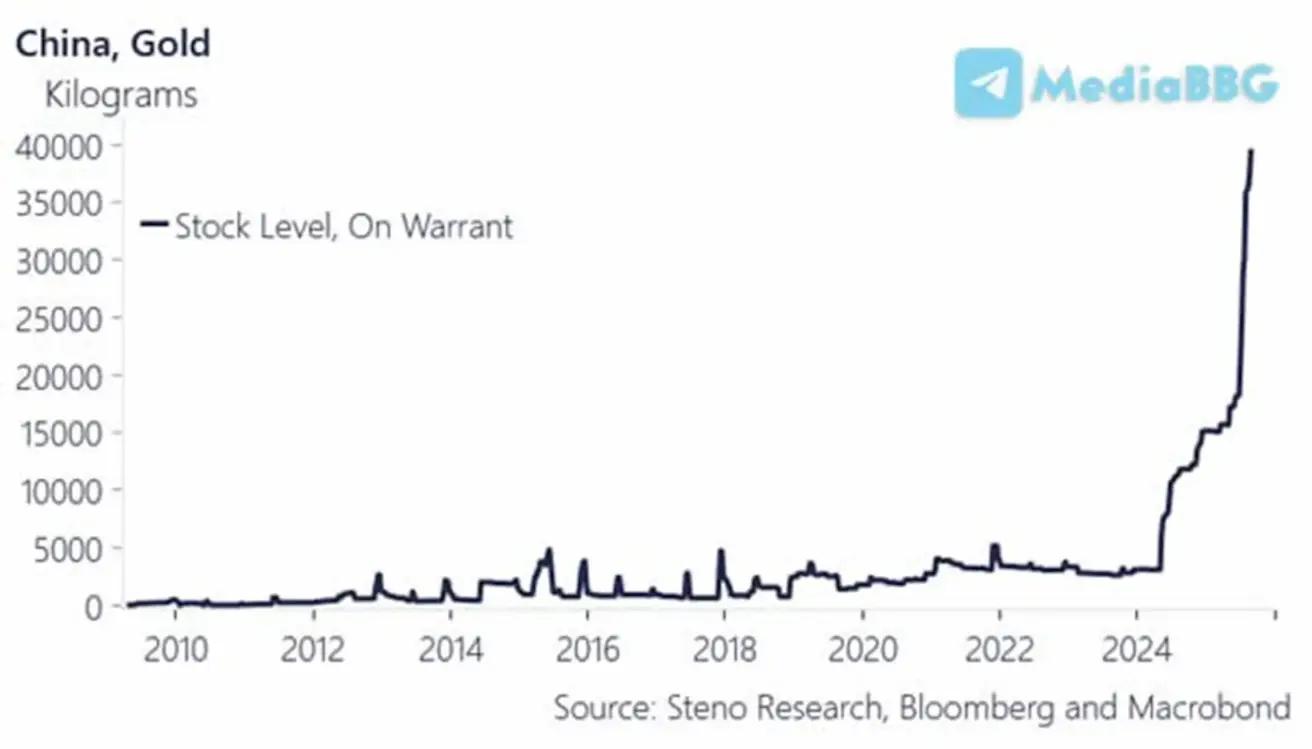

Центральный банк Китая в августе продолжил наращивать золотые резервы: официальные запасы выросли на 60,000 тройских унций, что эквивалентно увеличению на $253.8 млрд в долларовом выражении. С начала 2024 года банк почти в восемь раз увеличил свои золотые резервы.

ФЬЮЧЕРСЫ НА ИНДЕКС ДОЛЛАРА (DX)

Недельная доходность: -0.47% (неделя закрылась на уровне 97.215). С начала 2025 года: -10.26%.

ФЬЮЧЕРСЫ НА НЕФТЬ

Недельная доходность: -0.45% (неделя закрылась на уровне $62.60/bbl). С начала года: -12.87%.

Управление энергетической информации США (EIA) в своем краткосрочном прогнозе по энергетике ожидает заметное снижение мировых цен на нефть. Brent, средняя цена которой в августе составила $68 за баррель, по прогнозу, опустится примерно до $59 за баррель в четвертом квартале 2025 года и приблизится к $50 за баррель в начале 2026 года. Этот прогноз связан со значительным наращиванием запасов нефти по мере увеличения добычи странами ОПЕК+. Согласно EIA, мировые нефтяные запасы в среднем будут расти более чем на 2 млн баррелей в день в период между третьим кварталом 2025 года и первым кварталом 2026.

- Ожидается, что мировой спрос на нефть вырастет на 740,000 б/с в 2025 году по сравнению с предыдущими оценками в 680,000 и 700,000 б/с. В 2026 году спрос, как прогнозируется, увеличится на 700,000 б/с, доведя суммарное потребление до 104.4 млн б/с.

- Глобальная добыча нефти, согласно прогнозу, вырастет на 2.7 млн б/с в этом году до 105.8 млн б/с и еще на 2.1 млн б/с в следующем году до 107.9 млн б/с, поддерживая прогноз избытка предложения.

ФЬЮЧЕРСЫ НА BTC

Недельная доходность: +4.72% (неделя закрылась на уровне $116,850). Доходность с начала 2025 года: +22.65%.

ФЬЮЧЕРСЫ НА ETH

Недельная доходность: +7.98% (неделя закрылась на уровне $4,702,5). Результат с начала года: +38.96%.

Рыночная капитализация криптовалют: $4 трлн (против $3.85 трлн неделей ранее) (coinmarketcap.com).

Доля рынка:

- Bitcoin – 57.4% (против 57.7%),

- Ethereum – 13.7% (против 14.1%),

- прочие – 29.0% (против 28.8%).

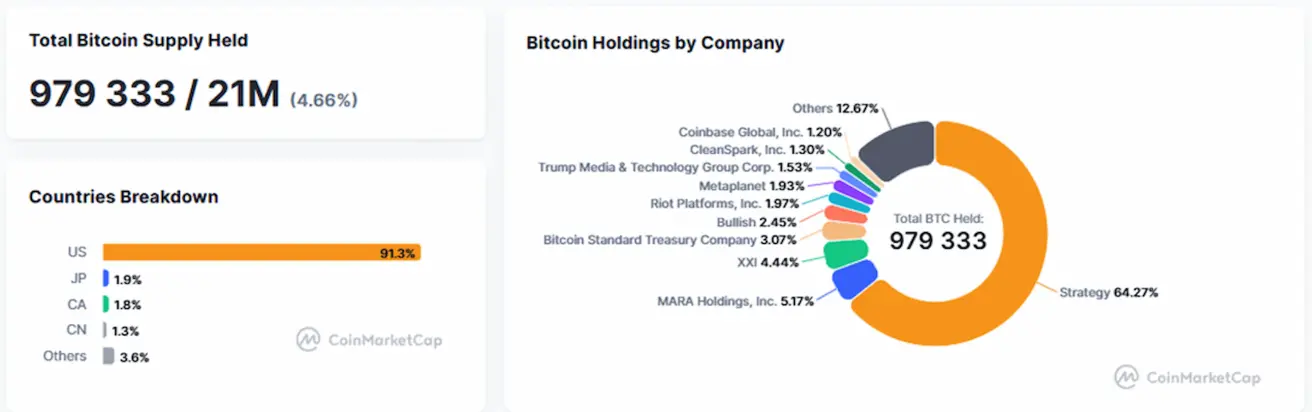

Публичные компании, использующие стратегию размещения Bitcoin на балансе, сохранили объемы на уровне предыдущей недели, удерживая 4.66 процента общего предложения Bitcoin на своих балансах.

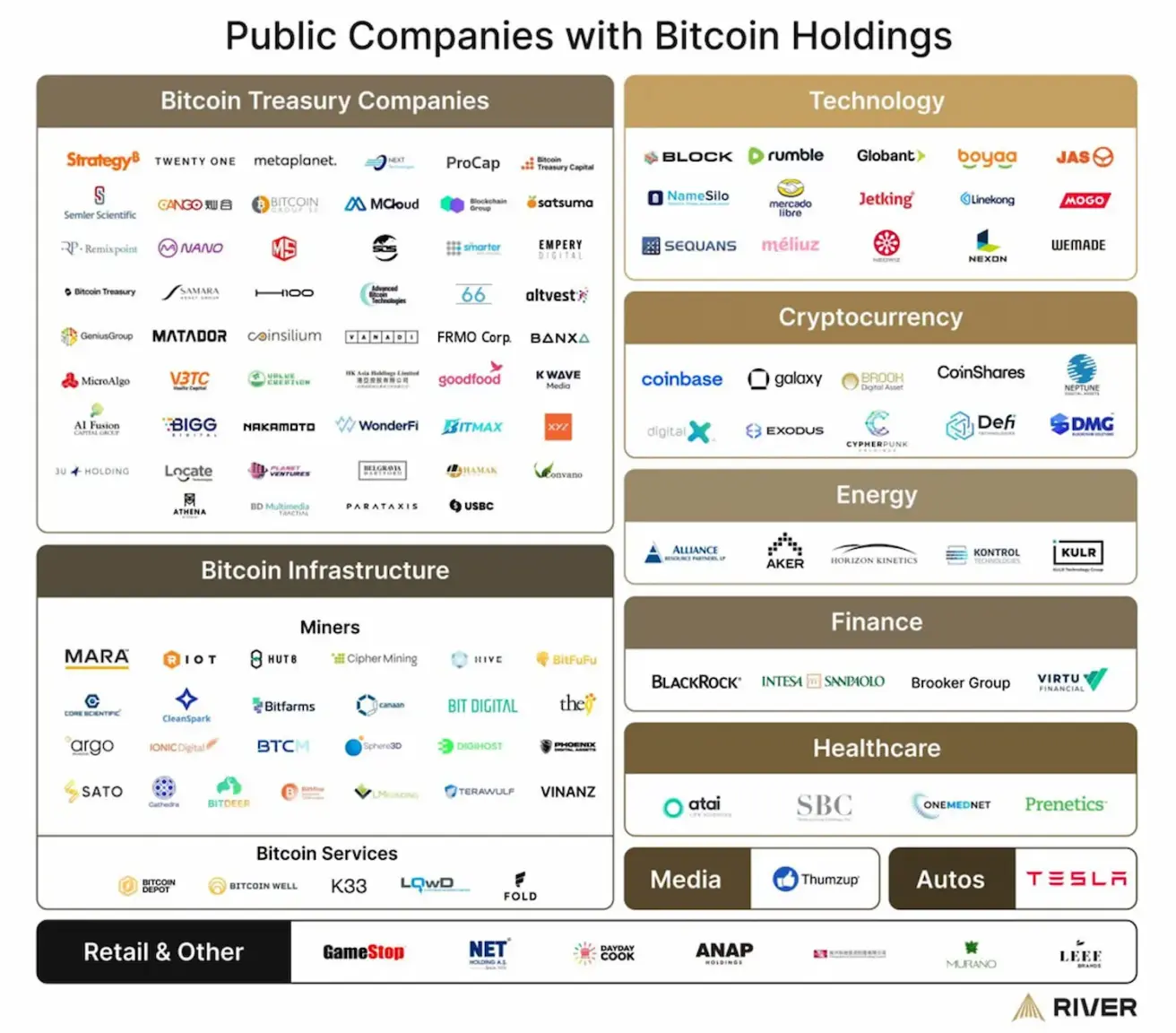

Количество компаний, приобретающих Bitcoin, продолжает расти. За последние шесть месяцев число публичных компаний с резервами в Bitcoin увеличилось с 80 до более чем 150, включая четырех эмитентов, входящих в индекс S&P 500.

English

English Қазақша

Қазақша